Inflation

January 26, 2026

From X Canada’s food inflation problem really started in 2008. Canada’s latest food […]

January 6, 2026

By Alasdair Macleod – Von Greyerz In this article, I explain the mechanics of […]

October 1, 2025

By Wolf Richter – WOLF STREET Inflation is in services, where it accelerated further, even […]

September 20, 2025

By Ryan McMaken – Mises Wire The Federal Reserve is set to lower […]

June 22, 2025

By Marcus Lu – Visual Capitalist After a global spike in inflation following […]

March 31, 2025

By Jenna Ross – Visual Capitalist Imagine there’s a thief that sneaks into […]

February 16, 2025

By Felix Richter – Statista Just a few days after President Donald Trump […]

October 28, 2024

By Dorothy Neufeld – Visual Capitalist Today, the rising cost of living is […]

October 8, 2024

2024.10.02 US stocks ripped higher on Monday, with all three indexes closing at […]

July 27, 2024

By Wolf Richter for WOLF STREET The Bureau of Economic Analysis released today the PCE price […]

July 22, 2024

By Daniel Lacalle Why is the price of gold rising if the global […]

April 30, 2024

2024.04.27 Investors in stocks, bonds and commodities should be aware of the rate […]

April 27, 2024

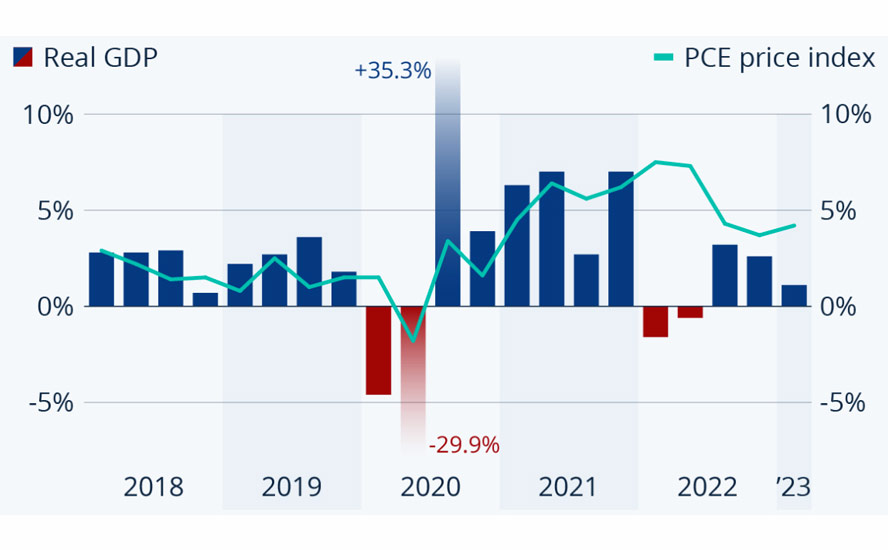

By Felix Richter – Statista The U.S. economy grew slower than expected in […]

April 19, 2024

By Felix Richter – Statista After there’s been a lot of talk about a […]

March 17, 2024

By Wolf Richter – WOLF STREET From mid-October through the end of January, the 6-month […]

March 16, 2024

By Wolf Richter – World Street The Producer Price Index (PPI) for final […]

March 13, 2024

By Felix Richter – Statista Inflation in the U.S. edged up slightly in February, […]

March 5, 2024

By Dorothy Neufeld – Visual Capitalist Global economic prospects hang on a delicate […]

March 3, 2024

By Wolf Richter – Wolf Street In the 20 countries that use the […]

March 1, 2024

By Ryan McMaken – Mises Institute According to the Bureau of Labor Statistics’ […]

February 14, 2024

By Greg Iacurci – CNBC Inflation declined in January and consumers’ buying power […]

January 12, 2024

By Wolf Richter – Wolf Street Inflation in core services remains hot, and […]

December 4, 2023

By James K. Galbraith – Project Syndicate Once again, larger deficits and higher […]

November 29, 2023

2023.11.29 For over a year now the main topic of discussion has been […]

November 19, 2023

By Michael Maharrey For the first time in several months, the Consumer Price […]

November 15, 2023

By Felix Richter Inflation in the U.S. cooled down more than expected in […]

November 2, 2023

By Michael Matulef The threat of hyperinflation has haunted fiat money economies throughout […]

October 10, 2023

By Felix Richter Despite inflation coming down notably from its 2022 highs in recent […]

