The Fed has lost control of inflation

2021.11.05

The US Federal Reserve has done what market participants widely expected it would do, on Wednesday approving plans to begin scaling back its bond-buying program this month, and end it by next June.

The Fed has been purchasing $120 billion per month in Treasuries and mortgage-backed securities in an effort to steer the economy through the pandemic and keep interest rates close to zero. Since March 2020, the Fed’s holdings of these securities has more than doubled to around $8 trillion.

But with the economy improving and unemployment falling to 4.8% from a scary 14.7% during the darkest days of covid-19, the central bank has been pressured to “taper” its bond purchases. In fact there have been calls to activate two of the Fed’s tools to deal with rising inflation — reduce bond purchases and hike interest rates.

Both actions are bad for the gold price which tends to shine when interest rates fall (unlike stocks and bonds gold does not offer a dividend or interest-bearing yield) and is tarnished when rates rise. Moreover, because gold is a hedge against inflation/ currency devaluation, the precious metal is often chosen by investors as a place to park their money when the prices of goods and services are rising, like currently. Even the hint of rising inflation generally pushes bullion prices higher.

There has been a vigorous debate going on in the financial press concerning whether inflation is “transitory” or “sticky”. The answer is important as it will guide the Fed’s timing of an interest rate hike, or series of hikes, which it typically does to tame inflation, if it goes beyond the Fed’s 2% target.

At AOTH we fall squarely in the “sticky” camp. More on that later. For now we need to understand a bit more what the Fed is planning.

The Federal Open Market Committee (FOMC) decided on Wednesday to begin reducing the monthly pace of its net asset purchases by $10 billion for Treasury securities and $5 billion for mortgage-backed securities.

Along with the $15B tapering announcement, the Federal Reserve also kept interest rates in the zero-bound range, in line with market expectations.

According to the Wall Street Journal the Fed doesn’t want to lift rates until after they have ended bond purchases. That would mean the earliest interest rate increase is next June.

Bloomberg wrote just before the two-day meeting that [Fed Chair Jerome] Powell will be at pains to separate the tapering decision from a signal that the Fed is in a hurry to raise rates, avoiding a re-run of the 2013 “taper tantrum” under then-Chairman Ben Bernanke, which caused damaging swings in financial markets. Powell was a Fed governor during that period and has repeatedly said that the lessons from 2013 have been learned.

Back to inflation.

The Fed’s official line is that inflation is “transitory” based on supply chain disruptions resulting from the pandemic. However there are signs that Fed officials are less beholden to this position and more willing to accept that inflation is going to be harder to shake than earlier thought.

In the above-mentioned Bloomberg story, it was reported that FOMC members may revise the characterization in the statement of inflation from “largely reflecting transitory factors” to acknowledging it’s lasting longer and has the potential to linger at high levels…

“They have backed away from transitory,” said Vincent Reinhart, chief economist and macro strategist at Mellon and a former Fed director of monetary affairs. “To use the word transitory would come across as tone deaf.”

An earlier Fed statement said, “Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors.”

At the close of their two-day meeting, Fed officials still said that elevated inflation would fall because high readings (US CPI is currently 5.4%, core inflation is 3.6%) are “largely reflecting factors expected to be transitory.”

“Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation,” part of the statement said.

However even Powell admitted that “Supply-side constraints have gotten worse. The risks are clearly now to longer and more-persistent bottlenecks, and thus to higher inflation.”

In late October both Powell and Treasury Secretary Janet Yellen warned that high inflation could extend into late 2022.

Before leaving the Fed, one more point is relevant. The Federal Reserve quotes “core inflation”, which strips out food and energy prices because they are supposedly too volatile. In doing so the inflation rate as quoted by the official source is underestimated. This is important to recognize because not only are food and energy (i.e., heat, electricity) basic to human survival — people need to eat and stay warm or cool regardless of their costs — they also happen to be rising the most.

