The Golden Age of critical materials – Richard Mills

2023.02.25

The electrification of the global transportation system and the move to decarbonize energy sources in favor of renewables, is one of the most overriding, long-lasting global themes currently underway.

Take a look around. The shift from fossil-fuel-powered vehicles to EVs run on batteries is happening in almost every country. Governments are spending billions on EV charging infrastructure and subsidies to incentivize consumers to switch to hybrids and plug-in electric cars, vans and trucks. China is the leader but other countries are catching up, as large automakers like Volkswagen, Mercedes Benz, GM and Ford come out with new EV models and plan new EV manufacturing/ assembly plants in North America and Europe.

Not only do we need to figure out a way to transition from gasoline-powered vehicles, there is also the question of how to fill the batteries demanded by electrification. Creating that energy — solar, wind, hydro and nuclear — involves a massive use of metals to build batteries, energy storage systems, transmission lines and smart grids.

Arguably, the three most critical inputs in the race to electrify and decarbonize are copper, lithium and graphite.

You know it’s interesting. While much of the investing “herd” is focused on how much the stock market will rebound, quietly, behind the scenes, something else is going on.

Amid de-globalization and the rise in geopolitical tensions, the need to quicken the energy transition and secure critical minerals supply has increased apace, and it comes on the heels of a decade of chronic underinvestment in the sector, thus magnifying the level of capital investment required.

As this article sets out to prove, we are entering a Golden Age of critical materials.

Energy transition stocks outperform

“We believe the post-pandemic era marks the beginning of a new supercycle for commodities, especially for critical minerals driving the clean energy transition,” Sprott’s Paul Wong and Jacob White wrote in a recent article titled ‘Critical Materials Start 2023 With a Bang’.

Their conclusion? “Escalating geopolitical tension and the need for governments to re-shore supply chains and production to ensure industrial security have helped to accelerate the transition, which will be commodity- and capital-intensive. We foresee a demand shock for commodities, particularly critical materials.”

Using technical analysis, the authors found that metals including lithium, uranium, copper and nickel, have attracted considerable investor attention over the past three years.

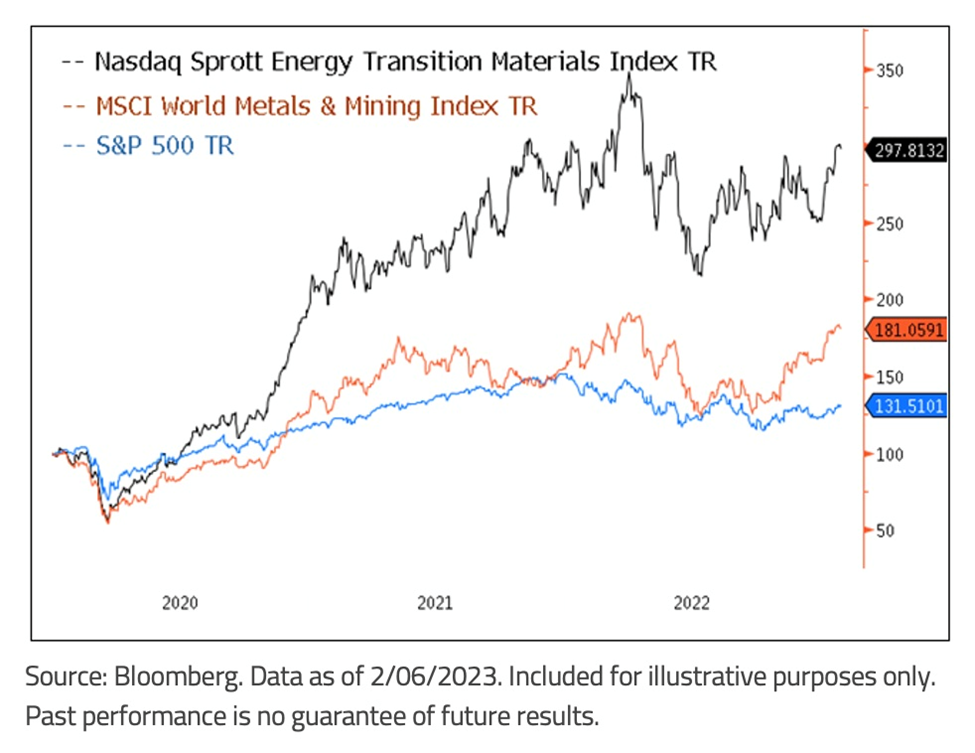

January proved especially lucrative for investors of energy-transition materials, represented by the Nasdaq Sprott Energy Transition Materials™ Index (NSETM™). The index, shown as the black line below, rebounded strongly by 17.51% for the month, outpacing most cyclical and resource sectors that Sprott tracks.

