May 25, 2021

May 25, 2021

According to Sprott Insights, the three areas of growing demand — solar, 5G and automotive — potentially account for greater than 125 million ounces, annually, in 10 years. Where is this new silver supply going to come from?

Their conclusion? “We do not see enough supply growth to offset the demand growth,” with mine supply falling since 2016 and “we do not see enough projects in development to generate the kind of production levels in question, at least not at current silver prices.”

Their conclusion? “We do not see enough supply growth to offset the demand growth,” with mine supply falling since 2016 and “we do not see enough projects in development to generate the kind of production levels in question, at least not at current silver prices.”

Do you like it?

May 24, 2021

May 24, 2021

Energy and precious metals explorer Max Resource Corp. (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2) continues to make significant progress at its flagship CESAR project in northeastern Colombia, along what is considered to be the world’s largest copper-producing belt in the Andean.

Do you like it?

May 2, 2021

May 2, 2021

Tin currently has the highest value of the major base metals, three times the value of copper and nine times the value of zinc.

Chances are the value of zinc could stay high for a while. This is because the global tin market is in the midst of a historic squeeze (or one might call a “super squeeze”).

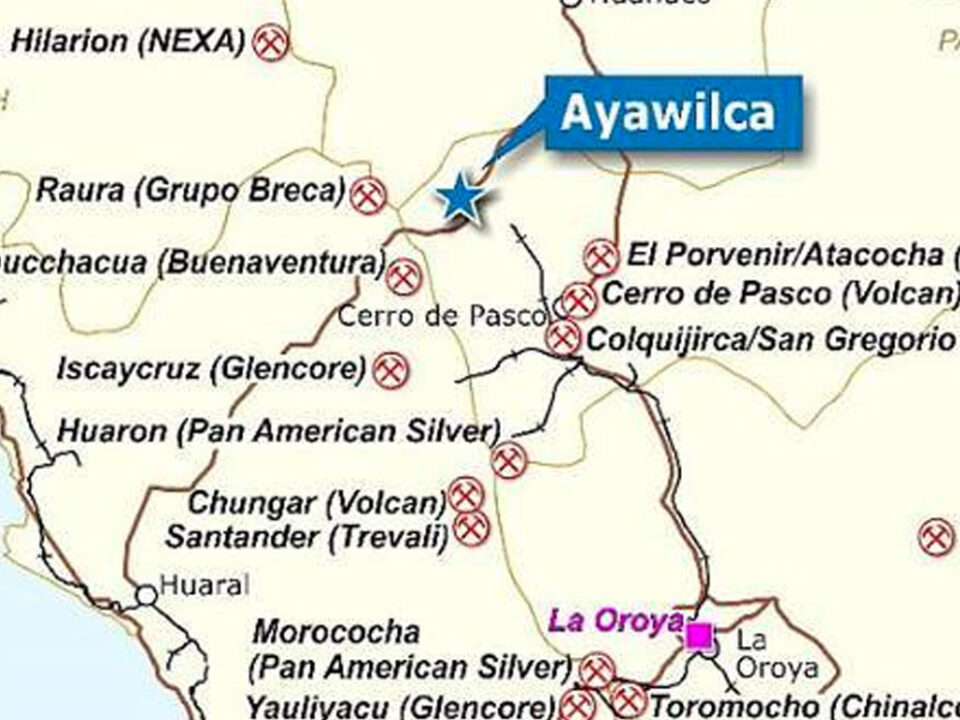

One potential source of tin that we should be looking at lies in the Pasco region of central Peru. This is where we find Tinka Resources (TSXV:TK, OTCP:TKRFF) and its flagship Ayawilca project.

Chances are the value of zinc could stay high for a while. This is because the global tin market is in the midst of a historic squeeze (or one might call a “super squeeze”).

One potential source of tin that we should be looking at lies in the Pasco region of central Peru. This is where we find Tinka Resources (TSXV:TK, OTCP:TKRFF) and its flagship Ayawilca project.

Do you like it?

April 29, 2021

April 29, 2021

According to the Silver Institute, global demand for silver will rise to 1.025 billion ounces in 2021, the highest in eight years, led by investments in industrial and investment-grade physical silver, ie., bars and coins.

“The outlook for the silver price in 2021 remains exceptionally encouraging, with the annual average price projected to rise by 46 percent to … $30,” it said in a statement.

