Graphite One aiming to publish prefeasibility study in Q2

2022.06.04

Energized by two new hires, Graphite One (TSXV:GPH, OTCQX:GPHOF) is anticipating a busy field season at its Graphite Creek property in Alaska, and putting out a prefeasibility study sometime this business quarter.

Industry veteran Mike Schaffner will join the company as Senior President, Mining, effective July 1, the same day that Graphite One’s COO, Stan Foo, will retire.

Prior to his appointment, Schaffner worked at Ambler Mining, where he oversaw engineering work for the Arctic prefeasibility study and managed the metallurgical test work program for the company’s drill program. He joined Ambler after 15 years with Newmont Mining (TSX:NGT), rising through positions of increasing responsibility to the level of General Manager at the Carlin Gold Mine, Cripple Creek and Victor mines, managing operating budgets over $750 million and a workforce of 1,200. Schaffner began his mining career with Echo Bay Mining and Coeur Mining at operations in Nevada.

“I’m excited to join the Graphite One team as the company moves into its next phase of development,” Schaffner stated in the June 1 news release. “I’ve been involved at every stage in the development process, from design to start-up, into operation and closure. I’m ready to help the team realize G1’s tremendous potential of becoming America’s first US graphite mining operation since 1990.”

Graphite One has also made a change at the board level, appointing Scott Packman to its board of directors in early May. Packman served as general counsel and executive vice president of Madison Square Garden Entertainment (NYSE:MSGE). He was also general counsel of MGM Holdings,the owner of the iconic MGM movie and television studio, for over a decade.

“Scott is highly regarded as a corporate strategist, successful operator, trusted advisor and as a pre-eminent negotiator and attorney. His addition to our Board of Directors is evidence of Graphite One’s focus on enhancing and broadening the skillset of its Board of Directors,” said Graphite One’s CEO, Anthony Huston.

High-Priority Infrastructure Project

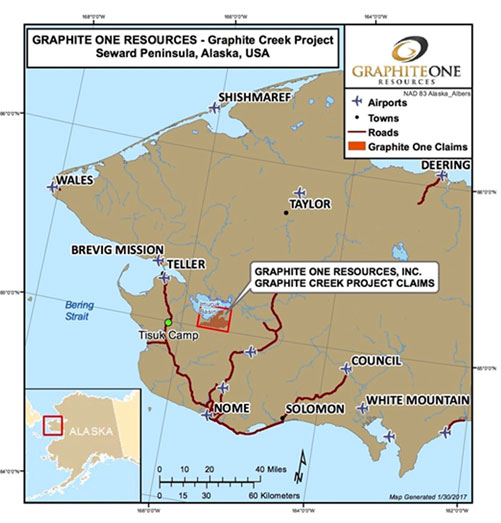

The Graphite Creek property is situated along the northern flank of the Kigluaik Mountains, Alaska, spanning 18 kilometers.

Located on the Seward Peninsula, Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production, while of course adhering to the necessary regulations that are integral to developing any new mine in the US.

“Designating the Graphite Creek project as a high-priority infrastructure project will send a strong signal that the US intends to end the days of our 100% import-dependency for this increasingly critical mineral,” Alaska Governor Mike Dunleavy said in his nomination letter.

