August 2, 2023

August 2, 2023

Article/Editing: Bruno Venditti The production of lithium (Li) and nickel (Ni), two key […]

Do you like it?

July 31, 2023

July 31, 2023

2023.07.31 Looking to build on the recently announced inaugural resource estimate for its […]

Do you like it?

July 31, 2023

July 31, 2023

2023.07.31 为了在最近宣布的玻利维亚 Golden Hill 矿区首次资源估算的基础上,Mantaro Precious Metals (TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ) 现已启动该矿区的尾矿取样计划。 该计划的目的是量化 Golden […]

Do you like it?

July 29, 2023

July 29, 2023

2023.07.29 The Surimeau mineral deposit in Quebec being developed by Renforth Resources (CSE:RFR, OTCQB:RFHRF, […]

Do you like it?

July 28, 2023

July 28, 2023

2023.07.28 Prudent Minerals Corp. (CSE: PRUD) has successfully completed the acquisition of all […]

Do you like it?

July 28, 2023

July 28, 2023

2023.07.28 Prudent Minerals Corp.(CSE:PRUD)已成功完成对总部位于哥伦比亚的金矿公司 Berlin Precious Metals Corp. 的所有已发行和流通股的收购。 根据去年12月签署的协议条款,Prudent已向 Berlin 股东发行 800 […]

Do you like it?

July 25, 2023

July 25, 2023

2023.07.25 Simply put, the road to reaching net zero begins and ends with […]

Do you like it?

July 24, 2023

July 24, 2023

By Megan Gannon Graphite One is getting a big injection of taxpayer dollars to […]

Do you like it?

July 21, 2023

July 21, 2023

2023.07.21 It may not seem like it, but the precious metals market is […]

Do you like it?

July 20, 2023

July 20, 2023

By Shane Lasley From the U.S. Department of Defense and policymakers in Washington, DC, […]

Do you like it?

July 18, 2023

July 18, 2023

2023.07.18 Graphite One (TSXV:GPH, OTCQX:GPHOF) and its Graphite Creek deposit in Alaska have […]

Do you like it?

July 16, 2023

July 16, 2023

2023.07.16 After nearly two years of work, the long-awaited inaugural mineral resource estimate […]

Do you like it?

July 16, 2023

July 16, 2023

2023.07.16 经过近两年的工作,期待已久的 Mantaro Precious Metals (TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ) 位于玻利维亚的 Golden Hill 矿产的首次矿产资源估算已经出炉,让人们一睹该项目的优势。 由 […]

Do you like it?

July 15, 2023

July 15, 2023

2023.07.15 Roads, ports & bridges, transmission lines, power plants, airports, dams, buses, subways, […]

Do you like it?

July 14, 2023

July 14, 2023

2023.07.14 When it comes to the diversity and reliability of critical mineral supplies, […]

Do you like it?

July 14, 2023

July 14, 2023

2023.07.14 就关键矿产供应的多样性和可靠性而言,西方经济体似乎还有很多地方需要弥补。 国际能源署 (IEA) 表示,尽管美国和欧洲努力实现多元化并减少对中国的依赖,但 2022 年一些关键矿产的供应集中度仍将加剧。 正如 IEA 2023 年版《关键矿产市场评论》所强调的那样,有问题的矿物包括镍和钴,它们是电动汽车电池的关键成分,其供应来源高度集中。 全球近 70% […]

Do you like it?

July 11, 2023

July 11, 2023

2023.07.11 The race is on to score lithium, the crucial electric vehicle battery […]

Do you like it?

July 10, 2023

July 10, 2023

2023.07.10 I recorded this at @GraphiteOne’s drill site near Nome, as I learned […]

Do you like it?

July 8, 2023

July 8, 2023

China’s metal export controls give impetus for US to develop its own graphite supply – Richard Mills

2023.07.08 China has certainly picked an interesting time to escalate the trade war […]

Do you like it?

