While G1’s CEO meets with US President Biden graphite elevated to equal rare earths critical mineral status- Richard Mills

2024.06.10

Anthony Huston, the CEO of Graphite One (TSXV:GPH, OTCQX:GPHOF), was at the White House with other industry leaders when President Joe Biden imposed tariffs on Chinese imports including natural graphite.

“I was honored to represent everyone at Graphite One in the meeting with President Biden,” Huston said in the May 15 news release. “We appreciate his support for the renewable energy transition and G1 is excited to continue pushing forward to create a secure 100% U.S.-based supply chain for natural and synthetic graphite.”

To help make graphite mined and processed in the US competitive with China, the tariff will rise from 0% to 25% by 2026. The tariff on EVs from China will quadruple from 25% to 100%.

In total, the new levies are expected to affect $18 billion worth of Chinese imports.

The substantial tariff increases are part of a larger government policy of shielding American businesses from unfair Chinese trade practices.

“To encourage China to eliminate its unfair trade practices regarding technology transfer, intellectual property, and innovation, the President is directing increases in tariffs across strategic sectors such as steel and aluminum, semiconductors, electric vehicles, batteries, critical minerals, solar cells, ship-to-shore cranes, and medical products,” the White House said in a statement.

The statement noted that “Concentration of critical minerals mining and refining capacity in China leaves our supply chains vulnerable and our national security and clean energy goals at risk.”

“Projects like Graphite One’s are important in so many ways — from job creation and the renewable energy transition to technology development and national security,” Huston said in response to Biden.

Huston’s inclusion in an audience with Biden at the Rose Garden is highly unusual for the CEO of a junior resource company; it also underscores the importance of graphite to the federal government.

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the economy and national security.

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain. The US currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

Washington has finally begun to recognize this vulnerability. In 2022, President Biden issued a Presidential Determination under the 1950 Defense Production Act (DPA), declaring graphite and four other key battery minerals at risk of supply disruptions, as “essential to the national defense.”

Mining projects focused on critical minerals like graphite, lithium, and cobalt are eligible for federal loan guarantees worth $72 billion.

The White House announced that “The tariff rate on natural graphite and permanent magnets will increase from zero to 25% in 2026.” To my knowledge, this is the first time the US government has grouped graphite with, or equated graphite’s importance to rare earths, and is thus hugely important to Graphite One, which is developing the first “mine to battery” supply chain in the United States, anchored by its Graphite Creek project in Alaska.

Like graphite, rare earths are considered critical minerals. Rare earth elements are used extensively in clean technologies and renewable energy, such as wind turbines, fuel cells, rechargeable batteries and electric vehicles. In 2010, rare earths prices shot up following export restrictions by China, which controls the market for REEs, mining 60% of them and processing 90%.

In December 2023, China banned the export of technology to make rare earth magnets. A ban on technology to extract and separate critical materials was already in place.

Graphite-based fire suppressant

A week prior to Huston’s visit to the White House, Graphite One senior management took part in a Defense Logistics Agency (DLA) visit to G1 project partner Vorbeck Materials’ facilities in Maryland. The DLA site visit took place at the half-way point in the $4.7 million DLA-funded project to develop a graphite and graphene-based foam fire suppressant as an alternative to Perfluoroalkyl and Perfluoroalkyl Substances (PFAS) fire-suppressant materials, as required by US law.

Ohio battery plant

In other Graphite One news, the company said it completed the initial planning sessions at the Ohio site chosen for its battery anode active material production plant, and continues to progress its two Department of Defense grant projects.

Graphite One senior management met with project consultants who are expected to assist with the designing and building of the synthetic graphite plant, as well as with local companies that are expected to supply goods and services. Consistent with its commitment to hire from the local communities near the Graphite Creek deposit north of Nome, Alaska, G1 has made a formal commitment to prioritize hiring and workforce training in the Appalachia, Ohio region where G1’s advanced graphite materials manufacturing plant will be located, on the site of the former Defense Logistics Agency’s Warren Depot for strategic materials. The hiring and workforce training and building of the synthetic graphite plant is subject to completion of project financing.

The company is developing labor agreements with Ohio construction unions, and has received letters of support from more than two dozen Ohio organizations including universities engaged in technology development, workforce training, and projects to advance the build-out of renewable energy infrastructure in disadvantaged communities.

As Graphite One builds its anode active material production plant, first to accommodate synthetic graphite, then natural graphite from the Graphite Creek mine, the company has the opportunity to make other graphite products. Two possibilities are silicon-blend graphite, where silicon is embedded within a graphite matrix in the anode; and hard carbon, which improves ionic flow and provides higher power densities in batteries.

Building a supply chain

Graphite One plans to start construction within the next three years, as part of the company’s strategy to become the first vertically integrated producer to serve the US EV battery market. Its supply chain strategy involves mining, manufacturing and recycling, all done domestically.

