The Quesnel Trough — Canada’s copper heartland – Richard Mills

2025.11.12

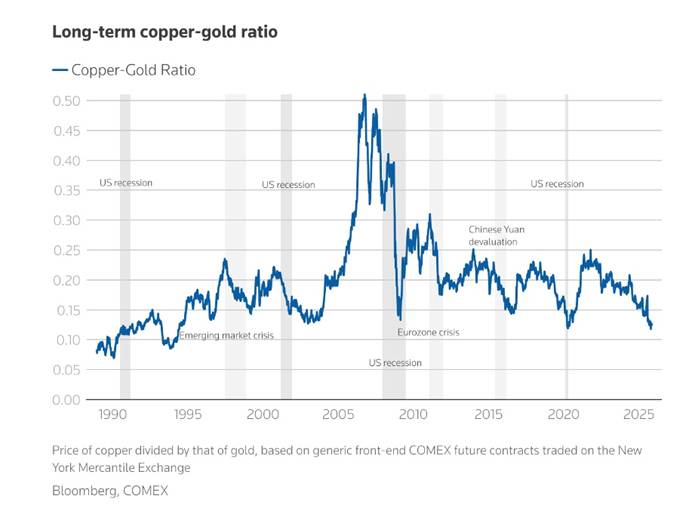

One way to make an educated guess as to the direction of the copper price is to look at the copper-gold ratio. To find the ratio, simply divide the price of a pound of copper by the price of an ounce of gold.

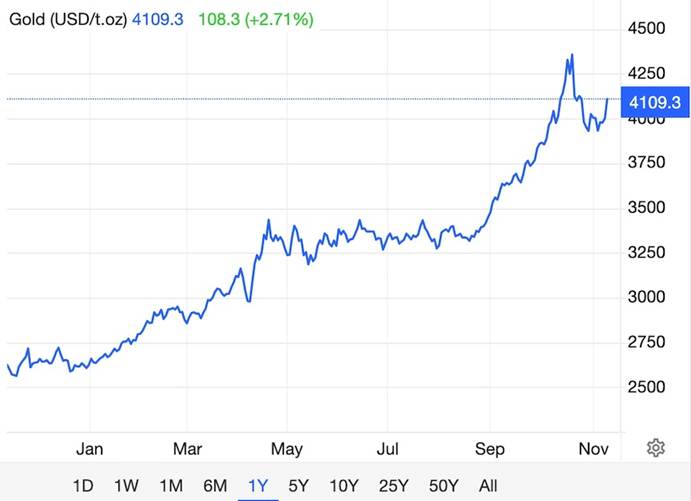

Copper is currently trading at $5.07 a pound and gold is $4,109.30 an ounce so the copper-gold ratio right now is 0.00123.

Because copper is used so frequently in industrial processes, the copper-gold ratio is an indicator of investor sentiment about global economic growth. When the world economy is booming, copper prices generally soar, while the inverse also holds true.

Gold, on the other hand, is a safe-haven metal, meaning it typically climbs during periods of economic turmoil and low growth, or when real interest rates turn negative.

If we look at a historical chart, the copper-gold ratio has sunk to a multi-decade low.

In the past, when the ratio rose, it meant a “risk-on” environment. Whenever the ratio fell, the environment was “risk-off”.

But we are not seeing a risk-off investing environment. Despite a global trade war, stock markets are doing just fine. Last Wednesday the S&P 500 reached its longest streak above its 50-day moving average since 2007, surpassing a 130-day stretch that ended in May 2011, Dow Jones Market Data showed. (MarketWatch). The S&P/TSX Composite Index hit a record high on Sept. 23, topping 30,000 for the first time, buoyed by the energy and base-metal sectors.

Reuters reports that the copper-gold ratio has started to unravel, mostly because economic growth has proven more resilient than expected, particularly in the United States. An artificial intelligence boom has kept US stock markets rocking. Despite this, the copper-gold ratio has declined sharply. So, what’s going on?

The low ratio might have you thinking that copper demand has fallen. But that isn’t the case. China is the biggest copper buyer, and its purchases have slowed in recent years due to a weaker economy. But Chinese demand has been replaced by a new driver — electrification and decarbonization. Electric vehicles for example need four times as much copper as regular gas-powered ones.

Technology companies are investing hundreds of billions of dollars to build AI data centers requiring reams of copper wiring.

Demand for copper — the cornerstone for all electricity-related technologies — is set to grow by 53% to 39 million tonnes by 2040, according to BloombergNEF.

Meanwhile, the copper supply is in trouble.

Due to unexpected closures and operational interruptions, such as the mud intrusion that shut down the world’s second-largest copper mine, Grasberg in Indonesia, the copper market this year is in a deficit. The shortfall is expected to deepen in 2026.

A combination of strong demand and limited supply has vaulted the copper price to record highs above $5 a pound.

Reuters explains that the copper-gold ratio has been distorted by trade policy:

Copper flooded into the U.S. ahead of expected tariffs from President Donald Trump’s administration. When a 50% tariff on semi-finished copper finally did take effect in July, raw and refined copper were unexpectedly exempted, shocking investors. New York copper futures plunged nearly 20% before rebounding partially, highlighting how disruptive trade policy can be.

As for gold, the spot price climbed above $4,300 an ounce in October, setting a fresh record high. In fact, gold’s five-year US dollar return tops the S&P 500’s performance over that period, leading some to observe that gold is performing more like a stock than a metal.

The reasons for gold’s run are many. They include robust buying from central banks, particularly emerging-market CBs afraid that their foreign-exchange reserves in dollars could be frozen like Russia’s were following its invasion of Ukraine in early 2022.

