Catastrophe bonds clobber government paper with 16.5% returns – Richard Mills

2023.10.28

It must suck to be a bond investor these days.

Bond markets everywhere have been rattled by a trifecta of high interest rates, angst over government deficits, and hawkish central bankers, who refuse to back down from their fight with inflation.

Yields on 30-year Treasuries earlier this month climbed above 5% for the first time since 2007. With prices moving in the opposite direction as bond yields, investors are rattled.

In a note, Bank of America Global Research said the rout in the fixed-income market is causing the “greatest bond bear market of all time,” as the peak-to-trough loss in the 30-year yield hit 50%. Reuters said BoFA’s report showed the current loss from the peak in July 2020 now outpaces any previous bear market, making bond-buying the “humiliation trade”. Ouch.

Financial blogger Ben Carlson waded deeper into the malaise, researching long-term government bond yields since the 1950s. He found that last century, the worst year for long-term yields was 1967, when they fell 9.2%. Since 2000, there have been far greater losses in long bonds, including a loss of 26% in 2022, a 12% drop in 2013, and a fall of nearly 15% in 2009.

Yields on 30-year Treasuries have gone from around 1% in March 2020 to the current 5%, which has led to a bond-market crash roughly the same as during the dot-com bust and the financial crisis, as the chart below by Datatrek shows.

The same is true of 10-year Treasuries, writes Carlson, with Bank of America saying this is the worst bear market in the benchmark bond ever.

Thankfully there is another option for those with a penchant for fixed income; they’re called catastrophe bonds, or CAT bonds for short.

What are CAT bonds?

Catastrophe bonds were created in the mid-1990s after Hurricane Andrew, the costliest hurricane in US history, caused so much damage it bankrupted some insurance companies. Insurers began exploring new ways to ensure they had adequate capital to cover claims.

Since then, the market for CAT bonds has developed rapidly; it’s now worth about $40 billion — though still a relatively small proportion of the global bond market valued at $133 trillion.

Big insurers like Swiss Re and Munich Re have increasingly looked to CAT bonds to protect themselves against devastating natural disasters, which are becoming more frequent as the planet warms. In July, Blackstone reportedly issued CAT bonds to shield property assets from natural-disaster losses, while Alphabet issued them in case its California operations get hit by an earthquake.

Asset managers are buying CAT bonds because they deliver outsized returns, and they like the portfolio diversification they offer. The debt instruments don’t correlate with equities or other fixed-income markets. According to Morningstar, the largest CAT bond funds are run by Schroders AG and GAM Investments of Switzerland. Also active in the market are Credit Suisse, Amundi Asset Management and Axa investment Managers.

Investors make money as long as the catastrophe outlined in the bond’s terms, such as a hurricane, flood or earthquake, fails to materialize. If it does, bondholders can lose some or all their money, which is used by the insurer to cover the cost of the damages from the disaster.

Why they’re doing so well

The current market for CAT bonds has been described as “buoyant”; this year’s issuance through September climbed 27% from the same period in 2022.

The Globe and Mail said catastrophe bond funds rank among the 10 best-performing credit funds this year, with funds from Securis Investment Partners, Schroders, GAM, Franklin Templeton K2 Advisors and LGT Capital Partners all returning over 8% from January to August.

As Bloomberg explains, Because of the way the bonds are structured, their coupons keep going up as Treasury yields rise, and investors get a sizable risk premium on their capital, as long as catastrophe doesn’t hit…

Returns have increased because rising Treasury rates automatically pass through to the coupons on CAT bonds, which are floating-rate instruments. Investors also are seeing bigger premiums for taking on the growing risk of severe weather events. And the terms that define a trigger event have tightened.

“There’s been a repricing of catastrophe risk around the globe, especially in places like California, Florida and Australia,” said Steve Evans, owner of Artemis, a firm that tracks the CAT bond and insurance-linked securities market. “The return potential has roughly doubled in the last decade.”

Also more than doubling, since 2021, is CAT bonds’ loss multiple. This refers to the amount of money an investor can make versus the amount he could lose.

Returns ranged from 2.8% and 5.8% between 2018 and 2021, but CAT bonds suffered in 2022 due to Hurricane Ian which struck Florida, resulting in more than $50 billion in insurance losses. So far this year, CAT bond investors have been spared major trigger events, with total insured losses in the third quarter reaching about $17 billion, less than normal for this period, analysts at Citigroup estimated.

Business Insider reports there have been 24 climate-related disasters in the US this year, but even with losses exceeding a billion dollars each, many haven’t been severe enough to trigger payouts. According to the Swiss Re Cat Bond Price Return Index, YTD returns should reach 16.5%, a new high, barring any new disasters over the next two months. By contrast, investors in US Treasuries have lost money this year.

The publication notes CAT bonds are largely insulated from other forces that typically move markets such as virus outbreaks, bank failures or wars. Money invested in CAT bonds typically goes into US Treasuries. Rising Treasury yields have meant returns on CAT bonds have also gone up. Finally, CAT bond yields have been rising because investors demand higher risk premiums, commensurate with increased frequency of severe storms and wildfires, Moody’s said last month.