July 8, 2023

July 8, 2023

2023.07.08 中国无疑选择了一个有趣的时机来升级与其西方竞争对手的贸易战。 周一,在美国 7 月 4 日庆祝活动开始前几个小时,中国宣布将对镓和锗实施出口限制,这两种金属对半导体、电动汽车和电信设备的制造至关重要。 中国商务部在一份声明中表示,以国家安全为由实施的新规定将要求出口商从 8 月 1 日起运输镓和锗化合物必须获得许可。 此举是全球日益激烈的技术霸主之战的一部分。根据欧盟今年对关键原材料的一项研究,中国已成为多达 […]

Do you like it?

July 7, 2023

July 7, 2023

By Adam Hamilton Gold’s latest pullback has left traders really down on it, […]

Do you like it?

July 6, 2023

July 6, 2023

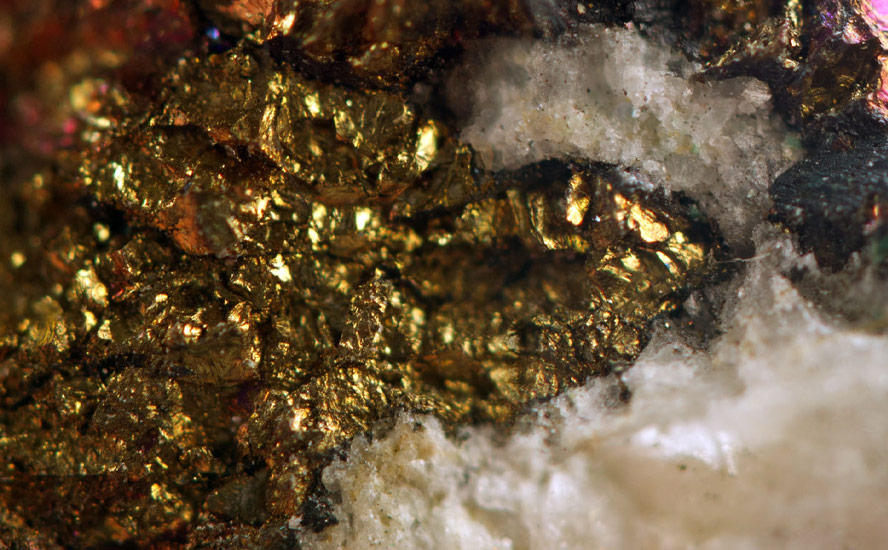

2023.07.06 As Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) continues to work its […]

Do you like it?

July 6, 2023

July 6, 2023

Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) 继续致力于 Fondaway Canyon 勘探计划,以增加更多黄金资源,该公司最近宣布了几项重要合作关系,以提升其旗舰项目的形象在内华达州。 具体来说,Getchell 聘请 […]

Do you like it?

July 5, 2023

July 5, 2023

2023.07.05 The precious metals market has been hit with solid selling pressure. This […]

Do you like it?

July 5, 2023

July 5, 2023

2023.07.05 贵金属市场受到强劲抛售压力的打击。本周,金价自 3 月份以来首次跌破 1900 美元/盎司关口。白银的表现也好不到哪里去,同样徘徊在三个月低点附近。 这与我们在 5 月初看到的情况形成鲜明对比,当时金价距离 2020 年 8 月创下的 […]

Do you like it?

July 5, 2023

July 5, 2023

2023.07.05 Analysts have long been pointing to a severe shortage of silver due […]

Do you like it?

July 4, 2023

July 4, 2023

2023.07.04 South America-focused junior explorer Max Resource Corp (TSXV: MAX) (OTC Pink: MXROF) […]

Do you like it?

July 4, 2023

July 4, 2023

2023.07.04 专注于南美的初级勘探公司 Max Resource Corp(TSXV:MAX)(OTC Pink:MXROF)(FSE:M1D2)已为其秘鲁 RT 黄金项目提交了一份技术报告。该报告日期为 2023 年 3 月 8 […]

Do you like it?