“The outlook for the silver price in 2021 remains exceptionally encouraging, with the annual average price projected to rise by 46 percent to … $30,” it said in a statement.

Do you like it?

April 27, 2021

April 27, 2021

The United States is back in the fold of countries pledging to reduce greenhouse gas emissions, and that is helping to drive demand for an assemblage of metals that a global push to decarbonize and electrify is expected to require.

Do you like it?

April 24, 2021

April 24, 2021

Joe Biden came to power as the 46th US president expecting to spend more on green energy and clean technology. Just how much more is starting to be revealed.

Do you like it?

April 17, 2021

April 17, 2021

2021.04.17 New Videos showing expanded Geological Model of Gold Zones: Fondaway Canyon, Nevada […]

Do you like it?

April 17, 2021

April 17, 2021

The big question is, will there be enough copper for future electrification needs, globally? Plus all the other modern-day uses of copper?

The short answer is no, not without a massive acceleration of copper production worldwide.

Global leaders have set strict decarbonization targets that require green-focused infrastructure built with copper. This, combined with a massive rise in government expenditures and years of underinvestment, has investment bank Goldman Sachs predicting that another commodity super-cycle is on the horizon.

The short answer is no, not without a massive acceleration of copper production worldwide.

Global leaders have set strict decarbonization targets that require green-focused infrastructure built with copper. This, combined with a massive rise in government expenditures and years of underinvestment, has investment bank Goldman Sachs predicting that another commodity super-cycle is on the horizon.

Do you like it?

April 15, 2021

April 15, 2021

Tinka Resources’ (TSX.V:TK, OTCQB:TKRFF) Ayawilca polymetallic project in Peru just got a whole lot more interesting with the discovery of a new tin zone, that is expected to add significant value to what is already the largest zinc development project in Latin America and one of the biggest zinc resources held by a junior explorer.

Do you like it?

April 11, 2021

April 11, 2021

“The adage of ‘if it can’t be grown it must be mined’ serves as a reminder that electric vehicles, transitional energy, and a green economy start with metals. The supply chain for batteries, wind turbines, solar panels, electric motors, transmission lines, 5G — everything that is needed for a Green Economy starts with metals and mining. Demand for these metals, principally lithium, nickel and cobalt on the battery side and copper, uranium and rare earth elements on the energy side is expected to rise rapidly.”

Do you like it?

April 5, 2021

April 5, 2021

Years of neglecting its critical metal supplies is catching up with the United States, as demand for the raw materials needed to build a new green economy that rejects fossil fuels gears up.

Do you like it?

March 30, 2021

March 30, 2021

Mainstream media and the large mining companies are finally catching on to what we at AOTH have been saying for the past two years: the copper market is heading for a severe supply shortage due to a perfect storm of under-exploration/ lack of discovery of new deposits, clashing with a huge increase in demand due to electrification and decarbonization.

Do you like it?

March 23, 2021

March 23, 2021

Goldman Sachs says that the next structural bull market for commodities will be driven by spending on green energy.

The fossil-fueled based transportation system needs to be electrified, and the switch must be made from oil, gas, and coal-powered power plants to those which run on solar, wind and thorium-produced nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

In a recent report, commodities consultancy Wood Mackenzie said an investment of over $1 trillion will be required in key energy transition metals over the next 15 years, just to meet the growing needs of decarbonization.

The fossil-fueled based transportation system needs to be electrified, and the switch must be made from oil, gas, and coal-powered power plants to those which run on solar, wind and thorium-produced nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

In a recent report, commodities consultancy Wood Mackenzie said an investment of over $1 trillion will be required in key energy transition metals over the next 15 years, just to meet the growing needs of decarbonization.

Do you like it?

March 19, 2021

March 19, 2021

Peru-focused Tinka Resources (TSXV:TK, OTCP:TKRFF) has the backing of a major player in the Peruvian zinc and silver market, adding significant heft to its flagship Ayawilca zinc-silver play.

Nexa Resources (TSX:NEXA), one of the world’s largest zinc producers, and owner of the only zinc smelter in Peru, purchased 28.895 million common shares from an arms-length shareholder, giving the Luxembourg-based firm an 8.8% stake in Tinka.

The transaction means Tinka Resources now has two major miners as shareholders — the other being Buenaventura SA (NYSE:BVN) — along with JP Morgan UK.