A low US dollar has also been good for gold and silver. Meanwhile, gold supply has peaked — supply can’t meet demand without recycling jewelry — ore grades have declined, and there have been few new gold discoveries.

Our gold mining industry is in trouble — Richard Mills

Buying interest accelerated this year due to continuing geopolitical risk and currency debasement fears. Purchases by retail investors partly driven by FOMO (fear of missing out) speeded momentum even further.

According to Reuters:

What this all ultimately means is that the copper-gold ratio is not “broken” but merely “bent” because the numerator and denominator are responding to different narratives.

The copper price reflects transition: massive investment in an AI-powered, electrified, renewables-heavy economy that should require more copper over time.

The gold price reflects fragmentation: more siloed geopolitical blocs and a reassessment of unquestioned U.S. dominance across the global financial system.

Canada’s copper moment

While gold has hogged the spotlight for much of Canada’s mining history — especially big gold mining camps like Timmins in Ontario, the Abitibi in Quebec and the Golden Triangle in BC — copper is making a comeback.

Pierre Gratton, CEO of the Mining Association of Canada, recently told BNN Bloomberg that With new mines, revived projects, and rising global demand for the metal, Canada is well positioned to lift national output levels to what it was two decades ago.

Canada mined 450,000 tonnes of the base metal in 2024, states the US Geological Survey.

Only about 50% of the copper mined in Canada is refined domestically.

Canada’s only copper refinery is the Canadian Copper Refinery (CCR), located in Montreal East, Quebec. CCR is part of Glencore Canada’s copper division, which also includes the Horne smelter in Rouyn-Noranda, Quebec. The Horne smelter processes materials that are sent to the CCR.

The country exports the majority of its copper in the form of ores and concentrates. Canada’s exports of unrefined copper concentrate in 2023 were 334,079 tonnes, while refined copper exports totaled 151,445 tonnes.

Last year, Canada exported $4 billion worth of copper concentrate to China and Japan, and $1.8 billion in refined copper, 99 per cent of which went to the US.

Gratton credits record-high copper prices to the electrification trend.

“Power needs copper. That’s what transmits power,” he said, adding “It doesn’t matter what kind of power — whether it’s nuclear power, whether it’s wind power, solar power, hydro power — it all goes on copper wire. Every house has copper wire. Every transmission line is copper.”

According to BNN Bloomberg, Canada’s copper output rebounded for the first time in a decade last year, climbing 6.2% above 2023 levels.

The publication notes Canada’s last copper boom was driven by China’s urbanization in the 2000s. Many new copper mines came online, but by 2023, output had fallen as deposits aged and permitting slowed, according to Natural Resources Canada, or NRCan.

“During the last 10 to 15 years, copper didn’t attract the kind of exploration that gold did,” said Gratton.

But that is beginning to change. Among the many new projects on the horizon:

- Teck Resources’ Highland Valley is being extended beyond 2040.

- Newmont’s Red Chris expansion could lift national copper output by 15% before the end of the decade.

- New Gold’s New Afton is ramping up to produce about 45,000 tonnes a year. The mine is expected to run until 2031.

- Foran Mining’s McIlvenna Bay in Saskatchewan is set to start production by 2026.

- Troilus Gold in Quebec, Yellowhead and Kemess in BC, and Fuerte’s Casino project in the Yukon, are all advancing through approvals alongside the long-discussed Centerra Gold’s Galore Creek and Tech/ Copper Fox’s Schaft Creek deposits in northwestern BC.

- Canada’s third-largest copper producer, Hudbay Minerals, said it expects to be crowned second place by 2027. The company said it produced about 39,000 tonnes of copper from its Canadian mines in British Columbia and Manitoba last year.

Infrastructure — power, roads, railroads, ports — remains one of the biggest constraints to increasing Canada’s copper output.

“In many northern and remote regions, access to reliable transportation, energy and port capacity ultimately determines whether a project can move forward,” Candace Brule, Hudbay’s senior vice president for capital markets and corporate affairs, told BNN Bloomberg.

In 2014 the BC government took a decisive step towards recovering minerals in northwestern BC through the construction of the Northwest Transmission Line.

The 344-kilometre line extended B.C. Hydro’s power grid north from Terrace into the Golden Triangle, famous for its large copper-gold deposits. The Red Chris mine was the first mine to use power from the line in the fall of 2014.

Now the provincial government plans to extend the Northwest Transmission Line further north to what Gratton called the “Copper corridor”. The line is expected to go live by the summer of 2026.

“We may not have found the same quantities of copper that Chile has, but there’s a lot more in Canada that remains untapped,” said Gratton.

Canada has identified 34 critical minerals, with BC supplying more than a dozen. There are 17 proposed critical-mineral mines and five precious metal-mines in advanced development.

As the Globe and Mail reported in October:

It’s British Columbia’s big bet: The publicly funded infrastructure project is meant to secure new private-sector investments, including a string of critical-mineral mines, for the sparsely developed northwest corner of the province…

Michael Goehring, president and chief executive of the Mining Association of BC, said the NCTL project will tip the scales in favour of 15 critical-mineral and precious-metal projects that require certainty of electricity supply before they proceed.

“This is a nation-building project that will bring clean electricity to mining projects in northwest and central B.C.,” Mr. Goehring said in an interview Sunday. “It will strengthen Canada’s position as a leading global supplier of critical minerals and metals, and it will unlock more than $45-billion in near-term economic activity for British Columbians – and all Canadians.”

