Renforth’s Surimeau invites comparison with Finnish polymetallic mining district

2021.09.17

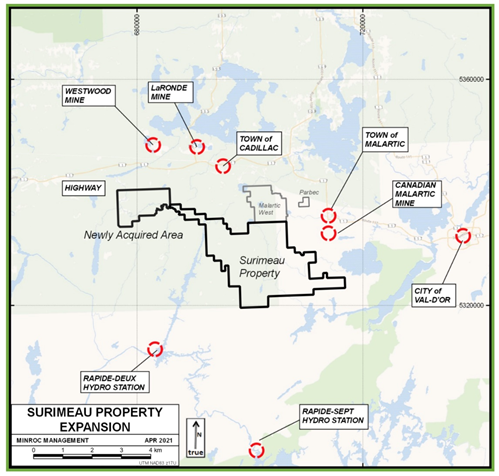

Renforth Resources (CSE:RFR, OTC:RFHRF, WKN:A2H9TN) continues to advance its Surimeau polymetallic project in Quebec, adjacent to the Canadian Malartic mine, the largest gold mine in Canada, and about 20 km south of Agnico Eagle’s LaRonde mine.

According to Renforth, information gleaned from drilling and trenching the Victoria West target, along with surface sampling, create an area of interest that includes about 5 kilometers of strike on the western end of a 20-kilometer magnetic anomaly.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside, and is intermingled with, VMS-style copper-zinc mineralization.

In fact, Renforth considers the style of mineralization to be an “Outokumpu-like” occurrence, referring to a district in eastern Finland known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold. About 50 million tonnes of ore averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined from three deposits between 1913 and 1988.

Renforth is fortunate enough to have a nickel sulfide deposit at surface whose secrets it is just starting to reveal to the market.

Just how large this nickel sulfide system is, remains to be seen.

RFR is clearly hoping to find nickel sulphides that when refined would be appropriate for lithium-ion batteries. This would make the project and/ or the company attractive to potential acquirers.

Geology

The Surimeau project occurs within a unique geological setting, where two types of mineralization, formed from completely different geological processes, are “mashed together” in one distinct orebody. Renforth’s Surimeau project is best described as a magmatic nickel sulfide deposit, juxtaposed with a copper-zinc volcanogenic massive sulfide deposit.

The first type of deposit, which may contain nickel, cobalt and platinum group elements (PGEs), is associated with ultramafic rocks. The second type, volcanogenic massive sulfides (VMS), were formed on or near the ocean floor during ancient underwater volcanic activity.

VMS deposits are sought after for mining because they usually contain a mix of base metals such as zinc, lead, copper, and sometimes precious metals including silver and gold. The minerals usually form massive sulfide mounds or layers, making them relatively easy to extract.

At Surimeau, the results from current (2020-21) and historical exploration indicate there is a confluence of magmatic nickel, copper and possibly PGEs (Renforth is still assaying results from a recent drill program and when those are available, the mineralogy will become clearer).

To fully understand what Renforth has at Surimeau, it is helpful to describe the two deposit types and identify analogues.

Ultramafic nickel sulfide deposits

Ultramafic rocks are igneous rocks with a low silica content, rich in minerals such as hypersthene, augite and olivine, formed from very high temperature (~1400oC) melts.

For ultramafic rocks to contain sulfide-hosted (i.e. recoverable) nickel, they must be adulterated by sulfur. When the rocks crystallize, usually the main mineral to form is olivine. If sulfur is introduced into the melt before olivine forms, liquidized copper and nickel sulfide melt separates from the silicate melt like oil and water, with the sulfide liquid sinking to the base and forming Ni-Cu rich sulfide accumulations.

A classic example of an ultramafic nickel sulfide deposit is the Kambalda District of Western Australia. Occupying 400 square kilometers, the Kambalda nickel field is underlain by two sequences of ultramic, mafic, felsic volcanic and sedimentary rock. The ores contain various proportions of massive, matrix and disseminated sulfides.

The key setting is the basal contact between the ultramafic rock hosting nickel mineralization and the underlying volcanic and sedimentary strata. Geologists are looking for the ancient ultramafic lava channels that flowed over the basalt surface. It is at the base of these channels where economic nickel sulfide mineralization can potentially accumulate.

Much of the nickel produced from the Kambalda District came from a few very large (>100,000 tonnes) nickel mines, all of which are located around the Kambalda Dome, where nickel has been mined from seven ore systems including Otter Juan, the largest producer in the district.

A Canadian example of nickel-bearing ultramafic orebodies that RFR thinks is similar to what Renforth has at Surimeau are deposits in the Thompson Nickel Belt of northern Manitoba.

The Thompson nickel deposits occur over a 130-km north-northeast trending interval, 660 km north of Winnipeg.

The Thompson Nickel Belt hosts over 18 nickel deposits and is estimated to have produced over 5 billion pounds of nickel since 1959. The nickel deposits are within the Opswagan Group, a sulfide-rich package of rocks infused by ultramafic intrusions. The nickel deposits are located within the ultramafic sills or in the metasediments close to the sills (a sill is a flat intrusion of igneous rock, that forms between pre-existing rock layers).

VMS deposits

Between the Mid to late Archean and the Holocene — the current geological period — volcanogenic massive sulfides (VMS) formed and are forming today on the ocean floor during underwater volcanic activity. Where the Earth’s crust was thin, magma boiled up, forming volcanoes which have associated very hot (>380oC) seawater plumes (“black smokers”) that contain zinc, copper, and some lead, silver and gold that spewed into the ocean.

