Max Resource finds opportunity in underexplored copper & gold regions of South America – Richard Mills

2023.07.19

As a leading indicator of economic health, copper’s performance is often closely scrutinized for its ability to signal an upcoming slowdown, which has been a running theme since last year.

Yet, the recent rally in copper has sparked a belief that the metal’s fundamentals are quite formidable — perhaps even stronger than most thought — irrespective of what befalls the economy.

After declining as much as 17% from its early 2023 high over wider concerns of economic slumps, copper prices have staged a rebound, jumping nearly 10% to trade near $8,500 per metric ton.

“They say copper has a PhD in the global economy and the recent strength runs counter to the many worries we keep hearing,” Carson Group chief market strategist Ryan Detrick said in a recent Business Insider interview.

To those who are more optimistic, including Detrick, copper’s resilience is an indication of more green shoots in the economy even as many economists worry about an imminent recession.

Word around the street is that after the most aggressive rate hike campaign in 40 years, the US Federal Reserve could actually have a chance of engineering a fabled “soft landing” (i.e. avoiding a recession). The Fed’s latest economic projections are also making it sound plausible.

“With housing bottoming and a consumer still quite strong, we think there’s a very good chance the economy can avoid a recession in 2023. To see copper improving recently could be another sign that Doctor Copper is sniffing out this lonely call,” Detrick added.

He also said it wouldn’t surprise him to see copper prices continuing to move higher, as he’s been calling for continued economic growth all year long.

Energized Copper Demand

What’s likely to support higher copper prices is an energized demand thanks to the metal’s broad applications in the renewables and EV sectors.

Those at Goldman Sachs view rising usage of electric vehicles as a “key pillar of copper’s bullish story”, recently forecasting copper demand from the sector to amount to 1 million tonnes (mt) this year, rising to 1.5 mt in 2025.

“Due to copper’s highly conductive and ductile nature, it is an ideal candidate for transformation and transmission of electrical energy in EVs,” the bank said in a note earlier this month.

Last year, EV production accounted for about two-thirds of the increase in global copper demand, with EVs likely accounting for about 27% of additional copper consumption over the next decade, the bank predicted.

Goldman said its analysts were optimistic about EVs, anticipating “strong sales in China, driven by lower prices and a high demand for EVs that has been building up over the rest of 2023.”

For a long time, analysts at Goldman have been bullish on the metal due to its high demand, predicting earlier that “we’ll be at the lowest observable inventories that have ever been recorded at 125,000 tonnes” this year.

BloombergNEF estimates that copper demand, driven by various clean energy initiatives like EVs, will grow a significant 53% to 39 million tons by 2040.

Analysts at S&P Global are expecting an even quicker and bigger jump, with copper demand set to double to 50 million metric tonnes as early as 2035.

In a scenario that meets the Paris Agreement goals (as in the IEA’s Sustainable Development Scenario), the energy sector’s share of total demand must rise significantly over the next two decades to over 40% for copper.

Undersupply Concerns Grow

However, looking further ahead in a scenario consistent with climate goals, the expected supply from existing mines and projects under construction is estimated to meet only 80% of the world’s copper needs by 2030, the IEA says.

According to consulting firm McKinsey, electrification is expected to create a 6.5 million ton shortfall at the start of the next decade, highlighting a substantial output gap that the mining industry has to address.

Some of the world’s largest mining companies and metal traders are warning the shortfall could arrive as early as 2025.

The International Copper Study Group (ICSG) says the copper market is facing another year of deficits this year. The group’s April forecast, via Reuters, calls for a supply shortfall of 114,000 tonnes in 2023, compared to a 431,000-tonne deficit in 2022.

When ICSG last met in October, it was expecting global mine production to grow by 3.9% in 2022 and 5.3% this year. It now thinks growth was 3% last year, and revised its forecast down to 3% in 2023.

The Reuters story says the expected wave of new supply from four mines — the DRC’s Kamoa-Kakula, Quellaveco in Peru, along with Quebrada Blanca II and Spence-SGO in Chile – is being offset by multiple hits to existing operations.

The ICSG cites as reason for its lowered mine growth expectations “operational and geotechnical issues, equipment failure, adverse weather, landslides, revised company guidance in a few countries and community actions in Peru”.

By year-end, the copper market is expected to be undersupplied, and some time in 2024, peak copper will arrive, generating deficits from that point, analysts at Goldman Sachs previously said.

Exacerbating the issue is that there are just very few copper projects in the pipeline beyond the four new mines cited by the ICSG.