The federal government’s budget, waiting to be passed by the House of Commons with a potential election on the line, commits $2 billion over five years to launch a Critical Minerals Sovereign Fund, and $371.8 million for a new First and Last Mile Fund to help get near-term mining projects into production.

Porphyries

The mining industry is on the hunt for large copper deposits that have favorable grades and are in locations amenable to mine developments.

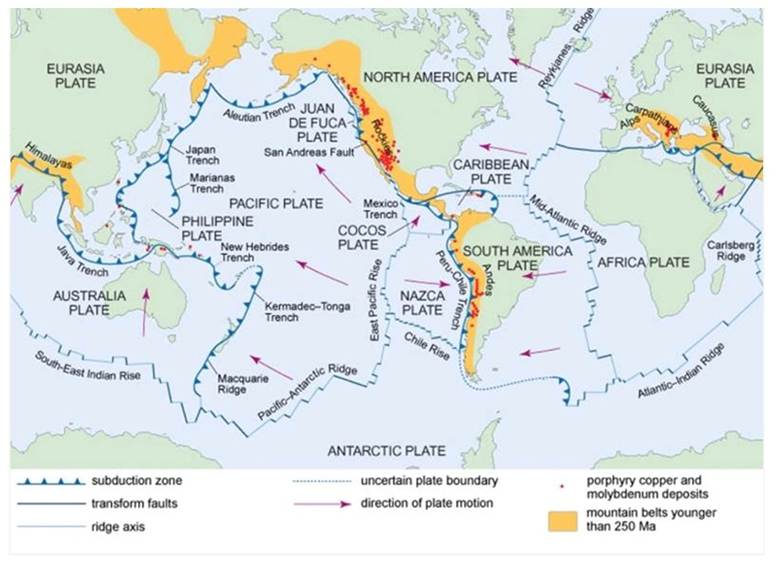

Over 80% of the world’s copper production comes from large-scale open-pit porphyry copper mines.A porphyry deposit is formed when a block of molten-rock magma cools. The cooling leads to a separation of dissolved metals into distinct zones, resulting in rich deposits of copper, molybdenum, gold, tin, zinc and lead. A porphyry is defined as a large mass of mineralized igneous rock, consisting of large-grained crystals such as quartz and feldspar.

Porphyry deposits are usually low-grade but large and bulk mineable, making them attractive targets for mineral explorers. Porphyry orebodies typically contain between 0.4 and 1% copper, with smaller amounts of other metals such as gold, molybdenum and silver.

Most porphyry copper deposits occur close to subduction zones around the Ring of Fire — the horseshoe-shaped Pacific Ocean basin where regular and sometimes dangerous earthquakes and volcanic eruptions occur. The Ring of Fire stretches 40,000 kilometers from the southern tip of South America, up the North and South American coasts to the Aleutian Islands, down the East and Southeast coasts of Asia, and ending in a boomerang-shaped arc off the eastern coast of Australia.

Copper porphyries were the first metallic deposits to be mined in open pits, starting in 1905 with the Bingham Canyon mine in Utah. Since 1970 over 95% of US copper production has come from porphyry deposits, and more than 60% of world annual copper production.

Among the largest copper porphyry mines are Chuquicamata (690 million tonnes grading 2.58% Cu), Escondida and El Salvador in Chile, Toquepala in Peru, Lavender Pit, Arizona and Malanjkhand, India, which has 145Mt at 1.35% Cu.

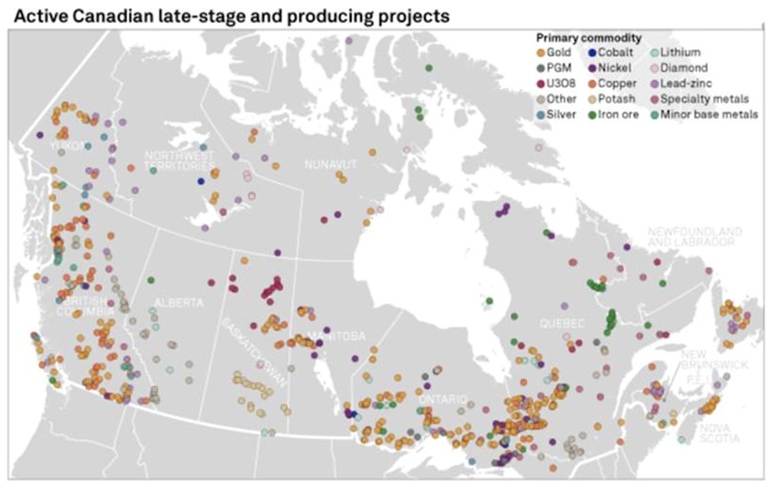

In Canada, British Columbia enjoys the lion’s share of porphyry copper/ gold mineralization. These deposits contain the largest resources of copper, significant molybdenum and 50% of the gold in the province.

Examples include big copper-gold and copper-molybdenum porphyries such as Red Chris and Highland Valley. Large, undeveloped porphyry deposits along the North American Ring of Fire include Galore Creek in BC and Northern Dynasty’s Pebble project in Alaska.

In the table below by GlobalData, via Mining Technology, we note that of 10 major operating copper mines in Canada, six are in BC.

