US DOE draft report reaffirms urgent status of six critical minerals including graphite – Richard Mills

2023.06.17

With the clean energy transition moving along rapidly, critical minerals are now at the forefront of international discussions, as they’re the building blocks for many of our modern technologies and are essential to national security and economic prosperity.

For the US, the world’s leading economy, securing reliable supplies for these minerals is especially important to not only sustain its dominance but also shed its supply reliance on key rivals like China.

As a result, the country has been busy linking up with its main allies to strengthen and diversify its supply of critical minerals. So far this year, the US has signed co-operative deals with Japan and Australia to ensure it has a robust supply chain and the know-how to the latest energy technology.

The Japan agreement is also expected to serve as a framework for the much-anticipated deal with the EU, which is still under negotiations.

Back in June 2022, in the wake of Russia’s invasion of Ukraine, the US and its G7 partners had already launched the Partnership for Global Infrastructure and Investment (PGII) to build clean energy supply chains. They also signed the Minerals Security Partnership to produce, process and recycle critical minerals.

These initiatives mark the emergence of a phenomenon commonly known as “joint industrial policy”, which is when states coordinate their industrial strategies at the international level and build supply chains collaboratively.

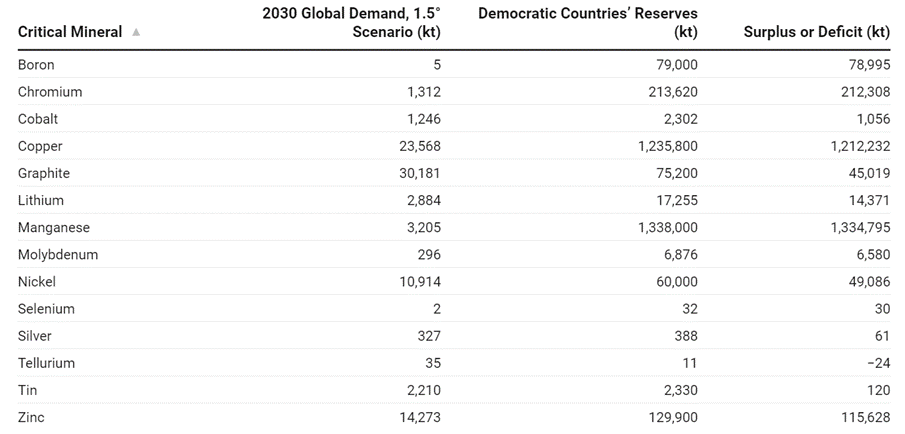

A study by Johns Hopkins University finds that partnerships among democratic states would be able to produce enough minerals to enable the world to limit warming to 1.5 degrees Celsius, the more ambitious target outlined in the Paris Agreement (see below).

Such policies are likely to be the way forward for nations like the US to secure enough supplies needed to build out their clean energy infrastructure.

US Critical Minerals

The US has a list of 50 mineral commodities that it considers critical to its economy and national security. The list is determined using the most advanced scientific methods to evaluate the mineral’s so-called “criticality”, an extensive process that goes through multiple agencies.

The current list was last revised and published in 2022

The US critical minerals list contains 15 more commodities compared to the first list created in 2018. Much of the difference, as noted on the US Geological Survey’s website, is the result of splitting the rare earth elements and platinum group elements into individual entries rather than including them as “mineral groups.” In addition, the 2022 list of critical minerals adds nickel and zinc to the list while removing helium, potash, rhenium and strontium.

The new list was created based on directives from the Energy Act of 2020, which indicates that at least every three years, the Department of the Interior must review and update the list of critical minerals, update the methodology used to identify potential critical minerals, take interagency feedback and public comment through the Federal Register, and ultimately finalize the list of critical minerals.

As defined in the Energy Act, a “critical mineral” is a non-fuel mineral or mineral material essential to the economic or national security of the US. and which has a supply chain vulnerable to disruption. Critical minerals are also characterized as serving an essential function in the manufacturing of a product, the absence of which would have significant consequences for the economy or national security.

The 2022 list of critical minerals, while “final” at the time, is not intended as a permanent designation of mineral criticality but will be a dynamic list updated periodically to represent current data on supply, demand, concentration of production and current policy priorities, the USGS says.

