Drilling starts at Getchell Gold’s flagship Fondaway Canyon, Nevada

2021.06.04

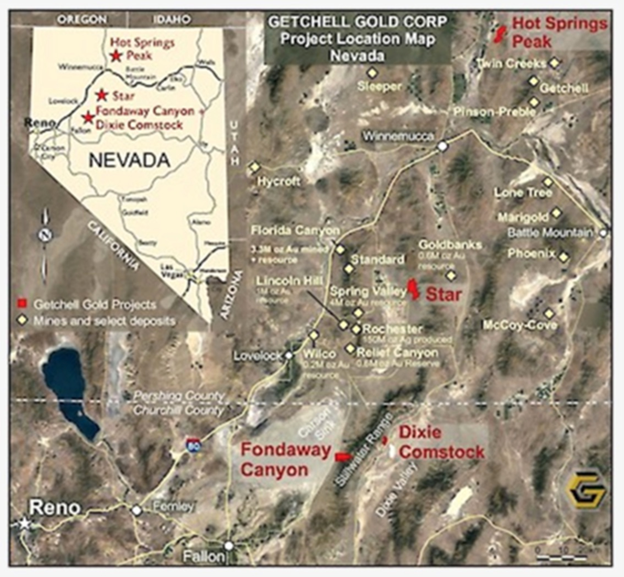

Getchell Gold’s (CSE:GTCH, OTCQB:GGLDF) Fondaway Canyon is an advanced-stage gold property located in Churchill County, Nevada. The project has been the subject of multiple exploration campaigns in the late 1980s and early 1990s.

Records show 591 holes totaling nearly 50,000 meters have been drilled on the property. The project area covers 12 known veins, including five mineralized areas — Colorado, Halfmoon, Paperweight, Silica Ridge and Hamburger Hill. A 2017 technical report showed an estimated 409,000 oz of indicated resources grading 6.18 g/t Au and 660,000 oz inferred grading 6.4 g/t Au – for a combined 1.1 million oz.

Drilling at Fondaway Canyon in late 2020 demonstrated the identification of thick zones of gold mineralization, interpreted as a down-dip continuation of surface mineralization: and high-grade mineralized structures with notable widths within the mineralized system. To follow up on these promising results, Getchell is planning an even bigger drill program this year at the Fondaway Canyon project.

Geological model

Gold mineralization is spread over 3.5 km of east-northeast trending and steeply south dipping structures, developed within fine-grained Triassic carbonaceous siliciclastic sedimentary rocks and Jurassic limestone, cut by tertiary dikes.

Getchell’s job is to figure out whether its project fits the picture of a big “Carlin-style” Nevada gold system, and if it does, how do they find the pathways that carried the gold from a presumably much larger deposit, below the near-surface mineralization?

Equally important: Where are the intrusives? ie., the igneous rock potentially hosting hundreds of meters of mineralization. The trick is finding the main conduit hosting the mineralizing fluids to depth, or on strike which may have soaked into the right age of sandstone along their path. That’s why Getchell needs to chase the system at depth and along strike.

To help shareholders to visualize the mineralized domains used for exploration targeting and mineral inventory, Getchell created an animated video, using a 3D exploration modeling package. Access the Fondaway Canyon Gold Project video through this link

2020 drill program

In November 2020, the company completed a drill program to extend the known mineralization and to characterize it for resource modeling. Six holes were drilled for a total of nearly 2,000 meters.

Shortly after announcing the first set of results earlier this year, the company quickly released assays for the remaining three holes, all of which have intersected broad zones of gold mineralization and significantly extended the previously defined gold domains.

Five of the six drill holes were collared within the Central Target Area, which Getchell believes is the “nexus for the gold mineralizing system observed at the project” — a 1,000 x 700-meter highly mineralized part of the east-west trending Fondaway Canyon gold corridor.

The holes reveal the presence of a thick zone of gold mineralization projected down-dip from surface on two NE-SW sections drilled 300 meters apart (for further details refer to the April 7, 2021 news release). The down dip trace of the mineralization for both sections drilled is now projected as being over 800 meters in length, more than twice the distance thought to exist based on previous geological models.

On the Colorado Pit to Pack Rat drill section, three 2020 drill holes intersected the newly identified Colorado SW Extension Zone, while on the Half Moon section, one hole discovered the North Fork Zone. Both mineralized zones are situated on the same stratigraphic plane and remain open laterally and at depth.

In addition, one hole on the Colorado Pit to Pack Rat section intersected a new structural zone of high-grade gold mineralization, the newly named Juniper Zone, less than 100m below surface. Of 17 consecutive samples extending 21.9 meters down hole, only one sample assayed less than 1 g/t Au, with the highest sample grading 25.5 g/t Au. The mineralized interval graded 6.2 g/t Au over 21.9m, including 9.6 g/t Au over 12.0m and 20.4 g/t Au over 3.2m.

According to Getchell, The 2020 drill program in the Central Area represents sizable step outs from the historical drilling and has produced a revised geo-mineralization model that has extrapolated the continuity of the gold mineralization over extensive distances.