Teck Resources’ Highland Valley is Canada’s largest open-pit copper mine; of the 39 copper mines in Canada, four of the top five are in BC. The following are the four largest copper mines by production in Canada in 2023, according to GlobalData’s mining database:

#1 Highland Valley, BC

#2 Gibraltar Mine, BC

#3 Copper Mountain Mine, BC

#4 Mount Milligan, BC

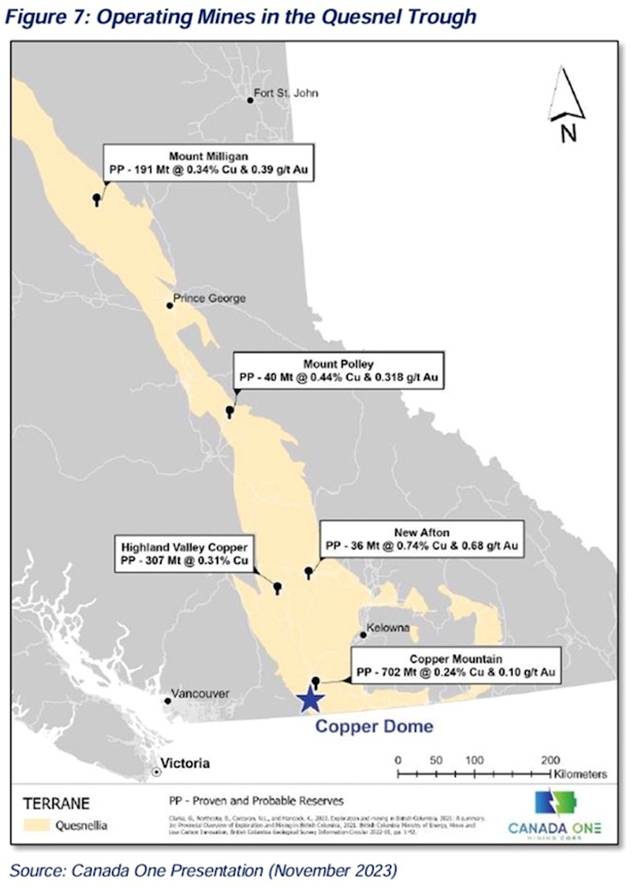

The abundance of copper (and gold) in the most westerly province is easily seen on the map below, of active Canadian late stage and producing projects. Notice the number of light orange (gold) dots and dark orange (copper) dots stretching from the US border through BC up to it’s northern border with the Yukon, that’s the Quesnel Trough.

The Quesnel Trough

The Quesnel Trough, also called the Quesnel Terrane, is a Triassic‐Jurassic aged arc of volcanic rocks that hosts several alkalic copper-gold porphyry deposits. Operating mines include Mount Milligan, Mount Polley, New Afton, Highland Valley and Copper Mountain.

The Quesnel Trough extends 1,500 kilometers from Washington State to the Yukon border. It is the longest mineral belt in Canada.

Active juniors

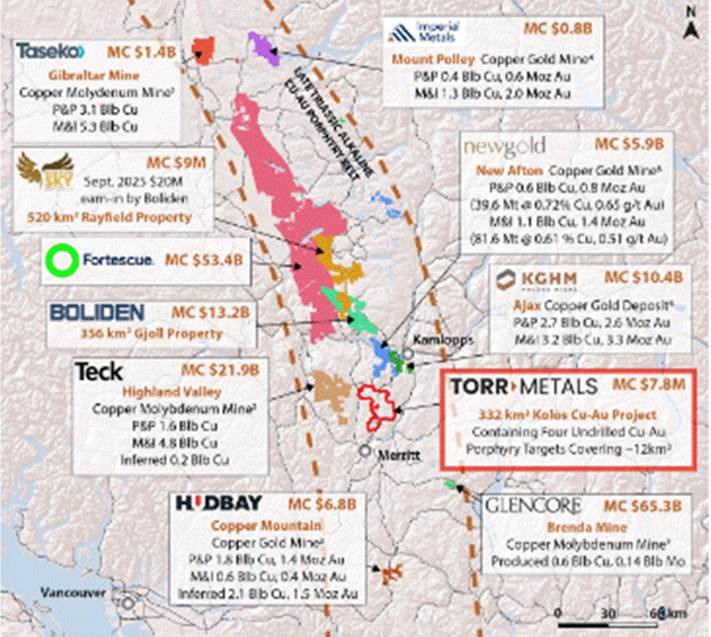

The Southern Quesnel Trough has the largest concentration of major mining companies in BC. That’s because they are looking for additional assets to supplement their reserves.

Perhaps there is no better indication of the majors’ new-found emphasis on copper than Barrick changing its name from Barrick Gold to Barrick Mining.

As shown on the map below, there are at least nine major or mid-tier mining companies operating within the Late Triassic-Alkaline Cu-Au Porphyry Belt, including Taseko (Gibraltar mine), Boliden (Gjoll project), Teck (Highland Valley mine), Hudbay Minerals (Copper Mountain mine), Imperial Metals (Mount Polley mine), New Gold (New Afton mine), KGHM (Ajax project), and Glencore’s shuttered Brenda mine.

But the New Afton mine will be out of ore in just six years.

Any significant new discovery would be a large potential discovery on its own but could also act as additional mill feed for these mines.

Remember, the juniors own the deposits that will become the world’s future mines. For years junior miners were starved for cash, the institutional and retail investment sectors essentially lost interest. Thankfully that has changed and money is flowing back into the sector.

According to Bloomberg,

- Mining and metals companies across North America have raised $2.9 billion across 185 deals, marking the largest monthly volume for sales of new shares by public companies in the sector since November 2013.

- Gold and silver companies account for a third of the number of October’s stock sales, and investment bankers say appetite for more deals has been consistently strong, with almost everything being oversubscribed.

- Investors, bankers and analysts expect more deals to come, with a “plethora of junior miners” dominating the activity in the market, and institutions having a large appetite for the shares, which is seen as a welcome sign and a vote of confidence from investors.