June 30, 2023

June 30, 2023

2023.06.30 Gold and silver prices have both seen impressive jumps this year, with […]

Do you like it?

June 27, 2023

June 27, 2023

2023.06.27 The three most critical inputs in the race to electrify and decarbonize […]

Do you like it?

June 26, 2023

June 26, 2023

2023.06.26 In mineral exploration, a promising discovery can often be validated by the […]

Do you like it?

June 26, 2023

June 26, 2023

2023.06.26 在矿物勘探中,一个有希望的发现通常可以通过随后的采样/钻探结果来验证。这就是 Max Resource Corp. (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2))在其全资拥有的位于哥伦比亚东北部的 CESAR 铜银项目中新发现的 […]

Do you like it?

June 26, 2023

June 26, 2023

2023.06.26 Copper Road Resources (TSXV:CRD) has prioritized drill targets at the JR Zone […]

Do you like it?

June 23, 2023

June 23, 2023

2022.06.23 In what has been a busy month for Mantaro Precious Metals (TSXV:MNTR, […]

Do you like it?

June 23, 2023

June 23, 2023

2023.06.23 对于 Mantaro Precious Metals (TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ) 来说,这是忙碌的一个月,该公司最近发布了两条与其在玻利维亚黄金勘探工作相关的重要消息。 首先,这家专注于拉丁美洲的初级企业向股东通报了其对 Golden Hill 矿区的首次资源估算的最新情况,该矿区去年完成了首次钻探计划。第二个是完成之前宣布的在玻利维亚收购的两处地产交易,以辅助其 […]

Do you like it?

June 22, 2023

June 22, 2023

2023.06.22 Renforth Resources’ (CSE:RFR, OTCQB:RFHRF, FSE:9RR) Surimeau project in Quebec is a district-scale […]

Do you like it?

June 21, 2023

June 21, 2023

2023.06.21 While the recent movement in gold, or lack thereof, has put investors […]

Do you like it?

June 21, 2023

June 21, 2023

2023.06.21 尽管近期黄金的走势或缺乏走势使投资者处于 “观望” 模式,但从长期来看,该行业对金属的立场仍然看涨。 在最近的一次视频采访中,CPM Group 的 Jeffrey Christian 表示,他在中期仍然非常看好黄金,预计价格最快将在第四季度开始上涨,然后在 2024 年加速上涨。 VanEck […]

Do you like it?

June 20, 2023

June 20, 2023

2023.06.20 Getchell Gold (CSE:GTCH, OTCQB:GGLDF) has been steadily expanding the resource through drilling […]

Do you like it?

June 18, 2023

June 18, 2023

Since 2014 in general, and 2022 in particular, the level of foreigners dumping […]

Do you like it?

June 17, 2023

June 17, 2023

2023.06.17 For years we’ve been reporting on how a decline in productivity from […]

Do you like it?

June 17, 2023

June 17, 2023

2023.06.17 With the clean energy transition moving along rapidly, critical minerals are now […]

Do you like it?

June 17, 2023

June 17, 2023

2023.06.17 随着清洁能源转型的快速推进,关键矿物现在处于国际讨论的前沿,因为它们是我们许多现代技术的基石,对国家安全和经济繁荣至关重要。 对于世界领先的经济体美国而言,确保这些矿产的可靠供应尤为重要,这不仅可以维持其主导地位,还可以摆脱对中国等主要竞争对手的供应依赖。 因此,该国一直忙于与其主要盟友联系,以加强关键矿物的供应并使其多样化。今年到目前为止,美国已与日本和澳大利亚签署了合作协议,以确保其拥有稳健的供应链和最新能源技术的专业知识。 日本的协议也有望成为备受期待的与欧盟达成协议的框架,该协议仍在谈判中。 早在 2022 年 6 月,在俄罗斯入侵乌克兰之后,美国及其七国集团伙伴已经启动了全球基础设施和投资伙伴关系 (PGII),以建立清洁能源供应链。他们还签署了矿产安全合作伙伴关系,以生产、加工和回收关键矿产。 这些举措标志着一种通常被称为“联合产业政策”的现象的出现,即各国在国际层面协调其产业战略并共同建立供应链。 约翰霍普金斯大学的一项研究发现,民主国家之间的伙伴关系将能够生产足够的矿物 […]

Do you like it?

