Manning kickstarts 2021 exploration at Lac Simone, Hope Lake iron ore projects, Quebec

2021.06.04

Manning Ventures Inc. (CSE:MANN, FSE:1H5) will soon have boots on the ground at its two iron ore projects, Lac Simone and Hope Lake in Quebec, collecting samples and mapping in preparation for an upcoming drill program.

According to the company, The objective of the work program is to map the iron-formation and the surrounding rocks in order to gain an understanding of the geometry and tonnage potential of each project. This work is designed to assist in the targeting for a future drill campaign, and to prioritize drill targets to focus on those with a potentially favourable mining geometry.

Samples will be collected in order to assess the grade and width of the iron formation. Additional laboratory test work will expand on the mineralogy (magnetite and /or hematite) of each zone.

“As Iron Ore prices trade at or near record levels, we are excited to see ground work get underway at these two projects,” said CEO Alex Klenman, in the June 3 news release. “This work is critical in prioritizing drill target locations, which we’re very enthusiastic about. We are eager to expand upon historical work and move our Iron Ore assets further along their respective developmental paths as rapidly as possible.”

The Lac Simone property just south of Fermont, Quebec, is accessible by road from Quebec City (see map below). The project consists of 63 mineral claims in two claim blocks totaling nearly 3,300 hectares.

Approximately 3 km to the west is Champion Iron Mines’ Moiré Lake deposit, which contains a resource estimate of 164 million tonnes grading 30.5% FeT in the indicated category and 417.1 million tonnes grading 29.4% FeT inferred.

Lac Simone was explored by Jubilee Iron Corp. between 1956 and 1964. During that time, Jubilee completed ground and airborne magnetic surveys at the northernmost magnetic anomaly, as well as mini-bulk sampling with basic metallurgical testing and three diamond drill holes. Bulk sampling in test pits produced an average head grade of 35.51% Fe, that was upgraded to a concentrate grade of 66.02% Fe.

Of the three drill holes completed, mineralized intervals up to 16.15 meters of 29.05% Fe were recovered.

