Push for more LNG overshadows fracking-caused earthquakes

2019.03.22

LNG Canada is getting more ambitious in its plans to build BC’s first liquefied natural gas (LNG) facility at Kitimat. The head of the consortium of Asian energy companies led by Shell Canada indicated last week that it’s only a matter of time before the group commits to an expansion.

The $40 billion project currently under construction envisions two “trains” – industry parlance for the system of compressors that turns the natural gas into liquid for shipment – that would output an estimated 14 million tonnes per year. Two more trains to be built later (or sooner) would double production to 28MMtpa.

“The five joint venturers now have probably two main considerations in their head as to when they go ahead with [the final investment decision] on the expansion trains,” LNG Canada CEO Andy Calitz said at an energy conference in Houston. “The first one is, what is the market doing? What is the market doing globally in terms of Korea, Japan and China, South Asia and India?”

“While CAPP is encouraged by LNG Canada’s decision to proceed with construction of its facility near Kitimat, B.C., one plant does not constitute an LNG industry. It’s a good start, but Canada needs to facilitate the development of more such projects on the West Coast.” Canadian Association of Petroleum Producers (CAPP)

Energy consultants Wood Mackenzie, in a recent report, said LNG Canada would need prices of around $9 to break even. Other analysts think prices may need to be even higher.

“I think they need to be more like $11 or $12 for this project really to be financially viable. So if an investment decision is made this fall, it would be on the basis of projections.” Werner Antweiler, a professor of economics at the University of British Columbia’s Sauder School of Business

Asian LNG prices drop to near three-year lows

Asian, European LNG prices crash below $5 on oversupply

But it was Mr. Calitz’s comments that made me wonder, perhaps before sending out signals about even higher LNG output, he should consider that a fracking ban was imposed in December by the BC Oil & Gas Commission (BCOGC) following three earthquakes around Fort St. John. The magnitude 3.4, 4.0 and 4.5 quakes were caused by Canadian Natural Resources Ltd., the country’s largest oil and gas producer, while drilling two wells about 20 km south of the city on Nov. 29.

As far as we can tell, the fracking ban on CNRL is still in place. There is no news about a restart on the company’s website nor on BCOGC’s web page.

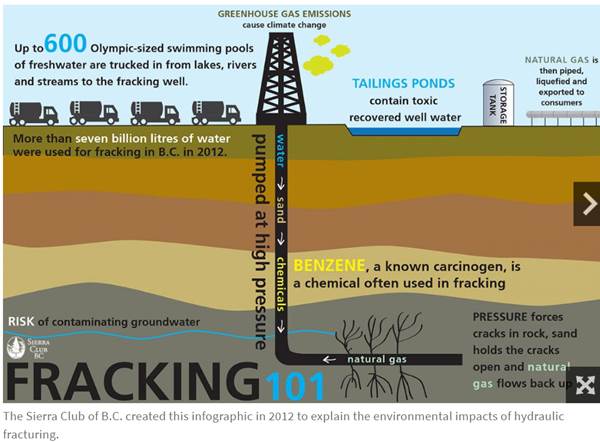

If more frequent and more powerful earthquakes occur, fracking could be shut down again, if not by the pro-industry Oil & Gas Commission, by residents fed up with its negative effects, including the greenhouse gas methane, and benzene that leaked into the water supply being consumed by pregnant women.

Without natural gas fracked and pipelined from northeastern BC’s Montney region, there won’t be any LNG trains running.

Fracking and earthquakes

How do we get the natural gas for LNG? We frack it. Most of the conventional natural gas formations in British Columbia have already been depleted. What’s left is “tight gas” trapped in shale rock formations, primarily the Montney in northeastern BC. According to the BC Oil and Gas Commission, only 22% of BC’s remaining natural gas reserves are conventional; the rest are unconventional, which involves fracking.

In hydraulic fracturing, or fracking, a concoction of chemicals, water and frac sand is pumped into a well at high pressure to break apart the shale rock in order to create fissures that release the natural gas.

Fracking defenders say the process is perfectly safe and contained. The reality is that pollutants are released throughout the process – into the air and water.

Some of the wastewater is pumped underground into waste wells or saline aquifers. There are serious concerns about the ability of these waste wells and aquifers to handle the increased pressure. The evidence is showing that deep-well injecting, and fracking, are linked to the occurrence of earthquakes.

The connection between fracking/ wastewater injection and earthquakes has been strenuously denied by the industry. But a study published in 2016 found that both fracking wells and wastewater disposal wells, drilled near the border between BC and Alberta, could be linked to earthquakes of magnitude 3 or larger.

The same year the BC Oil and Gas Commission confirmed that fracking caused a 4.6-magnitude earthquake at a project operated by Progress Energy, that would supply gas to the now-cancelled Pacific NorthWest LNG terminal in Prince Rupert.

A major research project testing seismicity in northeastern BC found a 13-fold increase in the number of earthquakes under 2.5, from just 14 between 2009 and 2013, to 186 for one year, between August 2013 and August 2014.

