Vanadium Solves Renewable Energy’s Biggest Challenge

2017.06.25

When looking for an investment your method should involve a thematic approach, studying global long term dominant trends. Then study the different sectors in order to select the one that is going to match up well with what you think is the soon to be overriding theme. This is top down investing.

The second part of your search for the dominant investment is a bottom up approach. This is where you find individual companies in the specific sector you have chosen to invest in.

The second part of your search for the dominant investment is a bottom up approach. This is where you find individual companies in the specific sector you have chosen to invest in.

So what is that investable theme I mentioned earlier?

Today we are at the start of a major, at least decade long transition in how energy is produced and stored. A global energy transition, from the burning of fossil fuels for energy and transportation, to using renewable non-polluting solar and wind energy is underway.

So let’s ask ourselves a few questions. Specifically, what are the energy metals that are going to make the much needed increased adoption of renewable energy possible? Could one of these critical energy metals stand head and shoulders above the rest?

Solar and Wind have a problem

Every sunny afternoon there’s a remarkable amount of the sun’s energy, in the form of solar power, fed into the electricity grid. The problem is that all this new electricity from the sun is coming through the grid at the wrong time of day. Between noon and 4pm is a trough in power demand. It’s during peak hours of demand in the evening when all this excess energy can be utilized.

Wind power encounters the same intermittency problems as solar power – sometimes the wind blows, sometimes it doesn’t, sometimes the sun shines sometimes it doesn’t.

Having the flexibility of being able to store electricity, and using it when the grid needs it, has always been one of the biggest challenges for renewable power.

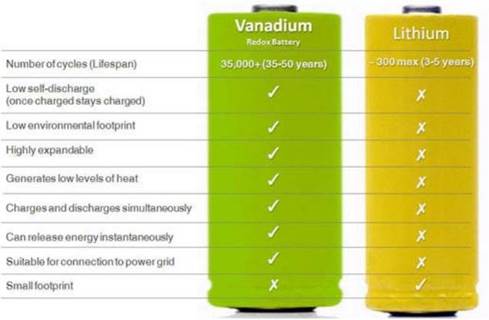

Batteries are one way of achieving the needed flexibility. But the batteries used need to last for more than the 300 or 400 charge/discharge cycles of lithium-ion batteries – replacing your batteries every few years is not cost efficient. So what’s the answer?

“We think there’s a revolution coming in vanadium redox flow batteries. …With a vanadium redox flow battery (VRB), you can put solar power and wind power into the battery, and you can put excess grid power into the battery at night.” Robert Friedland, 2017 Northern Miner’s Lifetime Achievement Awardee, in a Northern Miner interview

Vanadium

Renewable Energy’s Problem Solved

An emerging market opportunity is rapidly developing for vanadium pentoxide (V2O5) to be used as the main ingredient, the electrolyte, in the vanadium redox flow battery (VRFB) aka the Vanadium Flow Battery (VFB) or V flow battery.

Vanadium Flow Battery’s can store large amounts of energy almost indefinitely, which makes them perfect for wind/solar farms, industrial and utility scale applications, to supply remote areas, or to provide backup power.

How VFB’s work

Batteries store energy and generate electricity by a reaction between two different materials, usually zinc and manganese.

In VFB batteries, these materials are liquid and have different electric charges. Both liquids (V2+/V3+ and VO2+/VO2+) are pumped into a tank. A thin membrane separates the two liquids but the liquids are able to react and an electric current is generated.

Vanadium is used because it can convert back and forth from its various different states which carry different positive charges. The risk of cross contamination is eliminated as only one material is used. They are also safer, as the two liquids don’t mix causing a sudden release of energy.

The liquids have an indefinite life, so the replacement costs are low and there are no waste disposal problems. Also, battery life is extended potentially infinitely. By using larger electrolyte storage tanks VFB’s can offer almost unlimited energy capacity and they can be left completely discharged for long periods with no ill effects.

Introducing hydrochloric acid into the electrolyte solution almost doubles the storage capacity and enables the system to work over a far greater range of temperatures, from -40°C to +50°C.

V-flow batteries offer the best deployable large battery storage technology developed so far.

Vanadium has also begun to play a role in applications for electric and hybrid vehicles. Vanadium acts as a supercharger to batteries by increasing the energy density and voltage of the battery. This is important for electric and hybrid vehicle performance since energy density equates to distance/range, while voltage equates to torque.

Vanadium One Energy Corp.

TSX.V:VONE $00.15 June 13th 2017

Frankfurt 9VR1

Outstanding shares, 29,342,457

Cash 2017-03-14, Cdn$1,300,000.00

Vanadium One’s Mt. Sorcier property claims are located 18 km east of the city of Chibougamau in the eastern part of the Abitibi Region, Québec, Canada.

Between 1970 and 1976 a large exploration program was initiated on the Mt Sorcier property to confirm the potential of a significant iron, titanium and vanadium deposit.