Supply issues predate covid

Michele Schneider, managing editor at MarketGauge Group, suggests that covid is “the straw that broke the camel’s back” of the supply problem but explains that the prices of a number of commodities, including metals, energy and agricultural products, were low a few years ago. This caused miners and oil producers to cut production and farmers to reduce their harvests, as is normal in a bear market. When the pandemic hit, we therefore had relatively low supplies, that when combined with very accommodative Fed policies (low interest rates, QE) and high demand coming out of the pandemic, including a “hoarding mentality”, resulted in elevated inflation.

“People think that it’s transitory, we’ve heard that word over and over again but we don’t believe that’s the case. We really believe we’re looking at this is just beginning and all of this volatility is just a part of that, extending probably into 2023 perhaps even 2024,” she told BNN in a Nov. 1 video interview.

Killing King Coal

If we take just one important aspect of rising prices, energy inflation, and follow it through to fertilizer price hikes and food inflation, we can see how these things are connected.

In September China vowed to stop building coal-fired power plants abroad, to help combat climate change, an activity it has supported by financing coal projects in countries like Vietnam and Indonesia under its Belt and Road Initiative (BRI).

About half of Europe’s coal plants are gone or slated to close soon. Up to half of the UK’s electricity came from coal in the mid-2000s; today practically none does. Same with Denmark.

Canada, meanwhile, will reportedly ban coal exports by 2030 as part of the global effort to banish harmful coal emissions. The decision was made at the COP26 climate summit in Glasgow, where a statement from the Prime Minister’s Office read, “This investment will lead to the successful implementation of country-level strategies and associated kick-start projects, build support at the local and regional levels, and accelerate the retirement of existing coal mines and coal power plants, while enabling new economic activities and contributing to a socially inclusive and gender equal transition.”

That last part was included as a joke. It’s not all puppies and rainbows, however.

Because of too massive, too fast of a shift to renewables and a de-investment in fossil fuels, before renewable energy is ready to take the place of oil, natural gas and coal, electricity prices are 500% higher than normal in Europe, and in China, record-high prices of coal and NG have squeezed economic growth in the world’s biggest commodities consumer.

In short, the climate crisis has turned into an energy crisis.

Flooding across China’s key coal-producing provinces, resurgent demand for Chinese goods in the wake of pandemic easing, and market distortions including power rationing and price controls, are behind an energy shortage that has pushed coal and natural gas prices to record highs. Emergency power rationing is triggering concerns that households and factories could be left without power as temperatures plunge.

In Europe, a colder-than normal last winter depleted natural gas inventories, causing electricity prices to soar, as demand from rebounding economies surged too fast for supplies to match.

The price of NG is currently six times higher than last year and about four times higher than it was in the spring.

As governments and institutional investors divest themselves of funds that traditionally flowed into fossil fuels, i.e. coal/ oil & gas producers, or pipeline infrastructure, they are trying to bring on renewables to replace the lost output.

However, with no easy way to store the energy generated from renewables, utilities are finding they must continue to utilize “dirty” coal and natural gas, despite commitments to lessen their dependence on fossil fuels to fight climate change.

As Bloomberg puts it, In other words: A strained global gas market triggered Europe’s record-setting spike for electricity prices — and the transition amplified it.

The problem isn’t about to sort itself out anytime soon, because even though solar and wind power are getting less expensive, many parts of the world still depend on coal and natural gas as a primary source, or as a backup.

The obvious example is the United States. With 40% of the country’s electricity now generated by NG, higher gas prices will inevitably push up electricity and heating bills. US natural gas futures have already more than doubled this year.

Remember the key dilemma: investors are actively dumping coal and oil stocks, and instead are putting funds into cleaner, greener renewables, even though the intermittency factor and the infancy of battery storage technology means we are a long ways from replacing fossil fuels.

Meanwhile power consumption is projected to increase 60% by 2050, according to Bloomberg New Energy Finance, driven by continued economic and population growth.