In a Bloomberg TV interview on June 26, Robert Friedland, founder of Ivanhoe Mines, claimed that mining investment in the S&P 500 remains low as electrification accelerates. “That’s worrisome, as it means capital isn’t flowing to new projects that could help meet growing demand,” Friedland said.

New Mines Needed

Clearly, the world needs new copper mines, but they can’t be built and commissioned that fast. In North America, 20 years can elapse between initial discovery and first production. We’ve got less than seven years.

Sam Crittenden, an analyst with RBC Dominion Securities, recently estimated that the energy transition’s copper requirements will mean an additional 1% of copper supply, the equivalent of one large copper mine coming online every year.

But this may be easier said than done. Among the issues impeding new supply are lower ore grades, depletion of existing mines, a lack of new discoveries, and resource nationalism in three of the main copper-producing countries: Chile, Peru, and the DRC.

Chile, the top producer accounting for nearly 30% of the world’s copper, serves as a good example of why new copper supply is so hard to come by. The country’s output has stagnated due to deteriorating ore quality and water restrictions in the arid north. Permitting is also getting tougher.

Output from state-owned miner Codelco is near the lowest level in a quarter of a century, underscoring the copper industry’s battle to maintain production as new deposits become trickier and pricier to develop.

Codelco recently reported that its wholly owned mines churned out 326,000 metric tons in the first three months of this year, down 10% from a year ago. That would put it just below its annual guidance of 1.35 million to 1.42 million tons.

“It’s a complex transition time, between deposits that are running out and projects that will come into operation,” Codelco’s CEO Andre Sougarret said in a statement.

Then there’s the recently approved mining royalty bill that requires companies responsible for over 80,000 tonnes of fine copper output a year to pay more taxes, which could scare away further investment from the likes of BHP and Glencore.

Meanwhile, a logistics issue is emerging in No. 2 producer Peru, which has long been marred by political instability. Still recovering from its worst social unrest in decades, Peru saw its copper exports plummet 20% during the first two months of the year, even as production rose.

Recent developments within the two biggest copper producers now have us questioning whether they can be relied upon for future supply to sustain the electrification demands, or do we need to start looking elsewhere?

Max Resources’ CESAR project

Maybe that place is Colombia, which shares the geological advantages of the Andes, plus the mineral-rich basins previously explored for petroleum and known for their large coal reserves.

To this day, many parts of Colombia, including the Cesar Basin, remain largely underexplored for key minerals like copper.

One junior mining company that has been making a myriad of discoveries in this region is Max Resource Corp. (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2). Based in Vancouver, the company currently holds the largest area prospective for copper in the Cesar sedimentary basin, with mining concessions collectively spanning over 188 km².

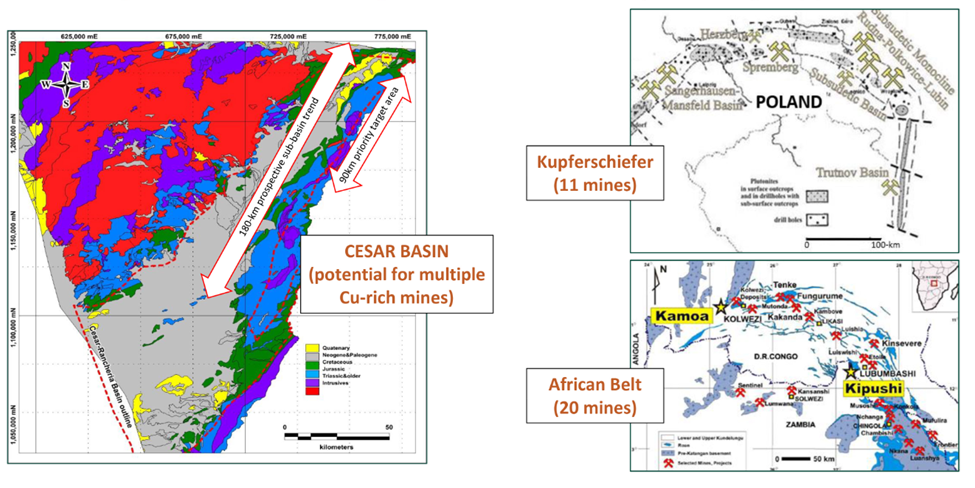

Max’s property, named CESAR after the prolific mineral-rich basin on which it is situated, is divided between three major copper-silver zones (AM, Conejo & URU) that are individually located along a 90 km long belt (see map below).

The Cesar Basin has a simplified Jurassic-Triassic stratigraphy, characterized by Cu-Mo-Au porphyry and porphyry-related vein systems in the upper levels and sediment-hosted style Cu-Ag deposits lower down.

