Sprott favorite Freegold Ventures continues to ascend Golden Summit

2021.08.31

In the United States, real yields on government bonds are currently negative and have been for some time. The 10-year Treasury note offers a yield of just 1.3% and the current rate of inflation is 5.4%, making real interest rates -4.1%. Longer-term US Treasuries offer slightly higher yields of 1.84% (20-year) and 1.91% (30-year), resulting in negative real rates, respectively, of -3.56% and -3.49%. The Canada 10-year savings bond offers 1.18% against the July inflation rate of 3.7%, the biggest jump in a decade, leaving a -2.52% negative real yield.

American and Canadian investors have not yet caught onto the fact that negative real interest rates are a buy signal for gold, but it’s a different story across the Atlantic.

In July, according to the World Gold Council, gold exchange-traded funds (ETFs) in Europe, particularly Germany and the UK, added 17.1 tonnes, offsetting North American fund outflows of 7.3 tonnes, leaving global ETF inflows positive at 11.1 tonnes.

Germans ever-mindful of Weimar-era hyperinflation 100 years ago are buying physical gold, snapping up bars and coins at the highest rate since 2009. Real yields in Germany are currently sitting at -4.25%. A Bloomberg story last week quoted WGC data saying that H1 demand for bars and coins in Germany increased by 35% compared to the previous six months, with Germans pouring into the metal as a hedge against rising inflation.

Real rates are also negative in the UK, with 2% inflation in July subtracted from the Bank of England’s 10-year bond yield leaving -1.33%.

Inflows among European gold ETFs were driven by the European Central Bank’s (ECB) pledge to keep monetary policy supportive of growth (ie. low interest rates, quantitative easing), whereas outflows in North America were almost entirely driven by large US funds, the gold council states.

Negative real yields and gold

Several factors influence gold prices (mainly the US dollar, gold ETF inflows/ outflows, inflation rate, bond yields, safe haven demand, physical gold demand, gold supply) but none is more reliable than real interest rates.

The demand for gold moves inversely to interest rates — the higher the rate of interest, the lower the demand for gold, the lower the rate of interest the higher the demand for gold.

The reason for this is simple, when real interest rates (interest rate minus inflation) are low, at, or below zero, cash and bonds fall out of favor because the real return is lower than inflation. If you are earning 1.6% on your money from a government bond, but inflation is running 2.7%, the real rate you are earning is negative 1.1% — an investor is actually losing purchasing power, Germans understand this, most Americans and Canadians do not. Gold is the most proven investment to offer a return greater than inflation, by its rising price, or at least not a loss of purchasing power.

Negative real rates are one good reason we at AOTH continue to feel good, despite a couple of recent dips, about gold (and silver). Another is the resurgence of the coronavirus.

Despite mass inoculation programs in many countries that have successfully limited the spread of earlier covid-19 strains, the highly transmissible delta variant is threatening to up-end progress made in both controlling the pandemic and allowing economies to re-open.

The US is seeing 142,000 new cases per day, and while that is 44% lower than the seven-day moving average peak observed on Jan. 10, 2021, it is 1,117% higher than the lowest daily case rate reported on June 18.

First detected in India last October, delta has been found in more than 130 countries according to the World Health Organization. It is twice as contagious as the first strain of covid and 50% more transmissible than the alpha variant originating in the UK.

Epidemiologists are also finding delta is resistant to vaccines, including in countries with some of the highest vaccination rates, such as Israel.

Last week during a speech at Jackson Hole, Wyoming, US Federal Reserve Chairman Jerome Powell appeared less certain than in previous comments, about whether the Fed would “taper” its monthly $120 billion bond purchases. While Powell said there is still the potential for a taper this year, he noted there is uncertainty regarding the alarming spread of the delta variant.

Powell’s lack of clarity saw investors clamoring for the safety of gold and other precious metals, spurred on by a drop in the US dollar index, under 93. Many observers expect the trend to continue, including Sprott Mining portfolio manager Conor O’Brien, business partner and confidente of billionaire resource investor Eric Sprott.

Interviewed last week by Sprott Money host Craig Hemke, O’Brien named three stocks Sprott is most bullish on, including one of AOTH’s top picks in the junior gold space, Freegold Ventures (TSX:FVL, OTCQX:FGOVF).

Freegold Ventures

The company is simultaneously progressing two drill programs this year, one at the advanced-stage Golden Summit project and another recently started at the Shorty Creek copper-gold porphyry project.

