Defense Metals on track to build rare earth mine

2018.02.27

Those who have worked in the business as long as I have will easily remember the rare earth mania of 2008-11. For about three years following China’s export restrictions on rare earth elements, which hiked the prices of REEs to record highs, the junior resource market was awash with new rare earth explorers.

These tiny companies fanned out across (mostly) Canada, the US and Australia in search of the next rare earths motherlode that would break the world’s dependence on China, which then and now has a monopoly – the country either mines or processes something like 95% of the 17 rare earth elements (REEs) and turns them into oxides, then continues the process of making high-purity metals, alloys and powders that are used in everything from cell phones, flat-screen TVs, permanent magnets, and lasers, to wind turbines, nuclear reactors and missile guidance systems. Click here for a more comprehensive list

They mostly failed. Not one of those highly touted junior held rare earth deposits outside China has been turned into a mine. The hype dissipated and resource investors moved on to other metals.

Arguably though, the importance of rare earth elements has never gone away; in fact they are more crucial than ever, as trade tensions between the US and China and the markets for REEs grow – such as for neodymium, praseodymium and dysprosium used in permanent magnets placed in electric vehicles.

Fore more read our Rare earths in cross-hairs of new arms race

This article will look back at the rare earth mania, describe why none of these companies have made it past the feasibility stage, and present a roadmap for how to build a rare earths mine, one step at a time, that is both feasible and cost-effective.

Rare earth mania

Today, the only significant non-Chinese firms currently producing rare earth elements are Molycorp, whose Mountain Pass mine in California mines the REEs and ships them to China for processing, and Lynas, whose Mt. Weld mine in Western Australia produces a concentrate that is processed in Malaysia. A few other countries produce a handful, tonnage-wise, of REEs but they are very small compared to China – just 1,600 to 3,000 tonnes annually compared to China’s 105,000 tonnes.

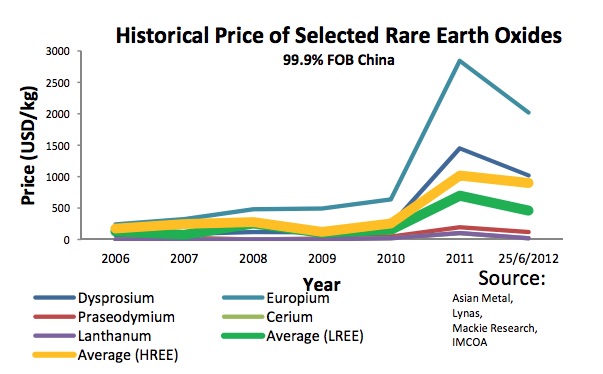

For a time though, rare earths were on the lips of every mining investment house and resource junior. To not have a rare earths play meant missing out on the party. The chart below courtesy of Avista Group shows the bubble inflating then the pop. For instance dysprosium prices rocketed from $118 a kilogram in 2008 to an insane $2,262/kg in 2011. Europium ran up from around $600/kg in 2010 to $3,000/kg the following year.

While the spike in rare earths prices was good for Molycorp and all the exploration companies that sprang up in search of them, buyers of products made from rare earths balked and pressured governments to do something about it. The US, European Union and Japan brought a case to the World Trade Organization to try and settle the dispute and get China to lift the restrictions.

In 2015 it did, resulting in a torrent of Chinese rare earth exports into the market and the inevitable collapse in prices. The move caught Molycorp off-guard. The company had just spent over a billion dollars on another upgrade at Mountain Pass but within months, Molycorp fell deeply in debt and went bankrupt.

Most of the rare earth juniors withered and died too. For a more detailed history read our How the US lost the plot on rare earths.

Separation anxiety

Mining rare earth elements is fairly straightforward – if found close enough to surface they can be scooped up in open pits, crushed and gravity-separated from the host minerals – but separating and extracting a single REE takes a great deal of time, effort and expertise.

The ore is ground using crushers and rotating grinding mills, magnetic separation (bastnasite and monazite are highly magnetic, they can be separated from non-magnetic impurities in the ore through repeated electromagnetic separation) and flotation gives you the lowest value sellable product in the rare earth supply chain – the concentrated ore. The milling equipment including crushers, grinding mills, flotation devices, and magnetic, gravity, and electrostatic separators all have to be configured in a way that suits the type of ore being mined – no two ores respond the same way.