June 15, 2023

June 15, 2023

2023.06.15 Victory Battery Metals (CSE: VR) (FWB: VR6) (OTC: VRCFF) has delivered the […]

Do you like it?

June 15, 2023

June 15, 2023

2023.06.15 Victory Battery Metals (CSE: VR) (FWB: VR6) (OTC: VRCFF) 在 Smokey Lithium […]

Do you like it?

June 14, 2023

June 14, 2023

2023.06.14 Graphite One (TSXV:GPH, OTCQX:GPHOF) aims to become the first vertically integrated domestic graphite […]

Do you like it?

June 13, 2023

June 13, 2023

By Michael Maharrey Given the current macroeconomic environment and the supply and demand […]

Do you like it?

June 12, 2023

June 12, 2023

By Neils Christensen Gold has not been able to hold its gains above $2,000 […]

Do you like it?

June 10, 2023

June 10, 2023

2023.06.10 Ask anyone what is the best commodity to invest in, 9 of […]

Do you like it?

June 9, 2023

June 9, 2023

By Frik Els Despite two consecutive years of bumper topline earnings north of […]

Do you like it?

June 9, 2023

June 9, 2023

By Mining.com Gold has long been considered a store of value and a […]

Do you like it?

June 7, 2023

June 7, 2023

2023.06.07 In our previous article outlining the key players in the precious metals […]

Do you like it?

June 7, 2023

June 7, 2023

2023.06.07 在我们之前概述贵金属市场关键参与者的文章中,我们强调全球央行是黄金需求上升的主要驱动力之一。 自 2007-08 年金融危机以来,各国央行作为各自国家的最后贷款人,一直在囤积黄金以履行其金融义务。彭博社此前报道称,自 1971 年美国放弃金本位制以来,银行购买的黄金数量最多。 截至今天,各国央行正在享受最长的黄金购买期,这代表着自 20 世纪 90 年代和 21 […]

Do you like it?

June 7, 2023

June 7, 2023

2023.06.07 Victory Battery Metals (CSE:VR, FWB:VR61, OTC:VRCFF) recently completed a four-hole drill program at […]

Do you like it?

June 6, 2023

June 6, 2023

2023.06.06 Dolly Varden Silver (TSXV:DV, OTC:DOLLF) has begun its 2023 exploration program with […]

Do you like it?

June 4, 2023

June 4, 2023

2023.06.04 It’s no secret that central banks around the world are buying up […]

Do you like it?

June 4, 2023

June 4, 2023

2023.06.04 世界各地的中央银行都在购买黄金,这显然已不是什么秘密。 世界黄金协会 (WGC) 数据显示,今年前三个月,各国央行共购买了 228 吨黄金,为第一季度以来的最高水平。 这是继 2022 年本已创纪录的一年之后,银行储备中增加了价值约 700 亿美元的 1136 […]

Do you like it?

June 3, 2023

June 3, 2023

2023.06.03 Vancouver-based Mantaro Precious Metals (TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ) is planning a 15-hole, 2,500-meter […]

Do you like it?

June 2, 2023

June 2, 2023

2023.06.02 Quebec-focused critical minerals junior Renforth Resources Inc. (CSE:RFR, OTCQB:RFHRF, FSE:9RR) has been […]

Do you like it?

June 1, 2023

June 1, 2023

2023.06.01 Copper Road Resources (TSXV:CRD) Batchewana Bay project sits on the northeastern flank […]

Do you like it?

May 30, 2023

May 30, 2023

2023.05.30 Gold mining companies, already facing depleted gold reserves, are beginning to feel […]

Do you like it?

