Under the Spotlight with Max’s CEO Brett Matich and Colombian Geology Expert Chris Grainger – Richard Mills

2022.10.11

Within an under-unexplored region of northeastern Colombia, Max Resource Corp. (TSXV:MXR, OTC:MXROF, Frankfurt: M1D2) has not only been finding high-grade copper zones at its flagship CESAR copper-silver property, but expanding these areas, suggesting the potential for a massive sediment-hosted system similar in surficial extent to the biggest in the world (the Central African Copper Belt running through Zambia and the DRC, and Poland’s Kupferschiefer deposits).

Late last month, Vancouver-based Max reported its ground-based Induced Polarization (IP) and Total Magnetic Intensity (TMI) anomalies correlated well with surface geochemical targets, and successfully defined new drill targets at URU-C and URU-CE.

Max to drill URU in October; geophysical results correlate with surface geochemical anomalies

These two copper-silver-rich discoveries are the first to be drill-tested at CESAR. They extend at least 200m below surface, as confirmed by geophysics, and form part of the 20-km-long URU District, located along the southern portion of the CESAR North 90-km-long copper-silver belt.

Ahead of the Herd spoke to Max’s CEO Brett Matich, and technical consultant Dr. Chris Grainger, who is on Max’s advisory board.

Rick Mills, Publisher/ Editor, Ahead of the Herd:

How is the new government affecting mining in Colombia, and specifically Max?

Dr. Chris Grainger, Max technical Advisor: I think the key with Max is that before Gustavo Petro even was campaigning, we knew that his government was going to be leftist. We were proactive positioning ourselves with projects that wouldn’t suffer.

I’ve been in Colombia for more than 13 years and I avoid working in gold because of all the social issues and we knew copper was the future, the potential for copper going forward in Colombia was so much better. It’s going to work with the new government.

There’s a lot of noise coming out of Colombia now but it’s very clear all you had to do was watch and listen to what the president was saying pre-election. What is now being said by his ministers, particularly the Minister of Mining, and the Minister of the Environment, is very clear, and it follows what he said.

Rick Mills: They like copper, they like renewable energy.

Chris Grainger: Yes, the new government wants to be involved in the transition to renewable energies. As you know Colombia’s biggest exports are hydrocarbons and thermal coal. So, they’re going to be reducing that, the President very clearly said we need more copper, nickel and lithium.

There’s not a single lithium company in the country. Cerro Matoso/ South 32 is a nickel company but over the last 15 years in Colombia they’ve been getting challenged by local communities, they have now resolved the issues, and the government knows they need nickel mining in Colombia. They need copper, they said, that’s why we’re involved with the copper industry, the copper potential in Colombia is a lot better than gold, it’s obviously the future, right?

There’s three key points that came out with the government and you need to follow these rules. The first one is, the government said if you are going to be working in the metals industry you’ve got to be working in one of these three metals, which we are.

Secondly, Petro said if you’re working in an area where there’s artisanal mining, particularly formalized cooperatives, you’re going to have problems, because the government is going to prioritize formalized cooperatives, so that’s going to cause a lot of problems in the gold mining space. We have no artisanal miners in any part of this belt, there’s no gold in this system, it’s copper-silver, so we don’t have that issue, we’ve escaped that problem.

He then said if there is any mining in, or exploration activities going to be held in environmentally sensitive areas, there’s going to be an issue. They’ve followed that up. So you might’ve seen in the news in the last few days, the California District, where Ventana has 8-12 million ounces in North Santander, it’s now on hold, because that was in an area called “Paramo”, which is a high-altitude watershed, the Minister of the Environment came out and said it’s dead. We don’t have any environmental issues with national parks, “Paramo” zones, or anything like that.

The third issue is if you’re in an area that’s sensitive to indigenous or Afro-Colombian communities you’re going to have a problem. You can work with those communities and that’s what the government wants you to do, so if you’re in an area where there’s an indigenous community and you have an agreement with them you can work, that’s fine. But if you don’t have one in place and the indigenous communities are against you, you’re going have a big problem. So, there are the three issues, we don’t have any of those problems so that’s one of the reasons Max was set up, apart from the fact that the prospectivity here is fantastic.

