Victory Battery Metals delivers encouraging results from Phase 2 drilling at Smokey lithium project – Richard Mills

2023.06.15

Victory Battery Metals (CSE: VR) (FWB: VR6) (OTC: VRCFF) has delivered the much-anticipated results from its Phase 2 drilling at the Smokey Lithium property. The program consisted of four holes for a total of 1,966 feet of drilling.

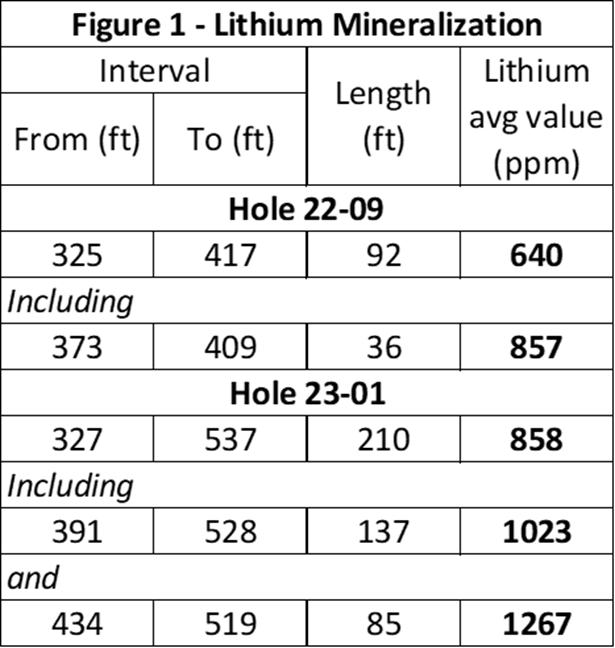

Hole 23-01, from 264 feet to end of hole 536.5 feet, intersected 695 parts per million (ppm) lithium in claystone, including 858 ppm Li over 210 feet from 327 feet to 537 feet, 1,023 ppm Li over 137 feet from 391 feet to 528 feet, and 1,267 ppm Li over 85 feet from 434 feet to 519 feet.

Its maximum intercept of 1,620 ppm Li occurred over 8 feet from 464 feet to 472 feet.

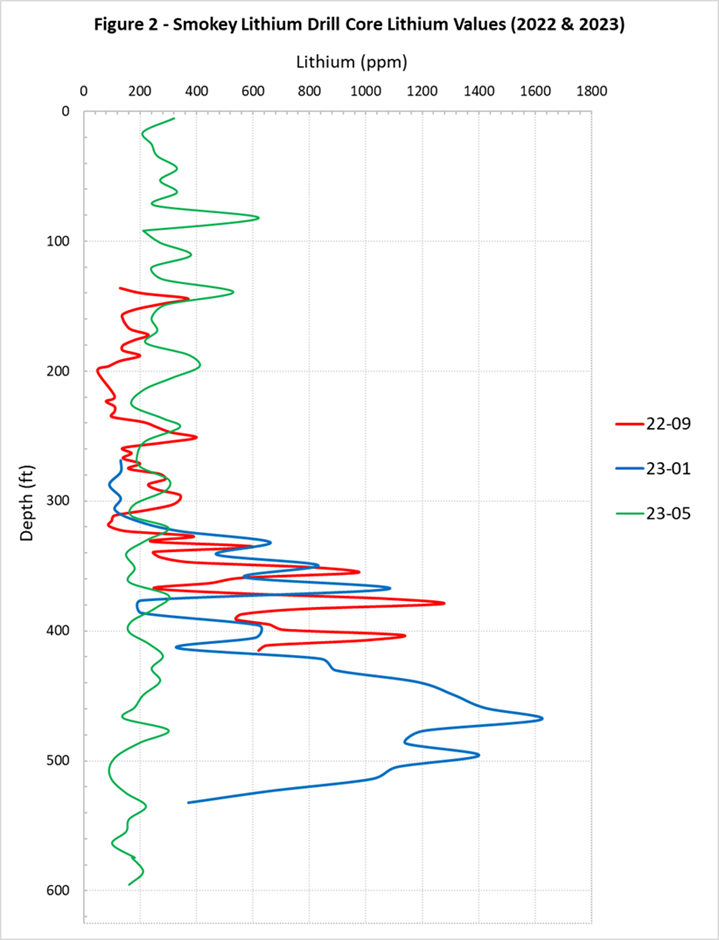

Hole 23-01 compares favourably to hole 22-09 from VR’s previous drill program, correlating in lithology but with higher lithium values to 22-09, achieving a main objective of this drill program to test the bottom of the claystone, noting that 22-09 ended in significant claystone-hosted lithium mineralization at 417 feet (see figure below).

