Coronavirus infects dollar

2020.03.07

Up to a month ago the US dollar was showing resilience in the face of a slowdown in the global economy evidenced by anemic growth. As central banks including the US Federal Reserve reacted by lowering interest rates, it looked as though strength in the US economy (stock market bull, 50-year-low unemployment, etc.) would see the States through the downturn, especially since US Treasury yields were that much higher than those of competing bonds such as the German “bund”.

All that has changed with the coronavirus.

Yields tank

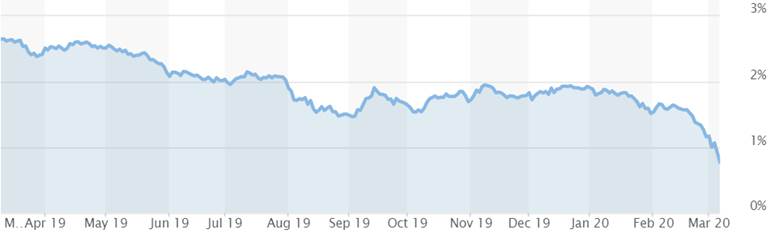

Back in October the yield on the 10-year Treasury was 2 percentage points higher than the 10-year bund, which remained stuck in negative-yield territory – among trillions of dollars worth of sovereign debt. On Friday, both countries’ bonds fell, but the spread between them is now just 1.4%.

As Covid-19 fears continued to rattle markets, with cases surfacing in four new states Thursday, the 10-year Treasury note slumped 22 basis points to a record low 0.698%, against the 10-year bund which hit a six-month low of -0.739%, within striking distance of record lows hit last September, at the height of the US-China trade war.

Dollar dented

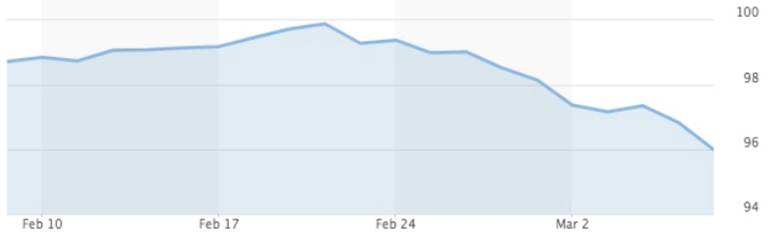

Despite a positive February employment report, the US dollar followed Treasuries downward, the steep fall in yields denting the greenback’s appeal. The USD index (DXY), which measures the strength of the dollar against a basket of six other major currencies, sunk to 95.883, its lowest in a year – a precipitous drop from two weeks ago when it was cruising around 99. DXY was down 2.4%, its worst weekly performance since February 2016.

CNBC noted the lower buck has [wiped] out the yield advantage that had fueled a popular carry globally – borrowing at negative rates in the euro and yen to buy U.S. assets.

“The driver is the equity markets and the collapse in U.S. bond yields this week,” CNBC quoted Kenneth Broux, FX strategist at Societe Generale.

The beneficiary was clearly gold.

Gold soars

On Friday gold prices neared a 7-year high, even as a mass liquidation of equities forced investors to cash in gold gains to cover losses in the stock market. As of this writing, spot gold was trading at $1,689 an ounce and gold futures were at $1,672, their best performance in more than four years. (earlier in the day gold futures hit $1,690.70) The yellow metal gained nearly 7% for the week and is up 11.3%, year to date, while silver traded 4.5% higher between Monday and Friday.

Strong demand for gold, the world’s oldest safe-haven asset in times of crisis, was reflected in the February figures for gold-backed exchange-traded funds. According to the World Gold Council, a net $4.9 billion or 84.5 tonnes flowed into gold ETFs last month, pushing holdings to an all-time high of 3,033 tonnes. Helped by a 4.4% increase in the gold price, the value of assets under management (AUM) was up 4.4% in February, breaking the previous record high set in 2012. North American gold ETFs led the way at 42 tonnes of inflows.

“The dollar’s safe-haven status is being tarnished,” Kitco quoted Marc Chandler, managing director of Bannockburn Global Forex, Friday. “It is lower against all the major currencies, and many emerging-market currencies, where Eastern and Central European currencies lead the advancers….After advancing 2% yesterday, gold is pushing higher still.”

More cuts on the way

At AOTH, we agree that gold will run further, and the dollar will remain pressured, because the Fed is poised to slash interest rates deeper, in an attempt to goose consumer spending and revive flat-lining economic growth, amid coronavirus fallout. The number of infected world-wide reached 100,000 on Friday. As of Friday evening, at least half of all states have confirmed cases and 17 people have died.

In fact, some medical experts say the containment phase has passed and that Covid-19 is inevitable. That would mean living with the respiratory virus in our communities, much like the flu and managing its potentially fatal diagnosis.

“This is spreading throughout the world and it will continue to spread throughout the world,” Isaac Bogoch, an infectious disease physician at Toronto General Hospital, told CBC earlier in the week.

