Poster child of government-industry cooperation, Graphite One builds circular economy

2022.04.07

Moving further towards its goal of becoming America’s first fully integrated graphite producer, Graphite One Inc. (TSXV: GPH) (OTCQX: GPHOF) has entered into two memorandums of understanding — one with battery materials recycler Lab 4 Inc. of Nova Scotia, Canada, and the second with Sunrise (Guizhou) New Energy Material Co., Ltd., a Chinese lithium-ion battery anode producer.

Under the first MOU, Graphite One and Lab 4 will work collaboratively to design, develop and build a recycling facility for end-of-life EV and lithium-ion batteries. Lab 4 is known for providing laboratory and engineering support to mining companies with a focus on recycling graphite, manganese and other minerals.

The intent of the second MOU with Sunrise, is to develop an agreement to share expertise and technology for the design, construction, and operation of Graphite One’s proposed US-based graphite material manufacturing facility. The plan for the materials facility — the second link in Graphite One’s US supply chain solution for advanced graphite products — will be detailed in the company’s Prefeasibility Study (PFS) expected to be released in the first half of 2022.

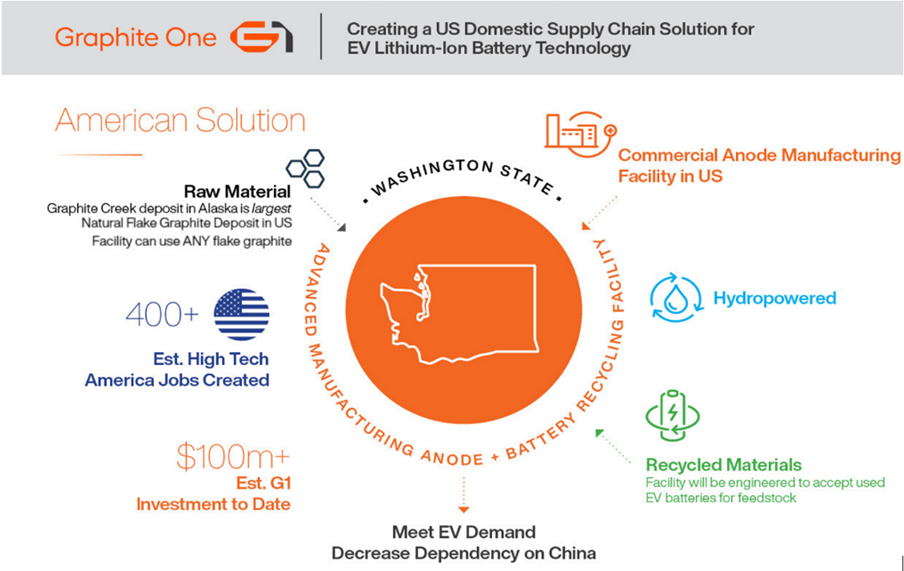

The recycling facility represents the third and final link in Graphite One’s 100% US-based graphite supply chain strategy, on top of its proposed Graphite Creek mine operation in Alaska and recently announced advanced materials manufacturing plant in Washington State. The recycling facility will be located next to the Washington manufacturing facility and engineered to accept used EV batteries for feedstock.

“With this new proposed recycling division joining our Graphite Creek mine and advanced graphite materials manufacturing plant as the third link, Graphite One plans to bring the full circular economy to the US graphite supply chain,” Graphite One’s President and CEO Anthony Huston commented in the April 4 media release.

“Adding recycling to renewable materials development is the missing piece in a true circular economy,” said Lab 4 CEO Ian Flint in a separate release.

“When you’re in the renewable energy space, you’ve got to think through the whole lifecycle — where will EV and lithium-ion batteries go when they are no longer useful? It can’t be to the landfill. That’s not responsible.”

Battery Recycling Opportunity

As Huston puts it, battery materials are “simply too critical and too scarce to let them go to waste,” not to mention the enormous amount of metals still needed for vehicle electrification.

BloombergNEF estimates that by 2030, consumption of key raw materials like lithium and nickel will be at least five times current levels. Graphite, too, could see its demand quadruple by the end of this decade.

According to the IEA, to meet the Paris Agreement goals, demand will rise by more than 40% for copper and rare earth elements, 60-70% for nickel and cobalt, and 89% for lithium over the next 20 years.

Facing a supply gap that could last decades, increased attention will be placed on global mine development to boost production of these minerals, requiring billions of dollars of additional investment. However, to maintain a sustainable supply, the recycling of EV battery metals is just as important, if not more.