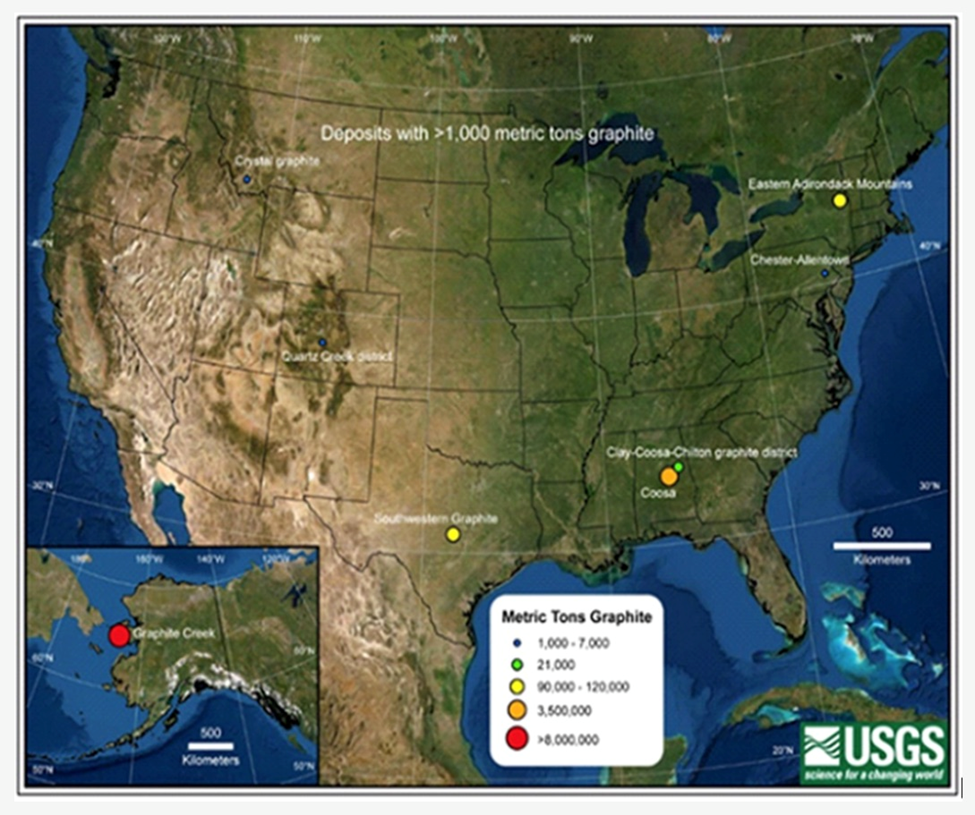

The US Geological Survey has cited Graphite Creek as the largest known graphite deposit in the country.

The updated USGS mineral database highlighted 10 sites with historical graphite production or undeveloped graphite resources (>1,000 tonnes of contained graphite resources and/or past graphite production).

Of these, only Graphite Creek contains more than 8 million tonnes, confirming Gov. Dunleavy’s previous statement that the mine “would be a superior domestic supply of this critical mineral.”

USGS involvement is a huge confidence-builder for Graphite One. The organization sent geologists to the property last year to conduct field work, leading them to assess Graphite Creek as the biggest graphite deposit in the continental United States.

Exploration

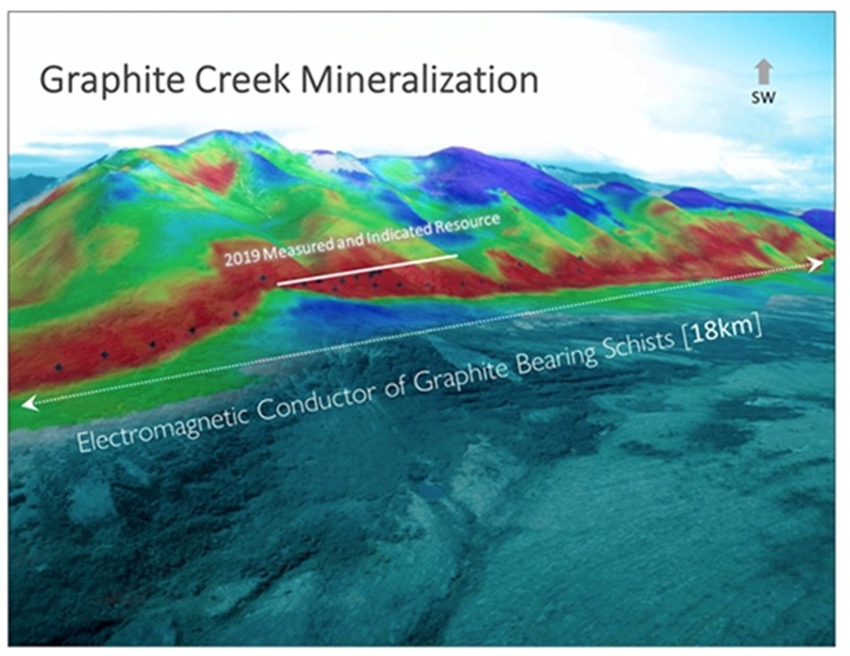

During 2021, Graphite One completed a drill program of >2,000 meters on Graphite Creek, the results of which will be used for an updated resource model. To date, only 20% of the graphite mineralized trend has been explored by the company.

