2021.07.15

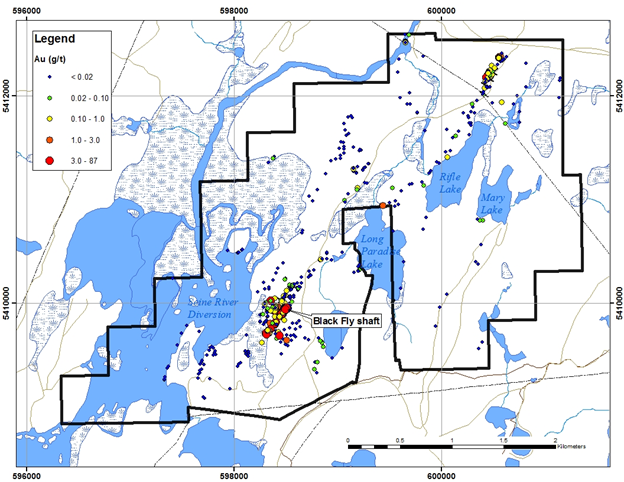

With the 2021 exploration program well underway at its Blackfly gold project in Ontario, Marvel Discovery Corp. (TSXV: MARV) (Frankfurt: O4T1) (MARVF: OTCQB) recently announced more promising results from earlier surface sampling.

Assays from Blackfly Project

On July 8, the emerging resource company received an additional 168 assay results, the third of three rounds from this year’s prospecting and mapping program. Highlights of the latest surface samples are as follows:

- 29 samples returned assays greater than 500 ppb gold;

- 12 samples graded from 1.00 g/t and up to 2.99 g/t gold;

- 9 samples in excess of 3.00 g/t gold; and

- 3 samples assayed greater than 30 g/t gold.

“Marvel’s Blackfly gold project is strongly living up to its potential. The surface samples reflect the wide variety of gold targets – some we knew of, and some are shaping up to be first time discoveries,” president and CEO Karim Rayani commented in a news release.

For the 2021 exploration program, the Marvel geological team has already conducted initial prospecting, field mapping and sampling, and just started trench sampling. A total of 303 samples were submitted for analyses, with surface samples taken in recent trenching pending.

The latest update follows up on the second round of sampling results released on July 5, which included 62 assays. The most notable result was the identification of a potential new gold zone southeast of the shaft area with a sample that returned 52.5 g/t gold, representing a new drill target.

Speaking of which, progress has also been made in Marvel’s ongoing diamond drilling on the property. The first three holes are now complete, and core logging is underway. So far, visually, the core is looking “very promising”, the company says.

The field team believes that gold zones were reached in each hole, with visible gold found in a vein intersected at a depth of 8m in one drill hole.

2021 Exploration Program

This year’s exploration program at the Blackfly project represents a continuation of the work initiated in 2020, which included a compilation of historical information and completion of high-resolution airborne magnetics and time-domain electromagnetic data collection.

Several geophysical anomalies were identified from the ensuing geophysics report, and targets for follow-up were recommended.

Marvel’s geological team began the 2021 program work of prospecting, bedrock mapping and rock sampling. Trenching is being done for further definition of the gold mineralization associated with the known anomalies and geological structures.

The first round of assays was released back in early June, consisting of 78 samples with coarse visible gold noted in one sample that returned 24.3 g/t gold.

Diamond drilling is underway with 16 drill holes planned for the entire summer field season.

Project Background

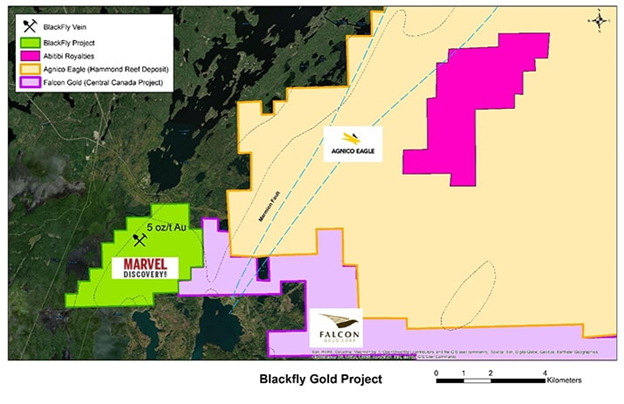

Marvel’s Blackfly property is located in the developing Atikokan gold mining camp, along and within the Marmion Lake fault zone, approximately 13.6 kilometres southwest of Agnico Eagle’s Hammond Reef gold deposit.

One of Agnico’s main exploration projects, Hammond Reef presently has an estimated 3.32 million ounces of gold in reserves (123.5 million tonnes grading 0.84 g/t gold), plus 2.3 million ounces in measured and indicated resources (133.4 million tonnes grading 0.54 g/t gold).