2021 drill program

Up to 4,000 meters is slated for the Central Area of Fondaway Canyon, where the objective is to conduct infill and step-out drilling to further delineate and expand on the mineralization discovered in 2020.

“The stellar results from the 2020 drill program blew the potential of the Fondaway Canyon Gold Project wide open,” said Getchell Gold President Mike Sieb, in the June 1 news release. “The revised geological interpretation represents more than a doubling in the projected down-dip extent of the gold mineralization from previous geological models and has provided ample target areas for the 2021 drill program to further delineate and expand upon our recent discoveries.”

The hope, Getchell says, is that sufficient infill drilling will be done to increase confidence in the geological model to support a revised resource estimate (from the 1.1Moz identified in 2017). A second goal is to continue stepping out from known gold intercepts to expand the geological model.

Colorado to Pack Rat section

The first target is the Juniper Zone, shallowly located down-dip of the Colorado Pit. It was here in 1989, when the drill hit one of the highest gold intersections in the project’s history, returning 17.6 g/t over 15.2 meters, within a larger 44.2m interval grading 8.1 g/t Au. Last year, drill hole FCG20-02 came back with a respectable 6.2 g/t Au over 21.9m. The zone is interpreted as striking to the northwest and dipping fairly vertical. A number of historical gold intercepts lie within the strike plane and potentially form part of the Juniper Zone.

During Phase 1 drilling, the drill is expected to be mobilized to the canyon floor so that the Colorado SW Extension Zone can be further delineated.

North Fork Zone on Half Moon section

Last year, drill hole FCG20-04, collared north of where the Half Moon Vein is exposed on surface, encountered the high-grade Half Moon Shear Vein 108.1m down hole and 54m vertically below surface. The drill also intercepted a broad 144m intercept of gold mineralization, newly identified as the North Fork Zone, extending to the bottom of the hole, with the final sample of hole FCG20-04 returning 7.9 g/t Au over 1.0m, indicating the lower extent of the North Fork Zone was not reached. Phase 1 drilling will therefore include a series of holes to further delineate the North Fork Zone down dip of hole FC17-04’s gold mineralized interval, and laterally around the broad gold mineralized interval intersected in FCG20-04.

Pediment Target Area

The Pediment Area to the far west of Fondaway Canyon, is currently scheduled to be tested by one hole during the Phase 1 drill program. Further details on the Pediment target will be provided prior to the drill moving to the area.

Nevada

Ever since Newmont’s discovery of the large Carlin deposit in the 1960s, gold mining has become a focal point of Nevada’s economy. The state is consistently ranked among the top five mining jurisdictions in the world; in the latest Fraser Institute Investment Attractiveness Index, Nevada was number one.

Each year, more than 5 million ounces of yellow metal are produced, which based on today’s gold prices, amounts to about US$9.5 billion in value. Nevada is home to nearly 30 gold mines, with more to come.

The state offers an attractive tax regime with a low net profits tax and zero income tax. Regulations and permitting processes are transparent and easy for explorers to navigate.

According to the US Geological Survey, if Nevada were a country, it would be among the world’s top four gold producers. The Nevada Bureau of Mines and Geology tallies gold reserves at about 70 million ounces, enough to sustain gold production near current levels for up to 15 years.

The creation of Nevada Gold Mines in 2019 — a joint venture of Barrick and Newmont — has piqued the interest of other companies looking to discover and develop new ounces in the golden state. Major miners with new projects include AngloGold Ashanti, Coeur Mining and Kinross Gold.

As proven by many others, one of the most important keys to building up a project is identifying and exploring areas where mining activities have been documented in the past, which is exactly what Getchell Gold has done so far.

Conclusion

Between an oversubscribed $2.7 million private placement and the exercise of warrants worth $646,730, Getchell’s combined $3.356 million ensures the company has a healthy treasury to finance what looks to be an extremely active field season.

At Fondaway Canyon, the planned 4,000-meter drill program doubles the scope of last year’s highly successful drilling.

Getchell also plans to initiate a maiden drill program at its Star copper-gold-silver project located 60 km north of Fondaway. Though much earlier-stage than Fondaway Canyon, I like the recent IP survey results showing four porphyry-type anomalies. This is a great place to start investigating with the drill.

A previous sampling program yielded high copper content, as well as gold and silver. While most of Getchell’s hopes will be pinned on Fondaway Canyon, Star just might surprise shareholders with a discovery hole.

The 2020 drill program has already shown that the gold mineralization at Fondaway Canyon is thick and broad, with high-grade intervals that were not accounted for in the company’s geological model. The mineralization remains open, and every indication shows that it could continue. The significant potential for extensions is likely to be investigated further in this year’s exploration program, as Getchell continues its path towards building ounces at what it believes could be another Carlin-style gold system.

Getchell Gold

CSE:GTCH, OTC:GGLDF

Cdn$0.50, 2021.06.03

Shares Outstanding 72.9m

Market cap Cdn$35.2m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Getchell Gold (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.