“Mineral criticality is not static, but changes over time,” said Steven M. Fortier, USGS National Minerals Information Center director. “The 2022 list of critical minerals was created using the most recent available data for non-fuel mineral commodities. However, we’re always analyzing mineral markets and developing new methods to determine the various and evolving critical mineral supply chain risks.”

Prior to publishing the 2022 list of critical minerals, the USGS completed a thorough review of more than 1,000 comments received from the public, stakeholders, and local and state officials. These comments were received in response to the draft critical minerals list the USGS released for public comment in November 2021.

DOE Critical Minerals Assessment

Meanwhile, the US Department of Energy is also continuously assessing the “criticality” of minerals to incorporate into its critical materials strategies. While similar to the USGS, the DOE assessments differ in that they are focused specifically on “the importance of materials to energy and decarbonization technologies” and are “performed with an eye to the future.”

In late May, the DOE released a preliminary report that compiles core analysis for its latest Critical Materials Assessment for public comment. The DOE is actively seeking input from the public on these areas of interest to ensure that the Critical Materials Assessment is comprehensive and accurate.

The Request for Information, which is being issued by the Office of Energy Efficiency and Renewable Energy (EERE)’s Advanced Materials and Manufacturing Technologies Office (AMMTO), aims to enhance the DOE assessment before it is finalized.

Like previous reports, this analysis provides a range of possible demands for selected materials based on various deployment scenarios, levels of sub-technology market penetration, and material intensities.

To evaluate supply risk, projected demand is compared against current production capacity to estimate the supply gap while also considering social, political, and other market disruption factors.

The DOE says rather than predicting the future, the goal is to understand potential roadblocks to energy deployment in the short term (2020–2025) and medium term (2025–2035), which would help inform R&D investments and policy engagement.

DOE Report Specifics

This report leverages the findings of 11 “supply chain deep dive” reports the DOE released in 2022 as part of Executive Order 14017 on securing America’s supply chains. These reports were designed to evaluate the potential vulnerabilities to the supply chains that make up the country’s energy sector industrial base and that contribute toward decarbonizing the US economy.

A list of candidate materials was first derived from these DOE supply chain assessments. They cover technologies such as carbon capture, electric grid (including transformers and high-voltage direct current transmission), energy storage, fuel cells and electrolysers, hydropower including pumped storage hydropower, rare earth magnets, nuclear energy, platinum group metal catalysts, semiconductors, solar photovoltaics, and wind energy.

The candidate material list was further refined in consultation with experts from various DOE offices. The final candidate list has 37 materials along with their technologies, as shown in the table below:

The DOE notes that since the last CMS report in 2019, the global material supply chains have been significantly impacted by various events, namely the Covid-19 pandemic which has caused labour and material shortages, reduced capacity, and delayed capacity development for multiple energy products. Additionally, Russia’s invasion of Ukraine has limited energy and material supply to the US and European countries, leading to increased pressure on obtaining supply from other Asian countries and higher prices.

The International Energy Agency (IEA) reported that increased fuel prices were responsible for 90% of increased average generation costs for electricity on a global basis.

While the global pandemic did not affect the growth of certain clean technologies such as electric vehicles (EVs), Russia’s invasion has boosted near-term demand for oil and gas, and has also changed the way various governments plan for energy security and deploy clean energy in the medium term to meet zero carbon emissions by 2050, the DOE says.

Screening Methodology

As the DOE notes in its report, performing a criticality assessment of all of the elements in the periodic table (plus a variety of engineered materials) that are currently used in all energy technologies is a nearly impossible task. The periodic table includes 118 specific elements, a large number of which are being used to some extent in energy technologies.

Similarly, a comprehensive list of energy technologies ranges from specific power generation and storage technologies to wide-ranging end use and efficiency-enhancing technologies. To complicate matters further, each broad technology class contains a range of available nascent and mature subtechnologies,

In an attempt to objectively identify a more targeted list of key materials and clean energy technologies, the DOE assessment introduces a formal screening methodology to determine which materials to evaluate in more detail. The purpose of the screening methodology is to provide a “simple and replicable method” for categorizing materials into two groups:

(1) key materials, which are those that have some specific concern to clean energy and decarbonization technologies in the short to medium term, and are thus included in the broader material criticality assessment; and

(2) Lower-risk materials, which contribute to technologies that are anticipated to be less important over the next 5 to 15 years (due, for example, to decreasing demand for a mature technology or lack of demand for a more nascent or noncompetitive technology).

