Energy

September 19, 2024

By Baba Tamim – Interesting Engineering Westinghouse Electric Company has reached a significant […]

September 9, 2024

By Avi Salzman – Barron’s Just south of Harrisburg, Pa., on a narrow island […]

September 4, 2024

By Robert Rapier – OilPrice.com The concept of the “energy transition” emerged after the […]

September 3, 2024

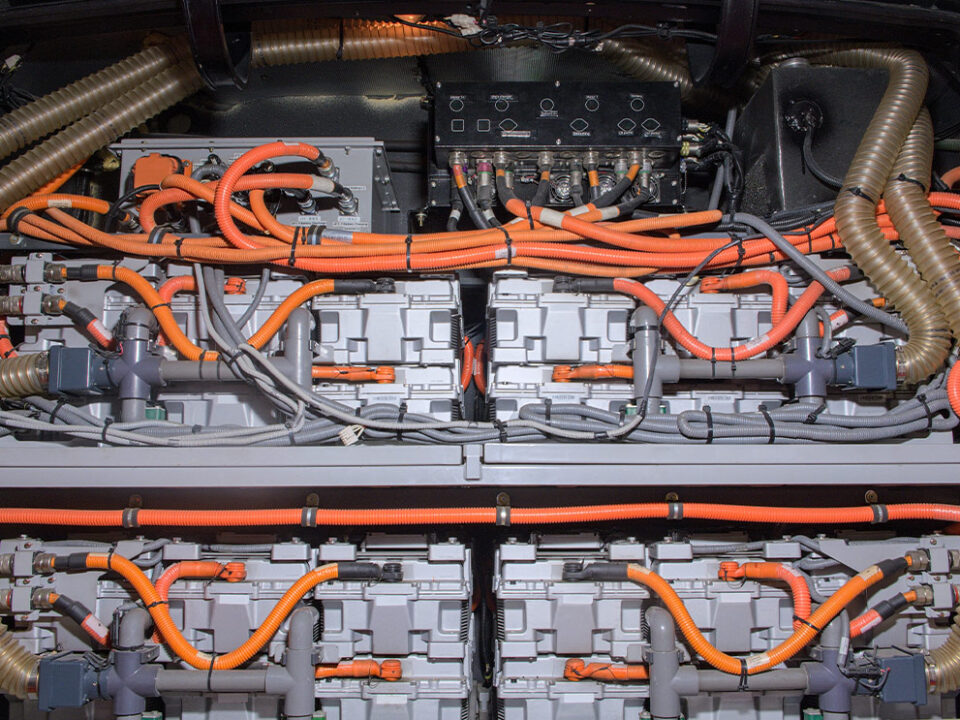

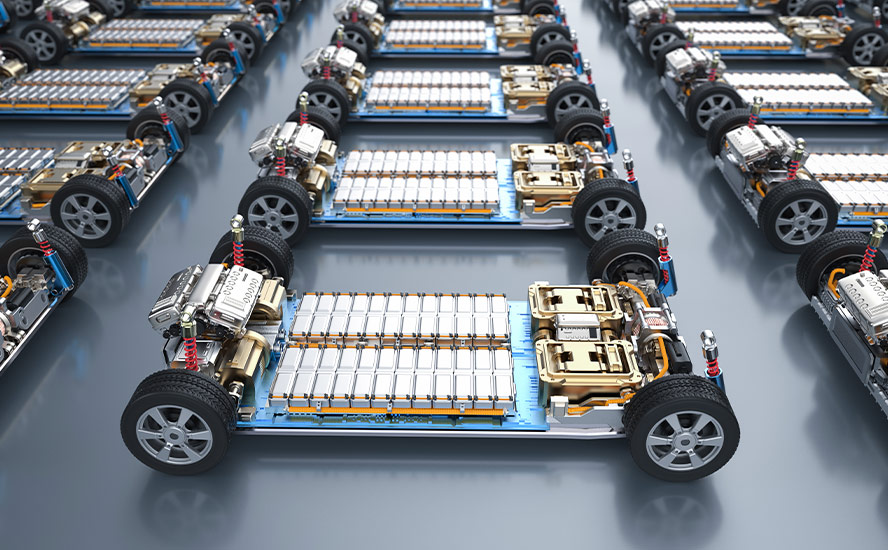

By Bruno Venditti – Visual Capitalist Elements Lithium-ion batteries are essential for a clean […]

