Silver to follow gold higher, on continued strong investment and industrial demand

2020.10.06

Gold and silver appear to be bouncing back from the drubbing they took in September, with both precious metals striking higher on Monday, Oct. 5.

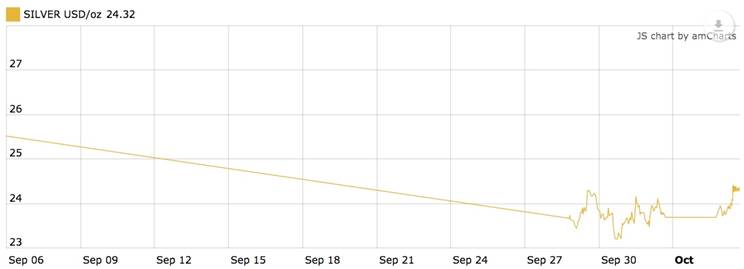

As of this writing, spot gold finished about $15 better than Friday’s close, @ $1,910.30 in New York, while silver also had a good day, finishing $0.63 higher @ $24.32.

The white metal saw a significant decline in September, falling from a $29 per ounce peak to a trough below $23. Like gold, silver has been reacting to a firmer US dollar and an uptick in real yields. After falling as low as 0.52% in early August, the benchmark 10-year Treasury note yield rose to 0.78%, as of Monday, Oct. 5, the latest auction date.

US Dollar

10 Year Treasury Yield

Despite recent headwinds, it looks to be clear sailing going forward for silver, according to recent forecasts from three financial services firms.

“A higher gold price, along with the ongoing recovery in industrial demand, particularly from China, means that the price of silver is likely to rise in the year ahead,” Capital Economics said in a report published on Sept. 30.

“All in all, a market deficit in conjunction with a higher gold price should lift the price of silver to $25 and $27 per ounce by end-2020 and end-2021, respectively,” assistant commodities economist Samuel Burman wrote. He added,

“Demand for non-interest bearing safe-haven assets, such as gold and silver, should rise as real yields in the U.S. drift a little lower. We forecast that the US ten-year nominal yield will fall to 0.50%, from 0.70% currently, by the end of this year and that it will remain at this level in 2021. The Fed has already stated that it will keep policy ultra-loose until at least 2023 and allow inflation to overshoot its target.”

The London-based firm predicts gold will be back to $2,000/oz by year’s end. CIBC concurs that gold is likely to push higher, reaching $1,925/oz in the third quarter and $2,000 in the fourth, for a full-year average price of $1,800. The Canadian bank has raised its gold price forecasts, to $2,300 an ounce in 2021, $2,200 in 2022 and $2,100 in 2023.

As for silver, CIBC estimates a run up to $32/oz in 2021, $31 in 2022 and $30 in 2023. This year it expects the white metal to hit $25/oz in Q3 and finish the year at $28/oz.

Daily Treasury Real Yield Curve Rates

“The outlook for continued low real interest rates, increasing government debt burdens coupled with geopolitical uncertainty arising from the upcoming U.S. election are all supportive of further significant price appreciation,” the bank’s analysts wrote in a research note to clients.

Silver, it says, “has potential to provide investors with even more torque given the relatively smaller market for silver vs. gold.”

Raymond James also raised its silver price forecasts for 2021, to $25 an ounce, 37.9% higher than its previous call, and to $22.50 in 2022 – a 25% increase. The brokerage firm uses a model that bases predictions on the gold-silver ratio. Its current model uses an 85:1 ratio to estimate silver prices, and an 80:1 ratio for silver prices in 2021, 2022 and further out.

“Our price forecast changes reflect our views that the significant increase in monetary stimulus and Central Banker indications that interest rates are expected to be lower-for-longer have created a macroeconomic back drop that supports increased investment demand for gold, driving prices higher,” the Raymond James analysts wrote in a research note.

We have seen the gold-silver ratio decline from a multi-decade high of 127:1 in March, to the current 78:1, meaning it takes 78 oz of silver to buy 1 oz of gold. This is still high by historical standards, meaning silver remains undervalued compared to gold, and will likely move higher, towards the average historical ratio of 55:1.

Burman, of Capital Economics, thinks silver prices should gain momentum on the back of ongoing fiscal stimulus in China, and greater industrial activity which drives around half of annual silver consumption. He points out the latter will be helped by governments investing in green energy, including solar panels which contain silver paste.

5G technology is set to become another big new driver of silver demand.

Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled devices.

The Silver Institute expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

Although weak consumer confidence because of the pandemic has crimped demand for some of silver’s end uses, including autos and consumer electronics, governments’ recently announced infrastructure investment programs are expected to lift silver industrial demand.

On the supply side, among a second wave of covid-19 shutdowns this summer (the first wave was in March) were some of the biggest producing silver mines in the world, although some production has come back online.

In July, mining companies in Peru were forced to keep operations suspended, and halt new ones, as the number of coronavirus cases soared. Among the companies affected were Trevali and its Santander silver mine, Hochschild Mining’s Inmaculada, and Fortuna Silver Mines’ Caylloma. Investment projects such as Anglo American’s $5 billion Quellaveco, Minsur’s $1.6 billion Mina Justa and Chinalco’s $1.5 billion Toromocho expansion have been delayed by several months.

In Mexico, the world’s largest silver producer, a surge of covid-19 cases in March led to the suspension of non-essential services. Among the companies forced to temporarily halt their operations, were Newmont Mining, Argonaut Gold, Pan American Silver, Sierra Metals, Excellon Resources and Alamos Gold.

The Silver Institute is predicting a 13% decline in silver production from Latin America this year – equivalent to 67 million fewer ounces – with global supply set to fall 7.2%.