August 30, 2023

2023.08.30 The US officially has a debt problem, in the present and in […]

August 30, 2023

2023.08.30 美国目前以及未来都正式存在债务问题。截止到目前,美国的国债总额略低于 33 万亿美元,占国内生产总值(GDP)的 122%!然而,更大的问题在于其增长速度,导致利息支付不断膨胀。 根据国会预算办公室(CBO)的预测,未来 30 年的利息支付将达到约 71 万亿美元,并在 2053 年占据所有联邦收入的 35%。 […]

May 18, 2023

By Dorothy Neufeld Every few years the debt ceiling standoff puts the credit […]

May 8, 2023

By Felix Richter Coming off historically low interest rates in the wake of […]

April 30, 2023

By Felix Richter Having proven surprisingly resilient in the face of the Fed’s aggressive […]

April 3, 2023

By Alasdair Macleod How likely is it that the downturn in broad money […]

March 31, 2023

By Nouriel Roubini In the face of high and persistent inflation, recession risks, […]

March 8, 2023

2023.03.08 Has anybody noticed there is something strange going on in commodities? Whether […]

February 24, 2023

2023.02.23 Consumer spending makes up 70% of global GDP. It’s no wonder, therefore, […]

February 21, 2023

By SchiffGold Despite the hotter-than-expected CPI report, the mainstream still seems convinced that the […]

February 16, 2023

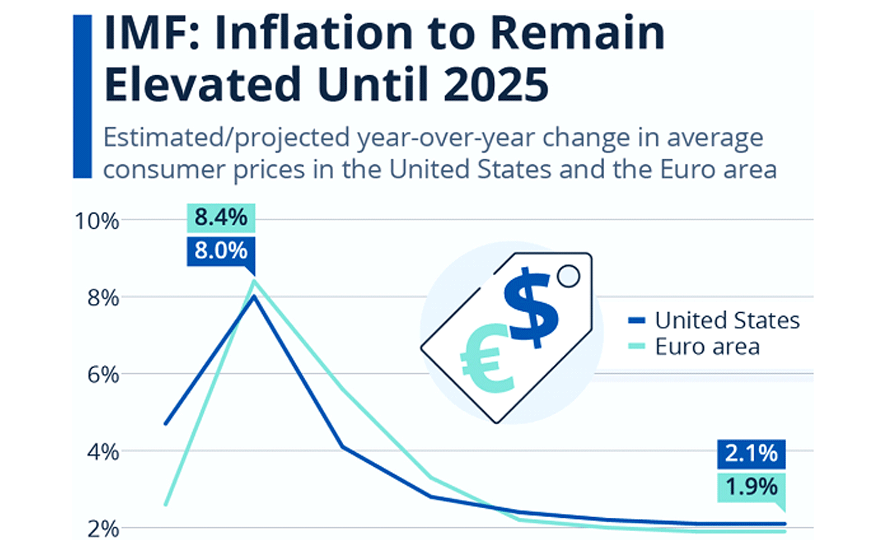

By Dorothy Neufeld Investors are bracing for longer inflation. The Federal Reserve indicated […]

February 11, 2023

By Quoth the Raven 2023.03.11 It would be a situation where we are […]

February 1, 2023

By Wolf Richter 2023.02.01 The Bank of Canada hiked its policy rates by […]

February 1, 2023

By Quoth the Raven 2023.02.01 It’s not the time to celebrate the S&P’s […]

January 31, 2023

BY SCHIFFGOLD 2023.01.31 The mainstream is optimistic about both the economy and the Fed’s […]

January 27, 2023

By Joseph E. Stiglitz 2023.01.27 NEW YORK – Despite favorable indices, it is […]

January 26, 2023

By Quoth the Raven 2023.01.26 Friend of Fringe Finance Lawrence Lepard released his most recent […]

January 22, 2023

By Brian Boone 2023.01.22 So far, in the 2020s, farmers, food processors, suppliers, […]

January 14, 2023

2023.01.14 US inflation cooled in December, putting the US Federal Reserve on track […]

December 31, 2022

It seems fitting that the year we are expecting to see an unprecedented rise in US government spending and money-printing to spur an economic recovery, marks the 50th anniversary of the end of the gold standard.

Done at the time to fight an economic crisis, we are still feeling the effects of this disastrous decision, five decades on.

In this article, we explain why President Nixon did what he did, and why every promise that unshackling the US government from the requirement of maintaining the dollar's value in terms of gold would mean for the United States, has been broken.

