Magna Gold cranks up production in Mexico as gold & silver prices find traction in inflation and geopolitical tensions

2022.01.27

Inflation is one of the best determinants of gold price movements, because investors buy precious metals as an inflation hedge when the prices of goods and services are rising faster than interest rates.

Although gold offers neither a yield (bonds, GICs) nor a dividend (stocks and mutual funds), it is considered a smart investment when inflation diminishes an investor’s principal or erodes the purchasing power of a currency.

Gold is even more popular when real interest rates, typically the yield on the US 10-year Treasury note minus the inflation rate, are below zero, like currently.

The current 10-year Treasury note yields 1.75% and the December CPI rate of inflation (minus food & energy) is 7%, making real interest rates minus 5.25% — an ideal environment for gold prices.

Ticking off all the bullish factors for gold right now, we have rising and “sticky” inflation that is pushing up against Fed plans to control it with a pitiful 1% rate increase this year, at most 2% over two, and negative real bond yields which are always a strong buy signal for gold investors.

Rising geopolitical tensions add to gold’s allure. There are a number of hot spots in the world today that could easily flare up into a conflagration that escalates into a shooting war or even the nightmare scenario of missiles being launched.

They include the ongoing threat of war between North and South Korea that would draw in the United States; tensions between the US, China and its neighbors over Taiwan; and a migrant crisis in Belarus that Ukrainian officials believe is a ruse invented by Russia to stage an invasion of Ukraine, similar to what happened in 2014 when Russian forces annexed Crimea.

Gold’s move up this week coincided with the Biden administration’s announcing $200 million in military aid to Ukraine, citing fears of a Russian invasion.

At AOTH, we like physical gold bullion for its store of value, and gold juniors for their leverage to rising gold prices. One of our favorites is Mexico-focused Magna Gold.

Magna Gold (TSXV:MGR, OTCQB:MGLQF)

Magna aims to become Mexico’s next major precious metals producer with multiple gold and silver assets spread across the mineral-rich states of Sonora and Chihuahua.

The company’s crown jewel is the former producing San Francisco mine, which was rebooted in the third quarter of 2020 and achieved full-scale commercial production last summer.

Mexico is a country best known for its abundance of precious metals.

Its rich mining history dates back some 500 years ago with the arrival of Spanish conquistadors who were enticed by the land’s wealth of silver and gold.

Today, it has grown into one of the top metal producers in the world. Not only is it the biggest silver producer, Mexico also ranks among the best gold-producing countries.

According to the US Geological Survey (USGS), Mexico’s silver production reached nearly 5,600 tonnes in 2020, about 2,200 tonnes more than second-place China, representing over 20% of the global mined output.

Gold production in 2020 was 111.4 tonnes, good for 9th place in the world.

The nation’s vast resources and mining-friendly policies make Mexico a prime destination for explorers looking for the next high-grade discovery.

Located 150 km north of Hermosillo in Sonora, Mexico, the San Francisco property consists of two previously mined open pits (San Francisco and Chicharra) and associated heap leaching facilities, covering a total area of 47,395 hectares.

The mine was previously operated from 1995 through 2000. During that time, approximately 13.5 million tonnes of ore at a grade of 1.13 g/t Au were treated by heap leaching, and 300,834 ounces of gold were recovered.

Mining operations ceased in 2001 as a result of low gold prices, although leaching and rinsing of the heap continued for approximately one year after.

In 2005, Timmins Gold (now Alio Gold) acquired the mine and processing equipment and began commercial operations in 2010. Since then, the mine has produced more than 820,000 ounces of gold, making it one of Mexico’s most successful gold mining operations in recent history.

Looking to re-establish San Francisco as a profitable mine, in March 2020, Magna agreed to take on the project, with a long-term view of improving the mine operation.

An updated prefeasibility study (PFS) on the property in 2020 showed total proven and probable reserves of 47.6 million tonnes, graded at 0.495 g/t Au, leaving 758,000 ounces of contained gold.

Now at full capacity, the San Francisco mine is capable of producing as much as 90,000 oz of gold annually.

There is also ample room for resource expansion, with an estimated upside of 3Moz gold and 50Moz silver.

