Graphite One could supply a major portion of North America’s graphite demands – Richard Mills

2023.02.09

Graphite One (TSXV:GPH, OTCQX:GPHOF) is moving closer towards its goal of becoming the first vertically integrated domestic producer to serve the nascent US electric vehicle battery market.

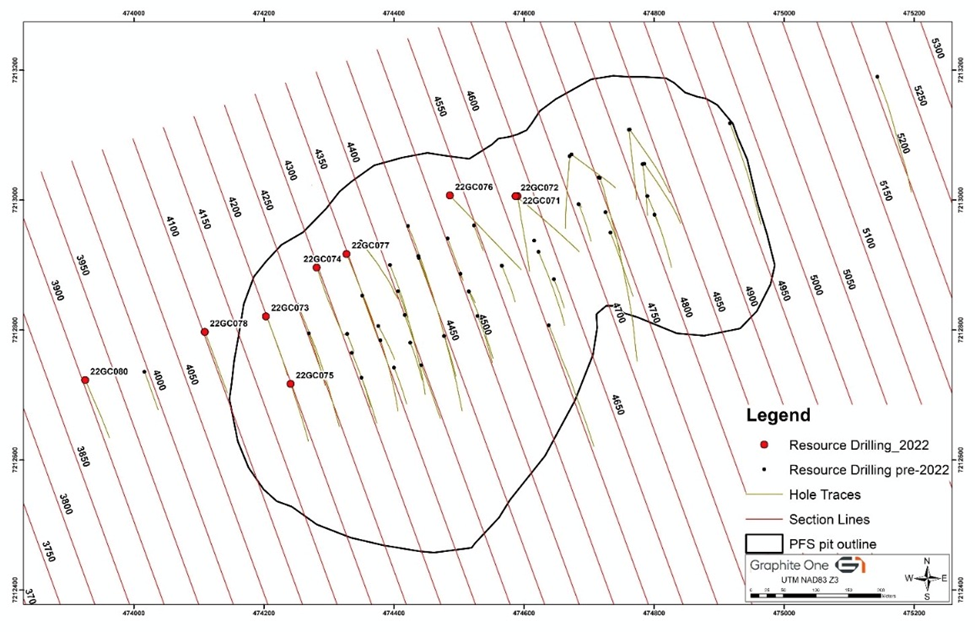

The company this week announced 2022 drill results confirming that significant graphite grade continues 4 kilometers from the prefeasibility study (PFS) pit boundary.

Assays from step-out hole 22GC079 include 58.2 meters of 4.18% graphite. Flake graphite ore suitable for electric-vehicle batteries typically grades 2-3% Cg (total carbon in graphite form), so these are exceptional grades.

Feasibility study drill work shows the deposit remains open to the east, west and down dip.

“Our 2022 drill results continue to demonstrate excellent continuity over the length of the anomaly, and we look forward to releasing new resources numbers shortly,” Graphite One’s CEO Anthony Huston said in the Feb. 7 news release. He added: “Our 2022 drilling results come at a critical point as we continue to see the demand for graphite increase. We believe this deposit could potentially supply a major portion of North America’s graphite demands far into the future.”

2022 drill results

Results from the 2022 field program show that Graphite Creek, located

on the Seward Peninsula 55 kilometers north of Nome, Alaska, is living up to its designation by the US Geological Survey as the largest and highest-grade graphite resource in the United States.

Conducted last June to September, the field program included 1,940 meters of drilling for resource definition. The program also increased field camp capacity, completed key environmental baseline studies, and ran 210 meters of geotechnical drilling for the mill site and tailings area.

According to Graphite One, the 2022 drill results will be used to update the measured, indicated and inferred resource estimate published in the Oct. 13, 2022 prefeasibility study. The company expects to release these updated resource figures by the end of the first quarter.

Among 2022’s best drill intercepts,

- Hole 22GC071 returned 18.5m of 4.7% Cg, 22.2m of 6.8% and 20m of 6.7% Cg starting from 19m downhole.