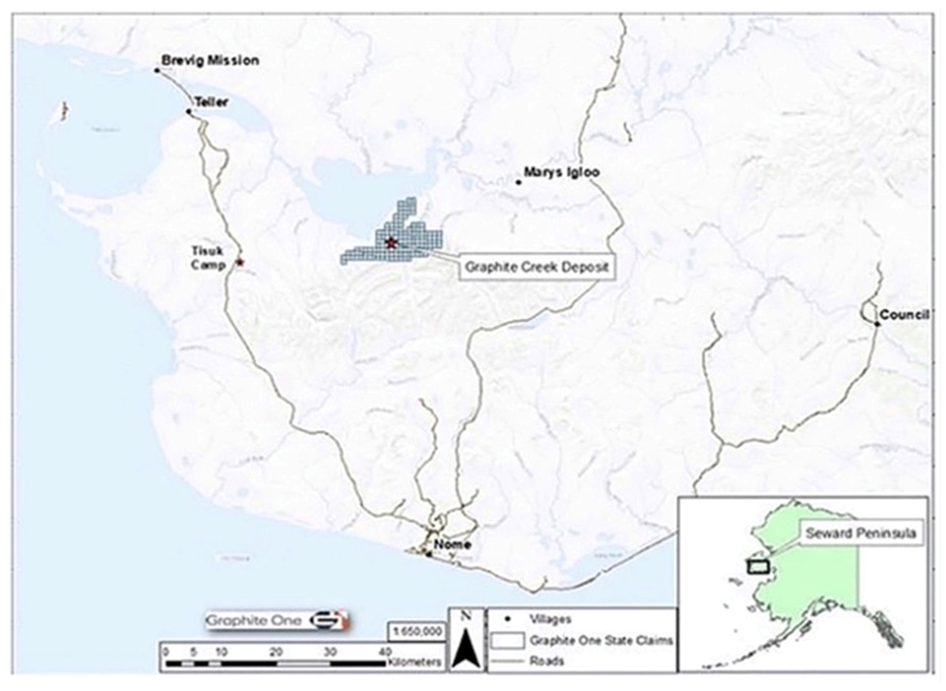

The Ohio facility represents the second link in Graphite One’s advanced graphite materials supply chain; the first link is Graphite One’s Graphite Creek mine in Alaska.

The plan also includes a recycling facility to reclaim graphite and other battery materials, to be co-located at the Ohio site, the third link in Graphite One’s circular economy strategy.

Subject to financing, the plant will manufacture synthetic graphite until a source of natural graphite becomes available from the company’s Graphite Creek mine, according to the March 20 news release.

The company says it will produce 25,000 tons per year of battery-ready anode material, and plans to ramp up production to 100,000 tpa.

Synthetic vs natural graphite

Synthetic, or artificial graphite, and natural graphite are both used in battery anode applications, but synthetic dominates the market.

As mentioned earlier, China is the number one graphite producer in the world, outputting 850,000 tonnes in 2022, and accounting for two-thirds of mine supply. Moreover, the Asian nation also controls 80% of synthetic graphite production.

Synthetic graphite’s primary application is in the graphite electrodes used for electric arc furnace steelmaking, which accounts for 70-80% of graphite electrode consumption. The market for this sector is estimated at 1.6 million tons in 2024, and is expected to reached 1.9Mt by 2029, according to Mordor Intelligence.

The boost is partly due to the Chinese government’s recent Work Plan for Steady Growth of the Iron and Steel Industry, which promotes the expansion of steel production with electric arc furnaces.

Total synthetic graphite consumption is pegged at 3.04Mt this year, compared to 1.68Mt for natural graphite.

With China increasingly driving synthetic graphite demand, increased usage of natural graphite is expected from non-Chinese sources, who are seeking to establish ex-China supply chains.

This is especially the case following China’s decision last fall, requiring export permits for some graphite products — retaliation against the United States and the European Union for widened curbs on Chinese companies’ access to semiconductors.

Under the new graphite restrictions, which took effect on Dec. 1, 2023, exporters must apply for permits to ship two types of graphite: synthetic graphite, and natural flake graphite and its products.

Some battery-makers are keen on natural graphite due to its lower carbon emissions compared to synthetic graphite, which is made from petroleum coke.

Another major graphite trend to watch is how countries and end users respond to China’s new export restrictions. Last year we witnessed graphite companies secure funding from US and EU government initiatives to develop mines and anode plants outside of China.

Feasibility study

Last July, the DoD awarded GPH with a technology investment grant of up to $37.5 million under Title III of the Defense Production Act.

Graphite One Awarded $37.5 Million Department of Defense Grant Under the Defense Production Act

Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

The USGS has cited Graphite Creek as the country’s largest known graphite deposit, and “among the largest in the world.”

In March 2023, Graphite One updated its resource estimate, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite.

Measured and indicated resources now stand at 37.6 million tonnes at 5.14% graphite, with an inferred resource of 243.7 million tonnes at 5.07% graphite.

According to the prefeasibility study (PFS), the mine is expected to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

In its May 2024 project review session with the DoD project team overseeing Graphite One’s $37.5 million Defense Production Act Title III grant, Graphite One senior management outlined plans for the 2024 field season at Graphite Creek. Work remains on schedule to complete the feasibility study as planned by December 2024, subject to financing. “As we near completion of the FS, we can now say that DoD’s support has cut about two years off of our initial feasibility study timeline,” said Huston.