The resurgence of interest in the Atikokan camp in recent years has led to the development of Hammond Reef and Agnico’s recent efforts to stake or acquire lands close to this multi-million-ounce deposit.

The Hammond Reef gold property lies on the Hammond shear zone, which is a northeast-trending splay off of the Quetico fault zone and intimately associated with gold mineralization.

Assessment file records indicate that the original Blackfly gold discovery was made in 1897, making the occurrence one of the earliest found in the Atikokan gold mining camp. The project’s 45-foot shaft was sunk in 1898 shortly after gold was discovered.

Several companies have since added to the property’s database, including Rebair Gold Mines Ltd. (1945 to 1948), Steeprock Mines Ltd. (1949, and again in 1961), Aavdex Corporation (2004) and TerraX Minerals Inc. (2009 to 2012).

Initial work documented by D.K. Burke in 1941 reported two gold vein shoots, a northern and a southern one. The southern shoot averaged 11.9 g/t Au over a thickness of 0.33m along a strike of 21.6m, and the northern shoot averaged 13.44 g/t Au over 0.27m over a 32m strike length.

The most recent work on the property was conducted by Terra-X during 2010-2012, which included compilation of much of the historical reports and data, diamond drilling and surface geochemistry.

According to Terra-X’s assessment report, the lineament containing the Blackfly vein has alteration and mineralization traceable over a 4.4km strike length, as shown by the distribution of samples collected along it.

The best gold values from this lineament occur in the area of historical work, where TerraX’s grab samples included results of 167 g/t and 85.6 g/t Au.

The project, comprising 64 unpatented mining claims covering 1,296 hectares of land, was acquired by Marvel (formerly International Montoro Resources) in September 2020 via an option agreement.

To earn a 100% interest in the property, the company must make escalating payments totaling $65,000 in cash and issue 500,000 shares plus an additional 500,000 warrants. It must also spend a total of $153,600 in exploration on the property over a four-year period.

Newfoundland Expansion

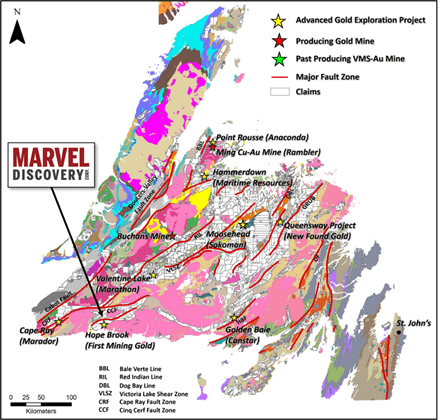

Elsewhere in Canada, Marvel is continuing to make strategic land acquisitions in what may be the next frontier of gold mining: central Newfoundland.

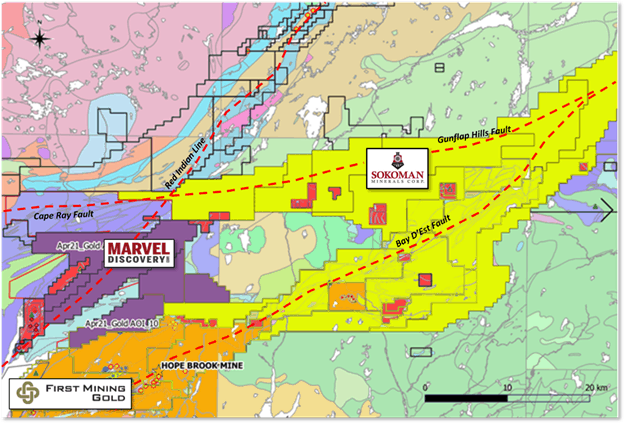

In late June, the company acquired a significant land position within the Hope Brook area by staking 763 claims (19,075 hectares) located contiguous to First Mining Gold and the Sokoman Minerals-Benton joint venture (see map below).

Of significance in the area is the former Hope Brook gold mine, which was in production between 1987-1997, producing 752,163 ounces of gold plus a copper concentrate.

Exploration and resource definition by Coastal Gold Corp., which was acquired by First Mining in 2015, has outlined an additional 6.33 million tonnes at an average grade of 4.68 g/t Au for 954,000 ounces of gold in the indicated and inferred categories.

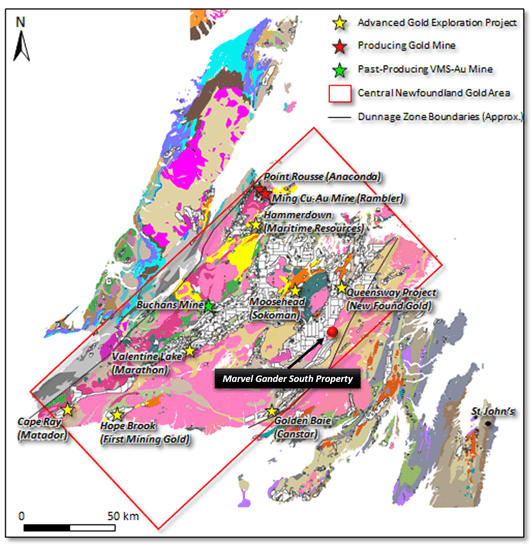

Marvel’s new land position is hosted within the Exploits Subzone of the central Newfoundland gold belt, which has seen increased exploration activity in recent years.