Given both supply and demand factors, Capital Economics estimates the silver market will remain in a small deficit, right through to 2022.

Silver Dollar Resources (CSE:SLV, OTC:SIDRF)

In August Silver Dollar Resources (CSE:SLV, OTC:SIDRF) finalized a letter of intent (LOI) with First Majestic Silver to acquire up to a 100% interest in the La Joya silver-copper-gold project in Mexico.

The property is about 75 km southeast of the state capital city of Durango in a prolific mineralized region with past-producing and operating mines including Grupo Mexico’s San Martin mine, Industrias Penoles’ Sabinas, Pan American Silver’s La Colorada, and First Majestic Silver’s La Parrilla and Del Toro Silver mines. Access and infrastructure are considered excellent with highway, rail and power lines nearby.

The project hosts the La Joya mineralized trend as well as the Santo Nino and Coloradito deposits. It consists of 15 mineral concessions totaling 4,646 hectares.

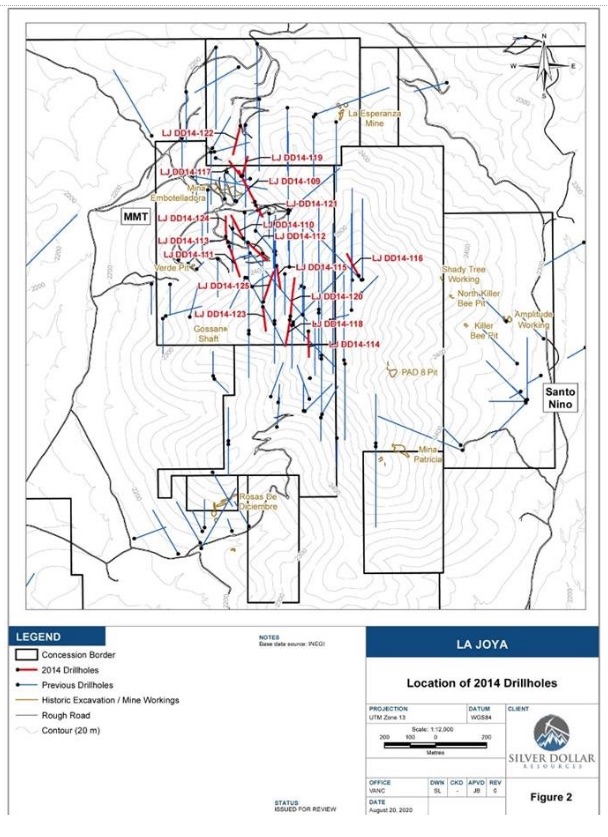

Initial exploratory drilling identified a 2.5-kilometer mineralized trend with economic intercepts up to 230m wide.

With the option agreement finalized, Silver Dollar has been going through historical exploration data at La Joya, including records of a Phase 3 drilling program conducted by SilverCrest, a previous operator, between February 27 and March 29, 2014. What it has found is breathtaking.

Included among the unreported results of a 17-hole in-fill drill program (2,698 meters), was “the presence of discrete high-grade stockwork and structurally controlled veining”. Hole LJ DD14-116 intercepted 2.0 meters grading 723.5 grams per tonne (g/t) silver (Ag), 8.97% copper (Cu) and 0.09 g/t gold (Au), or 1,778.1 g/t silver equivalent (AgEq).

These are very high silver and copper grades; in my opinion the extreme high-grade nature of the vein makes it a mineable width.

According to Silver Dollar’s CEO, Mike Romanik, the 750m-wide gap between the Main Mineralized Trend and the Santo Nino deposit will be a priority at La Joya because “It demonstrates the tremendous potential for resource expansion.”

Silver Dollar summarizes SilverCrest’s 2014 results in an Aug. 25, 2020 news release:

The Phase 3 drilling program targeted infill drilling along the Main Mineralized Trend (Figure 2) and was successful in confirming significant mineralization in 15 of 17 holes (two holes were drilled for geotechnical logging and no assay records have been located). The results provide Silver Dollar with further confidence in the extent of the mineralized system and verify several key features of the polymetallic Ag-Cu-Au deposit identified in the National Instrument (NI) 43-101 Preliminary Economic Assessment Technical Report (the “PEA”), with Effective Date of October 21, 2013, and Released Date of December 5, 2013 (refer to SEDAR)

In other recent news, Silver Dollar announced that its shares began trading in the United States on the OTCQB Venture Market (“OTCQB”) under the ticker symbol “SLVDF”. The company’s common shares will continue to trade on the Canadian Securities Exchange (“CSE”) under the symbol “SLV”.

“Qualifying for trading on the OTCQB is the next step in our ongoing effort to increase visibility, expand trading liquidity and broaden our shareholder base,” said Mike Romanik, President of Silver Dollar, in the Sept. 30 news release.

On Sept. 17 SLV announced that $10.5 million was raised through a private placement, whereby 7.5 million shares were offered @ $1.40 per share. Of the total, 4.6 million shares were purchased by Eric Sprott, earning the renowned resource investor a 19.9% stake in the company. First Majestic Silver invested $700,000, meaning the major silver miner now holds about 16.4% of SLV’s shares.

“We would like to thank Eric Sprott, First Majestic, and our existing shareholders for their support and welcome several new investors,” said Romanik. “This funding positions us to pursue our explorations programs at both our Red Lake properties and hit the ground running in Mexico where we have already identified numerous priority drill targets at the La Joya Silver Project.”

Silver Dollar Resources Inc.

CSE:SLV, OTC:SIDRF

Cdn$1.78, 2020.06.10

Shares Outstanding 34,583,980m

Market cap Cdn$61.55m

SLV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Silver Dollar Resources (CSE:SLV). SLV is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.