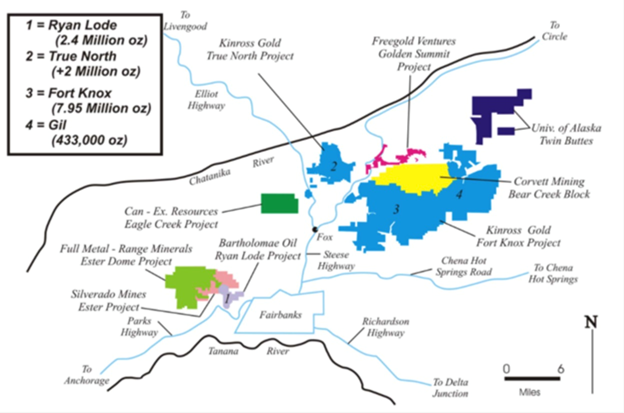

A large, bulk tonnage gold project with significant room for expansion, Freegold’s flagship Golden Summit property is a 30-minute drive from the city of Fairbanks, the second-largest city in Alaska. Fairbanks serves as a major population and supply center for the state’s interior region.

To date, over 80 gold occurrences have been documented within the project boundaries. Historical records show that 6.75 million ounces of placer gold have been produced from the streams draining Golden Summit.

Freegold acquired an interest in the project in mid-1991 and subsequently conducted exploration including geological mapping, soil sampling, trenching, rock sampling, geophysical surveys and drilling.

Drilling by Freegold between 1991 and 2009 totaled 26,902 metres of core and reverse circulation drilling in 214 holes, and 26,640 metres of rotary air blast drilling in 2,028 holes, before a comprehensive property compilation was completed in 2010. This compilation identified the potential to delineate a resource in what is known as the Dolphin area.

A ground-based geophysical survey was also undertaken, which indicated that the alteration in the Dolphin area is well defined by a low resistivity feature. This resistivity survey, in conjunction with soil geochemistry and re-interpretation of previous drill results, provided guidance for resource definition and expansion.

An extensive drilling campaign was carried out by Freegold during 2011-13, from which the company was able to delineate and upgrade the mineral resource through successive drilling in and around the Dolphin area.

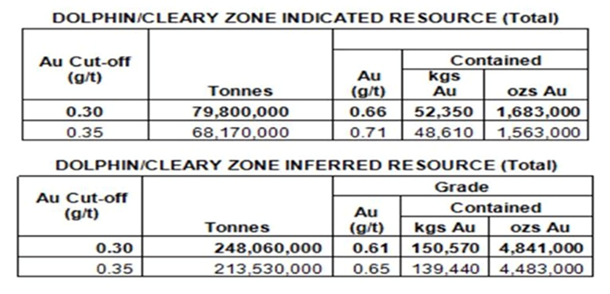

The Golden Summit property has seen continual resource expansion since the inaugural 2011 resource was issued. In 2013 Freegold published a non pit-constrained resource of 6,524,000 ounces of gold as categorized below.

The Dolphin Stock resource is contained predominantly within a uniform intrusive granite body with a modest grade of about 0.63 grams per tonne gold but remains wide open for expansion. In fact, the 2020 hole 1 discovery, discussed below, collared just north of the resource, proved there may be a much higher-grade, bigger prize potential in the sediments surrounding the intrusive to add to that 6.5Moz.

In January 2016 Freegold completed a preliminary economic assessment (PEA) for a conceptual pit using a 0.30 grams per tonne cut-off grade, and demonstrated 2,947,000 ounces of gold at an average grade of 0.69 g/t as broken out below.

The study showed that just this small part of the deposit would produce 98,000 ounces gold per year for 24 years, with peak production of 150,000 ounces at a cash cost of $842/oz using only a $1,300 gold price. A key parameter was the operating cost per tonne of just $18.11 for the sulfide ore and only $14.90/t for the oxide ore.

The PEA also indicated that the first phase of production postulates a heap leach operation for the oxide ore (as did the Fort Knox comparison which sits 5 km southeast) with estimated capital costs of only $88 million that would last for 8 years. There are 528,000 ounces in the first phase of oxide production at an average grade of 0.63 grams per tonne gold.

A drill program that started in early 2020 was designed to test a revised interpretation, based on Freegold’s work that higher-grade mineralization may extend to the west of the old Cleary Hill mine workings in an area of limited previous shallow drilling.

New discovery

On May 6, 2020, Freegold announced results for GSDL 2001, hole 1 with 257m of 2.94 grams per tonne gold including 188m of 3.69 g/t, which included high-grade sections of 2m of 169 g/t with the last 20m grading 9.87 g/t. The hole was collared just north of the mineralization in the PEA and drilled to the north.

The huge improvement in grade came from the altered sedimentary host rocks that surround the Dolphin intrusive. The drill holes showed pervasive silicification and veinlets throughout the sediments, as well as high-grade veins.

This exciting new discovery rocketed the stock to $1.95 per share but delays in the lab and covid precautions with a Canadian company operating in Alaska using Canadian drillers created extraordinary delays and Freegold’s share price has corrected significantly.

However, we’re finally getting a steady flow of news with the assay results from all 18 holes drilled in 2020 released, along with the first eight holes of the 2021 drill program.

Over 23,000 meters in 43 holes has been completed since drilling restarted in February.