The latest resource estimate (March 2019) — derived from drilling less than 30% of mineralization — showed 10.95 million tonnes of measured and indicated resources at a graphite grade of 7.8% Cg (graphitic carbon), for some 850,000 tonnes of contained graphite. Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

A preliminary economic assessment (PEA) on Graphite Creek supports a 40-year operation with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% purity) per year.

The next steps for Graphite Creek include an updated resource model and new technical data for a prefeasibility study (PFS), which will incorporate results of the 2021 drill program.

Graphite supply chain: 3 links

Graphite One aims to become the first vertically integrated domestic producer to serve the nascent US electric vehicle battery market.

The Vancouver-headquartered company in May announced a memorandum of understanding (MOU) with Sunrise (Guizhou) New Energy Material Co., Ltd., a lithium-ion battery anode producer based in Guizhou Province, China.

Sunrise and GPH plan to form an alliance to establish a graphite material manufacturing facility in Washington State.

The plan for the materials facility — the second link in Graphite One’s US supply chain solution for advanced graphite products, mining is the first — will be detailed in the upcoming PFS.

What we know so far, is that Sunrise will help to design, construct and operate the plant, which will source natural graphite from Graphite One’s Graphite Creek deposit near Nome, Alaska.

Once in full production, the plant is expected to turn graphite concentrates into 41,850 tonnes of battery-grade coated spherical graphite and 13,500 tonnes of graphite powders per year.

Note: this level of prospective production would cover the amount of graphite the US imports in most years!

The third link in Graphite One’s US-based graphite supply chain involves battery materials recycler Lab 4 Inc. of Nova Scotia, Canada. Under an earlier MOU, GPH and Lab 4 will work collaboratively to design and build a recycling facility for end-of-life EV and lithium-ion batteries. Lab 4 provides laboratory and engineering support to mining companies with a focus on recycling graphite, manganese and other minerals.

The recycling facility will be located next to the Washington State manufacturing facility and engineered to accept used EV batteries for feedstock.

Circular economy

This year, Graphite One proceeded with the second link of its proposed supply chain strategy by selecting a location for the graphite products manufacturing plant. Now, with a recycling facility planned nearby, the company has closed the loop on its “circular economy” blueprint, much like the one being advocated by the Biden administration.

The administration allocated $7 billion as part of a huge infrastructure bill aimed at developing a US battery supply chain and weaning the auto industry off its reliance on China. In a July 2021 report, the White House said the number of mineral commodities the US is reliant on imports, has jumped to 58 from 21 in 1954.

Biden is reportedly invoking War powers to encourage domestic production of critical minerals for batteries.

Adding minerals like graphite, lithium, nickel, cobalt and manganese to the list could help mining companies access $750 million under the 1950 Defense Production Act (DPA). The presidential directive would fund production at current mining operations, productivity and safety upgrades, and feasibility studies.

“With this new defense designation under U.S. law, graphite joins a select group of ‘super-critical minerals’ that are essential to commercial technology and national security applications,” said Huston. “This action by President Biden validates Graphite One’s strategy of creating a full supply chain for advanced graphite materials located in the United States.”

The president has also tucked $500 million into the Ukraine aid bill he signed into law last month. The half a billion would expand funds available under the DPA, to obtain critical battery minerals like nickel, cobalt, lithium and graphite.

Another $3 billion is being tapped to support domestic manufacturing of batteries used in electric vehicles and energy storage. This money comes from the above-mentioned $1.2 trillion infrastructure bill passed by Congress last year. A separate $60 million program for battery recycling is also being made available.

Conclusion

In developing the largest graphite mine in the US, and with plans to build an anode manufacturing facility and a recycling plant in Washington State, Graphite One is perfectly positioned to become America’s first fully integrated graphite supply chain.

In fact, the company is providing the template for a brand-new circular economy that merges mine production of battery-grade graphite, with the processing and recycling of lithium-ion battery anode material needed for the future green economy.

That’s something I can get behind, and have, by owning GPH shares. I believe the stock price will appreciate significantly in the coming months, as Graphite One keeps hitting key milestones like a PFS, and industry-government collaboration on critical minerals continues.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.28, 2022.06.03

Shares Outstanding 85.5m

Market cap Cdn$110.2m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH) GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.