RM: Can you get into how many locals we’re employing, what we’re using them for?

Brett Matich, CEO, Max Resource Corp.: We’re employing about 95% locals, two senior geologists, seven junior (some now near senior) geologists, some come from the local geology university so we’re also teaching our employees skills.

We have expanded our socialization and environmental team, so we’re pushing a lot on socialization and also environmental. We have local communities involved on the environmental, so we’re very big on ESG. We’re not just employing, we’re teaching skills. We’ve been doing this for a couple of years, so it’s not like the government comes in, oh yeah your going to do this, we’re actually already doing it, so, they know all about us, they know the relationships, it gets back to the communities.

RM: Sounds likeMax is doing all the right things. Let’s get into the Rancheria Basin/ Cesar.

BM: One of the slides in the corporate presentation would be a good one for Chris to talk about, because it’s got the three basins: the Kupferschiefer Basin, the African Basin, and the Cesar Basin. This is relevant to what we’re doing, in looking at the prospectivity of multiple deposits down this belt.

CG: Let’s get started with that slide, then we’ll move onto the drilling and the geophysics.One of the reasons there’s so many majors watching us, is we’re tying up an entire district here, ok? We’re not looking for one deposit, we’re not making one discovery, we’re looking to tie up a whole district here where there’s going to be potentially multiple deposit.

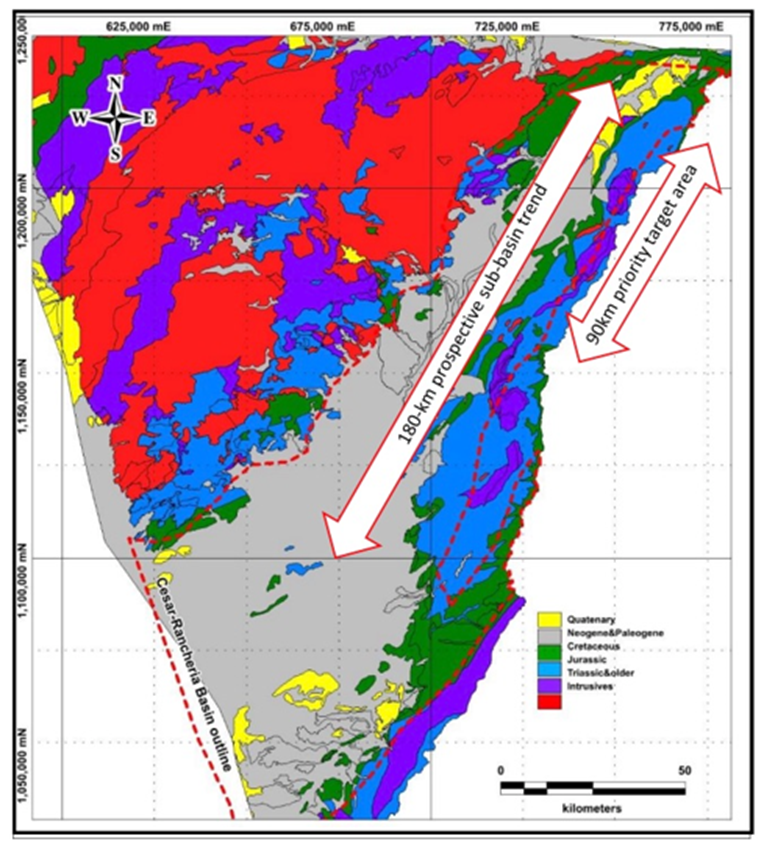

When you’re looking at sediment-hosted copper-silver deposits, or variants of those, they always occur in big districts. There are two main districts globally, firstly the Kamoa-Kipushi belt that’s in Central Africa and the Congo and runs through Zambia, that’s probably the most heavily endowed copper district in the world. It’s about 200-km strike length, as you can see there’s about 20 major deposits there, they’re some of the highest-grade copper deposits in the world. It’s been mined for a hundred years. There’s probably about 40 companies there, and in total about 40 mines. It’s one of the systems that appears very similar to the Rancheria Basin/ Cesar.