Given that these metals are particularly durable, there is significant opportunity to reuse or repurpose them, taking the pressure off producers to keep up with demand.

Carmakers have already embarked on a battery recycling trend to cut down their usage of scarce raw materials. Mercedes-Benz last month firmed up plans for a 2,500-tonne battery recycling plant in Germany. BMW said it was focusing as much as possible on recycling nickel, with up to 50% scrap nickel used in the high-voltage battery of its new BMW iX model.

JB Straubel, CEO of battery materials start-up Redwood Materials, sees the future battery supply chain ultimately as a “closed loop” where recycling is key. His company recently entered a partnership with Ford and Volvo to recycle EV batteries. Last year, Redwood raised as much as $700 million from a group of high-profile fund managers, including T. Rowe Price, Baillie Gifford and Fidelity, to expand its operations.

Mining firms, too, are beginning to recognize the importance of battery recycling in alleviating global supply constraints. Metals giant Glencore announced in February that it plans to build a new lithium-ion battery recycling plant, as part of its deal with UK battery maker Britishvolt. French mining group Eramet is also eyeing a battery recycling facility in France by 2024.

A big reason that battery recycling has only begun to emerge in the key auto markets is the cost barrier; historically speaking, recycling is not a very profitable business.

However, the growing emphasis on “clean energy” and concerns with the global supply of EV minerals have made recycling more imperative than ever. Combined with the high commodity prices seen in recent years, recycling has become an attractive proposition and an avenue of income growth for companies.

The public sector is also doing their part in supporting recycling practices. Canada-based Lithion Recycling this week received C$22.5 million in funding from the Quebec government to continue developing a technology that is designed to recover 95% of strategic materials from end-of-life lithium-ion batteries and industrial waste.

The new funding by Lithion adds up to the C$125 million it had raised earlier this year from Quebec-based Fondaction, and from Korea’s IMM Investment Global, an investment fund that already has established relationships with cathode, cell and battery pack manufacturers such as LG, Samsung, SK Group, POSCO, and Hyundai.

The US, which has long sought to improve its battery supply chain, just invoked its Cold War powers by including lithium, nickel, cobalt, graphite and manganese on the list of items covered by the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War.

To bolster domestic production of these minerals, US miners can now gain access to $750 million under the act’s Title III fund, which can be used for current operations, productivity and safety upgrades, and feasibility studies. The decision could also cover the recycling of these materials, according to Bloomberg sources, an indication to us at AOTH that the US is looking to follow the “full circular principle”.

Later this year, the Department of Energy will begin the process of doling out $6 billion in grants for battery production, half of which are earmarked for domestic supplies of materials and battery recycling.

The Biden administration has already allocated vast amounts — including $6 billion as part of the infrastructure bill — towards developing a reliable battery supply chain and weaning the auto industry off its reliance on China, the biggest EV market and leading producer of lithium-ion cells.

America’s “Critical Mineral” Push

This move by the US to invoke the Defense Production Act is widely viewed by analysts and mining companies as urgently needed, and provides further proof of critical minerals’ growing geopolitical importance.

Currently, the US has a list of 47 import-dependent minerals that it considers “critical” to its economic and national security, and out of those, 32 are being produced by China and Russia.

Such a level of mineral dependence means the US will forever be “under the thumb” of its biggest rivals, unless it develops a reliable and sustainable supply chain. As for vehicle electrification, the nation already has a mountain to climb to secure enough minerals to achieve its goals.

Among the minerals key to winning the global EV race, graphite arguably is most significant and should be a top priority for the US, given it is the essential ingredient in electric vehicle batteries.

The lithium-ion battery used to power EVs is made of two electrodes — an anode (negative) on one side and a cathode (positive) on the other. Metals like lithium, nickel, manganese and cobalt are all used as cathode material, and depending on the battery chemistry, there are different options available to battery makers.

But for the anode, the common denominator in all lithium-ion batteries is graphite, and there are currently no substitutes for this raw material. It is also the largest battery component by weight, with each battery containing 20-30% graphite, up to eight times the amount of lithium.

According to the World Bank, graphite accounts for 53.8% of the mineral demand in batteries, the most of any. Lithium, despite being a staple across all batteries, accounts for only 4% of total demand.

The battery anode material, known as spherical graphite, is manufactured from either flake graphite concentrate produced by graphite mines, or from synthetic/artificial graphite. Only flake graphite upgraded to 99.95% purity can be used in EV batteries.