Going back a bit further, it was noticed that from late September to year-end, the index rallied on the back of peaks in the US dollar and Fed rate hikes. The January burst is explained by fears of hyperinflation abating, and the Fed signaling it might slow rate increases. Also playing into the bullish narrative, is a much-warmer winter in Europe than expected, allowing the EU to dodge an energy-induced hard landing, as well as China quickly reversing to a covid re-opening following months of strict lockdowns.

“With all three major economic regions experiencing a sudden reversal from left-tail (negative) to right-tail (positive) outcomes, massive forced buying was triggered,” the Sprott article states.

In fact the news is even better; energy-transition equities have been outperforming the market since 2020.

The chart below shows that from Jan. 2, 2020 to Feb. 13, 2023, NSETM gained 197.81%, compared to the S&P 500’s 31.52% and the MSCI World Metals and Mining Index (81.06%).

The latest edition of the TSX Venture 50 list shows investors are increasing loading up on stocks with an energy-transition theme.

The list, released on Tueday by the Toronto Stock Exchange, showcases small-cap issuers across five sectors — energy, mining, clean technology and life sciences, diversified industries, and technology.

The companies are ranked by their 2022 performance in three areas: market capitalization growth, share price appreciation and trading volume.

Unsurprising to me (I was AOTH writing this was going to happen, see centered article link below), is how well mining did last year. The sector grew 174% compared to 34% combined growth among other sectors, driven, Global News states, in part by sudden increased investor interest in the critical minerals and metals space.

$2.85 trillion in new US spending bolsters bull market in electrification & decarbonization metals

Another interesting trend, documented by Bloomberg, is energy traders using profits reaped from trading oil and gas, to expand into metals and agriculture.

While it’s not the first time that major energy merchants like Gunvor Group, Hartree Partners LP and Vitol Group have done this, Bloomberg says the energy crisis and the war in Ukraine underscored how high natural gas prices curbed metals output and boosted fertilizer costs. Also, metals like copper and lithium are crucial to the energy transition, and a renewable diesel boom is boosting crop demand.

“It’s sensible diversification,” a commodities consultant and former strategy director at agri giant COFCO International was quoted saying. “Margins and revenues in agricultural and metals trading have proven resilient in recent years.”

New commodities supercycle

As mentioned, since the onset of the Russia-Ukraine war, deglobalization has accelerated and geopolitical tensions have risen. The need to quicken the global energy transition and secure critical minerals supplies has increased commensurately, and it comes on the heels of a decade that saw chronic underinvestment, which now magnifies the level of capital investment needed.

Sprott therefore believes we are in the early stages of a new commodities supercycle, represented by energy-transition materials.