Starting in the far north of the Jurassic basin, classic stacked red-bed outcrops with extensive lateral continuity have been rock sampled within the 32 km long AM District. Highlight values of 34.4% copper and 305 g/t silver have been documented in these sedimentary red-bed sequences.

The Conejo District, midway south, demonstrates mineralization at the contact of intermediate and felsic volcanics which outcrops over 3.7 km. The average of surface samples at a 2.0% cut-off comes in at 4.9% copper.

To the far south, the 2022 inaugural drilling was initiated at two mineralized surface exposures, each located 750 m apart and lie within the URU District’s 20 km long, 2 km wide mineralized target area.

This URU drill program was the first opportunity to test continuity of the structurally controlled copper-silver mineralization within the volcanic host rocks in the sub-basinal environment of the Cesar sedimentary basin.

Currently, there are two primary depositional models being used for the massive CESAR project.

The sediment-hosted stratiform copper-silver mineralization found in the southern end (URU and Conejo zones) of its Cesar project is interpreted to be analogous to the Central African Copper Belt (CACB), while the northern end (AM zone) is compared to the Kupferschiefer deposits in Poland.

It’s estimated that nearly 50% of the copper known to exist in sediment-hosted deposits is contained in the CACB, headlined by Ivanhoe’s 95 billion lb. Kamoa-Kakula discovery in the Democratic Republic of Congo.

Kupferschiefer, considered to be the world’s largest silver producer and Europe’s largest copper source, is a mining orebody ranging from 0.5 to 5.5m thick at depths of 500m, grading 1.49% copper and 48.6 g/t silver. The silver yield is almost twice the production of the world’s second-largest silver mine.

Based on the hypothesis that the mineralization at the northern end of its property is sediment-hosted and stratiform, similar in style to the Kupfershiefer, Max began the 2023 exploration season on the AM mining concessions.

To confirm the continuity of mineralization and its hypothesis, Max drilled two scout holes down dip from surface exposures at the high-priority Herradura target this past January. The holes were spaced 250m apart and drilled to a depth of approximately 350m. Both intersected multiple copper-replacement beds containing malachite and chalcocite with copper values ranging from 0.04% to 0.96%.

These results indeed helped to confirm the presence of Kupferschiefer-style mineralization within the northern AM District.

Meanwhile, the first diamond drill program last fall at the 74 km² URU District also demonstrated its proof-of-concept. The program was designed to test the continuity of the structurally controlled copper-silver mineralization within the volcanic host rocks similar to the CACB.

Drilling at the URU-C and URU-CE targets, located 0.75 km apart, confirmed the continuation of copper-silver mineralization at depth. Twelve of the 14 holes intersected mineralized zones, with six intersecting significant copper-silver mineralization.

In short, Max is on the right track with the two-depositional models being used for the massive CESAR project, and the exploration results to date reflect the belief that there’s a large, potentially world-class copper-silver system straddling along the 90 km belt.

Gold Exploration in Peru

The progress Max has achieved at CESAR for two-plus years has somewhat overshadowed its other key asset in South America: the RT gold project in Peru.