Hole 23-02 reached claystone at 11 feet but was terminated at 155 feet due to adverse ground conditions that involved swelling clay and the collapse of the hole. Hole 23-03 was drilled to a depth of 617.5 feet, averaging 218 ppm Li for 64.5 feet from 203.5 feet to 268 feet.

Hole 23-05 intersected claystone at surface and averaging 303 ppm Li from surface to 220 feet, with highest intercepts of 620 ppm Li for 9.5 feet from 77.5 feet to 87 feet, 530 ppm Li for 9.5 feet from 134.5 feet to 144 feet, and 410 ppm Li for 9 feet from 192 feet to 201 feet.

Interestingly, the company noted that the claystone intercepted beginning at surface on hole 23-05 has characteristics that are of high interest to its exploration team and would require continued analysis in relation to significant deposits that exist in the region.

Smokey Expansion Plans

While Victory was awaiting assays from the recently completed drilling at its Smokey lithium project in Nevada, a preliminary analysis had led the company to believe there is a much bigger lithium exploration target present.

As a result, the Vancouver-based miner recently initiated plans to expand the property with the staking of an additional 100 claims for 2,066 acres, while its exploration team continues to analyze the overall drill program findings. The newly staked ground almost doubles VR’s total landholding at Smokey to 5,691 acres.

The company continues to analyze its overall results from all exploration activities, including its most recent drill results combined with 2022 drilling, field mapping, surface sampling, and Tromino passive seismic studies, to develop the most complete picture for ongoing exploration plans at Smokey Lithium.

Three years of geological study, surface sampling and drilling have so far confirmed that the project is underlain by thick sections of claystone rocks that extend as deep as 500 meters.

“Smokey Lithium is in a prolific lithium region that is highly competitive, and we have acted prudently at this time to respond to preliminary analysis of the recently completed drill program, as sequential information was delivered from the lab, to expand the Smokey lithium property,” VR’s president and CEO Mark Ireton commented.

Drilling Summary

In early May, VR completed a four-hole drill program that significantly expanded the area and thickness of the targeted claystone sequences of the Esmeralda Formation, which is known to host many significant lithium clay deposits.

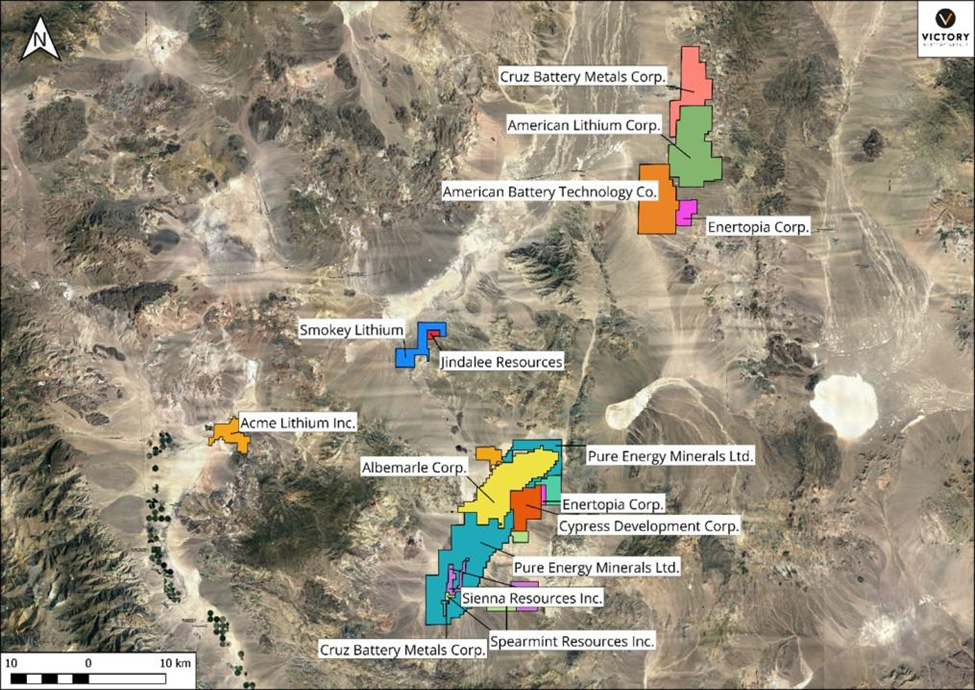

VR’s Smokey Lithium property lies approximately 35 km north of Clayton Valley, and 32 km west of American Lithium’s TLC project, within the Big Smokey Valley.