Done at the time to fight an economic crisis, we are still feeling the effects of this disastrous decision, five decades on.

In this article, we explain why President Nixon did what he did, and why every promise that unshackling the US government from the requirement of maintaining the dollar's value in terms of gold would mean for the United States, has been broken.

December 8, 2022

2022.12.08 Over the past year, relentlessly rising interest rates (because of the global […]

December 7, 2022

2022.12.07 The economist who predicted the financial crisis sees a “long and ugly” […]

December 4, 2022

2022.12.04 Economist Nouriel Roubini believes the world economy is lurching toward an unprecedented […]

December 1, 2022

2022.12.01 The US Federal Reserve continues to grapple with inflation, which at 7.7% […]

November 11, 2022

2022.11.11 Gold and silver prices jumped on Thursday following the release of October’s […]

November 5, 2022

2022.11.15 In 2021 the world’s militaries spent USD$2.1 trillion, marking the seventh straight […]

November 3, 2022

2022.11.03 The US Federal Reserve is grappling with how to reduce inflation, which […]

September 17, 2022

2022.09.17 This year has seen a correction in the gold price, commensurate with […]

September 6, 2022

2022.09.06 At the start of August, British homeowners saw an 80% increase in […]

August 19, 2022

2022.08.19 Years of neglecting its critical metal supplies is finally catching up with […]

August 16, 2022

2022.08.16 In 1979, then US Federal Reserve Chair Paul Volcker faced a serious […]

August 6, 2022

2022.08.05 The US Federal Reserve started off declaring that historically high levels of […]

June 17, 2022

2022.06.17 We call ourselves Ahead of the Herd because we see things before […]

April 29, 2022

2022.04.29 In our last article, we discussed a proposed new economic model for […]

April 27, 2022

2022.04.27 Modern Monetary Theory, or MMT, posits that rather than obsessing about how […]

March 19, 2022

2022.03.19 Food inflation has historically been the catalyst for many popular uprisings, from […]

February 8, 2022

2022.02.08 Someone born in 1979 is 43 years old this year. No doubt […]

January 21, 2022

2022.01.21 Inflation is the rate at which prices within a basket of goods […]

January 15, 2022

2022.01.05 Inflation is one of the best determinants of gold price movements, because […]

December 21, 2021

2021.12.21 The gold to oil ratio is an important indicator of the global […]

December 18, 2021

2021.12.18 Several months after the US Federal Reserve began describing the country’s inflation […]

December 17, 2021

2021.12.17 The US Federal Reserve announced this week what many market participants were […]

December 16, 2021

2021.12.16 A government generally has two “levers” it can pull, to help get […]

November 5, 2021

2021.11.05 The US Federal Reserve has done what market participants widely expected it […]

October 26, 2021

2021.10.26 The US Federal Reserve’s official line is that inflation is only temporary, […]

October 23, 2021

2021.10.23 Thanksgiving is a time to appreciate the food on our tables, but […]

September 10, 2021

2021.09.10 There is an old joke often told about economists: Three economists are […]

August 20, 2021

2021.08.20 Gold prices are slipping as talk of a “taper tantrum” has investors […]

August 6, 2021

2021.08.06 If rising food prices are ruining your appetite, you’re not alone. Costs […]

May 14, 2021

Continuing the US (and Canadian) economic recovery is obviously important but it should not come on the backs of the poor who bear the most weight of inflation, particularly increases in food prices.

Government officials need to be aware of how their monetary and fiscal policies are impacting the most vulnerable in society.

Government officials need to be aware of how their monetary and fiscal policies are impacting the most vulnerable in society.

April 14, 2021

Gold prices ticked higher on Tuesday after inflation data showed US consumer prices rose in March for the fourth straight month and inflation hit its highest level in 2.5 years.

The US Federal Reserve, whose dual mandate is to keep inflation in the “Goldilocks zone” of around 2% and to control unemployment, has been downplaying inflation, telling the public that even if prices rise, it will only be temporary.

The US Federal Reserve, whose dual mandate is to keep inflation in the “Goldilocks zone” of around 2% and to control unemployment, has been downplaying inflation, telling the public that even if prices rise, it will only be temporary.

October 24, 2020

2020.10.24 Joe Biden’s performance in Thursday night’s presidential debate was solid. The former […]

March 14, 2020

2020.03.14 One of the worst weeks on Wall Street mercifully ended on Friday. […]