May 30, 2023

May 30, 2023

2023.05.30 已经面临黄金储量枯竭的金矿公司开始感受到在当前经济环境下进行整合以维持自身的压力,因此并购的势头越来越大。 自然而然地地,该行业将需要向高品位矿石丰富且金矿保证经济可行的地方集中。 另一个需要考虑的途径是在世界上资源最丰富但仍未充分开发的地区寻找金矿资产。在矿产丰富的南美洲大陆,哥伦比亚就是符合这一描述的一个国家。 在地理上,哥伦比亚是一个多元化的国家,拥有数千平方公里的未勘探前景土地,具有勘探金和铜等有价值矿产的巨大潜力。目前,该国只有 1.1% 的领土被生产阶段的矿业权占用,而只有 2.3% 被勘探项目覆盖。 根据哥伦比亚矿业法,勘探矿山的权利通过30年的特许经营协议获得,分为勘探、建设和开采三个阶段。一旦特许权进入采矿阶段,它可以再延长 30 年。 尽管哥伦比亚的黄金业务长期以来一直面临着严格的官僚主义和环境障碍,此外还有受到非正式矿工/犯罪分子袭击的威胁,但这并没有阻止矿业公司放弃其丰富的黄金资源。如今,哥伦比亚是仅次于秘鲁和巴西的南美洲第三大黄金生产国,年产量约为 […]

Do you like it?

May 29, 2023

May 29, 2023

By John Doody With inflation, geopolitical conflict, and the banking crisis disrupting the […]

Do you like it?

May 28, 2023

May 28, 2023

2023.05.28 Max Resource Corp. (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) announced this week […]

Do you like it?

May 28, 2023

May 28, 2023

2023.05.28 Max Resource Corp. (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) 本周宣布发现另一个重要的铜银系统,称为 AM-7,位于其在哥伦比亚全资拥有的 CESAR […]

Do you like it?

May 26, 2023

May 26, 2023

2023.05.26 For all the talk about needing more lithium to feed our vehicle […]

Do you like it?

May 26, 2023

May 26, 2023

对于所有关于汽车电化原材料的讨论目前都围绕锂,而对石墨的关注还不够多;石墨应该可以说也是一种重要的矿物,甚至可能更重要。 事实上,石墨是电池负极材料的理想选择,它负责在充放电过程中存储和释放电子。由于其天然的强度和刚度,石墨是一种出色的热和电导体,不仅可以满足电动汽车电池的电压要求,还可以满足固定式电池的电压要求。 如今,石墨是电动汽车电池中重量最大的成分,占电池的 45% 或更多。每个电池单元消耗的石墨原料几乎是锂的四倍,是钴的九倍。 毋庸置疑,石墨对于电动汽车供应链来说是不可或缺的。彭博新能源财经预计,在电动汽车电池热潮改变交通运输行业的背景下,石墨需求到 2030 年将翻两番。 国际能源署 (IEA) 将时间延长了 10 年,预测石墨需求的增长在 […]

Do you like it?

May 25, 2023

May 25, 2023

2023.05.25 At AOTH, we see Getchell Gold Corp. (CSE:GTCH, OTCQB:GGLDF) as an excellent value play in […]

Do you like it?

May 25, 2023

May 25, 2023

By James Attwood and Valentina Fuentes André Sougarret won global acclaim in 2010 […]

Do you like it?

May 25, 2023

May 25, 2023

The balancing act of fighting inflation without triggering distortions on the markets is […]

Do you like it?

May 24, 2023

May 24, 2023

The demand for lithium-ion (Li-ion) batteries has skyrocketed in recent years due to […]

Do you like it?

May 23, 2023

May 23, 2023

2023.05.23 Electrification and decarbonization continue to be one of the most dominant investment […]

Do you like it?

May 23, 2023

May 23, 2023

By Niccolo Conte Steel is a critical component of modern industry and economy, […]

Do you like it?