Moreover, the Department of Defense is now paying a greater percentage of the feasibility study costs than previously. In a management and discussion analysis (MD&A) for the first quarter 2024, G1 announced: the Company entered into a revised cost-share agreement with the Department of Defense (“DoD”) to adjust the DoD’s share of expenditures associated with the feasibility study from 50% to 75% based on a revised contract value of $49.8 million. The DoD’s maximum share of the expenditures is now $37.3 million.

In other words, the DoD will still pay $37 million, but with significant savings achieved on the FS, enough to lower the cost from $75m to $50m, DoD’s cost share increases from 50% to 75% — great news for Graphite One and its shareholders.

EV sales increasing

Graphite has the largest component in EV batteries by weight, constituting 45% or more of the cell. Nearly four times more graphite feedstock is consumed in each battery cell than lithium and nine times more than cobalt.

With graphite such an essential component of the battery, commodity analysts pay close attention to the pace of EV sales.

The common perception is that EV sales are slowing down, particularly in the US. However, a little research by yours truly shows this is not the right conclusion. Below is the evidence:

- The auto industry ended 2023 with EV inventory of 113 days, compared with (a more common) 69 days for internal-combustion-powered vehicles, including hybrids, said Cox Automotive in its Industry Insights 2024. Cox analysts began last year predicting EV sales would top 1 million in the US in 2023. By Dec. 31, we had purchased or leased 1.1 million, representing year-over-year growth of 46%. There was market-softening earlier in 2023. (Autoweek, Jan. 19, 2024)

- EVs had a 7.6 per cent share of overall car and light truck sales, up from 5.9 per cent in the prior year. It was the first time U.S. EV sales reached one million in a year. (National Observer, Feb. 16, 2024)

- The decision by nearly every automaker to adopt the North American Charging Standard (NACS) port, which Tesla developed, will likely improve the charging experience and ameliorate range anxiety. Moreover, 2024 is expected to set another new record for volume of EVs sold and their share of the total market. Colin McKerracher of Bloomberg projects 2024 EV sales in the U.S. at just under 1.9 million units, making up 13 percent of new-car purchases. (Car and Driver, Jan. 13, 2024)

- “This was, from a sales volume perspective, the best year ever – near 50% year over year growth, and if you look at that growth increase, that volume was more than the entire number of EVs sold just two or three years ago.” McCabe says there’s plenty of growth ahead in both sales volume and market share – but it will be solid and steady, not explosive as originally (and incorrectly) forecasted. (BBC, Feb. 29, 2024)

- Despite the various headwinds, BNEF is anticipating a milestone this time next year: the first quarter in which consumers will purchase more than 5 million battery-electric and plug-in hybrid vehicles. (Bloomberg, Dec. 15, 2023)

Conclusion

Graphite One has received strong support from the US government for developing its “made in America” graphite supply chain anchored by Graphite Creek, the largest graphite deposit in the country and one of the biggest in the world. Two Department of Defense grants have been awarded, one for $37.5 million, the other for $4.7 million.

G1’s feasibility study is now 75% funded by the DoD.

In addition, G1 qualifies for federal loan guarantees worth $72 billion.

Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

Graphite One plans to develop a “circular economy” for graphite. Its supply chain strategy involves mining, manufacturing and recycling, all done domestically — a US first.

The new 25% tariff on Chinese graphite imports will help G1 to develop a home-grown graphite supply chain.

Graphite One’s importance to the US government is exemplified through CEO Anthony Huston’s appearance at a recent White House event.

Graphite has been elevated to the status of rare earths.

China, meanwhile, has imposed restrictions on Chinese graphite exports. Exporters must apply for permits to ship synthetic and natural flake graphite.

Increased usage of natural graphite is expected from non-Chinese sources, who are seeking to establish ex-China supply chains.

Graphite One is at the forefront of this trend. The company has significant financial backing from the Department of Defense, and political support from the highest levels of government, including the White House, Alaska Senators, Alaska’s Governor, and the Bering Straits Native Corporation, which has already made a $2 million investment with an option to invest a further $8.4 million.

The project isn’t near a salmon fishery and it has the backing of local communities such as Nome with it’s US$600 million port expansion. Nome has a long history of resource extraction.

Graphite One could take take a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it to its planned graphite anode manufacturing plant in Voltage Valley, Ohio. Initially, G1 will produce synthetic graphite and other graphite products.

Graphite One could supply a significant portion of the amount of graphite demanded by the United States.

Consider: In 2023, the US imported 83,000 tonnes of natural graphite, of which 89% was flake and high-purity, suitable for electric vehicles. Based on G1’s prefeasibility study, not the Feasibility Study expected this fall, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2024.06.07 share price: Cdn$0.76

Shares Outstanding: 137.8m

Market cap: Cdn$104.7M

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSX.V:GPH). GPH

is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

I see no time lines for production, manufacturing or usage, Muy importante.