If you look at the above image that’s in Poland, that’s the second district, the Kupferschiefer. This has also been mined for nearly 100 years, it starts at about 400m depth, whereas Max’s Cesar project mineralization starts at surface, the same as the Kamoa-Kipushi belt. Because of the grade in these systems compared to typical porphyry, you can mine them open pit and you can mine them underground, so they’re very flexible.

The Kupferschiefer belt is again about 200 km in strike and the average grades are 1.5% copper and 48 g/t silver, it’s probably got about 20 major deposits, it’s still the biggest silver producer globally, and it’s a major copper producer as well.

So, if you look at these two belts, there’s two things that stick out. First of all, these basins, that you have right geology, the style of mineralization varies, but overall, they’re the same systems. The key here is that both of these districts are about 200 km long, these sedimentary basins are about that size. Having the luxury of having so sedimentary experts come out and visit us, they say it’s kind of like the Goldilocks window. You’ve got to have a basin that’s not too big and not too small. If it’s too big you dilute the fluids throughout the basin and you don’t form economic deposits. And if it’s too small you don’t have the volume size enough for the fluids to go through and scavenge the metals out and then redeposit them.

The Rancheria/Cesar Basin we’re focused on is about 200 km of strike length, so it fits that. The difference is one junior company controls a large portion of the basin, it’s hugely prospective, we’ve only just started the first drilling campaign ever, in this basin, for copper-silver.

That’s why Cesar’s so attractive because these things don’t exist globally. If you look at the Rancheria sub-basin, this Jurassic basin which runs down the western flank of South America, it’s very extensive it runs from where we are on the Caribbean coast all the way down through Argentina, but it’s made up of different sub-basins, so you’ve got to find the right sub-basin, which has the right geology, the right structure and then it’s more prospective. That’s why we’re focusing on this part of the Jurassic basin which is called the Rancheria/Cesar sub-basin.

RM: Chris, please talk about the volcanic deposits to the south down the Andean Belt.

CG: If you look at this massive basin that runs all the way down, it starts in northern Colombia and runs all the way through Colombia. We are focusing on the Rancheria/Cesar sub-basin because that’s where the best geology, structure, and most showings are. It comes out into northern Ecuador, and there’s a bunch of juniors in there exploring. Then it goes undercover, and it comes out again in southern Peru and northern Chile.

There are three deposits there that are very important, because in the past they’ve been labeled as ISOCG (iron OXIDE copper gold) deposits, they’re not, they’re copper-silver deposits, and they’re very large.

So, on the northern Chile side you have Mantos Blancos which is Anglo American, that’s about 400 million tonnes of 1% copper with silver credits. So again, that is hosted in the same stratigraphy, it’s hosted in Jurassic, volcanics and sediments. It’s basically the same belt (as Rancheria/Cesar) it’s just a different sub-basin which is prospective.

There’s also Michilla, Michilla is what got Antofagasta up and running, again it’s a big open pit, it’s hosted in Jurassic-volcanic rocks, and its copper-silver. I think that’s just shy of 100Mt.

On the Peruvian side there’s a mine called Mina Justa which is hosted in sediments of the same age, and that’s about 300Mt.

So, what you can see is if you hit the right sub-basin, in this geology, in this style of mineralization you can find large deposits. And there are three good examples, in South America, of this type of system that have been discovered.

RM: Chris, please tell us about using IP and ground magnetics.

CG: We put a lot of time and effort into thinking about what’s the best way to explore for these systems trying to see the large structural controls.

We decided to focus ground geophysics on selected areas, where we’ve got a lot of surface mineralization, so we did ground IP (induced polarization).

The IP worked very well, our systems don’t have pyrite in them, it’s mainly chalcocite and there’s a very small percentages of bornite, a bit of chalcopyrite. So, if you do the IP, we find these distinct and continuous chargeability zones. They’re not super-high chargeability but that’s because IP was set up to find barren pyrite in porphyry systems.

Disseminated pyrite gives you high chargeable anomaly, whereas when you have interconnected sulfides as we have, as fractures, small breccias, and it’s not really disseminated it’s all inter-linked, when you put the charge in the ground into what we have it becomes chargeable but you lose that charge very quickly, so we weren’t expecting to get very high chargeability zones but we were expecting to get chargeability zones that were very continuous, and that’s what we see.