The major value in REE processing lies in the production of high-purity rare earth oxides (REOs) and metals – but it isn’t easy. A REE refinery uses ion exchange and/or multi-stage solvent extraction technology to separate and purify the REEs. Solvent-extraction processes involve re-immersing processed ore into different chemical solutions in order to separate individual elements. The elements are so close to each other in terms of atomic weight that each of these processes involves multiple stages to complete the separation process. In some cases it requires several hundred tanks of different solutions to separate one rare earth element. Heavy rare earth elements are the hardest, most time- consuming to separate.

The composition of REOs can also vary greatly; they can and often are designed to meet the specifications laid out by the end product users. An REO that suits one manufacturer’s needs may not suit another’s.

For more on mining and processing REEs, read our Mine to Magnet.

Doing it wrong

The challenges of producing anything more then a rare earth concentrate has always been several fold for junior resource companies – complicated mineralogy means complicated expensive metallurgy, a lack of infrastructure and a lack of technical knowledge of the extraction process.

The dispersement of the REEs in a typical deposit is not uniform and they are often contained in different ores – as high as 5. The more complicated the minerology the more complicated, expensive and time consuming metallurgy will be. A lack of infrastructure doubles down on your problems. This includes easily accessible power, water, NG, roads and railways. Many rare earth properties are far from any infrastructure, minimizing the prospect of advancement.

Even more challenging is developing a hydrometallurgical plant to produce the separate high purity rare earth oxides.

One of the world’s foremost REE geologists and mineralogists, Tony Mariano, says each REE deposit, assuming a favorable political climate and good logistics, will need certain conditions present:

- Favorable mineralogy and lanthanide distribution

- Necessary grade and tonnage

- Mining and mineral processing at low costs

- Successful chemical cracking of the individual lanthanides for their isolation and eventual recovery

- Low values of thorium, uranium and other deleterious impurities

- Minimum environmental impact

- Dudley Kingsnorth of Industrial Minerals Company of Australia outlines the necessary steps to take a REE deposit all the way to production:

- Prove resource: grade, distribution and understand mineralogy

- Define process and bench scale – each ore-body is unique. Because of this uniqueness a new separation process has to be developed for each individual deposit

- Conduct pre-feasibility study

- Demonstrate technical and commercial viability of the process

- Obtain environmental approval

- Publish Letters of Intent – marketing is customer specific. The main value-added from rare earths is not in the mining and extraction, so it is necessary to either develop your own supply chain or gain access to an existing supply chain

- Complete a bankable feasibility study

- Effect construction and start-up

There are significant barriers to entry into the rare earths market:

- Developing a rare earth mine and processing plant is capital intensive. Capacity costs are high – US$30,000+ per tonne of annual separated capacity versus less than US$3500 for an open pit mine in the US. History shows that the development time can be very long at 10-15 years

- Operational expertise on mining, cracking and separating is very limited outside of China

- Major mining companies and institutions are put off by high capex investments in such a tightly focused market. This leaves juniors with potential development issues

Back in 2008-11, all these challenges didn’t dissuade hundreds of juniors, whose booths lined the aisles of PDAC, from grabbing the opportunity to cash in on rare earth mania. Until prices crashed in 2012 and the hype was over. A few are still around, but most perished in the cold winter of investor disenchantment that descended on the rare earths sector post-2012. The phrase “over-promised and under-delivered” comes to mind.

The strategy of most of these companies went something like this: identify a rare earth deposit, then hone in on the most valuable REEs – typically heavy rare earth elements like dysprosium, europium, terbium, gadolinium, etc. – which at the time were commanding record-high prices.

The plan was to mine the most lucrative rare earths, produce a concentrate, and then build a refinery, at great expense, for converting the rare earth concentrate into individual 99.5% oxides, powders, metals and alloys for each desired REE for sale to end users.

The problem was that most of these companies either didn’t understand the complicated process involved in mining/ processing rare earths, or did know, and hid the truth from investors.

A couple of examples – no names will be mentioned.

