Getchell Gold poised to sink drills into Nevada projects Fondaway Canyon and Star

2021.05.20

Cashed up from a recent financing, Nevada-focused Getchell Gold (CSE:GTCH, OTCQB:GGLDF) will soon be heading back to its flagship Fondaway Canyon property to conduct a 4,000-meter drill program that doubles the scope of last year’s highly successful drilling.

Getchell also plans to initiate a maiden drill program at its Star copper-gold-silver project located 60 km north of Fondaway.

Between an oversubscribed $2.7 million private placement and the exercise of warrants worth $646,730, Getchell’s combined $3.356 million ensures the company has a healthy treasury to finance what looks to be an extremely active field season.

According to a May 18 news release, the technical team is making final preparations and is planning to mobilize to the site next week.

Fondaway Canyon

“We are extremely eager to return to Fondaway Canyon with the intention of expanding our new, near-surface gold zones discovered during the 2020 drill program,” Getchell Gold’s President Mike Sieb stated in the March 18 news release.

Drilling there in late 2020 identified thick zones of gold mineralization, interpreted as a downdip continuation of surface mineralization; and high-grade mineralized structures with notable widths.

In preparation for this year’s drilling, Getchell recently expanded its technical team with the appointment of Scott Frostad as Vice President, Exploration. According to the company, Frostad was instrumental in assimilating the voluminous historical dataset, developing the geological model, and managing the 2020 drill program at Fondaway Canyon.

His industry experience spans over three decades, having held positions at renowned gold companies such as Lac Minerals, Teck and Placer Dome.

Fondaway Canyon is an advanced-stage gold property comprising 171 unpatented lode claims totaling 1,186 hectares in Churchill County, Nevada.

It has been the subject of multiple exploration campaigns in the late 1980s and early ‘90s. Records show that 591 holes totaling nearly 50,000 meters have been previously drilled on the property.

The entire project area covers 12 known veins, including five mineralized areas and seven untested targets.

A 2017 technical report showed 409,000 ounces of indicated resources grading 6.18 g/t Au and 660,000 ounces of inferred resources grading 6.4 g/t Au, for a combined 1.1 million ounces.

The five zones comprising the 1.1Moz resource, shown on the map below, are Colorado, Halfmoon, Paperweight, Silica Ridge and Hamburger Hill.

Seventy to 80% of the ounces are within Colorado, Paperweight and Halfmoon, with the remainder found in parallel veins or splays off the main veins. Mineralization is contained in a series of steeply dipping en-echelon quartz-sulfide shears outcropping at surface and extending laterally over 1,200m, with drill-proven depth extensions to greater than 400m.

In November 2020, the company completed a drill program to extend the known mineralization and to characterize it for resource modeling. Six holes were drilled for a total of nearly 2,000 meters.

Shortly after announcing the first set of results earlier this year, the company quickly released assays for the remaining three holes, all of which have intersected broad zones of gold mineralization and significantly extended the previously defined gold domains.

These drill holes were collared within the Central Target Area, which Getchell believes is the “nexus for the gold mineralizing system observed at the project.”

Among the highlights:

- Drill hole FCG20-04 successfully encountered high-grade gold intercepts as it pierced the main Half Moon shear vein 54 meters below surface. These included 8.6 g/t Au over 9.8m, 2.7 g/t Au over 20.5m and 6.3 g/t Au over 3.3m.

- This drill hole also encountered a broad 144-meter intercept, newly identified as the North Fork Gold Zone, extending to the bottom of the hole with the final sample returning 7.9 g/t Au over 1m. This indicates that the lower extent of the North Fork zone was not reached.

- The remaining two holes, FCG20-05 and FCG20-06, successfully extended the Colorado Zone. Both holes encountered broad 100m thick zones of gold mineralization within the Colorado SW Extension target. FCG20-05 pierced the zone between 175 and 270 meters downhole, while FCG20-06 hit it between 165 and 285 meters downhole. Notable intercepts included 1.8 g/t Au over 90m, including 3 g/t Au over 45.3m and 4.4 g/t Au over 11.1m (FGC20-05); and 1.5 g/t Au over 37.7m and 1.1 g/t Au over 38.3m (FCG20-06).

Star

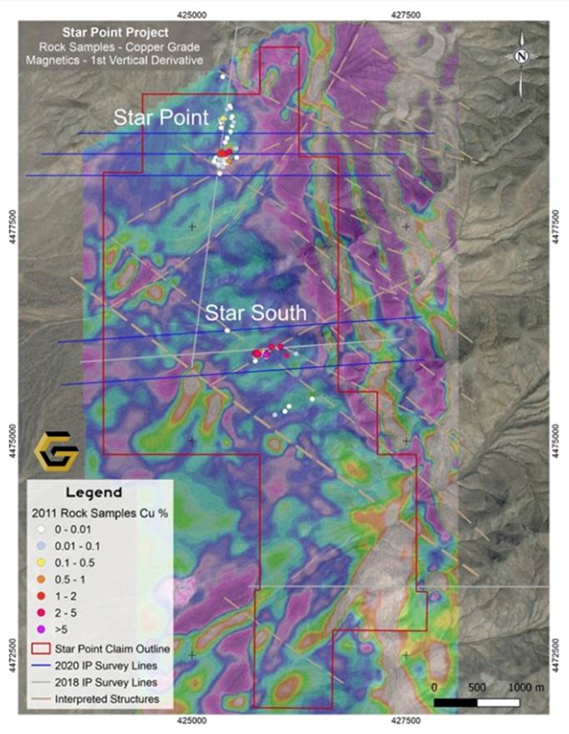

Getchell Gold’s Star copper-gold-silver project, located 60 km north of Fondaway Canyon, contains two main mineralized occurrences (Star Point and Star South), including a past-producing copper mine, with multiple priority drill targets identified. A geophysical survey last year delineated four additional anomalies exhibiting characteristics of porphyry-style mineralization on the property that will be included in this year’s drill testing.