We are first drilling two major zones URU-C and URU-CE that both show up as distinct chargeability zones, and then between them appears to be linking zones of some kind, and that looks like it’s following the structure of the folding of this basin, so we’ve got a number of blind targets, but we’ve also got the surface mineralization which is showing up very well. So, these appear to link up, between what we’re seeing at surface and what’s connected. So that’s very good, we know the IP works, that’s been a success.

We also did ground magnetics. Because we don’t have magnetite in the system, it’s a lot of hematite, we were unsure if it would work. It works surprising well. With ground magnetics you can move quickly, so we’ve just decided to keep the ground magnetics unit there and it’s covering the entire URU-C and URU-CE zones. The correlation we’re seeing between surface mineralization and the ground magnetics is fantastic and it’s also lining up with the IP as well.

So, you’ve got all these overlapping techniques now which are basically pointing us in the right direction. We’ve only just started drilling, we are anticipating seeing the veining in drill core, as we’ve seen in the outcrop, were going to know in the coming weeks.

RM: Chris, I never said it before but thanks for pointing us in the right direction a couple of years ago.

CG: No problems. I mean Colombia’s a good country; you’ve just got to understand how to operate. We can do that. I mean with Continental Gold we learnt a lot, with Cordoba [Minerals] we learned a lot more, with Collective [Mining] that’s a learning step as well, that’s another discovery, so there’s been three discoveries out of three companies. Max is the next one.

I truly believe we’re going to have discoveries here, I mean Colombia’s very kind, you have to understand how to operate here, and we’ve been here for a long time, I think we can work it out. A lot of people are worried about the government that’s come in, if you understand how to operate and what they want and being part of the right part of this industry, that’s been our focus, and that’s why Max was really put together. Copper is where you want to be, and this is a fantastic copper project.

RM: I’d like to talk a little bit about the drill program, what comes next? Where do you go from here? How many holes do you put in? What’s the plan for a follow up drill program?

BM: Just to quickly go on that, we’re drilling where we had the discoveries, at the URU-C base level and up on the ridge, so we’re definitely putting more holes there, you don’t want to leave there till you get those holes done. We anticipate the drill rig’s going to be there for some time and if you drill more holes that’s a good thing. Chris, can you give a quick summary of why we’re doing more holes there?

CG: Basically, because what we’re seeing at surface and what we’re seeing in the geophysics is making sense now. There are more blind targets that we need to test, so if we have one rig there, given these are man-portable rigs they’re production is bit slower, we may soon need a second rig, and Max has some $20 million in cash.

What you see at surface is maybe 15%, so as soon as you start drilling you expect to attain so much structural understanding, alteration what’s important, so we’re likely going to building more pads, and we expect there’s going to be more drilling and to be quite honest with you it’s probably just going to continue because every hole we put down we’re going to learn more.

The teams that are out doing the geophysics and the ground magnetics for example, we continue to identify new outcrops, so it’s as simple as that, it’s just more time, more drilling, more geophysics, more surface mapping, there’s going to be more things in the drilling pipeline, I think that’s the key.

RM: Juniors get a property, they tout one or two targets, every now and then you hear three, that’s not the case with Max, it’s back to what you said at the start, we potentially have hundreds of targets.

CG: Exactly, that’s it. That was always the idea and what Brett did by activating it, pushing it ahead and saying no, no JV’s, no sharing, let’s go get the whole basin, that’s what Max has continued to build, its endless, you could explore here for decades. I don’t think Max is going to be doing it, I believe it’s likely a major will take us out but yeah that’s it, it can go forever, as long as copper’s needed, right? It’s a really good position for us to be in, it’s very unique for a junior, and that’s why it’s so exciting.

BM: You’ve got all these outcrops above the ground there has to be mineralization under cover.

RM: Yeah, there’s just too much smoke not to have the fire.

CG: Exactly. That’s why we use the analogy of the other belts, because it’s very similar, a lot of smoke everywhere, that’s what you want to see. You know as well as anyone if there’s a lot of activity going on there’s got to be something going on underneath.

BM: It’s looking obvious that this is not just a matter of targeting the high-grade zones, this system appears to be a lot larger, which is what we were hoping for.