The following junior mining companies are operating in the Quesnel Trough, starting with AOTH’s three advertising sponsors:

Torr Metals (TSXV:TMET)

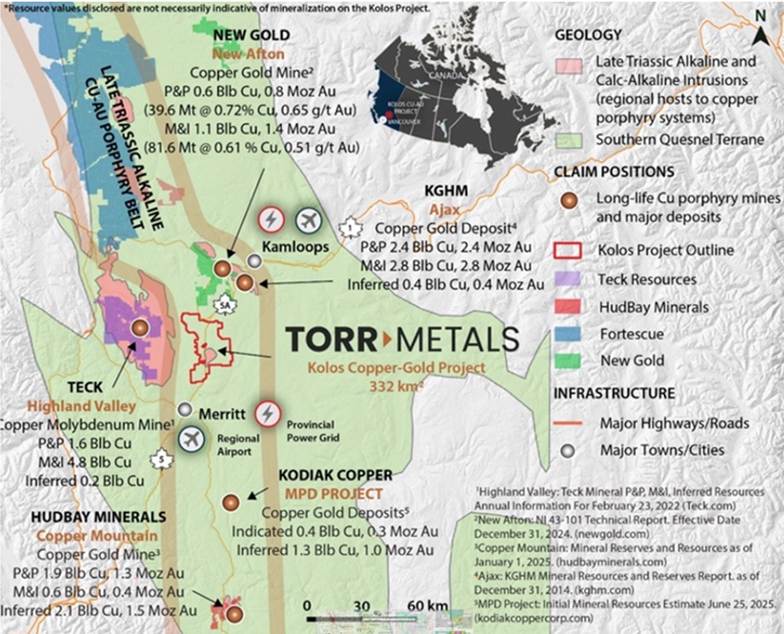

Torr Metals’ 332-square-kilometer Kolos Copper-Gold Project (including the 57 km² Bertha property optioned in March 2025 for full ownership) in BC contains Nicola Belt geology along trend and with similar attributes to alkaline and calc-alkaline copper ± gold ± molybdenum porphyry mines at Copper Mountain, Highland Valley and New Afton.

The project is adjacent to Highway 5, the Coquihalla Highway, with year-round access and operation potential via forestry service roads and substantial infrastructure provided by the city of Merritt located 23 km to the south. The project contains 16 historical copper and gold occurrences, the majority never drill-tested.

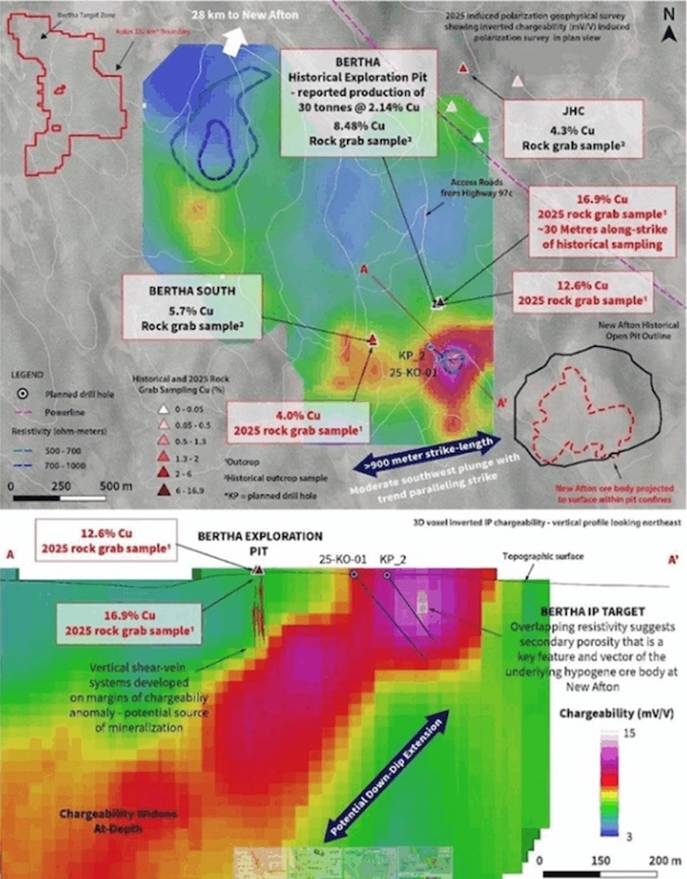

In total, Torr has identified four undrilled copper-gold porphyry targets at Kolos — Sonic, Bertha, Kirby and Lodi — with surface geochemical anomalies covering a combined 11.8 km². Bertha, Kirby, and Lodi are fully drill-permitted, while Sonic is in the permitting phase.

In August 2024 Torr Metals made a discovery that both confirmed the exploration methodology, and introduced a fascinating analog.

Final assay results from a total of 33 rock grab samples collected during 2024 reconnaissance programs revealed additional high-grade rock grab assays within the Kirby, Rea and Clapperton zones, as well as a new copper-gold discovery in the northern portion of the project that Torr termed the Sonic Zone.

CEO Malcolm Dorsey for the first time referenced New Afton as a potential comparable to the Kolos Copper-Gold Project:

“The discovery of the Sonic Zone is particularly promising, as it opens up a new area of mineralization that bears geological similarities to the high-grade New Afton copper-gold porphyry deposit, located just 27 km to the north,” he said.

The following three paragraphs are from the July 8, 2025 news release:

“The Bertha Zone represents a highly prospective, underexplored high-grade copper target where recent fieldwork has confirmed supergene-style copper mineralization, primarily sooty chalcocite, native copper, and malachite nodules hosted within brecciated volcanic rocks. This style and setting are geologically significant and comparable to the supergene enrichment zone at New Afton, located just 28 km to the north.”