September 3, 2024

From The Economist Decarbonising the world’s electricity supply will take more than solar […]

August 24, 2024

From Goehring & Rozencwajg Associates Mark your calendars: August 23rd promises to be […]

August 21, 2024

August 12, 2024

By Bruno Venditti – Visual Elements With the growth of battery-powered devices, from smartphones […]

August 8, 2024

From Elements – Visual Capitalist Economists have been attempting to forecast the point […]

July 12, 2024

By Bruno Venditti – Visual Capitalist Elements Global primary energy consumption reached a new […]

July 12, 2024

From Bloomberg President Joe Biden signed a bill into law that could well […]

July 6, 2024

By Carla Norrlöf – Project Syndicate Could changes to the longstanding “petrodollar” system […]

June 10, 2024

From Mining.com Researchers at the University College London and the International Institute for […]

May 19, 2024

By Sheena Goodyear – CBC GPS, or satellite-based navigation, has become standard in […]

May 19, 2024

By Judith Perera US President Joe Biden has now signed into law HR […]

May 8, 2024

From eia – US Engery Information In the past 10 years, more than […]

May 7, 2024

From The Economist Big tech wants more computing power. A lot more. According […]

May 5, 2024

By Bruno Venditti – Elements In 2023, solar energy accounted for three-quarters of […]

May 4, 2024

By Craig Mellow – Brron’s Most roads in the green energy transition lead through […]

May 1, 2024

From Mining.com The Senate voted Tuesday evening to approve legislation banning the import […]

April 23, 2024

By Bruno Venditti – Elements Despite efforts from the U.S. and EU to […]

April 7, 2024

By Lucia Kassai, Sharon Cho, Devika Krishna Kumar, and Alex Longley – Bloomberg When oil jumped above $90 a barrel […]

April 4, 2024

From Goehring & Rozencwajg The biggest mystery in oil markets surrounds the apparent […]

April 2, 2024

By Bruno Venditti – Elements Despite efforts to decarbonize the global economy, oil […]

April 2, 2024

By Will Wade and Mitchell Ferman – Bloomberg US oil companies including Diamondback Energy Inc. are considering small […]

March 30, 2024

By Charles Kennedy – OilPrice.com More than 20% of the total global refining capacity […]

March 29, 2024

By Bruno Venditti – Visual Capitalist The U.S. House of Representatives recently passed […]

March 28, 2024

By Prinz Magtulis, Nichola Groom, Jarrett Renshaw and Moira Warburton – Reuters The counter-intuitive fossil fuel boom under […]

March 27, 2024

From Goehring & Rozencwajg In an unexpected move, Aramco, the Saudi national oil […]

March 25, 2024

By Tsvetana Paraskova – OilPrice.com Western nations may be getting ahead of themselves in […]

March 23, 2024

2024.03.21 Until recently economists tended to treat energy inflation and food inflation as […]

March 22, 2024

By Stuart P.M. Mackintosh – Project Syndicate Amid an onslaught of grim climate […]