Frozen by uncertainty, investors have lowered expectations for US interest rates. On Tuesday the Fed cut the federal funds rate by 50 basis points – as a way to counter the economic effects of Covid-19. It’s worth pointing out that these emergency rate reductions don’t happen very often. The last time the Fed was forced to act was following the collapse of Lehman Brothers, before that it was 9/11, and the dot-com bubble bursting in the late ‘90s.

Traders are reportedly assigning a 65% chance of a 75-basis-point cut by the Federal Open Market Committee when it meets March 17-18. That would take borrowing costs down to 0.25% -0.5%, from the current 1% – 1.25%. By December, traders say there’s a 35% chance of rates going to 0% – where they went to in 2008 and stayed for 7 years.

Economic fallout worsens

So far we have mostly seen the effects of the virus on the supply side, such as Apple warning its earnings will be down because of disruptions in China, but we are also starting to see demand destruction.

Goldman Sachs says the world is facing the biggest commodity demand shock since the financial crisis, as the outbreak and its effects spread from Asia and the Middle East to Europe and the United States.

The bank’s head of global commodities research, Jeff Currie, notes that disruptions to demand for oil and other energy products will likely be unrecoverable, whereas for other commodities like steel and aluminum they could just be deferred.

On the other hand, gold has “immunity to the virus” and has outperformed other safe-haven assets like the Japanese yen and Swiss franc, said Goldman, via Bloomberg.

In a Feb. 28 report, Currie said China has lost an estimated 4 million barrels a day of oil demand, compared to 5 Mbod in 2008-09, and that 45% of container vessel sailings from Europe to Asia were canceled in the four weeks following Chinese New Year.

Oxford Economics recently downgraded China’s annual growth projections this year to 4.8% – the worst in decades.

An even dire warning came on Friday from Allianz SE, which said the outbreak and efforts to contain it may slice $320 billion off global trade each quarter that it lasts. If true, that would mean the coronavirus does more harm than the US-China trade war.

What’s coming?

Unfortunately the prognosis for both the virus and the economy, is not good. Likely it will get worse before it gets better. In a video interview with CNBC, Jeffrey Gundlach, the CEO of DoubleLine, thinks that short-term Treasury yields “are going back to zero,” but he does not believe that rates will go negative.

The so-called “Bond King” predicts more easing (ie. lower rates) is coming, warns transportation and financials are “the two sectors that are just falling knives” and is long gold. He’s even advising investors to stay in cash rather than cast their lot with a T-bill or note that is likely moving even lower.

A few select excerpts from the interview:

“I think Jay Powell understands that negative rates are fatal to global financial system. If we go to negative rates, there will be capital destruction en masse.”

“I think it is foolhardy to think anything other than this [pandemic] is going to take a major hit to short-term economic growth.”

“…obviously, the airlines are in free fall for good reason. [Airlines stand to lose $113 billion in sales if Covid-19 continues to spread, according to the International Air Transport Association – comparable airline losses from the financial crisis]

And small business activity is going to contract. Maybe grocery store sales will go up on a short-term spike. But all other kind of social activity is grinding to a standstill.”

“…the President and the physicians, on top of this coronavirus situation, and they are saying that they might have a vaccine in like a year, year and a half. So, nobody knows what is happening here. And so, caution is appropriate.”

“I turned bullish on gold in the summer of 2018 on my Total Return webcast when it was at 1190. And it just seems to me, as I talked about my Just Markets webcast, which is up on DoubleLine.com on a replay, that the dollar is going to get weaker. And the dollar getting weaker seems to be a policy. And the Fed cutting rates, slashing rates is clearly going to be dollar negative. And that means that gold is going to go higher.”

Scary stuff. Obviously the Fed’s motivation in dragging interest rates down further is to stimulate the economy through more consumer spending, which represents 70% of the US economy. When “all other kind of social activity [except for grocery shopping] is grinding to a standstill” spending ain’t happening, folks.

We already see this. According to a report in the Wall Street Journal, Positive test results for infections in the U.S. last weekend further raised the prospect of changes to behaviors that could lead to a drop in consumer spending, especially travel, tourism and entertainment.

The concern is that, unlike the quantitative easing programs meant to deal with the financial crisis, rate cuts will not be enough, first, because rates are currently much lower than they were pre-QE, and have very little room to fall before getting to 0%; and second, the Fed’s efforts will probably not be effective without a major response by public health authorities.

Also, monetary policy can do little to restore global supply chains, much less do anything about slack demand. As Marketwatch points out, its ability to stimulate demand is hampered by the fact that fighting the outbreak requires a temporary economic slowdown as people quarantine themselves.

Simply: To keep the virus from spreading throughout the population, lots of people will need to stay home. The new buzz-word being social distancing.

This is exactly what has happened in China. Millions returning to work after Chinese New Year were advised to work from home if possible. Normally bustling streets are empty as non-essential excursions are curtailed.