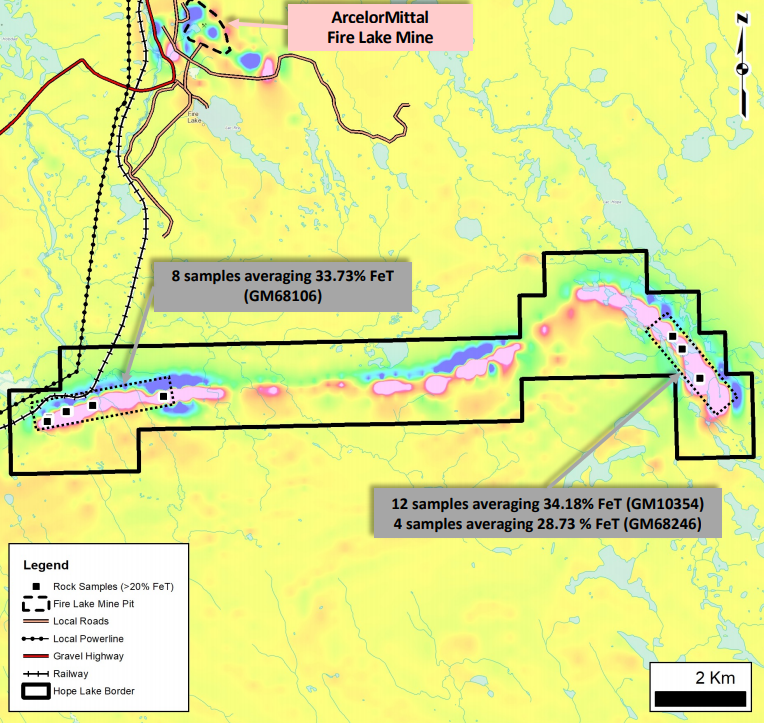

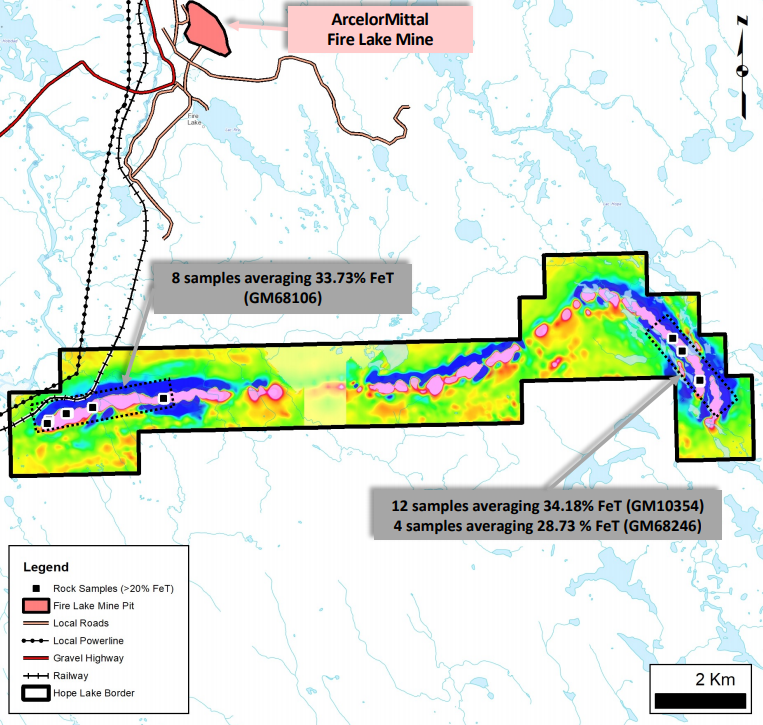

Like Lac Simone, the Hope Lake property was primarily explored in the past by Jubilee Iron, which completed ground and airborne magnetic and geological surveys at the northernmost magnetic anomaly, and two diamond drill holes.

The project, consisting of 68 mineral claims totaling more than 3,500 hectares in one contiguous claim block, is located approximately 60 km south of Fermont.

In 1959, 12 samples were collected at the east end of the property, with results averaging 34.18% FeT. One of the two drill holes did not make it to bedrock, while the other hole was drilled vertically and struck lean silicate (grunerite) iron formation from 3.7m to 23.5m.

In 1962, Jubilee performed basic metallurgical testing of samples collected from three surface zones in 1959. Magnetic concentration tests performed on these samples returned results of 68.4% and 68.1% Fe.

The Hope Lake property has also been the focus of several exploration campaigns in recent years.

In 2011 and 2013 Champion Iron Mines visited 48 outcrops and collected 16 samples, which reported average grades of 28.7% FeT and 33.7% FeT from each program, respectively. The sampling programs indicated that the property hosts high-grade quartz-hematite +/- magnetite iron formation.

A consultant’s report delivered in 2014 on behalf of Champion found that “Careful perusal of all available data on the Hope Lake claims suggests that the iron formation that underlies the claim block contains a potential iron-ore resource. The true grade and amount of iron-ore deposits most amenable to mining have yet to be determined, but there exists a demonstrably strong potential for deposits of economic grade” (Langton 2014, Report GM68246).

3 new properties added

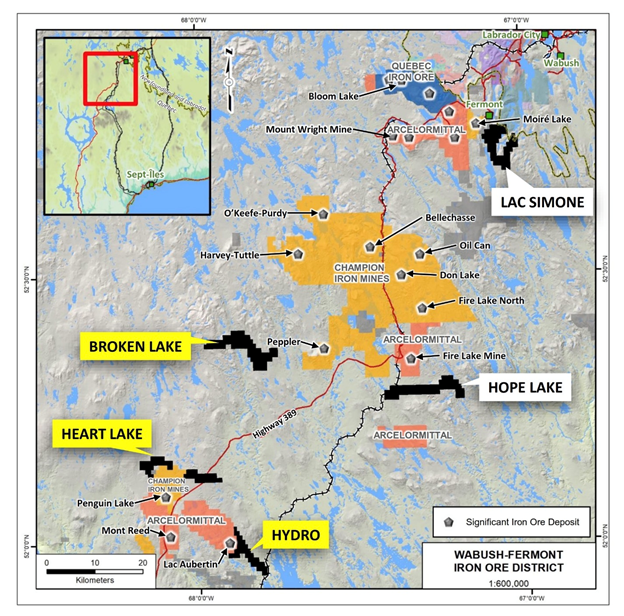

Manning Ventures has also moved to expand its land base in Quebec, having entered into a purchase agreement with the vendors of the Broken Lake, Heart Lake and Hydro properties.

Located west and southwest of Manning’s Hope Lake project (see map below), the three properties consist of 180 mineral claims totaling 9,501 hectares.

According to the company, The new Properties represent priority early-stage exploration opportunities with positive historical drill hole and rock sample results that have established the presence of iron formations. Situated within the Wabush-Fermont Iron Ore District, the Properties are also proximal to several known iron deposits and occurrences (Figure 1). With the acquisition of the Properties, Manning now controls five iron ore exploration projects – Hope Lake, Lac Simone, Broken Lake, Heart Lake, and Hydro – for 311 claims totalling over 16,372 hectares.

“These acquisitions add dozens of priority target areas to our iron ore exploration portfolio,” CEO Alex Klenman stated in the May 25 news release. “The amount of deposits in the area is impressive and we are certainly in the right place to make a significant discovery. This expansion positions Manning as a key exploration company in what has become a robust global sector. We’re eager to get on the ground and begin meaningful exploration programs shortly.”