March 20, 2024

2024.03.15 While there is disagreement over its causes, the reality of global warming […]

March 5, 2024

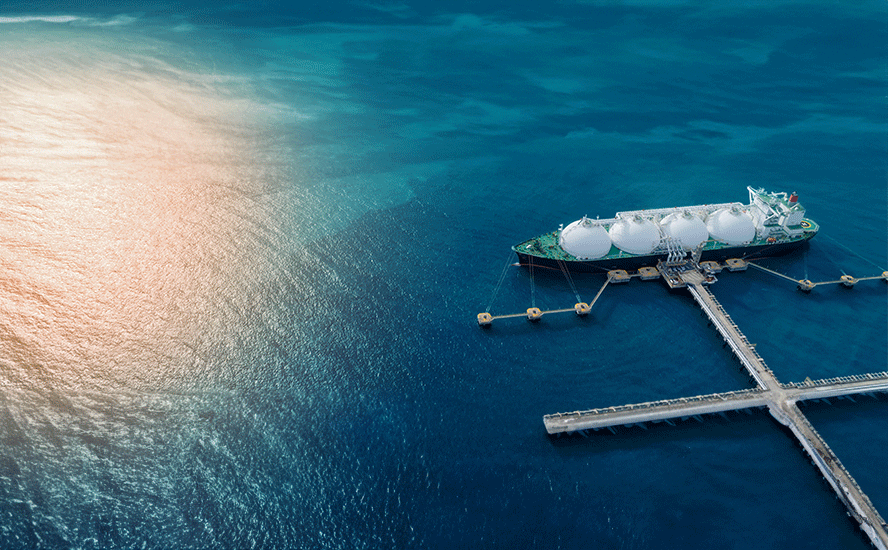

By Wolf Richter – Wolf Street The US became the largest LNG exporter in […]

March 4, 2024

By David Fickling – Bloomberg From Spindletop — the Texan oilfield whose 1901 blowout […]

February 27, 2024

From Goehring & Rozencwajg There are notable similarities between the uranium market twelve […]

February 26, 2024

By Newt Gingrich – Real Clear Wire If we took nuclear war seriously, we […]

February 17, 2024

By Goehring & Rozencwajg “Wouldn’t a recession and continued economic weakness reduce energy […]

February 15, 2024

By Omri Wallach – Vistual Capitalist Over the last decade, the United States […]

February 12, 2024

By Florian Zandt – Statista On February 7, French energy company TotalEnergies announced an […]

February 12, 2024

By Omri Wallach – Elements Over the last decade, the United States has […]

February 7, 2024

By Charles Kennedy – Oilprice.com U.S. manufacturers are recovering from an extended slump in […]

January 30, 2024

From Mining.com Global spending on the clean-energy transition hit record highs as the world […]

January 27, 2024

By Bruno Venditti – Visual Capitalist Nuclear power is among the safest and […]

January 25, 2024

By Tsvetana Paraskova Oilprice.com Even as some countries phase out nuclear power or retire plants […]

January 19, 2024

By Goehring & Rozencwajg North American natural gas is the cheapest energy molecule […]

January 15, 2024

2024-01-15 In British Columbia, the cost of building a Site C, a massive […]

January 12, 2024

By Goehring & Rozencwajg Associates In 2018, uranium assets were widely considered to […]

January 12, 2024

By Ella Nilsen, CNN fund 47 projects in 22 states and Puerto Rico – […]

December 29, 2023

By Marcus Lu – Visual Capitalist Global clean energy funding is projected to […]

December 29, 2023

By Patrick George – Inside EVs Say what you want about the guy up […]

December 22, 2023

By Goehring & Rozencwajg In late 2021, we made a bold and deeply […]

December 20, 2023

By Katie Nicholson, Carly Thomas – CBC News As part of the federal government’s net-zero […]

December 17, 2023

By Selin Oğuz – Visual Capitalist 2022 was a highly profitable year for […]

December 8, 2023

By Ari Natter Legislation that would bar the import of enriched Russian uranium […]

December 6, 2023

By Aldgra Fredly – The Epoch Times The United States and 21 other countries […]

December 5, 2023

By Jonathan Ford – Bloomberg Climate change and geopolitics have restored the fortunes of […]

December 4, 2023

By The Economist To wean their country off imported oil and gas, and in […]

November 27, 2023

By Colin McClelland – Mining.com The price of uranium will hit triple-digits for […]

November 14, 2023

By RJ Roux & Yaël Ossowski For decades, the fruits of the fracking revolution, plus our […]

October 24, 2023

By Goehring & Rozencwajg The uranium bull market is just getting started, but […]

October 22, 2023

By Doug Casey International Man: What makes uranium attractive as a speculation? Doug […]

October 6, 2023

By Goehring & Rozencwajg In our view, natural gas prices are reaching a […]

October 5, 2023

2023.10.05 The nuclear-powered energy train has left stations in Ontario and New Brunswick, […]

September 28, 2023

By Martin Armstrong While nuclear powers such as the United States and France are […]

September 25, 2023

By Pallavi Rao In 2022 oil prices peaked at more than $100 per […]

September 14, 2023

By Goehring & Rozencwajg Over the past twelve months, spot uranium advanced 12% […]