It is also in Esmeralda County, a prolific region for very large-tonnage lithium clay deposits with grades up to and exceeding 900 ppm. These include Noram Ventures (166Mt @ 900 ppm), Century Lithium (formerly Cypress Development, 593Mt @ 1,032 ppm), American Lithium (495Mt @ 1,000 ppm), Spearmint Resources, Enertopia and Jindalee Resources.

Note that the project is also in close proximity (35 km) to North America’s only producing lithium mine, Albemarle’s Silver Peak. Smokey surrounds Jindalee’s Clayton North lithium prospect on three sides, with excellent access and relatively flat ground (see detailed map below).

The latest drill program was a continuation of the first round of drilling completed in 2022, the assays from which clearly showed that the claystones underlying the Smokey property are mineralized with lithium.

As noted in the May 2 news release, the Phase 2 drill hole locations were selected to extend the strong lithium mineralization intersected from the initial 2022 drilling in hole-09. The fourth hole (23-05) on the 2023 program was selected specifically in an effort to determine the strength of lithological correlation between holes 22-09, 23-01, 23-02 and 23-03.

VR’s exploration team determined that the most compelling hole location to drill would be hole 23-05, about 1 km to the west southwest of hole 23-03, in order to gain the most knowledge of the potential deposit.

As a result, the claystone intercepts observed in hole 23-05 have clearly shown a significant thickness of terrific-looking claystones on the property. According to VR, the position of the 23-05, as a spatial outlier, suggests further drilling to the southwest will be very promising for discovery of additional intercepts of a classic Clayton Valley-style, claystone-hosted lithium zone.

All four holes reached claystone at depths of between surface and 600 feet. Thicknesses varied from 144 to 249 feet. Coloration when hydrated ranged from light gray with calcite veins, to blue-gray and brown, to tan, brown, green and black (see images above).

Following the completion of two rounds of drilling, VR determined that the Smokey project has moved from an “early stage” status towards an “advanced stage”, and it is closer to establishing a lithium clay deposit.

The next step, naturally, would be an initial resource estimate, which would reveal the project’s true potential in an already-prolific lithium mining region.

Exploration in Canada

Along with Smokey, VR also holds two other lithium properties in Canada as well: Stingray in Quebec and Georgia Lake in Ontario.

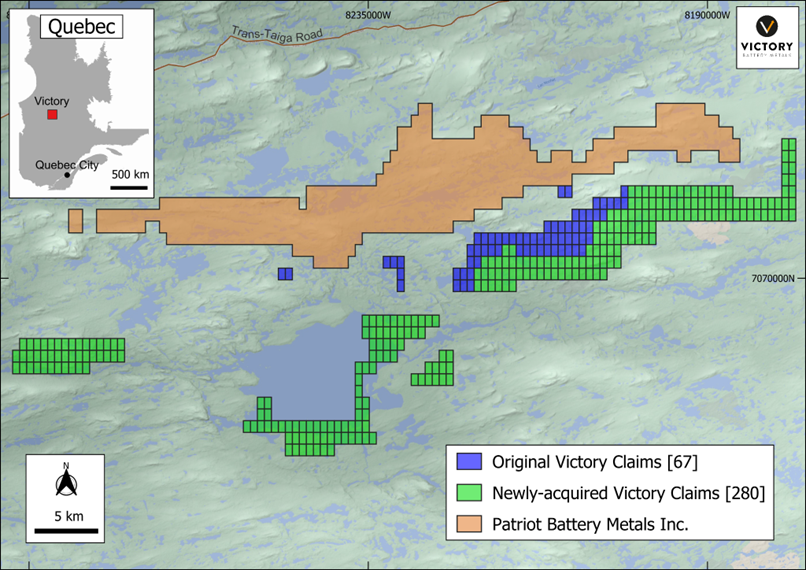

The Stingray property consists of an array of non-contiguous claims in the highly prospective James Bay lithium district. To date, the company has staked 347 claim blocks, 280 of which were recently acquired, for a total area of 17,792 hectares.

These claim blocks, as shown in the map above, are mostly situated south of Patriot Battery Metals’ (TSXV: PMET) Corvette property, spanning 65 km from west to east in strike length.