Beyond natural gas and coal, other energy products have been rising and are threatening to hit the consumer where it hurts — at the gas pump. Oilprice.com reports the global average price of gasoline has doubled over the last 20 years, and that motorists across Europe and Asia can expect high petrol and diesel costs well into the winter, as Brent crude stays around $85 a barrel.

Higher transportation costs have made their way up the food supply chain.

Average food prices are at a decade high (costing around a third more this September than last) and while rising fuel costs can’t be wholly blamed for escalating food inflation, if transport and farming costs continue to rise, our food bill is likely to keep climbing, writes Felicity Bradstock for Oilprice.com. She concludes:

One thing’s for certain, it’s going to get worse before it gets better. Those working in agriculture and industry are already taking the hit and it’s only a matter of time until this price burden is shifted to the consumer, not only at the pump but across a multitude of areas of our daily lives.

Fertilizer frenzy

We agree and one of the best examples is fertilizer.

Higher fertilizer prices are usually passed onto the buyer of fruits and vegetables, for the grower to preserve his profit margin. This is precisely what we see happening right now.

Recently the Green Markets North American Fertilizer Index hit a record high, rising 7.9% to US$996.32 per ton, and blasting past its 2008 peak. According to BNN Bloomberg, the fertilizer market has been smoked this year due to extreme weather, plant shutdowns and rising energy costs — in particular natural gas, the main feedstock for nitrogen fertilizer.

In Europe, surging natural gas prices have forced a number of nitrogen-fertilizer plants to halt or curtail production.

Green Markets says expensive fertilizer could push US corn farmers’ cost of production costs 16% higher. It could also mean smaller corn crops as some farmers look at switching to soybeans. Corn futures in Chicago haven risen more than 10% since mid-October, driven by concerns over fewer plantings.

Canadian grain farmers say the fertilizer rally “could not be any worse” after many saw their profits tumble this past growing season due to a severe drought that withered crops. With rising fertilizer prices adding an extra C$40-50 per acre, some may decide to plant crops requiring less of the stuff, like lentils.

Higher fertilizer costs are affecting farmers at a particularly bad time, as their crops are being ravaged by droughts and pandemic-related shortages that have interrupted normally smooth supply chains that deliver food from farm to table.

Bloomberg explains how the energy crunch has led to a fertilizer crisis that puts major staple crops including corn, rice and wheat in jeopardy, and has sent the Bloomberg Grains Spot Subindex up about 4% in the past month:

Nitrogen-based fertilizers, the most important crop nutrients, are made through a process dependent on natural gas or coal. Those fuels are in extremely tight supply, forcing fertilizer plants in Europe to cut back on production or even, in some cases, close. Meanwhile, China has curbed exports to ensure enough domestic supply. That’s on top of elevated freight rates, increased tariffs and extreme weather, all of which have disrupted global shipments.

It’s hard to overstate the importance of fertilizer to the food supply. Nearly every plate of food you touch has gotten there with the help of fertilizers. Even organic foods use animal manure and other nutrients. But it’s synthetic fertilizers that are widely credited for how the world gets fed.

Since we first started making synthetic fertilizers a little more than a century ago, the planet has gone from roughly 1.7 billion people to about 7.7 billion, largely thanks to enormous growth in crop yields. Some experts have even estimated the global population might be half of what it is today without nitrogen fertilizer.

With fertilizer markets now seeing unprecedented supply shocks and record prices, it means even more food inflation across the world.

Benchmark wheat prices are their highest since 2012, coffee is near multi-year highs and corn jumped 140% from May 2020 to May 2021.

A third of Brazil’s coffee farmers don’t have enough fertilizer, and in the US, some corn growers are having to pay more than double what they paid for fertilizer last year. Rice farmers in Thailand are asking the government to intervene. A ton of fertilizer there is now more expensive than a ton of rice.

Two of the world’s top fertilizer producers, Nutrien and Mosaic, have said they expect the price surge will continue, according to Bloomberg.