In 1974 Campbell Chibougamau Mines Ltd, while looking at the potential of a large open pit operation, published a resource estimate of 270,000,000 tons grading 27.6% Fe and 1.1% TiO2 (NI 43-101 non-compliant, considered historical).

Campbell Chibougamau Mines historical resource estimate used cross-sections spaced 365m to 488m apart. Every cross-section had a minimum of 3 vertical drill holes drilled 30m to 46m apart to a depth of 91m to 335m vertical.

The drilling covered two magnetite/titanium/vanadium deposits, the “South Zone” and the “North Zone”.

The “North Zone” was drill tested for a length of 1.8 km having an average true width of 137m wide and the “South Zone” was drill tested for a length of 1.9 km having an average true width of 61m. Both structures are open at depth.

The historical non 43-101 compliant resource estimate concluded that:

South Zone = 102,800,000 tons 27.4% Fe 1.05% TiO2. After concentration – 2.88 tons of magnetite rich rock would produce 1.0 ton of concentrate – tonnage/grade were: 35,694,444 tons @ 67.8% Fe, 0.95% TiO2, 0.68% V2O5.

North Zone = 171,000,000 tons 30.0% Fe 1.06% TiO2. After concentration – 2.88 tons of magnetite rich rock would produce 1.0 ton of concentrate – tonnage/grade were: 59,375,000 tons @ 66.2% Fe, 1.32% TiO2, 0.57% V2O5.

That’s a total, in situ historical resource of:

- 1.16b pounds of vanadium pentoxide (V2O5).

- 2.24b pounds of titanium oxide (TiO2).

- 63,507,083 tons of iron (Fe).

In 2013, a two hole drill program by Chibougamau Independent Mines Inc. confirmed Campbell Chibougamau Mines historical widths and grades.

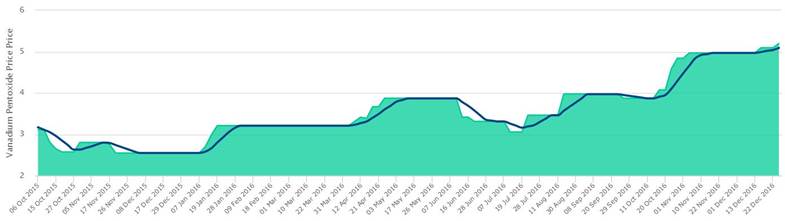

Vanadium Price US$

Vanadium One’s strategy is to establish a vertically integrated vanadium business with mining, processing and further downstream beneficiation platforms, including vanadium based energy storage.

There are three demand growth drivers for vanadium:

- Following the 2010 earthquake in China, the Chinese authorities tightened the building regulations resulting in the need for higher strength steel to be used for construction purposes. If the Chinese intensity of vanadium consumption were to match that of European steel producers, it would add 33,000t to annual world vanadium demand.

- A major growth area for vanadium steels is the automobile industry where stronger and lighter steel reduce the weight of vehicles, increasing fuel efficiency and lowering emissions.

- Vanadium Redox Batteries are seen as a substantial new market for vanadium as it is one of the few materials that can provide batteries of any significant size – a battery commissioned at the Minami Hayakita Substation Hokkaido Electric Power is 15MW.

Conclusion

Currently traditional clean, green, renewable energy sources are unreliable sources of electricity production. Vanadium’s unique properties make it ideal for a new type of battery that will revolutionize our energy storage systems.

The Vanadium Flow Battery (VFB), given its unlimited storage capacity, long battery life, low maintenance requirements, adaptability and almost non-existent environmental footprint is today’s answer to efficiently storing and accessing energy. The stored electricity will reduce our reliance on fossil fuels cutting pollution and CO2 emissions.

Your author believes the North American grid energy storage market is on its way to developing into a multi-billion dollar industry within a few years.

America currently imports almost every pound of vanadium it uses, and almost all of it comes from China, Russia and South Africa.

With no currently operating primary vanadium mines in North America vanadium is crucial for North America’s energy storage future.

I’ve got energy storage, security of supply and Vanadium One Energy Corp. (CSE:VONE) on my radar screen. What’s on your screen?

Richard (Rick) Mills

Richard’s articles have been published on over 400 websites, including:

WallStreetJournal, USAToday, NationalPost, Lewrockwell, MontrealGazette, VancouverSun, CBSnews, HuffingtonPost, Beforeitsnews, Londonthenews, Wealthwire, CalgaryHerald, Forbes, Dallasnews, SGTreport, Vantagewire, Indiatimes, Ninemsn, Ibtimes, Businessweek, HongKongHerald, Moneytalks, SeekingAlpha, BusinessInsider, Investing.com, MSN.com and the Association of Mining Analysts.

Sign up for Ahead Of The Herd’s free highly acclaimed newsletter.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Vanadium One Energy Corp. (CSE:VONE, FSE:9VR1) and they are an advertiser on his site, aheadoftheherd.com.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.