As reported by Patriot, the Corvette property has delivered promising results including drill intercepts of 1.65% Li2O and 193 ppm Ta2O5 over 159.7 m, 1.22% Li2O and 138 ppm Ta2O5 over 152.8 m, 2.13% Li2O and 163 ppm Ta2O5 over 86.2 m, and 2.22% Li2O and 147 ppm Ta2O5 over 70.1 m, including 3.01% Li2O and 160 ppm Ta2O5 over 40.7 m. Drilling to date indicates a principal spodumene-bearing pegmatite body of significant size and has been traced by drilling over a distance of at least 2.1 km.

Properties lying to the east and west of the Stingray claims have been reported to host pegmatite dikes, and Victory’s ground is prospective for pegmatites similar to those found on Infinity Stone’s Taiga and Camaro projects; however, these occurrences have yet to report any lithium values.

As VR’s exploration team continues to assess additional land claims in the area, it intends to conduct a geologic and surface geochemical survey together with an airborne geophysics survey on the Stingray claims.

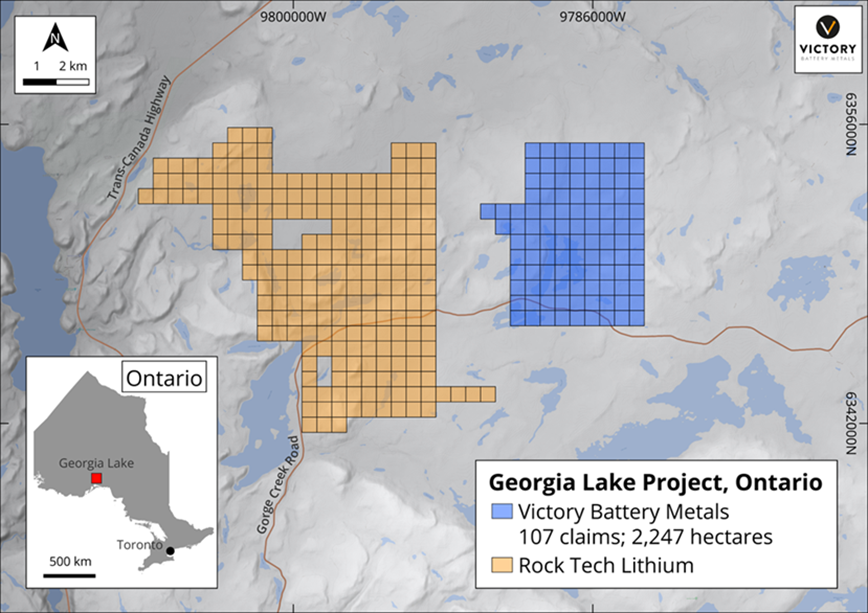

At Georgia Lake, located in the Thunder Bay district of Northern Ontario, the company recently sent the exploration team on site to conduct its summer exploration program.

The property is 1.8 km east of Rock Tech Resources’ advanced-stage lithium project within the Georgia Lake lithium district, which has a proven track record of economic lithium deposits dating back to the mid-1950s.

In the district, pegmatites bearing the lithium mineral spodumene occur almost entirely within metasediments, usually spatially associated with mica-bearing granitic rocks. Historical regional mapping indicates that Victory’s Georgia Lake property is largely underlain by metasediments.

A 2022 technical report on the Georgia Lake property produced a mineral resource estimate that outlined 10.6 million tonnes (Mt) indicated at a grade of 0.88% Li2O and 4.22 Mt inferred at a grade of 1.0% Li2O.

According to VR, pegmatites and mica granites are reported to the south, west and east of the company’s property. Mapping on Rock Tech’s ground has outlined additional bodies of mica granite not shown on Pye’s map, suggesting the possibility that previously unmapped mica granites and associated pegmatites may be found on Victory’s ground as well.

As such, the summer exploration will consist of prospecting and sampling to identify geological/geochemical indicators of these lithium-bearing pegmatites.

According to management, the discovery of new lithium-bearing pegmatite prospects on the Rock Tech ground is considered very encouraging with respect to its own program.

In the ‘Right Place”

In previous interviews, CEO Ireton said VR’s holdings are “in the right place at the right time,” given the amount of global as well as local interest in developing a reliable and sustainable electrical vehicle supply chain.