“Farmers could pass the higher cost of fertilizers on to consumers in the form of lower crop production and the subsequent higher food prices,” the news outlet quoted Alexis Maxwell, an analyst at Green Markets.

Money-printing continues

Besides energy inflation and food inflation, another factor that cannot be discounted with respect to rising prices, is the large increase in the money supply.

Consider: “quantifornication” is still going on in the US, Britain and the EU, meaning that excessive money-printing is continuing to devalue currencies at an alarming rate (this, by definition, is inflation, because it takes more units of currency to buy the same amount of goods as before).

Trillions more in economic recovery spending is promised, with little concern over the mounting debt pile.

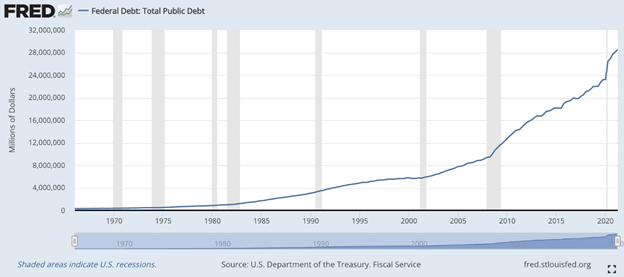

The now-almost $29 trillion national debt doesn’t include what the Biden administration has already spent on pandemic relief ($1.9T). It doesn’t include the two major spending bills totaling $2.8 trillion being debated by Congress, and it also excludes the $3T deficit on Biden’s proposed $6 trillion budget.

The Congressional Budget Office (CBO) is projecting that with all of this year’s spending, the national debt in 2021 could balloon to $35 trillion!

Conclusion

There is a historically close correlation between gold prices and debt to GDP. The higher the ratio, the better it is for gold.

As deficits grow and interest rates eventually rise, the CBO predicts the debt to GDP ratio could reach 202%, from the current 125%. At that rate, for every dollar the US economy produces, $2 is borrowed.

Remember, we have monetary easing happening at the same time as fiscal spending “carte blanche”, courtesy of Modern Monetary Theory, or MMT.

Meanwhile the fear of inflation continues to keep gold prices buoyant, with gold seen as an inflation hedge.

The precious metal hit a record-high $2,030 per ounce in August 2020, and has proven to be remarkably resilient to downward price pressures, including a stronger US dollar and a rising US 10-year Treasury yield. Since dropping to a one-year low of $1,700 in March, gold has regained nearly $70, trading at $1,769.30 at time of writing.

We are not the only ones who believe gold is just getting started for the next leg up.

David Garofalo and Rob McEwen — two of the biggest names in the Canadian mining industry — recently predicted investors will soon catch on that global inflationary pressures are far more intense than suggested, which could send gold prices to $3,000/oz from the current $1,750-$1,800 level.

Other esteemed economists — the well-known Nouriel Roubini is one — have warned that inflation is actually worse than we think and that stagflation is quite possible. Stagflation is what happens when rising inflation occurs amid a recession.

USA Gold ran an article about gold and “The Misery Index” — a combination of economic stagnation and runaway inflation — arguing that stagflation could force a “macro rotation into the precious metals sector.”

The chart above shows the Misery Index and gold from 1971 to present. The two variables correlated closely during the 1970s stagflation, in the 2008 financial crisis and the pandemic-driven breakdown. How to account for the divergence over the last year and a half? The piece says it probably has to do with the fact that Wall Street has largely bought into the Fed’s contention that inflation is temporary. If however inflation and unemployment persist, i.e., if the Misery Index keeps advancing, that lag on the chart might prove to be temporary. MKS Switzerland’s Nicki Shiels advises that a “stagflation would force a macro rotation out of typical reflation assets or commodities like oil and copper, and into the precious sector.”

How to protect our hard-earned dollars in this environment? We know that holding gold or silver is the best insurance against inflation or possible stagflation.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.