You’ve got to remember, you know what the mineralization’s like, you will likely have faults and folding, all sorts of things, right, but we’re seeing mineralization and dissemination in what appears to be a mineralized transitional zone. So, what that’s telling us is, this appears to be a lot bigger system, it’s got some complexity to it, we’re seeing that, it’s not just 10-meter widths of high-grade. This appears to have porphyry-size (bulk-tonnage) potential, where we are drilling the URU-C and URU-CE zone, that’s what you’re looking at.

RM: For myself, I just want to get it from you,how would this thing have formed? Is it a typical red-bed or is there something else at work here?

CG: If you look at the classic systems, say in Zambia or the DRC ypu’ve just got replacement of certain stratigraphic horizons, and then there’s the structural control that might break out to different things, or the Kupferschiefer which is just replacement of more reactive rocks, the 20-km-long URU District is kind of a hybrid on those, we see zones where we’ve got replacement, and then we see other zones where we see structures cutting through and they’re linking up these replacement zones, and they’re mineralizing rocks that might not be porous and permeable, but they’ve got structures going through them, that’s why we’re seeing veins.

I mean veins are basically structures filled with fluids, so we’re seeing the vein systems in structurally controlled zones and then we’re seeing replacement zones where the rock is more porous and permeable, and these fluids are kind of flowing through them and depositing metals as well so it’s a mixture. I mean no two deposits are the same they’re all variations on a theme, and that’s very much what Cesar is to us so far. We’ll know a lot more in the next month or so, that’s for sure.

RM: So, it looks like replacement-linking structures.

CG: Yes, I think you’re correct. I’m pretty confident that’s right.

RM: Anything else you want to add in here, Chris, about Colombia, or the project itself at URU?

CG: As I said, you need to know how to operate here, and we can do that, so it’s fine. We’ve got a big land package, we’ve received more titles than any other company in 2021. We’re not in an awkward situation with either communities, environmental or artisanal miners, we’ve dodged all of those problems because of our location, metal we are exploring for and we know how to operate, we just need time now to work out what’s going on and to keep exploring. It’s as simple as that.

RM: Brett, Chris thank you both for talking with me today.

Conclusion

While new copper discoveries create excitement in the industry, it is the size of a discovery that really matters and offers long-term growth potential for investors.

Such projects are extremely rare, but not impossible to unearth with the right approach.

The new government in Colombia has been clear on how companies that want to explore for minerals need to operate. It basically comes down to the right metals in the right location. The government wants juniors to be working in metals that help Colombia to transition to renewable energies, namely copper, nickel and lithium. Max’s focus on copper and silver obviously fits this criteria. Colombia has had a lot of problems with artisanal miners so it’s important to note that Max doesn’t have any gold in the system it’s exploring at CESAR.

The government also said that companies working projects that are disputed by nearby communities and/or indigenous peoples, or are located in environmentally sensitive areas, are going to have problems. MAX knew it would have no issues working in the Rancheria/Cesar Basin, a part of Colombia known for coal mining and oil & gas.

The project sits on a massive sedimentary system covering a significant portion of the 200-km-long Cesar Basin, a geological feature that extends for over 1,000 km from the northern tip of Colombia southwards through Ecuador and Peru.

There is access to major infrastructure resulting from oil & gas and mining operations, including Cerrejón, the largest coal mine in South America, held by global miner Glencore.

One of Max’s goals is to transition the Cesar Basin towards the mining of copper, a key metal for Colombia’s transition to clean energy.

The CESAR property is proving to be extremely prospective for copper and silver.

So far Max has uncovered three copper-silver districts, each located along the CESAR 90-kilometer-long belt:

- The 32-km long AM District with highlight values of 34.4% copper and 305 g/t silver;

- The Conejo District, averaging 4.9% copper (2% cut-off) over 3.7-km;

- The 20-km long URU District, which includes the URU-C and URU-CE discoveries, highlighted by channel sampling of: 7.0m @ 8.5% copper + 143 g/t silver; 16.8m @ 8.3% copper + 146 g/t silver; 52mn @ 4.9% copper + 41 g/t silver; 19.4m @ 1.3% copper + 2.5 g/t silver.