Warning Bells about Fracking and Earthquakes Growing Louder

The data corresponds with a dramatic increase in natural gas production in both BC and Alberta during roughly the same time period.

In 2015 the BC Oil and Gas Commission confirmed that fracking caused a 4.6-magnitude earthquake three kilometers from a project operated by Progress Energy. This earthquake was the largest in the world caused by a fracking operation.

The quake on Nov. 29 was almost as large, 4.5 on the Richter Scale.

Fracking and dams

There is evidence of a government cover-up of the risk fracking presents to dam safety. Documents released by BC Hydro under Freedom of Information legislation showed that BC Hydro officials in 2009 became alarmed at a coal-bed methane operation near its Peace Canyon Dam – 23 km downstream from the W.A.C. Bennett Dam, the world’s seventh largest hydro reservoir. The operation involved drilling and fracking coal bed methane wells to increase their permeability.

“BC Hydro believes that there are immediate and future potential risks to BC Hydro’s reservoir, dam and power generation infrastructure as a result of this,” Ben Parfitt from the Canadian Centre for Policy Alternatives (CCPA) quotes BC Hydro’s former chief safety, health and environment officer, Ray Stewart. From Parfitt’s article:

Stewart went on to warn that the “potential effects” of such actions could be natural gas industry-induced earthquakes that were greater in magnitude “than the original design criteria for the dam.”

Yet the BC government Crown corporation said nothing and did nothing about Stewart’s concerns, which may become even more prescient once the Site C dam is built, especially if fracking is done anywhere close to the structure.

How vulnerable are the Peace River dams to northeastern BC oil and gas operations? The Canadian Centre for Policy Alternatives has done extensive research on this topic. Among its key findings:

- Earthquakes from fracking occur closer to the surface than natural earthquakes, putting dams and other major infrastructure at risk.

- Ground movement from fracking could alter weak bedrock and change the way water naturally seeps through earth-filled dams.

- Between 2010 and 2013, 12 earthquakes were recorded near BC Hydro’s Peace River dams, corresponding with fracking for shale gas.

- At least 92 unauthorized dams have been built in northeastern BC, to be used exclusively by oil and gas companies for the purpose of fracking. Nearly a third were found to have structural problems including a lack of spillways. No companies have been fined for violating the rules.

For a deep dive into this topic read our BC earthquakes and fracking

Fracking and climate change

Extracting natural gas through hydraulic fracturing, transporting it to a terminal, and then super-cooling it for transport in tankers, is not clean energy; in fact, it may even be dirtier than coal.

In most cases, the same fracked natural gas is used to run the compression units, which pretty much defeats the purpose of LNG as “clean”.

According to a study by Wood Mackenzie, LNG will be the biggest source of carbon emissions growth by 2025 – due to strong demand from Asian buyers.

We have written extensively on the negative effects of natural gas on human health, the environment, and fresh water supplies. Parsing the complete list, found in our article New Brunswick nuclear energy vs BC LNG, here are the effects of NG on climate change (remember that for an LNG industry to be built in BC, the natural gas must be fracked, then supercooled using natural gas as well):

- Methane emissions: Natural gas is mostly methane (CH4), a potent greenhouse gas that is 25 times more efficient than carbon dioxide at trapping heat in the atmosphere over a 100-year period (the Intergovernmental Panel on Climate Change says methane is 86 times more damaging than CO2 over 20 years). Fugitive methane emissions run from 1% to 9% of total natural gas life cycle emissions. In order for natural gas power plants to be cleaner than coal, methane emissions over the plant’s life cycle must be kept below 3.2%, according to one study. The biggest methane leak in US history occurred in California in 2015. It took SoCal Gas nearly four months to plug the leak at the Alison Canyon gas field – during which an estimated 109,000 tonnes of methane was released into the atmosphere.

- Melting glaciers/ landslides/ forest fires. More methane and other emissions from natural gas development will result in higher carbon levels in the atmosphere, which have been shown to increase global temperatures. The effects are likely to include: the melting of Arctic permafrost to expose large lakes bubbling with methane gas; The crack of a glacier breaking apart was the trigger for the Mount Meager landslide near Squamish. Researchers think that warming temperatures are responsible for the “fumaroles” atop Mount Meager emitting hydrogen sulfide, carbon dioxide and steam. They are studying the gases, the expansion of the fumoles, and how fast the ice is shrinking, which could trigger an eruption and a landslide like in 2010, only 10 times worse; more prolonged droughts causing more forest fires of increasing intensity – last summer’s fire season in BC was the worst on record. Some fires were so hot, they couldn’t be put out with water alone.

A UN report last year said that limiting the temperature of the earth to a 1.5-degree rise means that people will have to immediately change the way they use fossil fuels, to avoid environmental catastrophe.

There is no way the BC government is going to be able to meet its climate change goals, having approved LNG Canada. The province has committed to cutting greenhouse gases by 40% by 2030 (and 80% by 2050) but LNG Canada would produce 3.45 megatonnes of carbon a year.

