Silver47 Exploration CEO Interview – Richard Mills

2025.03.21

Rick Mills, Editor and Publisher, Ahead of the Herd: Please tell us about your Red Mountain flagship project.

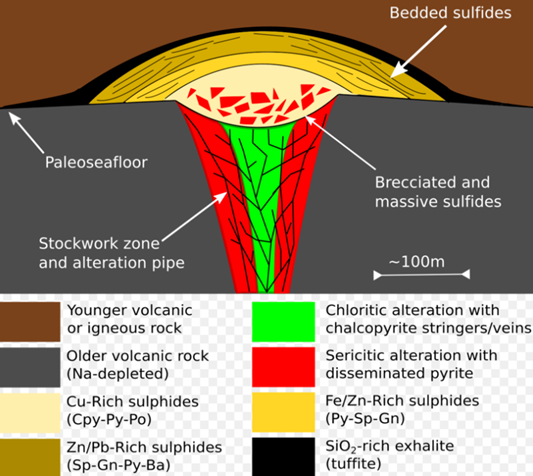

Silver47 CEO Gary Thompson: Well it all starts with the rocks. The rocks are Devonian meta-sediments and meta-volcanics, so we have the right rocks and right time period for volcanogenic massive sulfide (VMS) deposits. These deposits were forming on the ocean floor in this time period and they were subsequently uplifted to where we find them now. VMS deposits are our target at our flagship project Red Mountain.

These plumes / black smokers were spewing sulfides onto the ocean floor. Right around the vent is where you get the highest concentration, and then, depending on the currents they end up spreading away from the main vent, and they accumulate.

You tend to get more copper-rich around the vent of these black smokers because when the sulfides hit the ocean floor the sea water is colder than the vent, so the copper tends to precipitate out first and perhaps similarly there is gold. When you get further away from the vent then you tend to have more lead-zinc and silver because they’re less sensitive to temperature changes by the seawater.

RM: I’m very familiar with the potential involved with VMS. I covered Rick Mark’s VMS Ventures and we had considerable success with HudBay earning into, and eventually taking over the project. Reed Lake was the original discovery with several discoveries being made subsequently.

At Ahead of the Herd we believe there are many reasons a junior that comes upon a VMS deposit could be the belle of the ball as far as attracting investors, company suitors looking for a partner, a property, or an acquisition.

VMS deposits have long been recognized, by both majors and juniors, as potential “elephant” country.

GT: I know that story, you can have a very large accumulation in one deposit but that’s quite rare. It’s more common to have multiple deposits that can make exciting economics because they can be rich in both precious and base metals, that’s just the nature of the beast.

RM: What is the most attractive thing about Silver47’s Red Mountain Project to you?

GT: We wholly own a 60-km trend of the formation so we pretty much have the whole district staked up. High grades of silver and gold with a lot of room to grow the resource and the potential for new discovery is very high.

RM: Let’s look at that. Your project is on Alaska state permitted land. No BLM or indigenous issues, infrastructure and a trained work force is reasonably close and you are fully permitted.

GT: One of the great things about the state of Alaska is that we have strong support for mine development.

RM: Ok so you over-permitted to give yourself drill plan flexibility. The corporate presentation shows much more work on the east end of the property than the west end

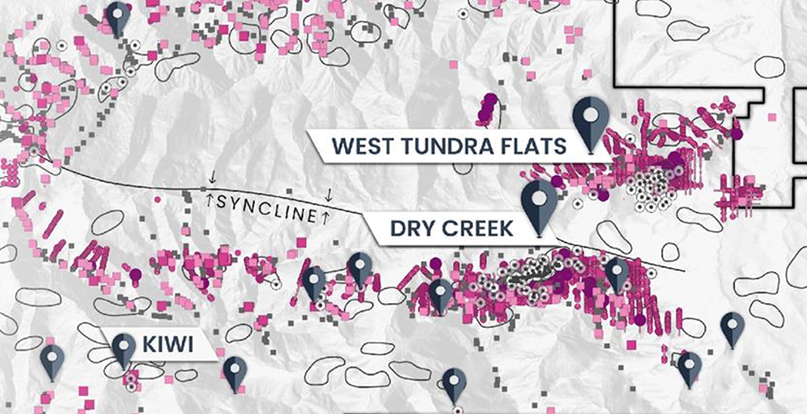

GT: Most historical work has been done on the eastern side of the project area where we have a syncline, which is a gentle fold of the strata.