2021 drilling focuses on the Cleary-Dolphin area, with approximately 40,000 metres planned in 80 holes. The program continues to test Freegold’s hypothesis that there is potential for a higher-grade corridor of mineralization that may extend from the area of the old Cleary Hill mine workings towards the Dolphin intrusive.

Infill drilling to upgrade and expand the existing resource categories is also being undertaken as well as cultural resource and environmental baseline work aimed at advancing the project through pre-feasibility.

Results for the first two holes of the 2021 program were released in June.

Hole GS 2101, drilled northeast of the contact with the Dolphin intrusive, continued to show very broad zones of greater than 1 g/t mineralization, with significant sections grading better than 1.5 g/t.

Hole GS 2108, drilled on the northern side of the Tolovana vein zone, intersected 41.1 metres of 3.99 g/t Au, within a broad zone of 296.3 metres grading 1.4 g/t Au.

Earlier in August, results from a further six holes (3,628.4 meters) were released, again intersecting mineralization above the resource grade.

The latest drill results are highlighted by GS 2122, which intersected 2.94 g/t gold over 111.2 metres, and GS 2121, which returned 609 g/t over 1.1m.

Visible gold was also identified in hole GS 2122 within narrow veins less than 20 cm wide, and in several other holes drilled in the vicinity of the Tolovana vein zone. Samples were taken and assays are pending.

In discussing the latest drill results from Freegold, Conor O’Brien, from Sprott Mining, noted that the lengthy 495m intercept from GS 2122, which assayed 1.17 g/t gold, contained several higher-grade intervals, including 3.6m of 26 g/t, 3m of 35 g/t, 3m of 20 g/t and 3m of 21 g/t.

He said investors could be misled into thinking that the 495m @ 1.17 g/t is a low-grade result. But if an average of the above-mentioned higher-grade intercepts is used, say 24 g/t, there is a big difference between 24 g/t and 1 g/t.

“The profitability in terms of the delta is 120 times different. So we’re hopeful for Freegold there is a much bigger high-grade story and a much more profitable high-grade story.”

He added, “They’re right beside Fort Knox (Kinross) who would be a natural acquirer and especially if a high-grade system ends up being proven out, like let’s say they have 15Moz but they’ve got 4-5Moz at call it 20 to 25 g/t, believe me there will be eyes looking at it.”

According to Freegold, 2021’s 40,000-meter drill program continues to test for the potential of a higher-grade corridor, effectively a vein swarm, consisting of multiple veins, veinlets and stockwork zones within areas of intense silicification and alteration extending from the area of the old Cleary Hill mine workings towards the Dolphin intrusive.

Drilling has also indicated the possibility of higher-grade mineralization at Cleary Hill well below the level of previous drilling.

Drilling will also be directed to the south of the Cleary Hill mine where previous workings, including the Colorado, Wackwitz and Wyoming vein zones, have never been tested to depth or along strike to the east. Past drilling in the Cleary Hill area has been largely shallow in nature and it is interpreted that the Dolphin intrusive likely underlies the Cleary Hill area at depth.

The program’s two key objectives are to determine the orientation and extent of the higher-grade mineralization; and to expand the currently known resource and upgrade resource categories as part of efforts to further advance the project through pre-feasibility.

The company also plans to test other targets that may have potential to host additional resources and other buried intrusives. Ground geophysics and soil sampling have been conducted and further drilling is planned to test these areas.

Conclusion

In writing about Freegold’s 2020 drill program, independent consultant and geologist Brad Aelicks, in an article for AOTH, noted that of the five holes, three reported grades over 100 grams per tonne gold: hole 1 with 2m of 169.5 g/t, hole 3 with 3m of 107 g/t and hole 5 with 3m of 131.5 g/t. The average of these intercepts is 136 grams gold — and we’re not talking about 30 cm single assays here — these are 2- and 3-meter wide intercepts.

In fact, the average mineralized intercepts across the five holes after cutting the high-grade still delivers 309 meters of 1.02 grams gold, 50% better than the Dolphin Stock grade and over three times the grade at Fort Knox!

Freegold has the sponsorship of Eric Sprott who owns 78,948,504 shares and 37,162,502 share purchase warrants, representing approximately 26% of the outstanding shares and about 34% of the o/s on a partially diluted basis assuming the warrants are exercised.

With an ambitious drilling program in progress at the Golden Summit property, Freegold is aggressively looking to unlock the value of its multi-million-ounce gold resource in one of the richest placer gold districts in Alaska. The intermediate goal is to deliver a prefeasibility study (PFS) for the project by the end of 2022.

Freegold Ventures

TSX:FVL, OTCQX:FGOVF

Cdn$0.56, 2021.08.30

Shares Outstanding 337,099,366

Market cap Cdn$190.6m

FVL website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Freegold Ventures (TSX:FVL)

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.