August 7, 2023

2023.08.07 With each day, it becomes clearer that nuclear power should play a […]

August 7, 2023

2023.08.07 随着时间的推移,人们越来越清楚核电应该在全球能源结构中发挥更大的作用。 根据国际能源署的数据,核能发电量约占世界电力的 10%,略高于太阳能、风能、地热能和潮汐能,但与水力发电相比仍相形见绌(如下图)。 但据 国际能源机构 (IEA) 估计,就一次能源消耗(指直接使用原始形式的能源)而言,核能的份额仅为 4% 左右,是所有能源类别中最低的。 毫无疑问,作为最古老的低碳能源技术之一,核能在能源排名上还有很大的提升空间,特别是如果我们要实现气候目标的话。 化石燃料依然占主导 我们不得不承认的事实是,化石燃料仍然是世界能源供应的主导力量,能源研究所 […]

August 5, 2023

BY Robert F. Service Tesla’s Powerwall, a boxy, wall-mounted, lithium-ion battery, can power […]

July 4, 2023

By Govind Bhutada The global physical oil market is astronomical in size and […]

June 29, 2023

2023.06.29 With the significant resources we have committed to renewable energy, you’d have […]

June 15, 2023

By Goehring & Rozencwajg Conventional oil production has now unequivocally rolled over. Unconventional […]

June 13, 2023

By Bruno Venditti Lithium has become essential in recent years, primarily due to […]

June 3, 2023

May 22, 2023

By David Messler As we approach the midpoint of 2023, WTI prices have mostly […]

May 19, 2023

2023.05.19 Nuclear gets a bad rap but it is bar none the safest […]

May 15, 2023

A standard combustion engine passenger vehicle in the U.S. uses about 11 barrels […]

May 5, 2023

By Goehring & Rozencwajg On December 13th, 2022, the U.S. Department of Energy […]

April 20, 2023

2023.04.20 It’s fair to say that the Russia-Ukraine war has now literally “gone […]

April 20, 2023

2023.04.20 毫无疑问,俄乌战争现已经迈入了 “核战争”的范畴。 3月下旬,俄罗斯总统弗拉基米尔·普京透露了在白俄罗斯部署战术核武器的计划。白俄罗斯是一个夹在交战双方之间的盟友国家。此举虽是预料之内,但不可避免需要西方做出下一步的决策。 而现在回应已经到来。七国集团近期承诺要结束俄罗斯对原子燃料市场的主导地位。据彭博社 4 月 17 日报道,包括加拿大、法国、日本、英国和美国在内的西方盟友已承诺共同将俄罗斯逐出全球核供应链。 彭博社消息人士称,这一承诺是在日本札幌七国集团会议期间召开的核工业会议上形成的。 英国能源大臣格兰特·沙普斯 (Grant Shapps) […]

April 13, 2023

By Anna Fleck Wind and solar power accounted for 12 percent of global electricity […]

April 3, 2023

By Selin Oğuz When looking at where clean energy technologies and their components […]

April 2, 2023

By Benjamin Zycher The obstacles confronting the “energy transition” are fundamental — they are […]

April 2, 2023

By Goehring & Rozencwajg After making a 14-year high of $130 per barrel […]

March 28, 2023

By Michael Kern The European Union needs to work on a divide among its […]

March 28, 2023

By Today in Energy Last year, the U.S. electric power sector produced 4,090 […]

March 24, 2023

By Goehring & Rozencwajg Over the past 15 years, the vast majority of […]

March 13, 2023

by Felix Richter According to data extracted from the UN Comtrade Database, China accounted for […]

March 12, 2023

By Selin Oğuz Although clean energy has been picking up pace in Asia, […]

March 12, 2023

By Goehring & Rozencwajg Crude oil fundamentals are very tight and risk getting […]

March 9, 2023

By Tom Ozimek Chevron CEO Mike Wirth said that maintaining secure and affordable energy […]

March 7, 2023

By Patti Domm Since Russia’s invasion of Ukraine, the U.S. oil and gas […]

March 6, 2023

By Wolf Richter Electricity generation, as measured in gigawatt-hours, has gotten hammered by […]

March 2, 2023

By Niccolo Conte A year on from Russia’s initial invasion of Ukraine, Russian […]