The screening method uses a scoring system based on a weighted sum of three factors. These factors are used to assess:

- The importance of the broader technology class to the energy system;

- The relative importance of the specific sub-technology or component under consideration within its technology class; and

- The importance of the specific material.

For example, to score neodymium for its use in wind turbines, the importance of wind energy was considered first, followed by the importance of turbines with direct-drive generators, and finally the additional neodymium demand growth implied by the growth of this specific technology.

The table below shows a summary of the metrics selected to measure each of the three factors, along with their relative weights and scoring determinations.

As shown above, each metric was assigned a threshold such that each material/technology pair could be assigned a score of 1, 2, or 3 based on the value of each respective metric. Each metric was also given a weight from 2 to 4 out of 9 total points to emphasize their relative importance. Therefore, the maximum total score in this framework is 27, with a minimum score of 9.

According to the DOE, the screening methodology was developed precisely to screen out materials that are characterized by particularly large commodity markets or those that are used in negligible quantities in individual applications (e.g. iron used in NdFeB magnets or the nickel used to coat them).

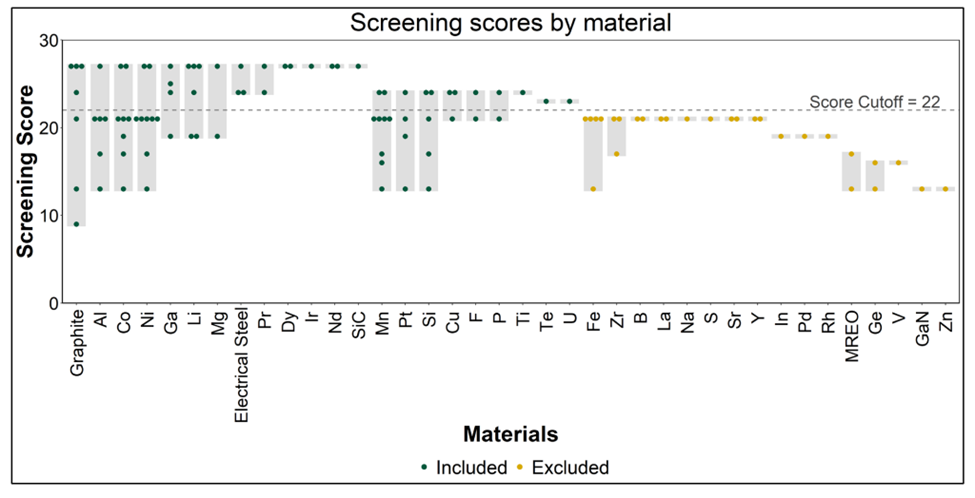

Such materials may receive high scores for technology and sub-technology/component importance, but the lowest score for material importance to the technology (each would receive scores of 21 in this example). For this reason, a threshold value of 22 was selected for inclusion in the overall criticality assessment.

Screening & Criticality Results

The screening scores received by the 37 candidate materials are shown in the figure below.

All materials to the left of iron meet the threshold to be considered key materials, while the remainder are lower-risk materials.

In total, 22 materials were selected for further evaluation in the criticality assessment.

Note some materials (i.e. aluminum, cobalt, graphite, germanium, lithium, magnesium, platinum, and silicon) are used in several applications, and so their scores cover a wide range. Others such as dysprosium and uranium are evaluated for their usage in only one or two technologies and receive a single score.

In assessing the criticality of the 22 highlighted materials, the DOE has adapted a methodology

developed by the National Academy of Sciences (NAS) that focuses on two main aspects: 1) impact of supply disruption; and 2) supply risk. These two dimensions are rated on a scale from 1 to 4 and presented on a matrix to illustrate the relative criticality of individual minerals.

The DOE evaluation specifically addresses concerns related to energy technologies. Firstly, the importance of a material to the energy sector replaces the assessment of “impact of supply restriction.” Secondly, five distinct factors are introduced to assess the “supply risk” of a material. Lastly, the assessments take a forward-looking approach by considering demand scenarios and analyzing the supply and demand dynamics in the short and medium terms, which can inform different policy response options.