- Hole 22GC072 returned 31.7m of 5.6% Cg, and 37.6m of 5.2% Cg starting from 62m downhole.

- Hole 22GC073 returned 3.8m of 7.6% Cg, 27.6m of 5.1%, 26.4m of 6.2%Cgand 17.3m of 4.3% Cgstarting from 13m downhole.

- Hole 22GC075 returned 10.5m of 7.7% Cg, 32.9m of 6.4% Cg and 2.1m of 12.0% Cgstarting from 3m downhole.

- Hole 22GC076 returned 53.1m of 7.5% including 12.3m of 11.5% Cg including 2.8m of 25.6% Cgstarting from 72m downhole.

- Hole 22GC079 located 2 km west of previous closest drilling returned 31.8m of 3.4% Cg, including 6.3m of 6.7% Cg, 21.5m of 2.6% Cg, 10.7m of 2.6%Cg, and 13m of 5.4% Cg, starting 5m below the surface.

Core drilling in the deposit area continued to encounter visible graphite mineralization over wide intervals, consistent with previous drilling. Hole 22GC079, drilled 2 km west of previous resource drilling and 4 km west of the PFS pit boundary, showed significant intervals above the cut-off grade. Selected intervals totaled 58.2m of 4.18% graphite.

The deposit remains open to the west, east and down dip. 2022 drilling aimed to extend the inferred resource to the west and upgrade inferred resources to measured and indicated around the PFS pit area. All holes drilled into the proposed north pit wall encountered significant zones of graphite, which will likely expand the pit to the north.

Graphite as critical mineral

The electrification of the global transportation system doesn’t happen without lithium and graphite needed for lithium-ion batteries that go into electric vehicles.

These batteries are made composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

An average plug-in EV has 70 kg of graphite. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

Due to its natural strength and stiffness, graphite is an excellent conductor of heat and electricity. Being the only other natural form of carbon besides diamonds, it is also stable over a wide range of temperatures, with a temperature resistance that goes above 3,500 degrees Celsius — the same as the outer atmosphere of the sun!

The cathode is where metals like lithium, nickel, manganese and cobalt are used, and depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, a material for which there are no substitutes.

Hence, graphite is considered indispensable to the global shift towards electric vehicles. It is also the largest component in batteries by weight, constituting 45% or more of the cell. It may surprise some readers to learn that there is nearly four times more graphite feedstock consumed in each lithium-ion cell than lithium and nine times more than cobalt.

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the national economy and national security.

According to the USGS, the battery end-use market for graphite has grown by 250% globally since 2018.

It’s thought that battery demand could gobble up well over 1.6 million tonnes of flake graphite per year (out of 2022 mine supply of 1.3Mt). Remember, the mining industry still needs to supply other graphite end-users. Currently, the automotive and steel industries are the largest consumers of graphite with demand across both rising at 5% per annum.

The US could be left in the dust as it continues to play catch-up in the EV race. For starters, natural graphite material is very difficult to source. Only about 20 countries make up the world’s supply, many of which produce insignificant amounts (<10,000 tonnes a year).

China is by far the biggest producer with 65% of the world’s graphite production. Due to weak environmental standards and low costs, China also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Mozambique, Madagascar, Brazil and South Korea. The US, on the other hand, produces absolutely no graphite, and therefore must rely solely on imports to satisfy domestic demand.

According to the USGS, in 2022 the US imported 82,000 tonnes of natural graphite, of which 77% was flake and high-purity, 22% amorphous, and 1% lump and chip graphite. The top importers were China (33%), Mexico (18%), Canada (17%) and Madagascar (10%).

But taking into account the fact that China, its main competition, controls all graphite processing, the US is actually not 33% dependent on China for its battery-grade graphite, but 100%. This is a precarious position to be in should it wish to stay in contention for EV dominance, and it will only worsen as demand for battery minerals grows.