- The rare earths deposit is located in a remote region with no infrastructure. According to a prefeasibility study, the open-pit operation would target the highest-grade REE mineralization. The project has a capex (capital expenditures) budget of $2.6 billion, including a hydrometallurgical facility that would produce four products: one heavy and one light REE concentrate, one oxide and one by-product mineral. The ore would be crushed at the mine site, trucked to a port, and then shipped along a canal to the hydro-met facility for further processing. Annual revenues would average north of a billion dollars.

- Another project is also on the middle of nowhere with no towns, roads or power nearby. Total capex including a mine, mill and hydrometallurgical complex is just over $500 million. Ore from the underground mine would be mined and processed into a concentrate, then barged approximately 200 kilometers to the rare earths refinery, where there is energy and transportation infrastructure.

- Both of these projects have no infrastructure, exorbitant capex that would scare off any institutional investor, and complicated mine plans, both in terms of logistics and processing. We could’ve chosen many other ill-fated examples.

Even if a junior miner was able to produce an oxide, that’s not the end of the road. From an initial 98% purity, the oxide must be further refined to 99.5% purity required by most end-users. The cost to increase the purity to 99.5%, and the technical knowhow/ operational expertise, is well beyond the capabilities of almost every junior miner for the several reasons listed above.

Very few REE miners will ever get paid for producing a 98% oxide let alone a 99.5% pure oxide.

It’s far more likely that most REE juniors will end up selling a mixed rare earth concentrate comparable to what a junior copper miner would sell.

Others further up the REE value-added supply chain (ie. end-users who have a proprietary process) will turn the concentrate into rare earth oxides and continue the process of making the high-purity metals, alloys and powders.

Doing it right

Fortunately there is an easier way to mine rare earths without getting into the inordinately high capital expenditures and processing complexity. The answer? Keep it simple and small, take what mother nature easily gives you.

At Ahead of the Herd we’ve identified a project in northern BC that has all the elements in place for a successful, small-scale rare earth operation: Defense Metals’ (TSX-V:DEFN) Wicheeda Project.

Located close to a major population centre, Prince George, Wicheeda has no uranium, low thorium values, all the necessary infrastructure, the deposit has simple mineralogy, and the metallurgy has already been demonstrated through bench-scale testing.

Enough historical drilling has been done to compile an historical non-43-101 compliant resource estimate of 11.2 million tonnes grading 1.95% Light Rare Earth Elements at a 1% cutoff (LREE = Ce + La + Nd).

A 2009 study was designed to discover the ease of making a rare earth concentrate from a composite rock sample taken from Wicheeda carbonatite, based on three assay samples.

Bench-scale testing yielded more potentially recoverable rare earth elements than the resource estimate’s current REEs (lanthanum, cerium, neodymium and samarium) such as dysprosium, europium and praseodymium.

The study author, Tony Mariano cited above, noted he’s only seen a high-grade REE concentrate similar to the Wicheeda composite in China, the centre of global rare earths processing.

Bench-scale flotation and hydrometallurgical testwork was done on Wicheeda drill cores at a SGS Lakefield lab during 2010-11. SGS successfully developed a flotation flow sheet that recovered 83% of the rare earth oxide (REO) and produced a concentrate grading 42% REO.

Subsequent hydrometallurgical testing in 2012 on a two-kilogram sample of the concentrate grading 39.7% TREO (total REO) produced an upgraded and purified precipitate that contained 71% TREO through a process of pre-leaching and roasting.

For more read our Defense Metals has sights set on rare earths, uranium

This isn’t just another rare earths story pump, like dozens of others told during rare earth mania. This project differs significantly from others that have tried, and failed, before it. Here’s how:

- Infrastructure in place. At 80 kms northwest of Prince George, Wicheeda isn’t remote. The deposit is situated alongside a major forestry service road that is connected to Highway 97, the main artery running through northern BC. Prince George has many industries currently using chemicals such as caustic soda and hydrochloric acid, and by-products of operations range from white/black liquor to lime and others. There is a trained workforce already very familiar with the shipping/receiving, use of, and proper disposal of chemicals, being home to a methanex plant and three pulp mills.

A planned 200-tonne-per-day pilot plant on a dormant sawmill site at Bear Lake is a short 40-minute drive north of Prince George on Hwy 97. A CN rail line runs past the old sawmill site and there is a siding running into the site. The Bear Lake site has adequate power, water, a railway siding and a nearby natural gas pipeline – all the elements needed for rare earth processing and shipping.