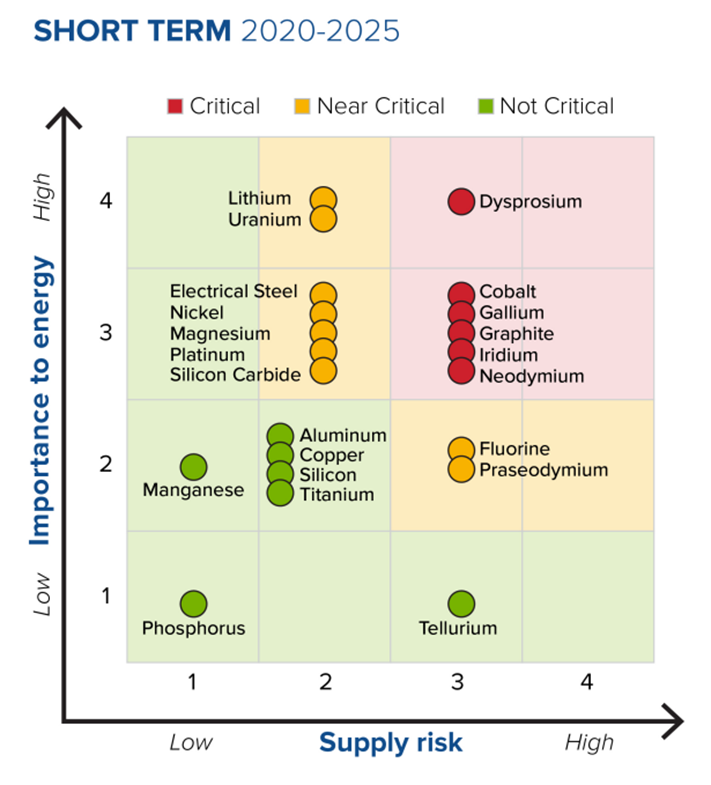

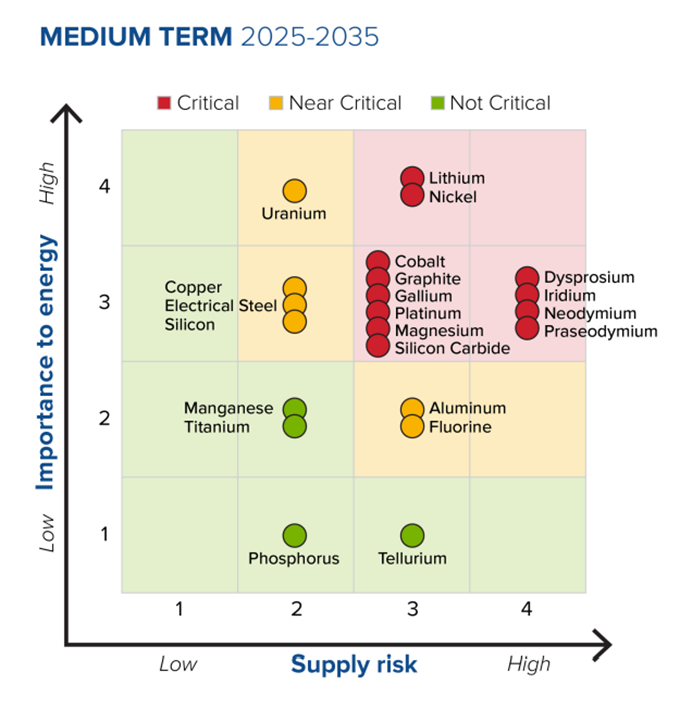

The criticality ratings for the key materials in the short and medium terms, respectively, are plotted below.

According to this analysis, there are six critical materials in the short term, which include cobalt, dysprosium, gallium, natural graphite, iridium and neodymium. The uses for these critical materials are spread across rare earth magnets, batteries, LEDs, and hydrogen electrolyzers. Then, there are nine near-critical materials, which include electrical steel, fluorine, lithium, magnesium, nickel, platinum, praseodymium, silicon carbide (SiC) and uranium. Finally, there are seven non-critical materials including aluminum, copper, manganese, phosphorous, silicon, tellurium and titanium.