To acquire 100% of the properties, Manning agreed to issue 4 million shares and 4 million warrants, exercisable at $0.35 for a period of two years.

Recent drilling at Heart Lake saw hole TM15-01 intersect 26.7% Fe over 25.6m, and end in high-grade iron formation. The claims are along strike with Champion Iron’s ground, where iron formation on the same trend, approximately 6 km away, contains a drill hole with two separate iron formations of 31.2% Fe over 50.8m and 30.8% Fe over 42.2m.

At Hydro, several historical rock samples in three separate zones were collected along an approximately 12-km trend of linear-style iron formation that has never been drill-tested. The samples average 32.5% Fe.

Broken Lake features about an 18 km-long trend of iron formation from which a well-mineralized interval exceeding 84m was reported, although no assays were documented. A 6 km-long belt of highly magnetic rocks has not yet been drill-tested, but it has been mapped as a magnetite-rich iron formation, representing a prime exploration target.

In the next-door province of Ontario, Manning Ventures recently announced sample assay results from its Flint Lake gold project, a property currently under option from Metals Creek Resources.

A stockpile sampling program from historical underground exploration at the west end of the Flint Lake mine, resulted in a range of assays from less than 5 parts per billion to 350 grams per tonne (g/t).

Field geologists grabbed 10 random samples from each of three quartz/ carbonate piles, with an additional five samples collected from loose muck, for a total of 35 samples.

According to Manning, Based upon the assay results and type of material the gold is hosted in, it appears the gold is coarser free gold that should be amenable to extraction via normal milling methods.

Located about 60 km from Kenora, ON, the Flint Lake gold project consists of four unpatented cell groups — Bag Lake, Dogpaw, Flint Lake and Stephen Lake — totaling 73 cells or 1,713 hectares.

Previous exploration in 2009 saw grab samples at the Flint Lake minesite return up to 720 g/t Au with significant visible gold. Grab samples from the Flint Central trench returned up to 112.5 g/t Au from blast quartz rubble hosting visible gold.

Historical and recent grab samples at Dogpaw featured 111.98 and 127.8 g/t Au from mineralized quartz veining, while at Bag Lake, the best assay result from a drill program in the 1980s was 34.09 g/t Au over 0.25m. Assays from Endurance Gold’s 2003 sampling program at Stephen Lake showed a range between 3.19 and 47.29 g/t Au. From 2008 to 2018, work by Metals Creek Resources brought in 253 grab samples, from which the highest grade was 29.47 g/t Au.

Conclusion

Manning’s timing for an exploration program is excellent, given the bullish fundamentals for iron ore and the gold price holding steady around $1.870/oz.

Iron ore prices recently broke a new record amid a sustained rally in commodities prices as demand from top consumer China remains as robust as ever.

Because China’s domestic iron ore supply is relatively low-grade and expensive to process, many steelmakers there find it cheaper and more efficient to import high-grade iron ore.

According to data from Fastmarkets MB, benchmark 62% Fe fines imported into Northern China (CFR Qingdao) are now changing hands for $210.99 per tonne – up more than 118% over the past 12 months.

At the center of the rally is rising steel prices, from Asia to North America. Steel demand remains strong as economies — China in particular — continue their massive investments in steel-intensive infrastructure.

The World Steel Association forecasts global steel demand to grow 5.8% this year to exceed pre-pandemic levels, followed by another 2.7% increase the year after. China’s consumption, about half of the global total, will keep growing from record levels.

China is also trying to rein in its world-leading steel supply. It views the supply boom during the coronavirus crisis as a contributing factor to the nation’s rising carbon emissions, in contrast to other big economies.

Measures aimed at cleaning up the world’s biggest steel industry have pushed mill profitability to the highest in more than a decade, which according to CRU Group analysts “incentivize mills to build up stocks and to charge more high-grade ore to lift productivity.”

Also fueling iron ore’s relentless surge is the intensifying diplomatic spat between China and Australia. On May 6, China indefinitely suspended all activity under a China-Australia Strategic Economic Dialogue, further exacerbating the strained relationship between the two countries.

Australia is by far the biggest iron ore producer in the world, followed by Brazil. Accordingly, Australia is China’s top supplier of the raw material.

I’m expecting plenty of news flow from Manning Ventures in the coming weeks, as exploration ramps up at its Lac Simone and Hope Lake iron ore projects.

Manning Ventures Inc.

CSE:MANN, FSE:1H5

Cdn$0.20, 2021.06.03

Shares Outstanding 42.2m

Market cap Cdn$5.8m

Mann website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own any shares of Manning Ventures Inc. (CSE:MANN). MANN is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.