Consider the following numbers, again supplied by the USGS: In the United States, four lithium-ion battery manufacturing plants are currently in operation, with an additional 21 in development. At full capacity, these plants are expected to require approximately 1.2 million tons per year of spherical purified graphite. Are they going to get all of it from mines? No. An estimated 40% to 60% will come from synthetic graphite. Because if they sourced it from mines, it would eat up almost 100% of current (2022) mined graphite supply of 1.3Mt. And this is for only one country! Where are all the other countries going to get the graphite needed to build electric-vehicle battery anodes?

(Note: The anode material — called spherical graphite — can either be mined, or manufactured from synthetic graphite, which is produced from heating petroleum coke feedstock in a special furnace, but this method is costly and super energy-intensive. Battery Power Online notes the graphite anode is responsible for 50% of the CO2 emissions from battery production, and that synthetic graphite is often processed with coal power in Mongolia.

Last year Fastmarkets wrote that Producing spherical graphite out of natural mined flake material requires less energy than the Acheson furnace process employed in synthetic graphitization. The latter is obviously reflected in a significant cost savings for natural graphite, which is priced around half that of synthetic).

Parallel strategy

Graphite One has a “parallel strategy” to simultaneously develop a battery anode materials manufacturing facility in Washington State and the Graphite Creek Mine in Alaska. Combined they are known as the Graphite One Project. Manufacturing would begin with purchased materials until Alaska production is available.

The Vancouver-headquartered company has a memorandum of understanding (MOU) with Sunrise New Energy Material Co., Ltd., a lithium-ion battery anode producer based in Guizhou Province, China.

Sunrise and GPH formed an alliance in 2022 to establish a graphite material manufacturing facility in Washington State.

The third link in Graphite One’s US-based graphite supply chain involves battery materials recycler Lab 4 Inc. of Nova Scotia, Canada. Under an earlier MOU, GPH and Lab 4 will work collaboratively to design and build a recycling facility for end-of-life EV and lithium-ion batteries. Lab 4 provides laboratory and engineering support to mining companies with a focus on recycling graphite, manganese and other minerals.

Government incentives

Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production. To reiterate, the US Geological Survey has cited Graphite Creek as the country’s largest known graphite deposit.

Meanwhile, the US government has begun taking a stand on US critical minerals vulnerability, including graphite.

On February 24, 2021, President Joe Biden signed an executive order aimed at strengthening critical US supply chains. Graphite was identified as one of four minerals considered essential to the nation’s “national security, foreign policy and economy.”

Last year, the United States government included lithium, nickel, cobalt, graphite and manganese on the list of items covered by the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War.

To bolster domestic production of these minerals, US miners can now access $750 million under the act’s Title III fund, which can be used for current operations, productivity and safety upgrades, and feasibility studies. The decision could also cover the recycling of these materials, according to Bloomberg sources.

The Biden administration has also allocated $6 billion as part of the $1 trillion infrastructure bill — towards developing a reliable battery supply chain and weaning the auto industry off its reliance on China, the biggest EV market and leading producer of lithium-ion cells.

All of this is in addition to the funding announcement on Oct. 19. The Department of Energy will award $2.8 billion in grants to 20 manufacturing and processing companies for projects across 12 states.

$2.8 billion for US battery supply chain announced

The funding will come from the bipartisan infrastructure law passed last year and will include components affecting both the electric grid and electric vehicles.

The Biden administration plans to have 50% of US auto production be electric and hybrid by 2030.

The annual Defense Appropriations Bill, passed Dec. 15, 2022, includes funding for graphite as a rechargeable battery material, as well as natural graphite-based foam fire suppressant.

Graphite One’s production from Graphite Creek is expected to qualify for tax credits under the U.S. Inflation Reduction Act, because it plans to produce both anode materials and purified graphite in the United States, as required by the act.

Battery plants galore

According to Bloomberg New Energy Finance, since 2009 there have been 882 battery manufacturing projects started or announced in the US, representing $108 billion in investment. Nearly 25% of those projects were rolled out in 2022.