In Canada, both Ontario and Quebec are looking to establish themselves as major battery metals hubs. The former has successfully attracted automakers Volkswagen and Stellantis (along with LG Energy Solutions) to establish two battery cell manufacturing plants. Belgium-based Umicore has also invested $1.5 billion in setting up a cathode active material facility near Kingston.

Meanwhile in Quebec, General Motors and South Korea’s Posco recently secured half of the financing for a $600 million EV battery component plant from both the provincial and federal governments.

A sizable chunk of these investments could well make their way to those further up the supply chain: the lithium miners. For example, last month Ford inked an 11-year deal with Quebec’s Nemaska Lithium to supply a maximum of 13,000 tonnes of lithium hydroxide for its batteries. Earlier this year, GM made a hefty $650 million investment in Lithium Americas, which is developing the Thacker Pass mine in Nevada.

The lithium mining sector is also undergoing a major shakeup following top producer Chile’s decision to nationalize its lithium. This is good news for North American lithium miners, who are likely to become more important as potential suppliers of the white-colored metal.

“Automakers may be more trepidatious around committing to lithium supply deals from Chile until it’s clear what nationalization will look like,” Caspar Rawles, chief data officer at Benchmark Mineral Intelligence, commented in a Reuters note. “Most automakers will have been looking for a diversified portfolio of regional supply before this anyway, but perhaps this makes other regions more appealing.”

Should Chile fail to provide the much-needed lithium, it could give a fresh impetus for the industry to find elsewhere, in particular regions that enjoy a high mineral potential and favorable government policies.

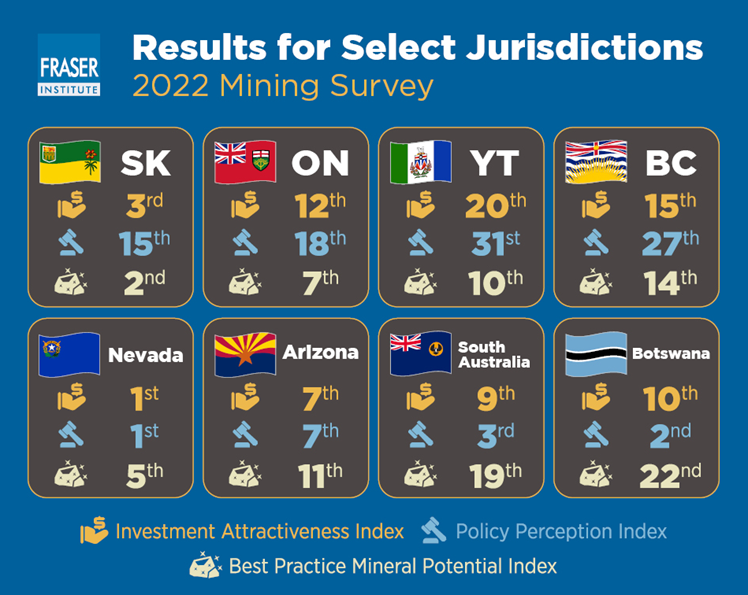

Fraser Institute’s 2022 annual survey of the global industry shows that Nevada now ranks as the world’s most popular mining jurisdiction. Within the US, it is by far the best place to mine gold and lithium, as proven in the past. Also ranked among the top 10 on a consistent basis is Ontario, which continues to attract huge investments.

According to Jeff Killeen, the director of policy and programs for the Prospectors & Developers Association of Canada, the geological map of Ontario would suggest there are “huge swaths” of the province that have potential for lithium discoveries.

Both Nevada and Ontario are currently being explored by Victory, with the Smokey lithium project being at the forefront of the company’s drilling efforts and the Georgia Lake property now being explored further this summer.

Conclusion

Flush with a $1.925 million private placement cash injection, Victory is in good shape to deliver on its 2023 field program at Georgia Lake, plus any additional drilling required at Smokey, which at this point looks very likely.

Ireton previously said that receipt of favorable assay results from the four holes drilled at Smokey would lead to a Phase 3 drill program, with holes drilled to a depth of 600 feet.

“Just to continue to prove out what we have currently found. The last hole last year was the one that really assisted us in rejigging our focus to this current program, and we’re very optimistic that based on the look of the core, we may obtain some favorable lab results.”

Victory Battery Metals Corp.

CSE:VR, FWB:VR61, OTC:VRCFF

Cdn$0.055, 2023.06.12

Shares Outstanding 66m

Market cap Cdn$3.96m

VR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Victory Battery Metals Corp. (CSE:VR). VR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of VR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.