May 22, 2023

May 22, 2023

203.05.22 Ontario-focused gold junior EGR Exploration Ltd. (TSXV: EGR) is setting wheels in […]

Do you like it?

May 22, 2023

May 22, 2023

2023.05.22 专注于安大略的初级黄金勘探公司 EGR Exploration(TSXV:EGR)正在启动其旗舰资产上的第一个金刚石钻探计划,并于本周对其进度进行了更新。 首先,它完成了一次 95 万加元的私募融资,发行了硬元和流通单位的混合股票,每个单位的价格在 0.11-0.14 加元之间,这是 EGR 过去一年股价的较高区间。内部人士参与了此次融资。 部分收益将用于资助该公司计划在明年对其 Detour […]

Do you like it?

May 20, 2023

May 20, 2023

2023.05.20 Mining companies are hoping to build on Bolivia’s rich mining history by […]

Do you like it?

May 17, 2023

May 17, 2023

2023.05.17 Canada has a prolific mining history. The country is famous for its […]

Do you like it?

May 16, 2023

May 16, 2023

2023.05.16 More question marks surrounding the US debt negotiations have left the public […]

Do you like it?

May 16, 2023

May 16, 2023

围绕美国债务谈判出现的更多问题让公众怀疑是否该为最坏的情况做准备。 美国从未拖欠过债务,但如果发生 “不可想象的” 结果(正如财政部长珍妮特·耶伦所描述的那样),经济肯定会陷入衰退,其速度比大多数人预期的要快。这使得贵金属成为当前环境中的必备品。 看涨白银 虽然黄金通常在经济不确定时期作为避险资产而备受关注,但其姊妹金属白银也同样引人注目。 事实上,它通常在牛市期间开始缓慢,但最终超过黄金。今年 3 月至 4 月,白银价格上涨超过 20%,轻松超过黄金和标准普尔 500 […]

Do you like it?

May 15, 2023

May 15, 2023

Inflation is a common economic phenomenon that can have a significant impact on […]

Do you like it?

May 13, 2023

May 13, 2023

2023.05.13 Victory Battery Metals: Smokey lithium project moves from early-stage to advanced-stage with […]

Do you like it?

May 12, 2023

May 12, 2023

多年来,我们一直在报道现有铜矿的生产率下降,加上缺乏勘探投资导致缺乏新发现,导致目前对全球经济至关重要的矿产出现供应短缺。 据估计,建筑、发电/输电和电子产品制造等各个行业每年消耗超过 2000 万吨。事实上,铜金属被认为是所有电气相关技术的基石。 近年来,全球向清洁能源的转变进一步扩大了对铜的需求,因为需要更多的金属来满足我们的可再生能源基础设施,例如用于太阳能发电和风力涡轮机的光伏电池。 BloombergNEF 估计,到 2040 年,在各种清洁能源计划的推动下,铜需求将增长 53% 至 3900 万吨。标准普尔全球分析师预计,到 […]

Do you like it?

May 12, 2023

May 12, 2023

2023.05.12 When looking for an investment, the approach I take involves looking at […]

Do you like it?

May 12, 2023

May 12, 2023

By Goehring & Rozencwajg Copper demand remains strong. According to the World Bureau […]

Do you like it?