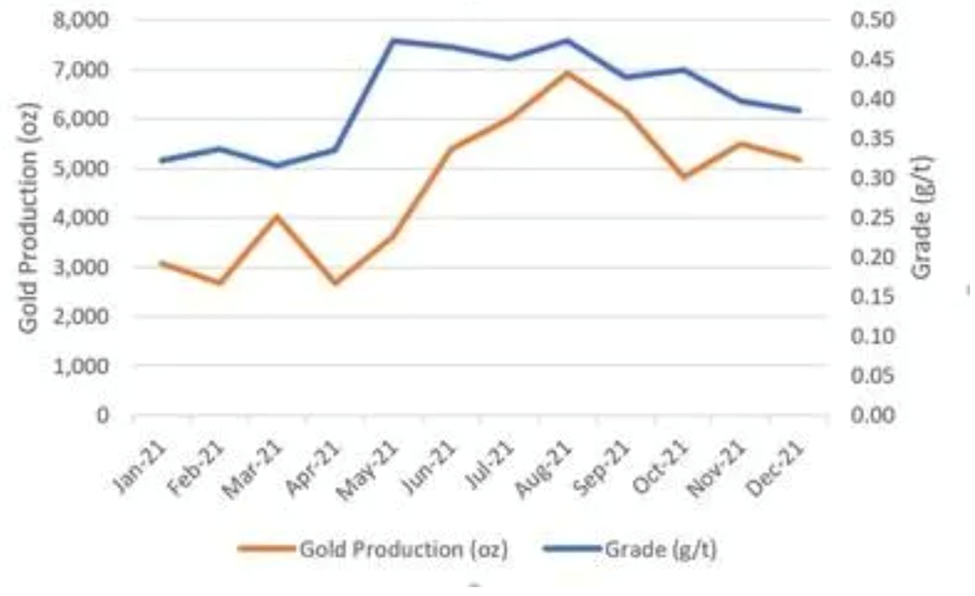

Magna’s latest update on San Francisco showed that the newly resumed gold operation has seen improved production on a quarterly basis.

In Q4 2021, the San Francisco mine reported gold output of 15,499 oz, more than doubling (+107%) its production from the same quarter in 2020. The company also met its production guidance for 2021, producing 56,099 oz last year. Preliminary cash costs for the quarter were $1,123 per ounce, and $1,299 for the full year.

Gold sold during the quarter was 16,305 ounces at an average realized gold price of $1,780 per ounce.

Although the strip ratio increased in Q4, it is expected to trend down, towards the life of mine average of 2.5 going forward.

“When we began the year, a very aggressive production target of 55-65K ozs was set — aggressive considering we were in the process of re-establishing production and ramping up at San Francisco. I am proud of the team as they exceeded our production targets in what was a challenging year industry-wide,” said Arturo Bonillas, Magna’s President and CEO, in the Jan. 26 news release. He added:

“2022 will be a transformative year for Magna as we look to generate meaningful cash flow, increase production at our operation and continue our aggressive growth plans through both organic and M&A-driven initiatives.”

Production guidance for 2022 has been increased to 65,000-75,000 ounces, at cash costs of $1,250-$1,350 per ounce.

Meanwhile, Magna has been advancing some of its other precious metals assets across Mexico. The next area of exploration focus is Chihuahua, where its newly acquired Margarita silver project is situated.

The property comprises two mining concessions within the prolific Sierra Madre gold belt, home to numerous multi-million-ounce gold-silver deposits. It lies 15 km northwest on strike with Sunshine Silver’s Los Gatos mine.

Margarita is part of a low-intermediate sulfidation epithermal Ag-Pb-Zn system, which can be traced to many of Mexico’s producing silver mines. The property hosts 7 km of outcropping multiple veins; only one vein has been drilled.

Channel sampling on the vein system returned values of 100-900 g/t Ag.

A total of 35 holes were completed along 1,700m of the Margarita vein during the 2018-19 core drill campaigns, with some drill intercepts returning over 1 kg/t AgEq values. Some drill intercepts have widths of over 48m of Ag mineralization.

Magna has obtained all necessary exploration permits to advance the project. Resource definition drilling is slated for completion by mid-February, with a maiden resource estimate and a PEA scheduled for release by the end of the first quarter.

Elsewhere, the company has drill programs planned at the San Judas and Veta Tierra gold projects, as well as the La Pima silver project.

Conclusion

Under the current commodity price environment, it’s safe to say that Mexico will remain a hotbed for investors given its mining history.

With a handful of intriguing gold and silver assets in its portfolio, Magna Gold represents an exciting prospect.

Magna’s latest update on San Francisco showed that the newly resumed gold operation has seen improved production on a quarterly basis.

Planned exploration on three gold and three silver properties increases the company’s likelihood of making new discoveries in minerals-rich Sonora and Chihuahua states.

As we’ve stated before, the company is on the verge of leading the next generation of mid-tier precious metals producers in Mexico. As things stand, it could be a matter of when, not if.

Magna Gold Corp.

TSXV:MGR, OTCQB:MGLQF

Cdn$0.77, 2022.01.26

Shares Outstanding 89.4m

Market cap Cdn$69.3m

Magna Gold Corp. website

Richard (Rick) Mills

Aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Magna Gold (TSX.V:MGR). MGR is a paid advertiser on his site Aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.