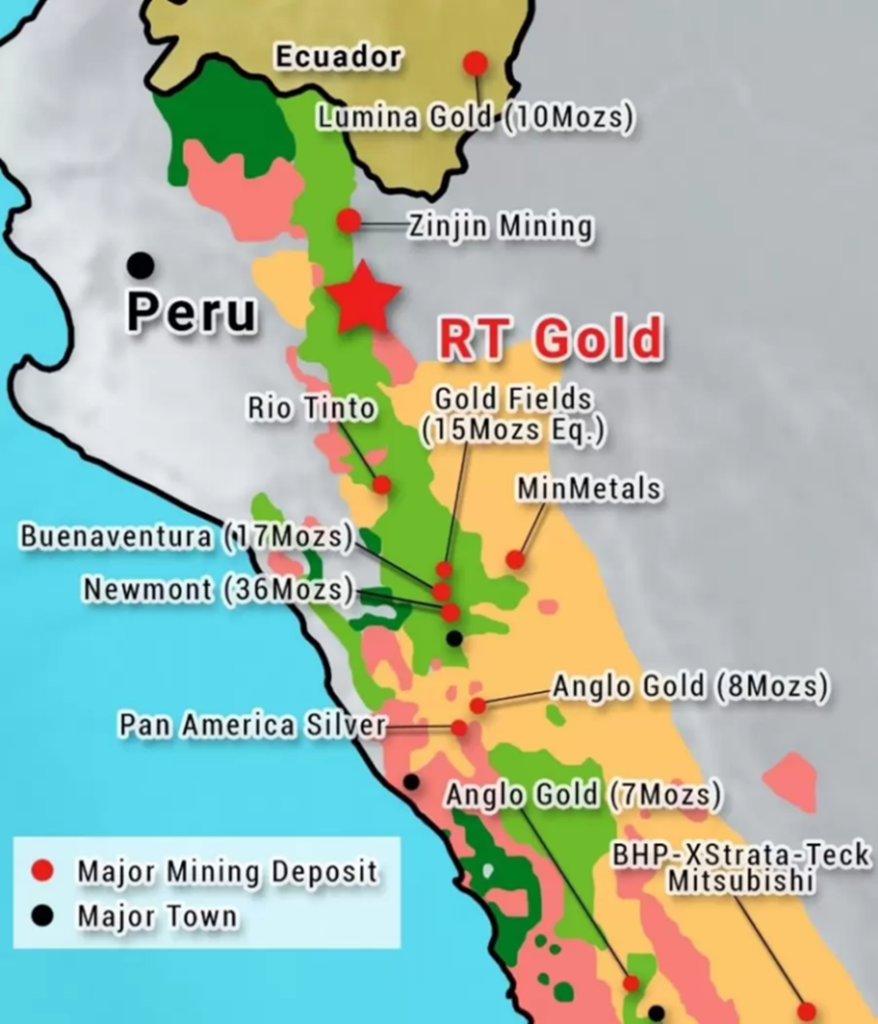

RT is located 760 km north-northwest of Lima in the district of Tabaconas, in the northern part of the Department of Cajamarca (hence the project is named “Rio Tabaconas”, or simply RT). It consists of two contiguous concessions that cover an area of 980 and 1,000 hectares, respectively.

The property sits along the Cajamarca metallogenic belt, extending north from central Peru into southern Ecuador. This prolific belt hosts a number of world-class deposits (see map below).

In Ecuador, there is the Fruta Del Norte discovery (15.5Moz Au), Mirador (2.7Mt Cu, 2.74Moz Au), and the new discovery by Solaris Resources at its Warintza deposit (2.7Mt Cu, 0.9Moz Au). On the Peruvian side, it has Newmont’s Yanacocha (8.61Moz Au).

Recently, Max filed a technical report that it believes “validates the true potential of the two distinct gold-bearing systems” found on the RT property — namely, the Cerro bulk-tonnage porphyry zone and the Tablon massive sulfide zone.

Cerro hosts several mineralized zones. Soil geochemistry has outlined a 2 km by 1.5 km gold anomaly that is open in all directions, with gold values ranging from 0.1 to 4.0 grams per tonne (g/t). The soil geochemistry is coincident with IP chargeability. A continuous channel sample across the zone assayed 3.3 g/t gold over a width of 25.5m.

Tablon, located 3 km to the northwest, was drilled in 2001 by Golden Alliance Resources Corp. In February 2021, Max obtained the historic drill core and commenced a re-logging and resampling campaign. The resampling confirmed thickness and grade of the 2001 drill intercepts and reasonably well reproduced the reported grades.

Results included high-grade gold values ranging from 3.1 to 118.1 g/t gold over core lengths from 2.2 to 36.0m. One intercept returned a metallics reassay value of 186 g/t gold over 2.2m, indicating the presence of coarse gold.

The next step for the project is to start an environmental survey, followed by drilling application.

Conclusion

It’s not often to see a mining junior holding onto two promising assets covering such a large underexplored land position in South America like Max does.

Better yet, the mineralization found on each project is quite unique. CESAR potentially hosts two well-known deposit types, and RT is found to contain two separate gold systems, giving the company an ideal lineup of minerals for diversification purposes.

At AOTH, we’ve been placing emphasis on the two dominant investment themes that will only rise in prominence moving forward: 1) Electrification and 2) Recession.

With the copper bull story likely to continue, as well as gold reportedly entering a new phase, Max represents a great opportunity for investors to leverage these two themes.

As evidence of its CESAR project already gaining industry recognition: last year, it inked a co-operation agreement with Endeavour Silver Corp., a mid-tier precious miner operating four mines in Mexico.

Also in 2022, the company closed over $25 million in financing, a rather large amount for a junior at the current stage; this is a sign of confidence in Max’s ability to take its flagship CESAR project further, and its future prospects elsewhere on the continent.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.145 2023.07.17

Shares Outstanding 161.9m

Market cap Cdn$23.5m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MAX). MAX is a paid sponsor on his site aheadoftheherd.com

This article is issued on behalf of Max

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.