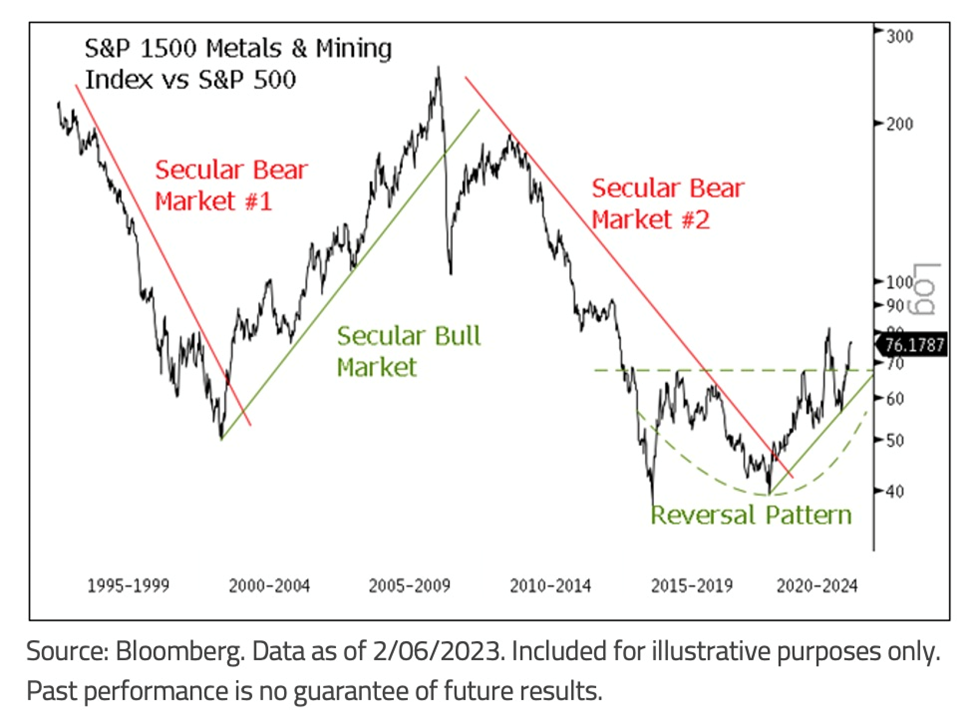

Like the last supercycle in the 2000s, China plays a major role. The two charts below describe a fascinating, and closely watched indicator for metals demand, known as the “China credit impulse”. This refers to the change in the rate of growth of new credit in China created by banks and other financial institutions. We must remember that China accounts for around 60% of metals demand. The expansion or contraction of credit created a boom- bust effect for metals.

The first chart highlights the performance of the S&P 1500 Metals & Mining Index versus the S&P 500 Index going back to 1995. Notice the bear market reversal starting in 2020.

The next chart plots the China credit impulse 12 months forward. Sprott then overlaid the copper price and the MSCI Global Metals and Mining Index to illustrate this lead indicator’s usefulness over the past decade. The correlation between the three variables is, imo, quite startling.

Combustion goes bust

Turning from the commodity supercycle to the energy transition itself, we note that there has been as much movement away from gas- and diesel-powered cars and trucks, as an embrace of electrification.

The tip of the spear, so to speak, is governments, particularly in Europe, enacting laws to ban the sale of internal combustion engine (ICE) vehicles and in one country, a full road ban.

Last week, Statista reported the European Union approved a law banning the sale of ICEs by 2035, marking the first such deadline for Germany, Italy, Romania, Bulgaria, the Czech Republic and Hungary. Other EU countries are aiming to phase them out earlier, between 2029 and 30. They include the Netherlands, Belgium’s Flanders region, Sweden, Greece and Slovenia. Leading Europe’s drive to electrify is Norway, where 80% of new cars sold are already fully electric, with 100% scheduled to be in 2025.

In the United States, as with most environmental initiatives, California is the leader, having set a 2035 phase-out date. The other states going along with California’s decision, or those expected to, are Washington, Oregon, Connecticut, Massachusetts, New York, Vermont and Delaware. Notably, 17 states which previously had tied their vehicles to California’s under the Clean Air Act, now want out.

While hybrids were initially to be phased out in California as well, some models with large battery power will now be allowed. Canada, Singapore, Slovenia and Japan are also treating hybrids favorably in their phase-outs, says Statista, noting that most nations want them gone also by the time their ban date comes up.

The article highlights Sri Lanka as the country setting the toughest goals when it comes to eliminating ICEs. By 2040, gas-powered cars will not only be prohibited from being sold, they will be banned from roads, along with “tuk-tuks” (motorized rickshaws) and motorcycles.

As combustion goes bust, the other part of the investable electrification/ decarbonization trend I mentioned at the top, is also quickening its pace. Ironically, this is being driven by a return to coal use, caused by Russia’s invasion of Ukraine, which blocked Europe’s access to natural gas, its primary source of electricity. As The Economist writes:

In their panic to keep the lights on, politicians across Europe and Asia are reopening coal mines, keeping polluting power plants alive and signing deals to import liquefied natural gas (LNG). State-owned oil giants, such as the UAE’s Adnoc and Saudi Aramco, are setting aside hundreds of billions of dollars to boost output, at the same time as private energy firms mint enormous profits. Many governments are encouraging consumption of these dirty fuels by subsidizing energy use, to help citizens get through the winter.