Therefore, a reliable EV supply chain not only requires domestic production of graphite, but also the capacity to process the raw material into battery-grade, which is why a fully integrated supply chain, for any major auto market, is so important.

Graphite Becoming Vital

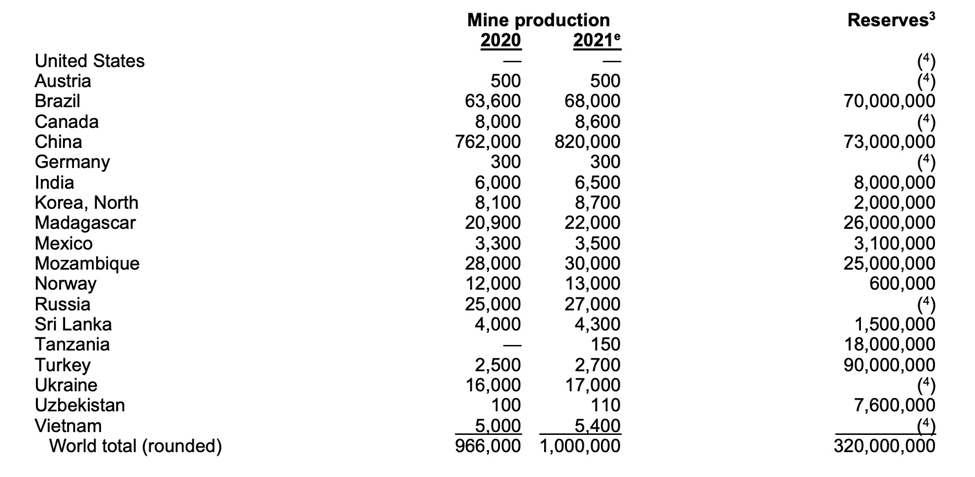

This is where the US could be left in the dust as it continues to play catch-up in the EV race. For starters, natural graphite material is very difficult to source. Only about 20 countries make up the world’s supply, many of which produce insignificant amounts (<10,000 tonnes a year).

China is by far the biggest producer with nearly 80% of the world’s graphite production. Due to weak environmental standards and low costs, China also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Brazil, Mozambique, Russia and Madagascar. The US, on the other hand, produces absolutely no graphite at all, and therefore must rely solely on imports to satisfy domestic demand.

A burgeoning EV sector meant that the level of import dependence has increased over the years. From 2016 to 2018, US graphite imports nearly doubled from 38,900 tonnes to 70,700 tonnes. Although imports have leveled off in recent years, the numbers are still substantial and alarming for the future of America’s EV economy.

According to the USGS, in 2021 the US imported 53,000 tonnes of natural graphite, of which about 57% was flake and high-purity, 42% amorphous, and 1% lump and chip graphite. The top importers were China (33%), Mexico (21%), Canada (17%) and India (9%).

But taking into account the fact that China, its main competition, controls all graphite processing, the US is actually not 33% dependent on China for its battery-grade graphite, but 100%. This is a precarious position to be in should it wish to stay in contention for EV dominance, and it could only worsen as demand for battery minerals grows.

This is where Graphite One’s second MOU with Sunrise becomes important.

“It is well understood in the North American graphite development sector that battery anode process expertise resides in China,” says Anthony Huston, CEO of Graphite One. “As Graphite One works to develop North America’s first complete advanced graphite material supply chain, the technical acumen Sunrise can provide, could allow us to optimize our processing capacity and ensure our new U.S.-based facility is purpose-built from Day One to the highest industry standards.”

Sunrise already produces 6,000 tonnes per year (tpy) of lithium-Ion battery anode materials and has an established research and development base. Its 100,000 tpy anode production facility is under construction in China’s Guizhou Province, with completion expected by the end of 2023. The main products include artificial graphite, natural graphite, composite graphite, and other anode materials. Sunrise’s principals each have over 20 years experience in commercially supplying lithium-ion battery anode materials to major battery producers and are named on over 100 related patents.

“With the many gigafactories being built in the US, Sunrise is excited to enter into this MOU with Graphite One, with the largest natural graphite deposit in North America,” said Haiping Hu, Chairman of Sunrise New Energy Material Co., Ltd. “We look forward to assisting Graphite One with the development of its planned anode facility to serve the American market at this critical moment in the transition to the low-carbon energy future we all seek.”

It’s estimated that increased use of lithium-ion batteries could gobble up well over 1.6 million tonnes of flake graphite per year, posing a serious threat to the global supply chain as the material is used in a variety of industries (global consumption of graphite for all uses reached 2.7 million tonnes in 2020).