Between the short and medium term, the importance to energy and supply risk scores shifts for most materials. There are 12 critical, six near-critical, and four noncritical materials in the medium term. For example, the “importance to energy” scores for copper and silicon increase while their supply risks remain the same. In addition, supply risk scores for aluminum, iridium, manganese, neodymium, phosphorous, platinum and SiC increase, while their importance to energy stays constant.

Nickel increases in both importance to energy and supply risk. Dysprosium, on the other hand, falls in energy importance due to potential substitutions in the medium term but increases in supply risk, remaining a critical material. All other key materials remain in the same category from the short term to medium term.

Conclusion

The Critical Materials Assessment provides us with an overall understanding of the vulnerability of relevant supply chains. Importantly, it further confirms the critical status of certain minerals identified by the USGS.

As highlighted by the DOE report, there are six minerals that are considered “critical” in the short term, one of which is graphite. Graphite is also one of only four USG-listed critical minerals that is essential to all six industrial sectors screened by the USGS.

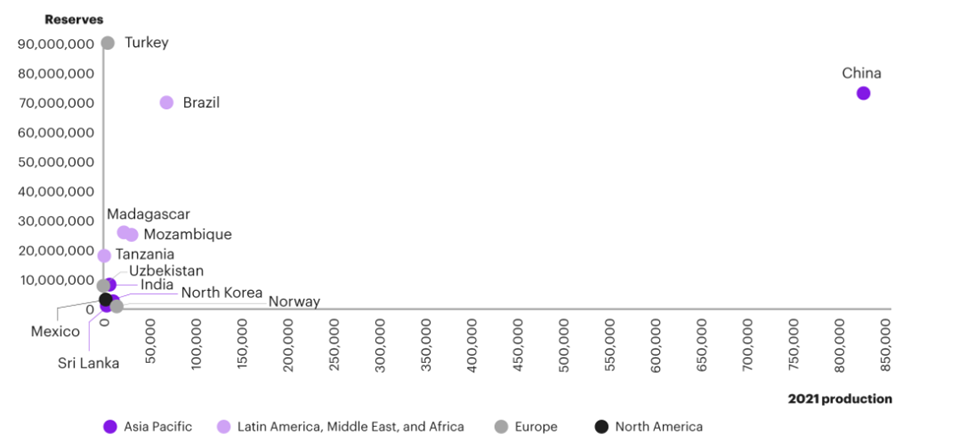

In the past, we’ve highlighted the importance of natural graphite in the world’s vehicle electrification process and the urgent need for the US, which is 100% reliant on imports, to develop its own supply. Graphite demand in recent years has been predominantly driven by its use as the anode active material in batteries for EVs and stationary energy storage systems.

According to the USGS, in 2022 the US imported 82,000 tonnes of natural graphite, of which 77% was flake and high-purity. The top importers were China (33%), Mexico (18%), Canada (17%) and Madagascar (10%).

But taking into account the fact that EV batteries require run-of-mine graphite to go through purification and coating, a process controlled by China, the US is actually not 33% dependent on its rival for its battery-grade graphite, but 100%. This is a precarious position to be in should the country want to stay in contention for EV dominance.

Hence, graphite is now firmly placed on the US government’s critical minerals list, and is identified as one of five key battery minerals that are at risk of supply disruptions. The other four — lithium, nickel, cobalt and manganese — typically form the cathode that decides the capacity and therefore tend to get more attention. But graphite, as the anode material, is probably the most crucial one since it’s far superior to current alternatives.

According to the USGS, the battery end-use market for graphite has already leaped by 250% since 2018. It’s thought that battery demand could gobble up well over 1.6 million tonnes of natural graphite per year.

For context, the 2022 mine supply was about 1.3 million tonnes, which means we’re very close to entering, if not already, a period of deficits. Benchmark Mineral Intelligence projects that natural graphite will have the largest supply shortfalls of all battery materials by 2030.

And this is just counting EV battery use only; the mining industry still needs to supply other end-users. The automotive and steel industries remain the largest consumers of graphite today, with demand across both rising at 5% per annum.

BMI has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand across all sectors.

All things considered, the graphite market has a tough mountain to climb, and its critical mineral label is more than warranted.

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.