The property covers extensions or is proximal to two major structures linked to significant gold prospects (Cape Ray, Matador Mining) and deposits (Hope Brook, First Mining) in southern Newfoundland (see figure below).

Rock lithologies and structures on the property are also related to those associated with Marathon Gold’s Valentine gold deposits, Sokoman’s Moosehead gold project and New Found Gold’s Queensway gold project.

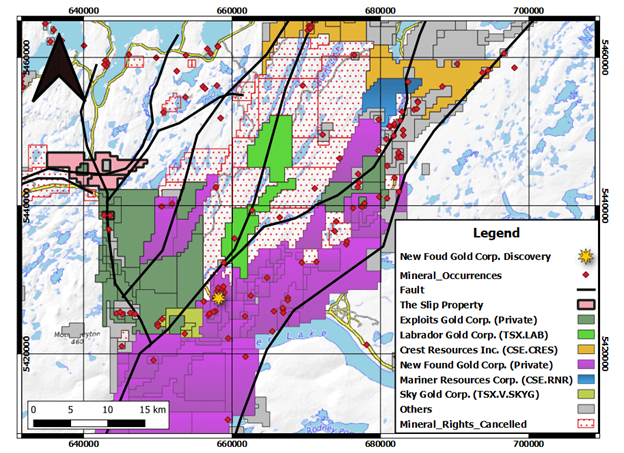

In addition to the Hope Brook property, Marvel holds three other projects within and around the Exploits Subzone of the central Newfoundland gold belt.

The Slip Lake property hosts gold mineralization with historical sampling of up to 44.5 g/t Au on surface. It is located 17.5 km northwest of New Found Gold’s Queensway project, which boasts historic drill intercepts of 92.96 g/t Au over 19m and a high-grade historic gold resource.

The Victoria Lake property is tied onto Marathon Gold’s Valentine Lake deposit, exhibiting a similar style of gold-bearing veins. Preliminary work on the project located several quartz-arsenopyrite veins returning grab samples ranging in value from 15.5 g/t to 24.9 g/t gold.

A third project, Gander South, proximal to the boundary between the Exploits Subzone and the Gander Zone, was acquired by Marvel in the beginning of June. This property lies approximately 10 km east of the northeast-trending Dog Bay-Appleton-Grub Line fault system, which extends from the north coast of Newfoundland 200 km southwest through Gander and is host to NFG’s Queensway project.

These structural corridors in the central Newfoundland area are intimately associated with recent gold discoveries including the Marathon Gold’s Valentine gold project, which contains 6 million ounces of gold.

Conclusion

As we’ve repeatedly mentioned, the Exploits Subzone of central Newfoundland may be on its way to becoming the world’s next large gold district.

The faults and subfaults in the area have shown a long tectonic history including fluid migration. Its major tectonic breaks — five to be exact — can be traced back to some 400 million years ago.

These deep crustal breaks are important mineralizing structures for hosting multi-million-ounce gold deposits. The potential is evident in Marathon’s Valentine Lake deposit and, more recently, New Found Gold’s Queensway discovery.

Today, central Newfoundland is home to a handful of up-and-coming gold explorers looking to become the next Marathon or NFG, and competition for land is growing fierce.

This week, TSXV-listed Falcon Gold also grabbed a strategic position within the Hope Brook area, next to Marvel’s claims. According to Falcon, the Hope Brook mine “was and is a very significant gold deposit intimately associated with the structures.”

Having established itself as a major landowner with three projects in this highly prolific region, Marvel represents an intriguing opportunity for investors looking for the next gold play in central Newfoundland.

For reference, following its first high-grade gold discovery, shares of NFG nearly increased tenfold since going public last summer. That’s the kind of growth prospects we’re witnessing in this emerging gold district.

It’s not just about this particular area either; Marvel holds as many as 10 projects across all of Canada.

Its recent work on the Blackfly property in Ontario is also creating a lot of excitement, being located next to one of Agnico’s key exploration projects. The drilling results will reveal more about this project, but don’t be surprised if gold discoveries become a common theme in the near future.

Marvel Discovery Corp.

TSXV:MARV, FSE: O4T1, IMTFF:OTC PINKS

Cdn$0.14, 2021.07.13

Shares Outstanding 74.32m

Market cap Cdn$10.41m

MARV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Marvel Discovery Corp. (TSXV:MARV). MARV is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.