Data from Benchmark Mineral Intelligence shows demand for natural graphite from the battery segment amounted to 400,000 tonnes in 2021, with that number expected to scale up to 3Mt by 2030.

Meanwhile, the world’s mine supply has been stagnant over the years. Between 2018 and 2019, total production actually declined by 20,000 tonnes. Global production in both 2020 and 2021 was nearly exactly the same, at a million tonnes.

A global graphite shortage is a matter of when, not if, without new sources of supply. For the US, which is 100% dependent on foreign imports of the material, it’s a ticking time bomb that could completely derail the nation’s vehicle electrification and decarbonization ambitions.

This all goes back to the importance of establishing a reliable, secure and sustainable “mine to battery” EV supply chain, beginning with a domestic graphite source and integrating it with processing, manufacturing and recycling to create a full circular economy.

Graphite Creek

Recently, the US Geological Survey cited the Graphite Creek resource near Nome, Alaska, as the largest known graphite deposit in the country. It is part of an integrated project proposed by Graphite One, which aims to mine and process the graphite and build an advanced materials and battery anode manufacturing plant in Washington State.

Graphite One was granted “High-Priority Infrastructure Project” status last January by the Federal Permitting Improvement Steering Committee (FPISC), which would allow the company’s approval process to be streamlined.

“Designating the Graphite Creek project as a high-priority infrastructure project will send a strong signal that the US intends to end the days of our 100% import-dependency for this increasingly critical mineral,” Alaska Governor Mike Dunleavy said in his nomination letter.

“Our project was found to qualify under both the ‘renewable energy’ and ‘manufacturing’ sectors, which shows the versatility of natural graphite as a tech metal essential to the US. economy,” Graphite One CEO Anthony Huston told The Northern Minerin an interview at the time.

Since then, Graphite One has moved its flagship project further along. During 2021, it completed a drill program of >2,000 meters on the Graphite Creek property, the results of which will be used for an updated resource model. To date, only 20% of the graphite mineralization trend has been explored by the company.

This year, Graphite One proceeded with the second link of its proposed supply chain strategy by selecting a location for the graphite products manufacturing plant. Now, with a recycling facility planned nearby, the company has essentially closed the loop on its “full circular economy” blueprint, much like the one being advocated by the Biden administration.

As mentioned, the company’s 100% US-based graphite supply chain strategy is anchored by its Graphite Creek resource. The Graphite Creek deposit is situated along the northern flank of the Kigluaik Mountains, spanning a total of 18 km (see map below). According to the USGS, this particular area of Alaska contains an abundance of graphite minerals, much of which remains underexplored to this day.

The latest resource estimate (March 2019) — derived from drilling only less than 30% of the Graphite Creek mineralization — showed 10.95 million tonnes of measured and indicated resources at a graphite grade of 7.8% Cg (graphitic carbon), for some 850,000 tonnes of contained graphite. Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

A Preliminary Economic Assessment (PEA) on Graphite Creek supports a 40-year operation with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% purity) per year.

Once in full production, Graphite One’s proposed graphite materials manufacturing plant is expected to turn graphite concentrates into 41,850 tonnes of battery-grade coated spherical graphite and 13,500 tonnes of graphite powders per year.

This level of prospective production cannot simply be ignored, given it would cover the amount of US imports in most years.

The next steps for Graphite Creek will include an updated resource model and new technical data for a Preliminary Feasibility Study (PFS), anticipated this month, which will incorporate results of the 2021 drill program.

Conclusion

After decades of relying on foreign supply of critical minerals, the US is finally waking up to the reality that it needs to mine and even process its own raw materials to accomplish its economic and climate goals.

Graphite One represents the ideal when it comes to industry-government collaboration to reach a shared goal — in this case, domestic mining and processing of EV raw materials, which up until now has been dominated by China.

The Biden administration has allocated $6 billion as part of a huge infrastructure bill aimed at developing a US battery supply chain and weaning the auto industry off its reliance on China. The presidential directive would fund production at current mining operations, productivity and safety upgrades, and feasibility studies.

Graphite Creek was granted High-Priority Infrastructure Project status last year by the Federal Permitting Improvement Steering Committee (FPISC), which would allow its approval process to be streamlined.

Graphite One’s CEO, Anthony Huston, reacted to President Joe Biden’s April 1 announcement that graphite and other critical battery materials are designated as “essential to national defense” under the above-mentioned Defense Production Act, by noting that unlike presidential orders, designations under the DPA carry the full force of law.