RM: Please describe the syncline to our readers.

GT: Take a book and open it halfway, at a 45° angle. What we see on the ground is top end of the page and the syncline is the spine of the book, and the reason we’re seeing the top end is because of what’s been folded up.

RM: In the three Geochem maps posted above we see a lot of silver, copper and zinc exposure.

GT: There have been some creeks that have gone through and eroded down into the mineralized horizon. A good example of that is the West Tundra Flats Zone, that horizon has been eroded and exposed at surface in the Dry Creek area and then it slightly dips down into the mountain. You wouldn’t necessarily see that if it was like a layered-cake strata, it might not be exposed at surface, so what we’re seeing and the reason why there’s so many showings is because we’re seeing those ends of the pages that are sticking out of the ground.

We trace those down and that’s how the West Tundra Zone was advanced and of course it’s now part of the resource. As far as part our plans for the year we’re looking to expand on that, it hasn’t been closed off yet so we believe there’s lots of room to grow the resource.

RM: Could you explain the polymetallic nature of VMS deposits?

GT: Well polymetallic deposits are just that, they’re multiple metals. What’s great about polymetallic deposits is what they do when you get into a mining scenario is they tend to normalize your production profile.

Hecla Mining’s operation at Green’s Creek was a polymetallic lead-zinc-silver-gold VMS and the zinc basically covered expenses when silver wasn’t doing well in the market. I think the way to look at these things is the base metals will pay for the mine and the precious metals can the gravy, or vice-versa, the precious metals are carrying you and the base metals are the gravy.

In our case we’ve got the main economic minerals, we’re quite zinc-forward so there is a lot of base metals in the system being zinc, lead, copper.

But we’re showing signs of improving precious metal ratios and that’s something that we’re going to flesh out perhaps in the coming drill season.

RM: An interesting critical metals aspect has recently come to light.

GT: We looked at our data from the 39,000 meters that have been drilled on this project and what we found was pretty interesting. We found considerable amounts of antimony and gallium, which are two strategic minerals that have now been classified as critical minerals.

China controls almost 90% of the world’s gallium and between China and Russia I think it’s about 75 or 80% of the world’s antimony. Both metals are banned from export from China.

Just recently the US President Trump signed a new Executive Order to accelerate the development of critical metal mines.

RM: After China’s trade restrictions on those metals the price shot up significantly.

GT: We’ve not done the metallurgical recoverability yet but they are certainly consistent throughout the resource. Perhaps they’ll end up as an uptick add to the overall value of the already polymetallic-in-nature resource.

RM: That leads us to your current focus.

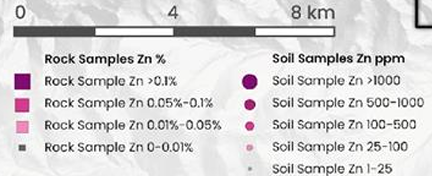

GT: The first order of business is trying to expand the existing resource which is currently 15.6 million tonnes at 336 g/t silver equivalent.

We’re going to try to expand the current two resource areas, West Tundra Flats and Dry Creek. They are roughly 2.5 kilometers apart so remembering back to the syncline explanation we want to know if they are the spine of the book folded up, do they connect together?

RM: Are these “zones with predictability?”

GT: Well, that’s the thing about at least the West Tundra Flats Zone. It’s like a layered cake a very continuous stratiform horizon, as a target area it’s exactly what you want, you just march the drill along it.

The Dry Creek Zone has some structural complexity so it’s maybe not as cut and dry but it’s also quite linear and stratiform. There’s been some post mineral faulting that has maybe offset some of the horizons a bit so it just adds a bit of complexity to it for our geologist to sort out.

