Victory Battery gets Phase 2 drilling started at Smokey Lithium, aiming to extend the mineralization – Richard Mills

2023.03.24

A sign of a burgeoning sector is one that is able to withstand market downturns. This is the particular case with lithium mining.

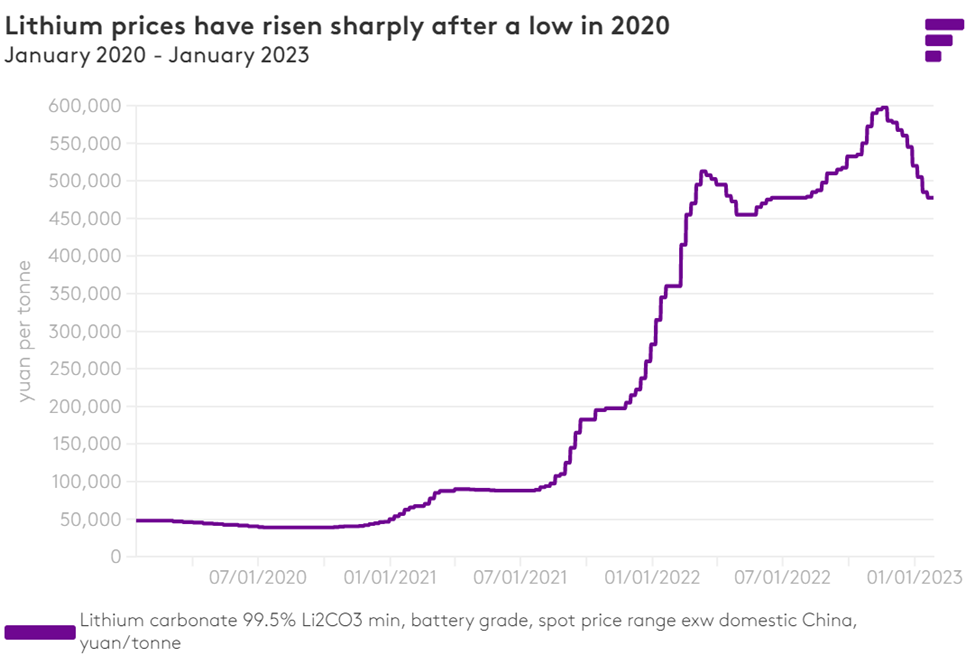

While the market has witnessed a steep decline in the metal’s price in recent months, the big players have remained largely profitable. The reason? A resilient demand for electric vehicles that could last for decades.

And despite lukewarm vehicle sales in China and measures taken by its EV battery maker to pressurize suppliers, the price of lithium is still ‘significantly’ higher than its long-term average, an analysis by Sprott shows. Between 2021 and 2022, spot lithium gained at least 1000%, an evidence for its healthy long-term outlook.

All the big car makers are well aware of this, and some have already taken strategic stakes in lithium producers even with oversupply concerns that have driven down prices. This is especially true in the US, seeing how General Motors invested a hefty $650 million in Lithium Americas.

According to Reuters, demand for lithium batteries in the US is expected to grow more than six times and translate into $55 billion per year by the end of the decade. Most of the lithium needed to build these batteries could well be mined in Nevada, the hotbed for lithium exploration and development right now.

Among those that are actively exploring the lithium-rich state is Victory Battery Metals (CSE: VR) (FWB: VR61) (OTC: VRCFF), an international mining junior whose interests span across North America. It is currently developing several existing projects, led by its Smokey Lithium property located next to American Lithium’s world-class property.

Smokey Lithium Phase 2 Drilling

The most exciting part of any mineral exploration project is arguably drilling, which carries the promise of new, earth-shattering discoveries.

This week, Victory announced exactly that: the start of its much-anticipated Phase 2 drilling at Smokey Lithium. This second phase drilling, planned for three holes, will focus specifically on high-quality drill targets, aiming to extend the strong lithium mineralization intersected previously on the property.

During the Phase 1 program, Victory’s team completed a total of 15 holes, which have produced favourable results including one hole that ended in significant, claystone-hosted lithium mineralization at 417 feet. The highest single sample interval was found at 377-381 feet grading 1,270 ppm lithium, which represents an impressive value by industry standards.

For Victory, this result was even more significant, as it validated the company’s theory that there is indeed a lithium deposit buried deep along the boundary margins of a nearby property (Jindalee).

Therefore, the company wants to build on those results and solidify its understanding of the lithium resource found within and around its property.

Locating ‘Buried’ Lithium

According to Victory, the new drill targets are a “perfect combination” of step out drilling on a previous mineralized intersection along with grassroots targets of claystone sediments within the Weepah Detachment fault and underlying claystones of the Esmeralda Formation of Nevada.

The Smokey Lithium project area and surrounding lands have shown strong lithium mineralization with the Esmeralda Formation at surface. “When combined with the highly encouraging results from Victory’s first round of drilling, the project area is highly prospective,” the company stated.

Additional exploration goals of the Phase 2 drill program – expected to be completed within a 2-3-week period, include drilling through the locally mineralized sediments above the Weepah Detachment fault.

This, Victories says, is important to grow its understanding of a significant area of known lithium mineralization including potentially important claystone-hosted lithium discoveries made in 2017 by Jindalee Resources to the immediate south of the property. The ASX-listed miner recently claimed that it has the largest lithium deposit in the United States after updating the resource for its McDermitt project.

The exploration efforts of both Victory and Jindalee have now shown that the most southern portion of the Smokey Valley is underlain by claystones, ashstones and mudstones of the Esmeralda Formation. This geology is critical for success in the region where large, blanket like mineralized sections have been recently found, Victory says.

Detailed geologic mapping by the company at the Smokey Lithium project has identified the contact of the Weepah Detachment slide block. This slide block conceals the Esmeralda Formation in the southern portion of the property. Lithium mineralization within the Weepah sediments has previously been noted by the USGS.

Victory sees the potential to drill through mineralized Weepah sediments and down into mineralized Esmeralda Formation sediments. The drill targets are specifically targeted at that geologic setting with the goal of significantly expanding the known lithium mineralization on the property.

“Building on our extensive exploration on Smokey Lithium, our team has a high level of confidence in our understanding of the resource potential, which has informed the locations of the drill target intercepts now underway and, which are aimed at establishing the maiden resource potential of the property,” Victory’s President and CEO Mark Ireton commented in a news release.

Conclusion

While more drilling still needs to be done before the true extent of the mineralization at Smokey Lithium can be fully determined, at this point, we can already conclude Victory is holding onto something highly prospective for the EV battery material.

Given last year’s successful exploration led by sample lithium results of over 1,200 ppm, it’s clear to see why follow-up drilling is required and the results should be highly anticipated.

The timing for Victory’s lithium expedition has never been better. The US Inflation Reduction Act has created a huge wave of interest in America-made metals that can feed the EV supply chain, and the aforementioned GM deal is only just the beginning of a huge wave of investments in this area.

As long as there are domestic lithium sources, which so far have been concentrated in Nevada, there won’t be any shortage of interest.

Victory Battery Metals Corp.

CSE:VR, FWB:VR61, OTC:VRCFF

Cdn$0.08, 2023.03.23

Shares Outstanding 66m

Market cap Cdn$5.3m

VR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Victory Battery Metals Corp. (CSE:VR). VR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of VR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.