If the virus continues its spread across the US, and consumers isolate themselves, businesses that deal directly with the public are expected to be hit first. This includes retailers, restaurants, luxury-goods companies and cinema operators.

What can be done to contain its spread and how bad could it get? A full answer is beyond the scope of this article but it doesn’t take a great deal of thought to extrapolate what could happen. If the rate of infection continues to rise, people will stop going to work, and many will feign sickness out of fear of being in an enclosed space with a bunch of sick colleagues. If the virus is allowed to run freely through communities, no longer confined to just travelers, it could affect small businesses, which lay staff off to conserve cash. The newly unemployed have trouble making ends meet, paying the rent or mortgage, buying groceries etc. Mortgage defaults rise, as do crime rates. Will there even be enough masks to go around?

An article by F. William Engdahl states that 80% of medicines consumed in the United States are made in China. Among them are most antibiotics, birth control pills, blood pressure medicines such as valsartan, blood thinners such as heparin, and various cancer drugs. The list also includes medications to treat HIV, Alzheimer’s disease, bipolar disorder, schizophrenia, depression and epilepsy,

Even over-the-counter remedies like Vitamin C have been outsourced to China, able to produce them much cheaper than in the West.

Imagine what could happen if factory closures or limited operations start restricting drug shipments, leading to shortages in the pharmacies of Europe and North America?

Engdahl quotes Rosemary Gibson of the Hastings Center bioethics research institute, who wrote a book on the topic, saying that “…if China shut the door tomorrow, within a couple of months, hospitals in the United States would cease to function.”

The passage is worth quoting in full:

At the time the outsourcing of US and European drug manufacture to China began no one could imagine the present health catastrophe growing out of Wuhan in a matter of days. The massive China quarantine since late January has shut some 75-80% of all Chinese factories and created an unprecedented domestic China demand for every kind of medical product since the WHO declaration of medical emergency around the coronavirus or COVID-19 events at the end of January. It is unclear how badly deliveries of vital pharmaceuticals including essential antibiotics from China to the USA or Europe or other countries will be affected though anecdotal reports of hospitals beginning to experience delivery problems are surfacing. Even the idea to turn to India, another major global pharmaceutical supplier, only finds that most Indian manufacturers are dependent on China for their active drug ingredients.

I can imagine smash and grab thefts at medical supply stores.

The US response so far does not inspire confidence. Donald Trump has voiced a number of “hunches” about the coronavirus – contradicting health officials on important facts and advice. Meanwhile, 100,000 are infected and the numbers in the US and Canada keep going up.

The US government has drawn criticism for limiting testing in the first few weeks of the outbreak. It promised to ramp up testing, but there is skepticism. Earlier this week the New York Times reported public health labs saying even if a million test kits were available, they can only test 15,000 people daily.

Conclusion

I started this article talking about the dollar, and I’d like to end it with a question: Could the coronavirus be the dollar’s Minsky Moment?

“Minsky Moment” refers to the idea that periods of bullish speculation will eventually lead to a crisis, wherein a sudden decline in optimism causes a spectacular market crash.

Donald Trump has throughout his presidential term rallied for a weak dollar and low interest rates to fix the trade deficit. He’s personally taken credit for the booming stock market, which is mostly due to stock buybacks, enabling record insider selling. Remember share repurchases artificially inflate earnings per share. They benefit management at the expense of company growth and ultimately, shareholders.

Trump appears to be getting his low dollar, thanks to the coronavirus, but he’s also getting a major stock market correction, a bottoming out of interest rates, and plunging Treasury yields that are getting dangerously close to 0%.

We know the coronavirus is hurting supply chains, it’s killing global growth, and its effects are being felt in the US, reflected in, a much weakened stock market, weak manufacturing data and the lower dollar. As US corporate earnings drop, so will share prices, and most importantly, there won’t be extra cash for stock buybacks. Without buybacks there is nothing to prop up the stock market. Poof.

How about bonds? At yields above 2%, investors piled into US Treasuries as a safe haven amid coronavirus fears and other geopolitical tensions. They were attractive in comparison to the trillions of negative-yielding sovereign debt sloshing around. But with yields plummeting to record lows and more interest rate cuts predicted, bonds are starting to look like a poor investment. If foreign investors slow or stop buying US Treasuries, as Russia has done and China did last May, the United States is in real trouble. Without purchasers of US debt (Treasuries) the US has no way of financing its annual deficits and $23 trillion pile of debt, without printing money. Printing money on a large scale causes hyperinflation.

A worsening US economy will turn investors away from bonds and Treasuries – no more financing for US debt. The dollar will fall further and commodities will rise, including gold and silver, pushed higher by investment demand for gold-backed ETFs and physical metal.

The world appears to be teetering on a precipice but it’s one of the best times I’ve seen in a long time for investing in gold and gold stocks.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.