“Supergene mineralization happens when copper-rich fluids from deeper underground move up through cracks in the rock, usually helped by rainwater or groundwater. As these fluids rise closer to surface, they interact with oxygen and other elements. This chemical reaction causes high-grade copper minerals, like chalcocite, native copper, and malachite, to form near surface.”

“At New Afton, the presence of a well-developed supergene blanket, characterized by abundant native copper and sooty chalcocite, was critical to the early economic success of the mine. This zone accounted for approximately 80% of the initial orebody, enabling low strip ratios, enhanced metal recoveries, and early cash flow. It overlies a deeper primary hypogene copper-gold porphyry system hosted within the Cherry Creek intrusion of the Iron Mask batholith, where brecciation and hydrothermal fluid pulses played a key role in both metal deposition and alteration zoning.”

I have been looking at these types of deposits in the southern Quesnel Trough for over 20 years. But no one has ever found another Afton. A well-developed supergene enrichment blanket superimposed on the hypogene mineralization is a target well worth chasing; Kolos appears to have it (although it is very early stage and needs to have more work), strengthening the potential comparison to New Afton. And let’s not forget at least three other large, already identified targets.

On Oct. 15 Torr announced it has started drilling the Bertha target. The inaugural drill program at Kolos is slated for 1,500 meters, up to seven holes, and is designed to test the 900m by 500m moderate-to-high chargeability induced polarization (IP) anomaly.

Under the Spotlight – Malcolm Dorsey, CEO, Torr Metals

Torr Metals starts drilling Bertha target at Kolos Copper-Gold Project – Richard Mills

Orestone Mining (TSXV:ORS)

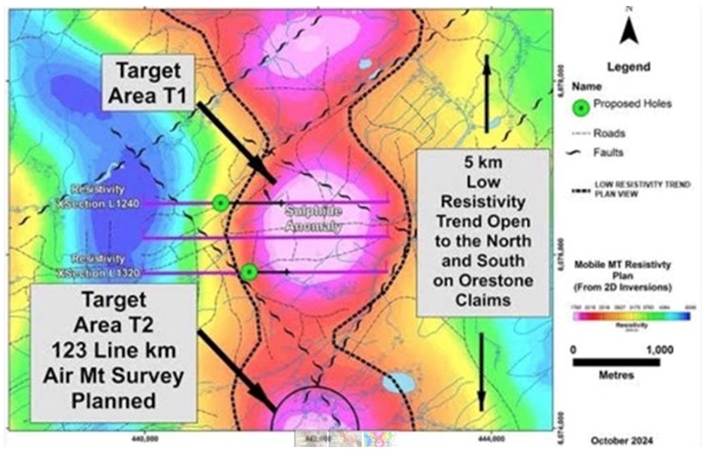

Orestone Mining has two of its three projects at the drill-ready stage: Captain in north-central British Columbia and Francisca in Salta province, Argentina.

The company’s 100%-owned Captain gold-copper project hosts a large, gold-dominant porphyry system that is permitted and ready to drill.

Captain is sited 150 km north of Prince George in the prolific Quesnel Trough, which hosts a number of copper-gold and copper-molybdenum porphyry deposits including the Mt. Milligan gold-copper deposit, 30 km north of Captain. The company currently controls 105 square kilometers in the politically safe jurisdiction of British Columbia. The area boasts year-round road access and excellent infrastructure.

Orestone has filed an amended Notice of Work (NOW) permit for an additional 23 drill locations at the Captain gold-copper porphyry property. The drill locations are on existing logging roads focused on the T2 target area which is a large target lying to the south of the primary T1 target along the same structural corridor. Drilling is anticipated in the first quarter of 2026.

Orestone’s near-term plans are to do more mapping and some resampling of the trenches. A recent check assay program revealed a lot of 4-6-gram material on surface, and they’ve planned where the first drill holes are going to be, but Hottman says they need to do a bit more confirmation before they start drilling.

A non-brokered private placement for up to $2 million at $0.08 per unit was announced on Oct. 14. Crescat Capital took down $232,000 of the financing, thereby maintaining its 11.64% ownership of ORS.

CEO David Hottman had this to say about the property, speaking with me on May 30:

“The Captain project is a target that was developed just south of the Mount Milligan mine and it’s about 120 kilometers northeast of the Blackwater deposit. It’s a project we’ve been exploring for a number of years.

The main target does not get exposed at surface, it’s below the sand and gravel moraine left from the last Ice Age so geophysics and drilling are the primary exploration methods to be used.

We have drilled a series of holes chasing the target and in numerous of the holes we have encountered porphyry dikes that are well-mineralized, in some cases over 100 to 200 meters. As I’ve mentioned in the past, they’re gold-rich so it’s more of a gold porphyry than a copper porphyry…

In 2022 we did a Magneto Telluric study which uses the magnetic field of the earth to help discern where metals are in the ground because that will disrupt the magnetic field. And so, the Magneto Telluric study indicated that the target was right in between a series of our drill holes that we had drilled on the edge of it on several different sides and intersected diking, but we need to now drill right down the center…

It’s an area that is quite large, the target would have the capability of being over a kilometer and a half long by about 500 to 750 meters wide, that’s enough room for a very major porphyry deposit and being gold-rich means there’s a potential to find a huge gold deposit here in BC.”