Our research also found that global carmakers and established battery manufacturers have announced plans to invest at least $50 billion into at least 10 states to build EV assembly and battery plants since the start of 2021, and states have made commitments totaling at least $10.8 billion to lure those investments, according to a tally of publicly disclosed incentives by Bloomberg and Good Jobs First. That figure almost certainly underestimates the actual number.

For a breakdown by state, read US battery and EV plants galore. Georgia alone has announced 30 factories related to electric cars and batteries since 2020.

Prefeasibility study

Last summer Graphite One underwent a major de-risking event with the release of the prefeasibility study (PFS) for its Graphite One Project. 2021 drilling has successfully upgraded the 2019 resource estimate, delivering nearly a 200% increase in measured and indicated resources.

The PFS also portrays the Graphite One Project as highly profitable, with expected costs of $3,590 per tonne measured against an average graphite product price of $7,301 per tonne.

The mine would produce, on average, 51,813 tonnes per year (tpy) of graphite concentrate for its projected 23-year mine life. The company itself would produce about 75,000 tpy of products, of which 49,600 tpy would be anode materials, 7,400 tpy purified graphite products, and 18,000 tpy unpurified graphite products.

The prefeas is based on only one square kilometer of the 16-km deposit, meaning GPH could easily crank up production by a factor several times the current (proposed) run rate of 2,860 tonnes per day.

Scale is important to Graphite One’s future customers; they will not want a fragmented supply chain for their lithium-ion battery anodes, purified graphite products and unpurified graphite products.

Feasibility study

With the positive results of the PFS, Graphite One has begun work on a feasibility Study (FS). The current lack of US anode material suppliers, combined with the projected increase in demand for these materials, has prompted Graphite One to investigate increasing the designed production capacity at Graphite Creek, to be used in the FS.

Graphite One plans to complete 20,000 meters of drilling in 2023-24 with the goal of increasing the annual concentrate production for the upcoming FS compared to that assumed in the PFS.

“We will be shifting gears this year and focusing on completing much more drilling during our 2023 summer program. We are well-situated for this work, having increased the capacity of the camp at Graphite Creek from 24 to 60 people last year,” said Mike Schaffner, Graphite One’s senior vice president of mining. He added, “We will also be switching from a helicopter-based drilling program to a road-based drilling program. With the large amount of fog and rain in the area, we expect to see significant improvements in the amount of drilling we can complete in the summer season with significantly reduced costs.”

Anode sampling

In December, Graphite One announced that concentrate, produced from graphite recovered during exploration, is being used to prepare sample battery anode materials for two major electric vehicle manufacturers, while an artificial graphite anode sample is being prepared for a third EV company. Results are expected this quarter.

This is a very crucial milestone for Graphite One in proving, a/ that its graphite end product is of sufficient quality to be battery-grade; and b/ that Graphite One is able to tailor its graphite processing to meet the specific graphite anode needs of its potential future clients.

Now we don’t want to speculate on who those companies are, but the fact that Graphite One describes them as “major EV manufacturers”, narrows the list down to a handful of American car companies, for now we’ll have to use our imagination to guess who they are.

Graphite One prepares sample battery material for EV Manufacturers’ analysis

Testing agreements

Graphite One made two more announcements in January, the first regarding the testing of graphite from Graphite Creek; and the second, the testing of Graphite Creek material “as a potentially critical mineral-rich carbonaceous feedstock.”

In the first news release, G1 states that the company, through a subsidiary, has entered into a Material Transfer Agreement with Pacific Northwest National Laboratory (PNNL), managed and operated in Richland, Washington by Battelle for the U.S. Department of Energy.

Under the MTA, PNNL will test anode active and other materials to verify conformity to electric vehicle battery specifications. The first materials to be tested will be the anode-active materials now being produced as samples by Sunrise, using Graphite Creek graphite. These samples will be sent to American electric vehicle manufacturers for evaluation as a possible source of battery materials.

(Recall that Graphite One and Sunrise are already working together, on the proposed graphite manufacturing facility in Washington State.)