These deposits tend to be fairly consistent and continuous horizons, of course they don’t go forever but again more of a lens-like or pod-like once “a string of pearls” you define it then you move on to the next one and you get on another pod and you define that and start to build up your tonnes that way.

Our second order of business is to step away from these known areas and look to make some new discoveries. As an example there’s one zone that is about 10 kilometers to the north of West Tundra Flats called Galleon and it’s one that has pulled over 1,200 grams silver surface rock trench samples. Galleon has not been drilled, so that’s one that we want to get some drilling on.

And third perhaps some more field work to help better understand the favorable horizon where the mineralization is hosted. Once you turn your eye to that horizon you know where you are in the system and which is the best horizon to be looking at.

RM: VMS camps like (Agnico Eagle’s) LaRonde and (Glencore’s) Kidd Creek aren’t always precious metals rich. They’re mostly thought of as a lead-zinc but every now and then you do get a VMS that is PM-rich.

GT: That’s exactly right and there’s been some work on these. Some like (former Kidd Creek owner) Noranda and LaRonde have some of the largest gold accumulations of any VMS camp but you can also get VMS’s that tend to be more dominant base metals rich.

It’s really a case by case I think for these deposits, like Eskay Creek is another good example in BC, well known when it was operating the first Eskay Creek and under Skeena (Resources) now there’s an Eskay Creek 2.0 but when that was first operating it was one of the richest gold-silver mines in the world it produced 3.3 million ounces at 45 g/t gold and 160 million ounces of silver at over 2,000 g/t silver so that was the original Eskay Creek VMS. They can be quite rich in precious metals on not a lot of material either.

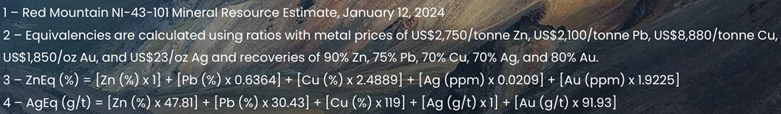

RM: The Red Mountain Project has a NI-43-101 Inferred Mineral Resource published January 2024. You use a silver and zinc equivalent for Red Mountain’s Inferred resource.

GT: Yes, we use both a silver equivalent and a zinc equivalent in our resource.

The silver side is so far composed of 36 million ounces of silver and 214,000 ounces of gold. Combining the gold and silver, at the prices used last year, works out to 55 million silver-equivalent oz or 33% of the resource is precious metals.

Half of the resource is zinc so there’s a half a million tonnes of zinc metal contained, it’s a good chunk of zinc. Concerning that 15.6 million tonnes of rock, another way to look at it would be just over 1,000,000 tonnes of zinc-equivalent at 7% zinc-equivalent grade.

RM: You drilled a number of holes last year, the assays were good, what is your confidence level in your resource?

GT: We did drill some infill and confirmation holes in 2024 confident in the validity of our resource and what we found was actually quite encouraging.

Hole DC- 24106 was an infill hole between other holes that was 5, 6, 7 grams gold and we encountered one of the highest-grade gold intervals when we cut 2.5 meters of about 15 grams gold, 250g/t silver, 22% zinc, 7% lead, 0.42% copper and some quite high antimony and gallium numbers.

That was within a 2.5-meter massive sulfide horizon, there’s another one that was a 0.9m massive sulfide horizon that had an 8g gold and a 225 grams silver plus ridiculous lead and zinc numbers.

You get these one to three maybe even 5 meters of massive sulfide and when I say massive sulfide it’s just like metal, there’s not a lot of rock, in fact in some cases I don’t think there’s any rock left at all it’s been replaced by metal sulfides.

And then you get these massive sulfide horizons within a broader 24-meter zone so there’s a lot of rich sulfides intermixed with a volcanic rock and that’s why we’re calling it semi-massive because it’s not quite solid metal like the solid massive sulfide horizons.