Nexa Resources (TSX:NEXA), one of the world’s largest zinc producers, and owner of the only zinc smelter in Peru, purchased 28.895 million common shares from an arms-length shareholder, giving the Luxembourg-based firm an 8.8% stake in Tinka.

The transaction means Tinka Resources now has two major miners as shareholders — the other being Buenaventura SA (NYSE:BVN) — along with JP Morgan UK.

Do you like it?

March 6, 2021

March 6, 2021

Is America’s infrastructure spending worth it? So far, the answer would lean towards a yes.

A report published by the American Society of Civil Engineers (ASCE) this week has validated the nation’s recent success in improving its infrastructure, while justifying the need for additional government spending.

A report published by the American Society of Civil Engineers (ASCE) this week has validated the nation’s recent success in improving its infrastructure, while justifying the need for additional government spending.

Do you like it?

March 5, 2021

March 5, 2021

The exploration success accumulated by Max Resource Corp. (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2) over the past year has not gone unrecognized.

Recently, the company was named one of the top 10 performing mining stocks in the 2021 TSX Venture 50, having seen its value increase more than three-fold over the past year. The TSX Venture 50 ranks the top 50 stocks from over 1,600 companies listed on the TSX Venture Exchange.

Last year’s winners included well-recognized names such as K92 Mining Inc., Great Bear Resources Ltd. and Discovery Metals Corp. Some of these have gone on to become billion-dollar market cap companies.

Recently, the company was named one of the top 10 performing mining stocks in the 2021 TSX Venture 50, having seen its value increase more than three-fold over the past year. The TSX Venture 50 ranks the top 50 stocks from over 1,600 companies listed on the TSX Venture Exchange.

Last year’s winners included well-recognized names such as K92 Mining Inc., Great Bear Resources Ltd. and Discovery Metals Corp. Some of these have gone on to become billion-dollar market cap companies.

Do you like it?

March 3, 2021

March 3, 2021

The presence of BHT mineralization hosted in banded iron formations could be an important characteristic at Fredriksson to trace and find deposits with the potential for scale — something a junior like Norden Crown Metals must be able to demonstrate to a prospective major (or mid-tier) acquirer.

Do you like it?

March 2, 2021

March 2, 2021

“Native silver” found in the Earth’s crust on its own, is relatively rare. More commonly, it is mined alongside gold, or as a by-product of zinc-lead ore. There are currently only 75 “pure play” silver companies, most of whom have projects in Chile, Argentina, Mexico and Peru.

The rarity of silver and gold becomes apparent when we consider how little of both have been mined throughout history – just 190,000 tonnes of gold and 1.6 million tonnes of silver. Or in ounce terms, 6.1 billion oz of gold and 51.3 billion oz of silver. All the gold ever mined in the world could fit into a cube 21.6 meters on each side, and all the above-ground silver could fit into a 55m cube.

The rarity of silver and gold becomes apparent when we consider how little of both have been mined throughout history – just 190,000 tonnes of gold and 1.6 million tonnes of silver. Or in ounce terms, 6.1 billion oz of gold and 51.3 billion oz of silver. All the gold ever mined in the world could fit into a cube 21.6 meters on each side, and all the above-ground silver could fit into a 55m cube.

Do you like it?

February 27, 2021

February 27, 2021

21.02.27 Industrial metals are on an absolute tear with no signs of slowing […]

Do you like it?

February 26, 2021

February 26, 2021

2021.02.26 Looking to advance what would be an integral part of the US […]

Do you like it?

February 12, 2021

February 12, 2021

2021.02.12 On Wednesday, Feb. 10, copper prices tore past $3.79 a pound ($8,350 […]

Do you like it?

January 25, 2021

January 25, 2021

2021.01.25 The Covid-19 crisis has served as a catalyst for a new “commodity […]

January 25, 2021

January 25, 2021

2021.01.25 “Finding gold in the shadow of headframes” is an old mining adage, […]

Do you like it?

January 20, 2021

January 20, 2021

2021.01.20 Gold may have come off the boil after rising above $1,900 an […]

Do you like it?

December 23, 2020

December 23, 2020

2020.12.23 The next time you crack open a can of beer, you might […]

July 5, 2020

July 5, 2020

2020.07.05 Precious metals are among the best places to park your money in […]