“We are delighted to work with one of the U.S. Government’s premier national labs,” said Anthony Huston, President and CEO of Graphite One, in the Jan. 20 news release. “Given PNNL’s experience in developing renewable energy solutions, and the importance of graphite to the major renewable energy applications as well as the energy storage systems required for the national grid, Graphite One sees this as a major step in our supply chain strategy.”

The second news release details Graphite One’s arrangement with Sandia National Laboratories in Albuquerque, New Mexico. The company’s subsidiary Graphite One (Alaska) has provided material from the Graphite Creek deposit to Sandia, as part of Sandia’s green extraction processing work.

National Technology and Engineering Solutions of Sandia, a subsidiary of Honeywell International, Inc., operates Sandia National Laboratories as a contractor for the U.S. Department of Energy’s National Nuclear Security Administration (NNSA).

In 2021, Sandia’s patent-pending process was awarded a prestigious R&D 100 Award, “GOLD Special Recognition in Green Technology for Environmentally Benign Extraction of Critical Metals Using Supercritical CO2-Based Solvent”. Sandia’s method uses supercritical CO2 in combination with a food-grade additive to extract rare earths and other critical minerals. Sandia will test Graphite Creek material as a potentially critical mineral-rich carbonaceous feedstock.

“We are pleased that Sandia will apply its path-breaking process to Graphite Creek material,” CEO Huston said in the Jan. 25 news release. “We are excited about the potential for value-added applications which identify flake graphite from Graphite Creek as a unique resource, and Sandia’s process will provide us important data on that potential with implications for how we unlock the value of G1’s additional critical minerals.”

Graphite One working with three EV manufacturers and two US Department of Energy labs

Conclusion

Graphite One has made a series of good-news announcements in recent weeks. The results of its 2022 drill campaign demonstrate the potential, in my opinion, for significant resource expansion. Step-out hole 22GC079 was the furthest step-out from the campaign, collared over 2 km west of the next closest hole and 4 km west of the PFS pit boundary. It intercepted a combined 58.2m of mineralization averaging 4.18% graphite. These are excellent grades; flake graphite ore suitable for electric-vehicle batteries typically grades 2-3% Cg.

Feasibility study drill work shows the deposit remains open to the east, west and down dip. An updated prefeasibility study with a new resource estimate is expected sometime this quarter.

Graphite One plans to investigate increasing the designed production capacity at Graphite Creek, to be used in the FS.

Graphite One also plans to complete 20,000 meters of drilling in 2023-24 with the goal of increasing the annual concentrate production for the upcoming FS compared to that assumed in the PFS.

Graphite concentrate is already being used to prepare sample battery anode materials for two major EV manufacturers, through Graphite One’s manufacturing partner, Sunrise New Energy Material Company. Sunrise is also preparing an artificial graphite anode sample for a third EV company. G1 says the results are expected this quarter.

If these sample batches are successful, it will surely push Graphite One onto the radar of not only major EV and battery manufacturing companies, but major mining companies.

We also have Graphite One signing a Materials Transfer Agreement with PNNL, the Pacific Northwest National Laboratory in Washington State, that will test the company’s anode-active and other materials to verify conformity to EV battery specs.

Then there’s Graphite One’s arrangement with Sandia National Laboratories in Albuquerque, New Mexico. A Graphite One subsidiary has provided Graphite Creek material to Sandia, for testing as a potentially critical mineral-rich carbonaceous feedstock, using its award-winning green extraction technology.

Both labs operate under the auspices of the U.S. Department of Energy.

EV manufacturers and PNNL are testing G1’s sample battery anode materials. Sandia National Laboratories will be testing Graphite Creek material as a potentially critical mineral-rich carbonaceous feedstock. The results could mean exciting times ahead for Graphite One shareholders.

Roth Capital Partners recently reiterated a Buy recommendation for GPH and upped its target price to $2.50/sh.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.17, 2023.02.08

Shares Outstanding 83.3m

Market cap Cdn$109.4m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.