So for us it’s all quite encouraging in that we’re seeing higher gold values than some of the previous drilling. I’d say what’s important to note is that we’ve got some better grades than we saw in some of their previous drilling and more importantly the 1980s vintage drilling wasn’t very good in that they didn’t recover as much core.

RM: We’ve gone over this whole thing and it sounds fantastic. The question I would ask is how did you get it from Whiterock Minerals?

GT: That’s a good question isn’t it? If it’s so good how did we get it for what we paid for it?

One thing that I’ve learned in this business from watching other successful entrepreneurs is that if you can get an asset that for whatever reason is in bankruptcy or just got into financial trouble and you could pick up an asset for a song and a dance that’s what you want to do.

We were fortunate that we had raised some funds and then we were looking for a project and we got introduced to this asset through Crescat Capital because they were investors in Whiterock.

What happened was Whiterock, an Australian-listed company, basically blew themselves up by overextending. They were underfunded and they were trying to build a gold mine in Australia that sunk them.

They were on-the-verge-of-bankruptcy and we were fortunate that we had the cash so we negotiated A low cash and share deal to purchase the asset 100%.

RM: Could you tell us why somebody might think about buying shares of Silver47? What’s the investment opportunity here?

GT: Structure you’ve got between management, Crescat, Eric Sprott and a couple of other strategic investors collectively holding about 50% of the stock.

What’s interesting is that we’ve traded over23 million shares since mid-November and we only have 50 million shares outstanding. So what does that tell you? Good liquidity, a very tight share structure.

We’ve got a solid resource that we’re confident we’re going to be able to grow with tons of exploration discovery upside, we’ve got strong shareholders, management has a lot of skin in the game and I think we’re going to go generate some new exciting results. So yeah I think it’s a great opportunity to consider. We are also looking at M&A to scale up and in this business scale provides better access to capital.

RM: You’re going to spend some money on drilling, how’s the treasury?

GT: We’re still in finance mode right now and we just upsized our most recent offering to $11 million.

We’ll definitely have a decent budget for drilling this year so we’re going to drill as much as we can.

RM: Gary are you planning on upgrading that inferred resource to measured & indicated?

GT: The plan is to revise the resource. We have yet to define our drill density plan but we want to improve the confidence in some of the higher-grade zones from inferred to indicated, or perhaps measured, but I think there’s lots of room to grow the resource.

I would also like to show an improved precious to base metal ratio from the drilling. We’ve demonstrated that might be possible by drilling a small number of holes last year. So, if we can continue that trend my goal would be to try and move it closer to that 50% precious metals to base metals.

I’m hoping that early in 2026 we’ll have a new revised resource statement to look at.

RM: Gary, anything else you’d like to add, just to summarize, finish up?

GT: Further information can found on the company website, https://silver47.ca/

RM: Thank you we had a great talk.

Silver47 Exploration Corp.

TSXV:AGA

Cdn$0.63 2025.03.06

Shares Outstanding 50m

Market cap Cdn$32.5m

AGA website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Silver47 Exploration Corp. (TSXV:AGA) AGA is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of AGA

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

6 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

In the context of commodities and junior resource companies, how might the erosion of creek beds, such as the West Tundra Flats Zone, influence the discovery of mineralized horizons, and could this method be applied to predict potential mining sites in other regions with similar geological structures?

The erosion of creek beds could influence the discovery of mineralized horizons on other projects but I have not heard of any other VMS district even come close to approaching what the West Tundra Flats Zone is showing.

Rick

Bob Moriarty thinks it is a 5BN mining asset

From your interview with Mr.Thompson one could conclude much morei s at stake .

What do you think ?

I like Gary, think he’s exactly the right guy to advance Red Mtn.

It is very early days on a project with unbelievable, imo, discovery potential.

168m ozs of silver eq has an insitu value of US$5.5B @ US$33.00 oz.

Rick

Hi Rick ,

Ever heard of Freeport Resources in PNG ?

Yes have looked at it. Need a partner to advance Yandera, hope they do a good deal.

Rick