Orestone expands Francisca to 9 km2; announces $2M financing – Richard Mills

Under the Spotlight – with David Hottman, CEO Orestone Mining

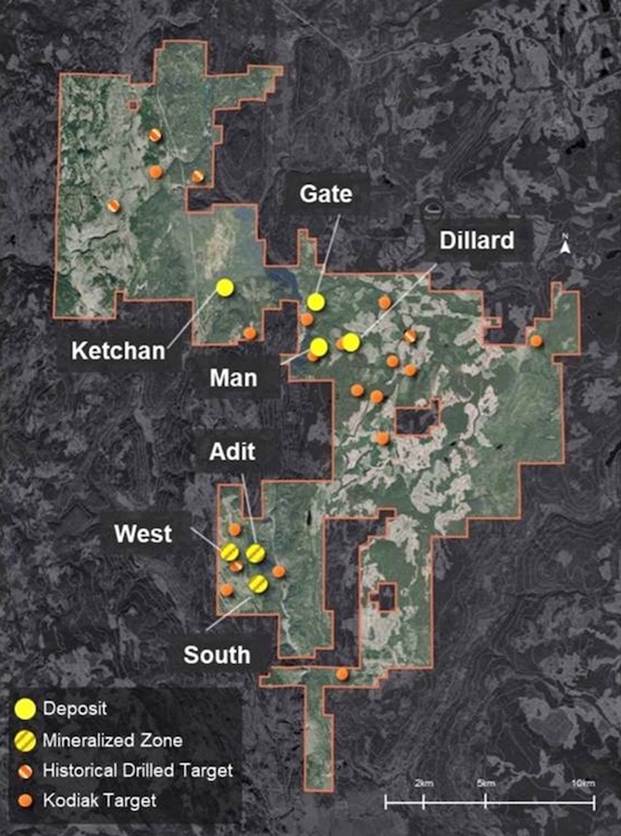

Kodiak Copper (TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1)

Kodiak Copper’s MPD Project is a 344-square-kilometer land package near several operating mines in the southern Quesnel Terrane, British Columbia’s primary copper-gold producing belt.

The company has published a partial initial resource estimate that comprises four of the seven mineralized zones: Gate, Ketchan, Man and Dillard. Between the indicated and inferred categories, the resource amounts to 1.676 billion pounds of copper and 1.21 million ounces of gold.

The 2025 drill program has focused on near-surface infill and confirmation drill holes at the West, Adit, and South zones using a combination of diamond and reverse circulation (RC) drilling.

A total of 44 holes and 5,003 meters was completed in mid-August.

Together with the resource estimate for the first four mineralized zones (Gate, Ketchan, Man and Dillard), this will complete the initial resource estimate for the MPD project — expected in Q4.

Results from nine drill holes at Adit were presented on Sept. 3.

Results from shallow infill drilling (10 holes @ 1,405m) at the West and South zones were presented on Sept. 22.

While the company has identified multiple zones, it remains committing to continued exploration to further grow the project, both through zone expansion and the testing of new targets.

On Sept. 25 Kodiak closed an oversubscribed $8 million bought deal private placement.

The company recently announced an expansion to its MPD copper-gold porphyry project in southern British Columbia, and the start of an additional metallurgical test work program to build on the maiden test results received in the second quarter.

The program, to be managed by JDS Energy with assistance from Kodiak advisor Mike Westendorf, will include composite samples from six deposits and mineralized zones at MPD: Gate, Man, Dillard, West, Adit and South (see Figure 1). The test work will focus on enhancing recoveries for copper and gold through gold characterization studies and the optimization of rougher and cleaner flotation processes. The results from the program are expected in Q1 2026 and will be used to support mineral resource definition work.

“We are pleased to initiate the next round of metallurgical test work, an important de-risking step as we advance our MPD Project,” Kodiak President and CEO Claudia Tornquist said in the Oct. 28 news release. “The program will build on the positive metallurgical results received thus far and is designed to optimize the recovery of both copper and gold, aiming to unlock further potential to enhance the project’s resource estimation and future economic prospects.”

Kodiak Copper expands MPD Project; Initiates next phase of metallurgical testwork – Richard Mills

Ahead of the Herd and Under the Spotlight – Claudia Tornquist CEO Kodiak Copper

Pacific Ridge’s flagship is the Kliyul copper-gold project, which hosts a significant inferred mineral resource and has several other targets along a 6-km trend. They are also exploring the RDP Project in the terrane.

Green River Gold is focused on its wholly-owned Fontaine Gold Project and Quesnel Nickel/Magnesium/Talc Project, which straddle a portion of the Quesnel and Barkerville Terranes.

CanAlaska Uranium has a copper-gold project (Mouse Mountain) located within the Quesnel Terrane.

Belmont Resources is exploring the Come By Chance (CBC) property, which they describe as a prime exploration opportunity for a porphyry copper-gold system in the southern Quesnel Terrane.

Golden Cariboo Resources has staked significant claims in the Cariboo Gold District, with projects underlain by the Nicola Group of the Quesnel Terrane, which is the host rock for several deposits in the region.

ArcPacific Resources: Owns the LMSL Copper Gold & Silver Project in the Quesnel Terrane.

Serengeti Resources holds several projects in British Columbia, including the East Niv Project, which is located off trend from the Kemess mine complex.

Metalero Mining focuses on the Benson Project, a large copper and gold exploration property in the Quesnel Trough.

ArcWest Exploration has the road-accessible Eagle project located between the Mt. Milligan mine and the Kwanika copper-gold project.

Eagle Plains entered into an option agreement for the MPW Copper-Gold Project with Tana Resources.

Westhaven Goldhas a large land package in the area with the Skoonka property showing high-grade gold results.