“With this new defense designation under U.S. law, graphite joins a select group of ‘super-critical minerals’ that are essential to commercial technology and national security applications,” said Huston. “This action by President Biden validates Graphite One’s strategy of creating a full supply chain for advanced graphite materials located in the United States.”

The DPA “provides the President a broad set of authorities to ensure the timely availability of essential domestic industrial resources to support national defense and homeland security requirements.”

Powerful US politicians are showing their influence in support of Graphite One’s aims.

Earlier this month, Senators Lisa Murkowski (R-AK) and Joe Manchin (D-WV), former and current chairs of the Senate Energy and Natural Resource Committee, sent a letter to President Biden urging him to make a DPA Title III designation to “invoke the Defense Production Act to accelerate domestic production of lithium-ion battery materials, in particular graphite, manganese, cobalt, nickel, and lithium.”

In a press release, Sen. Murkowski stated: “This is an overdue step that will help address one of our nation’s most significant vulnerabilities, our increasing dependence on foreign supply of critical minerals. While there are a range of actions we should be taking to address this challenge, including further federal permitting reforms, the Defense Production Act is an important complement to them.

“My hope is that this decision marks the start of a much more serious emphasis on our nation’s mineral security, and that real projects, especially mines, in states like Alaska, result from it. It is also critical that the five minerals addressed under this decision are just the start, not the end, of federal efforts to rebuild our domestic supply chains.”

Huston commented: “All of us at Graphite One want to thank Senator Murkowski, the Senate’s undisputed expert on critical minerals, and Chairman of the Senate ENR Committee, Joe Manchin who made such a compelling case for President Biden to take this step. Giving graphite and the battery materials the DPA Title III designation — as ‘essential to national defense’ — is a strong signal that the full force of the U.S. federal government will now be behind domestic development of these ‘super-critical minerals’.

“With the USGS recognizing Graphite One’s Alaska deposit just last month as being America’s largest known graphite deposit, and adding to that our plan to produce battery-ready anode material, Graphite One is ready to answer the call, and create a complete advanced graphite supply chain solution for the U.S.”

Anthony Huston was the only CEO quoted in Sen. Murkowski’s press release.

The fact that Graphite One now has graphite processing expertise, through its recent agreement with Sunrise, a Chinese lithium-ion battery anode producer, bolsters confidence among investors that GPH will be successful in the design, construction, and operation of Graphite One’s proposed US-based graphite material manufacturing facility.

Remember, it is well understood in North America that battery anode processing expertise resides in China. Why not therefore partner with a Chinese company that already has this knowledge, and whose principals have over 20 years experience supplying anode materials to major battery producers?

With the proposed development of a recycling facility, Graphite One is now perfectly positioned to become America’s first fully integrated graphite supply chain.

“There’s a compelling environmental imperative to not allow spent batteries — built to provide a renewable source of energy — to end up in landfills,” CEO Anthony Huston recently told The Northern Miner.

“That all points to recycling battery materials — and for Graphite One, this pointed us to Lab 4 and their ground-breaking work to recycle these materials right back into our planned manufacturing plant. With this new partnership, Graphite One would be the only fully integrated domestic supply chain for graphite to accommodate the different requirements of battery companies,” Huston stated in the news release.

Indeed, as it goes about developing Graphite Creek into a mine,

Graphite One is providing the template for a brand-new circular economy that merges mine production of battery-grade graphite, with the processing and recycling of lithium-ion battery anode material needed for the future green economy.

Also imprinted on this template is a model for environmental, social and governance (ESG), considered essential for any modern-day exploration and mining company to build support among stakeholder groups.

Among its ESG initiatives, Graphite One has consistently met with tribal, city and corporate leaders of the local communities of Teller, Mary’s Igloo and Brevig Mission, and has consulted with key leadership, the general public and various community groups in the City of Nome. Regular meetings have also been held with regional organizations and governing bodies such as Kawerak, Inc., Bering Straits Native Corporation, Nome Chamber of Commerce, Sitnasuak Native Corporation, Nome Eskimo Community, and the NACTEC – VOCED training center in Nome.

To ensure that the Graphite Greek project meets or exceeds all regulatory standards with regards to impacts on the environment, including the fish, plants and game, and air, land and water upon which surrounding Iñupiaq communities depend, environmental baseline studies have been ongoing since 2014.

“Only when the communities surrounding our efforts feel engaged, heard, respected, informed and understood, can we develop win-win solutions for everyone involved,” Huston states.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.94, 2022.04.06

Shares Outstanding 85.5m

Market cap Cdn$165.9m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.