And that’s with just the first phase; as mentioned at the top, the plan is to double the LNG output.

Dim market outlook

It’s curious that LNG Canada CEO Andy Calitz is so optimistic about LNG, he feels he can talk about doubling production to 28 million tonnes a year. A little bit of research shows that the future of liquefied natural gas is not bullish. With so many LNG plants being built worldwide, the market is setting itself up for a supply glut.

Indeed, BC is late to the LNG party. Australia and the United States are way ahead. Seven American LNG plants amounting to 90 million tonnes per annum (MMtpa) will likely reach a final investment decision by the end of this year, according to Bloomberg’s ‘Global LNG Outlook 2018’. US export capacity will double by 2030. 104 MMtpa of new capacity is expected to be added to the market by 2021.

“If all ‘likely and highly likely’ rated pre-FID projects get built, the global LNG market may provide 557MMtpa of capacity and looks to fall into another phase of supply glut even under a high-demand scenario,” states the report.

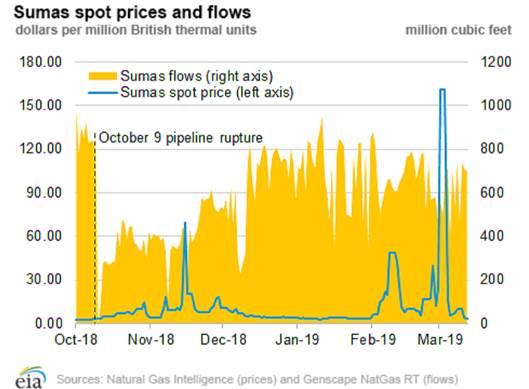

In other words, lower LNG prices. That’s probably not what Western Canadian gas producers want to hear. For the past year or so, Alberta NG prices have been under $2 per million BTU, compared to over $5 per MMbtu in 2014.

Like Canadian crude oil producers, Canadian NG companies face an over-supply of natural gas due to a lack of pipelines, which is dragging prices down. Their hopes are pinned on LNG Canada and its yet-to-be-built Coastal GasLink pipeline – which would move natural gas 670 kilometers from the Montney region to Kitimat. Construction of the LNG plant is expected to take five years.

The low prices are curtailing production. At Shell Canada’s Groundbirch natural gas operation, no new wells will be drilled over the next two years, meaning the facility’s output will drop by 15% due to natural well depletions, CBC News reported in January.

Tourmaline Oil has capped its production at 2017 levels.

As for what this means for LNG Canada, it’s hard to say. Likely the consortium has locked production into long-term contracts with suppliers, so it may be insulated against lower LNG prices. But it’s a pretty shaky foundation to build an LNG industry on, knowing that the market is going to be even more awash with gas.

Worst is yet to come

What we do know is that this LNG ship appears to have left the dock, and once under power, it may be impossible to turn around.

The $40-billion LNG Canada facility in Kitimat is only the first of many LNG plants likely to come.

“If you get one plant through, you’ll get a second and third plant to follow much easier,” Steve Laut, vice chairman of Canadian Natural Resources, told Bloomberg upon hearing the LNG Canada announcement, last October. “It gives confidence to the other proponents.”

According to the BC Oil and Gas Commission there are three more LNG projects in the planning stages, and five natural gas pipelines. The closest one to receiving a permit appears to be Woodfibre LNG which plans to build a $1.6 billion LNG project near Squamish, by 2023.

BC will start to resemble Alberta, where much of the province is covered in natural gas pipelines, compared to just three currently installed in the province. That means more fracking, more methane released, more CO2 and other pollutants released into the atmosphere, and more tanker traffic – making it harder for killer whales to find food and to mate, thus accelerating their population decline and possibly eliminating this majestic species from our ecosystem in a few years.

Conclusion

The province of BC continues to lumber into an LNG industry the government says will generate $22 billion worth of tax revenue over its 40-year life. That sounds pretty good, until all the negative consequences are tallied up.

The costs to human health of fracking natural gas, pipelining and burning it to get LNG, in terms of increased hospitalizations, and drains on the medical plan from respiratory diseases and being poisoned by carcinogens like benzene, are dire.

Plus the risk fracking poses to dams and other large structures, and the negative effects of fracking and tanker traffic on the environment – including global warming causing glacial melting, landslides, the extinction of BC’s killer whales, etc. – will cost a great deal more than $22 billion, over the next 40 years.

What is the net benefit to BC of just one LNG project, let alone two or three more and a massive pipeline system that would have to be built to move all that gas around? I strongly suggest there is none.

“I see what the problem is here. I’m talking in English and your listening in dingbat.” Archie Bunker

I have to ask why all the talk about increased LNG production now? I mean its kind of ironic that the LNG consortium is talking increases, building 5 more pipelines across the province and mega miles of pipeline up and down the coast to supply their compressor plants with NG, when fracking is shut down in northeast BC because of earthquakes. Did they not get the memo?

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.