Yet the reality is that the return of brown fuels is a subplot in a much grander story. By making coal, gas and oil scarcer and dearer — prices remain well above long-run averages, despite recent falls — Russia’s invasion of Ukraine has given renewable power, which is mostly generated domestically, a significant strategic and economic edge. Indeed, even as Mr. Habeck endorsed coal-mining last year, the Green politician set out plans to expand solar and wind energy, including in Lutzerath’s gusty Rhineland. All over the world officials are raising renewables targets and setting aside huge sums to bankroll a buildout.

US is now the second-biggest EV market

While EV penetration into North America has been slower, and continues to meet more resistance compared to Europe, the latest sales figures indicate this is changing.

Data from Bloomberg New Energy Finance (NEF) shows the United States is now the second-largest electric-vehicle market behind China. Last year, nearly a million EVs were bought in America compared to 650,000 in 2021, pushing Germany into third place.

Tesla led the way by a considerable margin with 510,610 units sold, followed by Ford @ 74,000 units.

“The US is poised for a breakout year in 2023 with new EV manufacturing capacity and a fairly generous federal tax credit expected to drive sales to around 1.6 million,” BloombergNEF noted.

Electric cars are expected to account for nearly 80% of EV market revenues and 83% of battery demand over the next two decades.

Annual spending on EVs reached $388 billion in 2022, up 53% from 2021, according to a new report published by BloombergNEF. The total value of electric vehicles sold to date in the passenger vehicle segment has now crossed $1 trillion. 2023 sales are likely to top $500 billion.

(for context, note that in the 10 years that EVs have been around, the value of total car sales (ICEs + hybrids + electrics) has been roughly $25 trillion. $1 trillion in EV sales thus only represents 4% of total sales)

At the top I mentioned that copper, lithium and graphite are the most critical inputs in the race to electrify and decarbonize. Lately the news on all three has been quite positive, which is why I remain extremely bullish on them and the companies exploring for them.

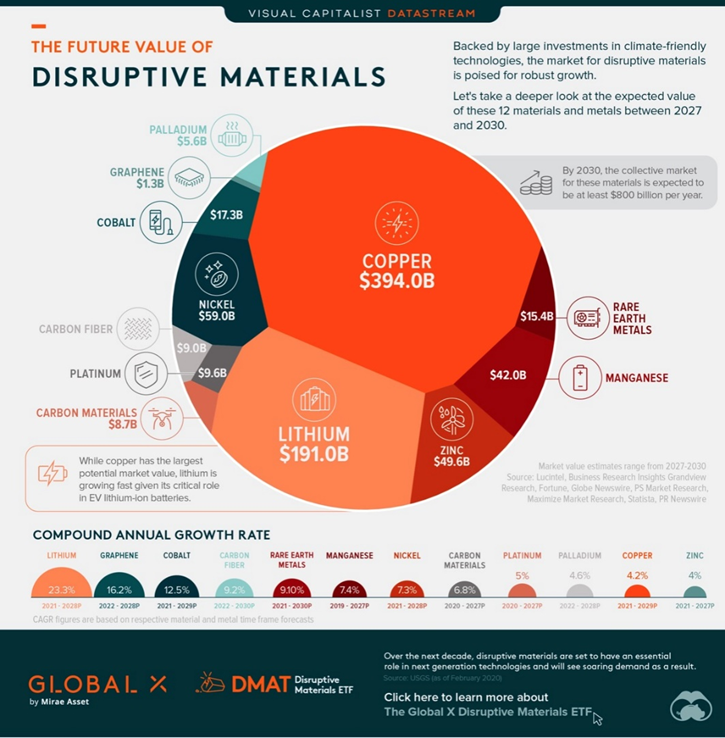

A recent infographic from Global X ETFs puts copper at the top of a list of 12 disruptive materials by market value. The copper market is expected to grow at a compound annual growth rate of 4.21% between 2021 and 2029, putting it at a projected 2029 value of $329 billion.

Lithium is a distant second at $191 billion, but is the fastest-growing materials market, with a 23.3% CAGR between 2021 and 2028.