The Star Point near-surface, high-grade copper oxide (tenorite) mine operated from the late 1940s through the mid-1950s. Ore was shipped to a smelter in Utah for processing, though there is no record of tonnages or grades.

Previous development focused on a 300 x 300-meter area at the southern edge of a north-south trending promontory. The surface area is covered with various pits, portals, shafts, open cuts and associated dumps. Underground development consists of several short shafts, winzes and tunnels of varying lengths, leading to a series of stopes and drifts.

Surface sampling began in 2011, with the samples primarily sourced from the dumps and to a lesser extent from outcrops. Of the 79 grab samples collected, 13 returned a grade >0.5% Cu, with the highest grades reported at 4.25, 3.00 and 2.35% Cu (see map below).

Fast forward to 2018, when a magnetic geophysical survey and a limited (one line) IP survey was conducted over the Star Point area. This revealed that the surface mineralized expression at Star Point is underlain by coincident magnetic anomalies that are interpreted as potential copper sulfide mineralization, possibly intrusion-related. They present a compelling drill target for the company.

Less than a month into its fall 2020 exploration at Star, the company showed its technical prowess by completing the Induced Polarization (IP) geophysical survey ahead of schedule.

A total of 22.5 km along five lines were done over the historical Star Point copper mine and the copper-gold-silver Star South artisanal mine site. The results, published on Nov. 24, identified four discrete anomalies characteristic of porphyry-style mineralization.

The second area of focus is the Star South Cu-Au-Ag prospect, situated just 2 km south of the historical mine.

This target area consists of a series of pits, artisanal adits and associated dumps within a 300 x 150m east-west trending area. These adits appear to follow high-grade Cu-Au-Ag mineralization hosted within quartz veins that are associated with shears trending in several different orientations.

As part of a 2011 sampling campaign, a total of 89 samples were collected, with the vast majority sourced from the dumps. As with the Star Point mine, there was an abundance of malachite and azurite mineralization (see image below), which is indicative of high copper content, as well as gold and silver.

What’s more impressive is that of the samples collected, many of them reported high grades of copper, gold and silver in combination, with 40 samples grading >1% Cu, 21 samples grading >1 g/t Au and 20 samples grading >30 g/t Ag. One sample returned an impressive 2.45% Cu, 9.26 g/t Au and 310 g/t Ag.

This sampling work was later validated by the 2018 surveys, which reported the presence of a strong conductor coincident with a NE-SW trending magnetic low. The geophysical signature is interpreted as a potentially mineralized structure along the thrust fault boundary, with the high-grade historical artisanal workings representing the mineralized expression at surface.

Conclusion

Getchell Gold is entering the field at an ideal time for gold prices. Trending down in the first quarter on account of optimism regarding economic recovery from the pandemic, as well as higher bond yields due to fear of inflation, spot gold has staged a remarkable turnaround in the past two and a half months. From a March 1 low of $1,724.80, the precious metal is back up to $1,866.10, at time of writing, for a gain of 8%.

With over $3 million in its treasury, Getchell is cashed up and ready to continue exploring two of its Nevada properties, Fondaway Canyon and Star. That, combined with a tight share structure, and the fact that Getchell is working in Nevada (according to the Fraser Institute’s 2021 Annual Survey of Mining Companies Nevada is the most attractive jurisdiction in the world for mining investment), makes GTCH an asset I want to own, and I do.

“It’s not very often that every hole of an exploration drill program returns gold intersections as good as or better than anticipated,” President Mike Sieb said earlier this year.

I couldn’t agree more.

Getchell already has a 1.1Moz resource at Fondaway Canyon. I continue to believe the project is a strong contender for building ounces — most likely at the Central Target Area, where five mineralized zones have already been found, and were used to delineate the 2017 resource estimate.

Last year’s drilling showed that the gold mineralization is thick and broad, with high-grade intervals that were not accounted for in the company’s geological model. The mineralization remains open at depth, and there is every indication it continues.

As an asset/ development stage junior, Getchell believes the deposit, the asset, is large and rich enough to start down a development path. An asset/development stage company is, in the opinion of management, and likely stockholders who are following the story, likely to become a mine. The risk has been greatly reduced, the wait time for a discovery non-existent, and the reward can be very nice, considering the much lower amount of risk, compared to an exploration-stage junior.

Over at the Star project, Getchell has some blue-sky potential. Though much earlier-stage than Fondaway Canyon, I like the recent IP survey results showing four porphyry-type anomalies. This is a great place to start investigating with the drill.

A previous sampling program yielded high copper content, as well as gold and silver. While most of Getchell’s hopes will be pinned on Fondaway Canyon, Star just might surprise shareholders with a discovery hole.

With two drill campaigns on the go, I’m expecting plenty of news flow from GTCH in the coming weeks.

Getchell Gold

CSE:GTCH, OTC:GGLDF

Cdn$0.53, 2021.05.19

Shares Outstanding 72.9m

Market cap Cdn$37.5m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Getchell Gold (CSE:GTCH). Getchell is an advertiser on his site Aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.