One of the most interesting things about Max, indeed what makes it unique, and so attractive to majors who have come to visit the property, is that it has succeeded in tying up an entire basin.

Max has so far received 21 mining concessions covering a total area of 188 km² — more than any other company has gotten in Colombia.

Most juniors have one, two, at the most three prospective areas they are exploring. Max has literally identified an enormous number of surface outcrops, that are copper-silver mineralized.

Especially since a trend right now is for the large mining companies to diversify into copper from gold and other minerals.

“We’re not looking for one deposit, we’re looking to tie up a whole district here where there’s going to be multiple deposits and potentially multiple mines,” Grainger said during our talk.

Think of it this way: large sediment-hosted copper districts are extremely rare. There are currently only two on Earth — the Central African Copper Belt running through Zambia and the DRC; and the Kupferschiefer deposits in Poland. The geology at CESAR has elements of both of these giant copper-silver districts, each of which has about a 200-km strike length, and hosts about 20 -40 deposits.

Max is working within the 200-km-long Cesar Basin, a sub-basin within a Jurassic-age basin that runs down the western flank of South America, all the way from where Max is on the Caribbean coast, in the north, through Argentina in the south. There are at least three large copper-silver mines in southern Peru and northern Chile, that are hosted in the same Jurassic-age volcanics and sediments, as Max’s CESAR.

According to Grainger, an expert on Colombian geology, “if you hit the right sub-basin, in this geology, in this style of mineralization, you can find large deposits.”

Max is getting its first peek at the geology behind the surface mineral expressions at its current focus of drilling, at URU. There’s a lot more to be understood, but so far we know the following:

- Where there is smoke there’s usually fire, and Max is seeing a lot of smoke. Logically, with so many surface outcrops, there must be a large system underneath driving it. Drilling should reveal a lot of information about what’s underground.

- There is a strong correlation at URU between surface mineralization and ground magnetics, and it’s also lining up with the IP survey. Max wasn’t expecting to get high chargeability, due to the type of minerals (mainly chalcocite), but the chargeability zones are very continuous, a sign they are on the right track.

- We’ve seen surface expressions of the mineralization in veins, these are the structures. But between the vein zones there is also evidence of disseminated (microscopic) sulfides, determined by X-ray Fluorescence (XRF). This is another good sign, that Max is not only looking at structures such as veins, breccias, and fractures, all of which can host minerals, but disseminated zones of copper-silver that could add more volume to the mineralization.

- Finally, and most intriguing of all, is that so far Max is seeing quite a bit of complexity in the drill core it’s been pulling up at URU — different styles of veins and alteration, suggesting something beyond high-grade vein widths, perhaps even a system of porphyry-size. While it’s still a mystery as to how the system formed, Grainger said it’s so far best described as “replacement-linking structures,” a kind of hybrid between Central African Belt and Kupferschiefer-type mineralization, where there are replacement zones — mineral deposits formed by chemical processes that dissolve a rock and deposit a new assemblage of minerals in its place — combined with other zones where structures cut through mineralization and link up to the replacement zones. “We’re seeing the vein systems in structurally controlled zones and then we’re seeing replacement zones where the rock is more porous and permeable and these fluids are kind of flowing through them and depositing metalsas well so it’s a mixture,” Grainger explains.

The key takeaway, and again it’s early days, but so far Max has determined that that there’s more than just high-grade vein zones jutting out at surface where they would go in and mine the vein(s), from underground or in open pits.

The underground environment is looking more complex, it contains replacement mineralization linking structures suggestive of a large mineralized system, where it would presumably not take long to build some decent tonnage. Indeed it’s mind-boggling to consider that Max is currently only drilling a 1-km portion of URU, of the 20-km URU District, and that URU is within the 90-km CESAR North, which is part of the 200-km-long Cesar/Rancheria Basin.

My opinion? There is so much more to discover and drill, but the way things are going Max might not be the company doing that – if the junior is able to prove it controls one of the three largest copper-silver districts in the world.

News should start flowing soon, this morning Max announced the start of drilling.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.33 2022.10.07

Shares Outstanding 160.2m

Market cap Cdn$54.2m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSX.V:MAX) MAX is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.