According to Global X ETFs, the collective market value for these 12 disruptive materials is expected to be worth over $800 billion by the end of the decade.

I find it unbelievable that while graphene is thrown in as almost an after thought graphite is not even mentioned?

The electrification of the global transportation system doesn’t happen without copper, lithium and graphite.

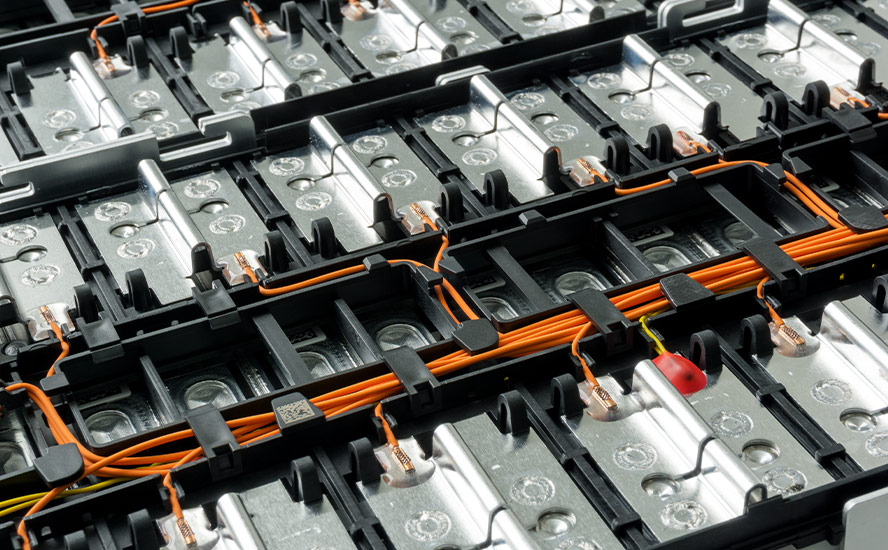

Lithium-ion batteries are composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

The cathode is where metals like lithium, nickel, manganese and cobalt are used, and depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, a material for which there are no substitutes.

An average plug-in EV has 70 kg of graphite. Benchmark Mineral Intelligence estimates that building 1 million electric vehicles requires 105,000 tonnes of medium- to large-flake graphite — the equivalent of five new mines.

Ahead of the Herd Newsletter 2023 Issue 13 GRAPHITE Special Addition

Graphite is the largest component in batteries by weight, constituting 45% or more of the cell. It may surprise some readers to learn that there is nearly four times more graphite feedstock consumed in each lithium-ion cell than lithium and nine times more than cobalt.

In the United States, four lithium-ion battery manufacturing plants are currently in operation, with an additional 21 in development. At full capacity, these plants are expected to require approximately 1.2 million tons per year of spherical purified graphite consuming almost 100% of current (2022) mined graphite supply of 1.3Mt.

And this is for only one use, EVs, in one country! Where are all the other countries going to get the graphite needed to build electric-vehicle battery anodes? Not to mention all the other uses of graphite, including for refractories, foundries and crucibles, metallurgy and lubricants?

Hence, graphite is considered indispensable to the global shift towards electric vehicles.

The graphic below lists Carbon Materials and Carbon Fiber Projected Market Value. Graphite is a form of pure carbon, diamonds another.

China is by far the biggest producer with 65% of the world’s graphite production. Due to weak environmental standards and low costs, China also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain, including the manufacturing of anodes needed for EV’s. The US is actually 100% dependent on China for its battery-grade graphite.

Conclusion

There’s a lot going in the critical materials area, and most of it is positive for the minerals that are mined and processed into end-products that are used in vehicle electrification, energy storage, and the roll-out of renewable energies such as wind and solar power.

Transitioning from fossil fuels to electric vehicles and renewables will be a herculean task, made all that much harder by the scarcity of the critical raw materials required.

Politicians beholden to pressure groups (environmental, indigenous), promise billions of dollars in subsidies and tax relief to build electric-vehicle battery plants and invite foreign “green” investment, yet have seemingly no concept of the metals needed for this transition.

The many pressures on supply, matched against explosive demand, all but guarantees higher prices for key critical materials, as the global electrification and decarbonization trend intensifies.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.