May 11, 2023

May 11, 2023

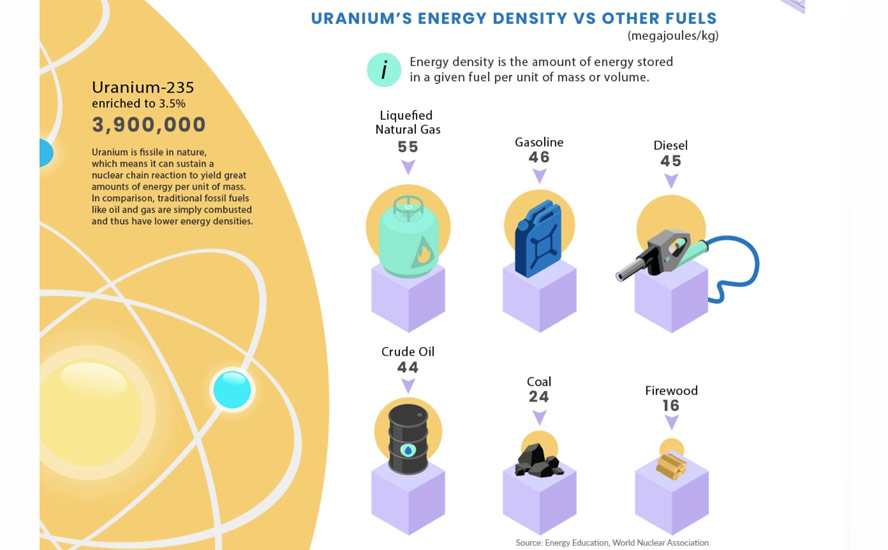

In 2021, global uranium requirements from reactors totaled 62,496 tonnes. By 2040, that […]

Do you like it?

May 11, 2023

May 11, 2023

Mark Ireton, Victory President & CEO – interview with Mari-Len Guzman from Investing […]

Do you like it?

May 10, 2023

May 10, 2023

2023.05.10 Under a certain market environment, precious metals are considered must-haves in a […]

Do you like it?

May 10, 2023

May 10, 2023

2023.05.10 在一定的市场环境下,贵金属被认为是现代投资组合中的必备品。 到目前为止,2023 年发生的事情已经证实,黄金和白银的飙升已经具备了条件。它们的价格今年都出现了令人印象深刻的上涨,黄金最近距离历史最高点只有几美分,白银也接近十年前的价格水平。 但一些人认为,贵金属的反弹才刚刚开始。分析师认为,这两种金属刷新纪录只是时间问题。 “我认为我们很可能会在未来几个月看到黄金的强劲表现。众星似乎都在看好黄金,不久之后它可能会突破新高,”外汇公司 Oanda 的一位高级市场分析师最近表示。 白银也遵循类似的路径创出新高。大宗商品咨询公司 CPM Group 的执行合伙人 Jeff […]

Do you like it?

May 10, 2023

May 10, 2023

2023.05.09 Richard Mills, Publisher/ Editor, Ahead of the Herd: Brad, Max Resource’s copper-silver […]

Do you like it?

May 9, 2023

May 9, 2023

By Niall McGee Last year, the federal government said that it would not […]

Do you like it?

May 6, 2023

May 6, 2023

By Mining.com The state of Nevada has recovered the world’s top-ranked jurisdiction spot […]

Do you like it?

May 5, 2023

May 5, 2023

2023.05.05 Mantaro Precious Metals (TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ) is strengthening its portfolio of South […]

Do you like it?

May 3, 2023

May 3, 2023

2023.05.03 The gold market continues to experience tightness due to difficulties expanding existing […]

Do you like it?

May 3, 2023

May 3, 2023

2023.05.03 由于近年来难以扩大现有矿床以及明显缺乏大型发现,黄金市场持续紧张。 投资者和央行在当前经济中都在囤积黄金,对贵金属的极高需求加剧了这一问题。 去年,全球黄金需求增长了 18%,达到了 2011 年以来的最高水平。与此同时,尽管停止了两年的连续下降,但 2022 年的供应量仅增长了 1%。 由于黄金需求迟早会超过供应,投资者和矿业公司正在政治稳定的管辖区寻求勘探项目,以包括水和电在内的基础设施的地区作为首选。 能够满足所有这些标准的一个地区是加拿大的 Abitibi […]

Do you like it?

May 3, 2023

May 3, 2023

By James Fernyhough As demand for copper surges, supply is increasingly likely to […]

Do you like it?

May 2, 2023

May 2, 2023

2023.05.02 Colombia continues to be one of Latin America’s most important gold miners, producing 1.96 million […]

Do you like it?