- Uncomplicated mining. The rare earth minerals bastnasite and monazite, containing the REEs, are disseminated fairly uniformly throughout the property. Mining would be an open-pit scenario, which is basically just an earth-moving operation. The raw ore would be run through a magnetic separator – bastnasite and monazite are magnetic – with the resulting early-stage concentrate trucked to DEFN’s pilot plant in Bear lake for further processing.

- Work with Mother Nature. Unlike other rare earth juniors, Defense Metals isn’t promising the moon and delivering an asteroid. The company’s plan is to use whatever elements are in the rare earth minerals to produce a mixed rare earth concentrate that would be sold, likely on long-term contracts, to end-users.

- Scale up slowly. Production, under a BC Small Mine Permit, would gradually be scaled up, from a 30-tonne bulk sample to a 200-tonne per day pilot plant that proves the ability to produce a mixed rare earth concentrate for commercial production. Defense Metals could also use its scaled-up processing plant to “contract process” other companies’ rare earths into a concentrate. There are three stages to the ramp-up:

- Step 1: Bulk sample metallurgical testing/ re-assaying the pulps. Defense Metals has sent a 30-tonne bulk sample from the deposit to SGS Canada’s Lakefield, Ont. metallurgical facility. “Building on the successful bench scale flotation testwork conducted in 2012 by SGS on a 100 kg composite sample of Wicheeda drill core, the goal of the Phase 1A testwork is to develop a robust flow sheet for producing high-grade REE flotation concentrates from a 200-kg sample of the 30-tonne Wicheeda REE deposit bulk sample. It is anticipated that 20 kg of REE concentrate will be produced by Phase 1A,” said Chris Graf, DEFN’s technical advisor.

- After the 20-kg sample of flotation concentrate has been produced, hydrometallugical testwork on the sample is expected to start at the end of May, to produce a purified, mixed REE concentrate and provide data for the design of a 200 tonne-per-day pilot plant at Bear Lake.

- Step 2: Pilot plant. The concentrate pilot plant will take the entire 30-tonne Wicheeda Lake bulk sample and process it, with the goal of demonstrating that the Phase 1 A flowsheet is capable of producing a high-grade REE concentrate at an industrial scale.

- Step 3: Hydrometallurgical test plant. The last step, and Defense Metals’ ultimate goal, is to build a hydrometallurgical plant at Bear Lake that would convert the rare earth concentrate into individual rare earth oxides, for sale to specific end-users. It’s expected that the Phase 2 pilot plant metallurgical testwork will produce about three tonnes of REE concentrate that can be tested by a Phase 3 hydrometallurgical pilot plant.

Click on the Feb 25 operational update for more details

Once the plant enters commercial production, customers could include military defense contractors, considering the high concentration of metals used for defense purposes, and companies in the magnet manufacturing sector, which require combinations of neodymium, praseodymium and dysprosium or samarium and cobalt. Like the concentration processing plant plant, the hydro-met plant could also do “contract processing” of other REEs from companies that ship their rare earth concentrates, by rail, directly to DEFN’s Bear Lake facility.

Conclusion

Sometimes less is more, especially when “more” comes at great expense and investor risk. Defense Metals has come up with a very manageable plan to cost-effectively put an extremely prospective rare earths deposit into production.

Unlike many juniors before it, the plan doesn’t involve a billion-dollar capex that includes a mine, mill and processing plant. Instead, DEFN is piggy-backing on previous bench-scale testing to slowly prove the metallurgy and then scale up – first developing a flow sheet from a 200-kg sample, to get 20kg of REE concentrate. Then a pilot plant to test whether the original 30-tonne bulk sample can produce a concentrate at industrial scale. And finally, a hydrometallurgical test plant that can produce three tonnes of REE concentrate – enough for commercial use.

Each step that is successfully completed will provide more confidence for investors, and further de-risk the project. If all these steps are completed, we see there being no shortage of customers wanting to purchase DEFN’s high-purity REE concentrate. At this stage we would also see Defense Metals as a high-priority takeout candidate by a magnet manufacturer, for example, wanting to lock up a reliable supply of rare earth concentrate, outside of China.

I’m looking forward to the successful completion of Phase 1A, a 20-kg concentrate.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Defense Metals (TSX-V:DEFN) is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of DEFN.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.