The ratings agency noted with climate threats growing, CAT bond issuance this year reached $10.3 billion by the middle of August, more than the $10 billion for all of 2022. It added the market is on track to eclipse the record high of $13.9 billion in 2021.

CAT bond issuance is currently being led by Florida, where a sharp rise in property values combined with increasingly intense storms has put a lot more wealth at the mercy of natural disasters, Bloomberg said. Peru and Colombia are also exploring the bonds to help them deal with extreme storms and floods.

The World Economic Forum has estimated the CAT bond market will jump to $50 billion by the end of 2025.

How CAT bonds work

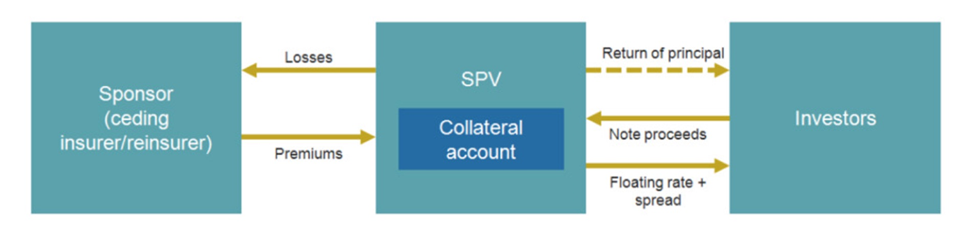

An insurer issues a bond when it wants to spread the risk of a potential disaster event among capital market participants. If the event occurs, investors could lose their investment, but if the catastrophe does not take place, the bond retains its value. As mentioned, in the disaster scenario, the insurance company uses the forfeited funds to help pay its substantial claims.

An investor purchases the bond with a principal payment, then receives regular payments, usually quarterly. The date length ranges from one to five years but is typically three years.

The investor’s principal payment is invested in safe securities, such as a US Treasury money market fund, thus minimizing or eliminating credit risk. The payments to the investor consist of the interest on those investments plus the premiums paid by the issuer of the bond. CAT bonds are issued and trade mainly in the institutional investor marketplace. (‘Alternative Investment Analyst Review’, Fall 2015)

Pros and cons

CAT bonds are attractive to investors because catastrophic risks are uncorrelated with other risks such as equity risk, interest rate risk and credit risk.

The second reason for their popularity is they offer higher rates of interest than regular bonds. Investors not only receive interest on the Treasury money market funds where they are deposited, they also get the premium paid by the issuer for taking on the risk of a disaster.

The obvious downside to the investor is that he/ she could lose their entire principal, or part of it, if the catastrophe occurs and the insurance company needs the funds to cover their losses.

For the issuer, CAT bonds are attractive because they reduce the issuer’s reserve requirement (money in the bank available to pay claims), increase its insurance protection, and pose virtually no credit risk.

The World Bank is a major issuer of CAT bonds. Bloomberg said the lender plans to increase its CAT bond issuance from the current $1 billion to $5 billion by 2028.

Of the roughly 30 CAT bonds the bank has issued over the past decade, only about half a dozen have required investors to cover some or all the damage the issuer tried to protect itself against.

The World Bank’s most recent deal was for Chile, in the form of a joint CAT bond and swap deal that provided $630 million of earthquake protection, Bloomberg said.

Conclusion

At AOTH we have written extensively about global warming and some of the natural disasters that have hit North America, Europe and Australia, mainly, over the years, including severe storms, “atmospheric rivers”, floods, droughts, and wildfires.

We’ve always said that “climate change” — a misnomer because the climate isn’t changing, it’s been warming since the last ice age ended 20,000 years ago — cannot be stopped. Warming and cooling result from the Earth’s natural cycles based on Malkovitch’s Theory, which states that as Earth travels around the Sun, three elements combine to produce variations in the amount of solar energy that reaches us. Although I will concede that fossil-fuel emissions have accelerated what was already happening naturally and made the problem worse.

What previous warming cycles tell us about current global warming

Rather than expending the effort and massive funding required to bring down global temperatures, arguably the more important priority is to harden our existing infrastructure from more frequent and violent storm surges, stop over-pumping depleted aquifers, move vulnerable coastal populations and energy infrastructure inland, build fire breaks, etc.

Catastrophe bonds are a way for insurance companies to spread the risk of a disaster among institutional investors. They reduce the likelihood of an insurance company going bankrupt, and increase the chances of homeowners and business owners — regular folks who bought policies with the CAT bond issuer — having their claims paid.

I’m not sure I’d be willing to bet against natural disasters, which are becoming much more frequent in a warming world, but CAT bonds can be lucrative. More deep-pocketed investors who can handle the risk of losing their principal, can potentially see an impressive ROI if their bet against the catastrophe happening turns out to be right.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.