Northwest Copper has three projects in BC, bookended by the Mount Milligan mine and the Kemess project, both owned by Centerra Gold.

Golden Sky has an earn-in agreement on it’s Gjoll/Rayfield project with major copper miner Boliden.

Permanent structural supply problem

S&P Global produced a report in 2022 projecting that copper demand will double from about 25 million tonnes in 2022 to 50Mt by 2035. The doubling of the global demand for copper in just 10 years is expected to result in large shortfalls — something we at AOTH have been warning about for years.

Copper smashed a new record on Oct. 29, with the three-month futures contract on the LME reaching $5.57 a pound or $11,146 a ton.

Global copper consumption has increased steadily in recent years and currently sits at around 26 million tonnes. 2023’s 26.5 million tonnes broke a record going back to 2010, according to Statista. From 2010 to 2023, refined copper usage increased by 7 million tonnes.

Wall Street commodities investment firm Goehring & Rozencwajg quoted data from the World Bureau of Metal Statistics confirming that global copper demand remains robust, outpacing supply.

The shift to renewable energy and electric transportation, accelerated by AI and decarbonization policies, is fueling a massive surge in global copper demand, states a recent report by Sprott.

Increasing investments in clean technologies like electric vehicles, renewable energy and battery storage should cause copper demand to climb steadily, and challenge global supply chains to meet this demand.

The IEA warns of a potential 30-40% supply shortfall by 2035 if no significant new supply comes online.

BHP points to the average copper mine grade decreasing by around 40% since 1991. The next decade should see between one-third and one-half of the global copper supply facing grade decline and aging challenges. Existing mines will produce around 15% less copper in 2035 than in 2024, states the company.

“Most of the high-grade stuff’s already been mined,” says Mike McKibben, an associate professor emeritus of geology at University of California, Riverside, quoted by NPR. “So, we have to go after increasingly lower grade material” that costs more to mine and process.”

2025 was a particularly bad year for copper mine disruptions.

Along with Grasberg’s “force majeure” closure, there were interruptions at Hudbay Minerals’ Constancia mine in Peru due to political protests; seismic activity caused flooding at the Kakula mine in the DRC owned by Ivanhoe Mines; and in Chile, port and mill disruptions hit two Teck Resources’ operations, and a tunnel collapse at Codelco’s El Teniente mine resulted in six fatalities and halted activities for over a week.

Reuters metals columnist Andy Home wrote that “next year is when the copper market looks set to feel the full impact of this year’s string of mine supply shocks.”

The copper market is expected to face its most severe deficit in 22 years in 2026 —590,000 tons — according to Morgan Stanley.

The deficit could widen by 2029 to a whopping 1.1 million tons.

This comes as global annual copper production is on course to contract for the first time since 2020.

Surging demand from AI data centers, renewable energy projects, electric vehicles, and all the traditional uses of copper is expected to outpace supply. This has analysts turning bullish on copper. Citigroup is calling for prices to hit $12,000 a ton ($6/lb) in the first half of next year, a level never seen before.

Vedanta Group Chairman Anil Agarwal was recently quoted saying we are now entering the ‘New Copper Age’:

“Copper has a very close association with the advance of human civilisation, and our ancient India. Around 6,000 years ago, the Indus Valley Civilisation, one of the world’s first great civilisations, came up in the Copper Age, when we learnt to use the red metal for the first time. I believe we are now entering a New Copper Age,” he said, adding that all the technologies of the future, including artificial intelligence or energy transition are all underwritten by massive amounts of copper.

Conclusion

Now is an ideal time to explore for copper in the Quesnel Trough, the largest collection of copper deposits in British Columbia and Canada.

Of the 39 copper mines in Canada, four of the top five are in BC: Highland Valley, Gibraltar, Copper Mountain and Mount Milligan.

All are located within the Quesnel Trough which extends from Washington State to the Yukon border. It is the longest mineral belt in Canada.

The largest concentration in BC, of majors hunting for additional assets to supplement their reserves, is in the southern Quesnel Trough. No fewer than nine major mining companies are active there.

Juniors play a very important role in the mining ecosystem: they own the deposits that will become the world’s future mines. Their role is to identify deposits, then develop them, through prospecting, sampling, geochemical and geotechnical surveys, and drilling, to the point where they have enough size and scale to be bought out by a major or mid-tier. Few juniors have the financial resources to go mining.

Among the many prospective junior resource companies operating in the Quesnel Trough, we highlighted three: Kodiak Copper, Orestone Mining and Torr Metals. Investors are advised to do their own due diligence when picking mining stocks.

The shift to renewable energy and electric transportation, accelerated by AI and decarbonization policies, is fueling a massive surge in global copper demand. But mines can’t keep up.

Due to a number of mine interruptions and closures this year, the copper market is entering a deficit for the first time since 2020.

The IEA warns of a potential 30-40% supply shortfall by 2035 if no significant new supply comes online.

The average copper mine grade has fallen around 40% since 1991.

There has been a lack of investment in new large-scale “greenfield” projects to meet future demand.

Shon Hiatt, a business professor at the University of Southern California, said, “It’s projected that in the next 20 years, we will need as much copper as all the copper that has ever been produced up to this date.”

These factors indicate that the market has entered a period of structural supply challenges that are unlikely to be resolved quickly, suggesting a prolonged period of market tightness and higher prices.

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Kodiak Copper TSX.V:KDK). Richard owns shares of Torr Metals (TSX.V:TMET) and Orestone Mining (TSX.V:ORS). ORS, KDK and TMET are paid advertisers on his site aheadoftheherd.com

This article is issued on behalf of KDK, ORS and TMET.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.