Minerals precipitate from “black smokers” forming Zn-Cu-Fe sulfide precipitate as mounds on or near the seabed. Eventually with the movement of tectonic plates, these mineral deposits ended up on land that was once underwater. VMS deposits usually contain abundant iron sulfides (pyrite or pyrrhotite) and lesser amounts of chalcopyrite, the copper mineral, and sphalerite, the zinc mineral. They are major sources of zinc, copper and lead, with gold and silver by-products.

We can see where the term “volcanogenic” come from, since the deposits are formed by underwater volcanic processes. The “massive sulfides” refers to the large accumulations of sulfide minerals that form on or below the ocean floor.

VMS deposits contain mostly base metals and may have lesser amounts of precious metals such as gold, silver and platinum. They are often major sources of zinc, copper and lead, with gold and silver by-products. Cobalt, tin, barium, sulfur, selenium, manganese, cadmium, indium, bismuth, tellurium, gallium and germanium may also be found in VMS deposits.

VMS deposits consist of a massive or semi-massive stratabound sulfide lens. Most are underlain by a sulfide-silicate stockwork vein system. Individual massive sulfide lenses can be over 100 meters thick, tens of meters wide, and hundreds of meters in strike length. VMS deposits range from 200,000 tonnes to more than 150 million tonnes and most often occur in clusters.

VMS deposits are estimated to have supplied over 5 billion tonnes of sulfide ore. They currently account for 22% of the world’s zinc production, 9.7% of the lead produced, 6% of copper, 8.7% of silver and 2.2% of gold.

An estimated 900 VMS deposits are found worldwide, averaging about 17 million tonnes each. As noted above they are still forming, mostly along extensional ridges where plate movements form cracks in the Earth’s crust — allowing a conduit for mineralizing fluid to travel up as hot liquids and be deposited, through billowing white and black clouds, onto the sea floor.

VMS deposits in Canada include Flin Flon, Bathurst, Snow Lake and Noranda. The Kidd Creek mine in Ontario near Timmins, the deepest base-metal mine in the world, is a VMS deposit that has been in production since 1966.

VMS deposits in Canada include Flin Flon, Bathurst, Snow Lake and Noranda. The Kidd mine in Quebec, the deepest base-metal mine in the world, is a VMS deposit that has been in production since 1966.

VMS deposits have long been recognized, by both majors and juniors, as potential elephant country — and because of their polymetallic content these types of deposits continue to be one of the most desirable because of the security offered against fluctuating prices of different metals.

Canadian VMS mines have deposits ranging from five million tonnes to 20 million tonnes, although the Bathurst No. 12 mine dwarfs them all at over 100 million tonnes.

Twenty economically viable VMS deposits were discovered in the Noranda District over 85 years, including Noranda’s Horne mine in northern Quebec which produced 11.6 million ounces of gold and 2.5 billion pounds of copper from 1927 to 1976, and Agnico Eagle’s flagship LaRonde mine just north of the Surimeau discovery.

Located 20 km north of Surimeau, LaRonde is the Canadian company’s oldest mine, with production starting in 1988. Its 2.2-km Penna shaft is the deepest single-lift shaft in the Western Hemisphere. The 7,000-tonnes per day mine and processing facility has produced over 6 million ounces of gold plus by-products, and still has 3 million ounces of gold in proven and probable mineral reserves (15.2 million tonnes grading 6.12 grams gold per tonne) as of December 31, 2020.

Agnico-Eagle describes LaRonde as a gold-rich volcanogenic massive sulphide deposit with significant silver, zinc and copper credits. LaRonde lenses were formed mainly by sulphide precipitation from hydrothermal fluids on the seafloor and by replacement below lenses.

Another appropriate Canadian analogue to Surimeau’s VMS mineralization is the Ring of Fire. The 180-km-long greenstone belt, running under the James Bay Lowlands of northwestern Ontario, hit the radar of mining companies and explorers in the early 2000s, when copper-zinc rich VMS mineralization was discovered at McFaulds Lake. Since then, exploration companies have unearthed resources and reserves of chromite, magmatic nickel-copper-PGEs, copper-zinc VMS, and well over 70 occurrences of multiple commodities.

One of those explorers, Toronto-based Noront Resources, currently finds itself at the center of a bidding war between two rival Australian mining heavyweights, Wyloo Metals and BHP, over Noront’s Eagle’s Nest project in the Ring of Fire.

Noront describes Eagle’s Nest as a magmatic Ni-Cu-PGE sulfide deposit hosted within a sub-vertically plunging bladed dyke-like body composed principally of peridotite. The Eagle’s Nest deposit is associated with an ultramafic sill complex situated at the contact between a large tonalite body to the northwest, and a volcanic sequence to the southeast. At over 15 km in strike length and up to 1.5 km in thickness, this sill complex is believed to consist of at least two individual sills known as the Double Eagle Intrusive Complex and the Black Thor Intrusive Complex. Both contain an ultramafic keel and/or feeder dyke with attendant Ni-Cu-PGE mineralization, overlain by crudely layered accumulations of dunite, peridotite and chromitite and capped by pyroxenite and gabbro.

Claimed by Noront to be the largest high-grade nickel discovery in Canada since Voisey’s Bay, Wyloo and BHP are each hoping to grab control of the advanced-stage nickel project, which is currently in the permitting phase.

Wyloo, a 37% shareholder of Noront, in May announced it intended to take over Noront for $133 million. However two months later, BHP surfaced with a $325 million offer.

The bidding war shows the degree of interest by mining majors in sulfide nickel deposits that can be converted into battery-grade nickel used to store energy in lithium-ion batteries.

Outokumpu District

As mentioned, Renforth’s Surimeau project is best described as a sulfide nickel magmatic sulfide deposit, juxtaposed with a copper-zinc massive sulfide deposit. The nickel-containing ultramafic orebody has been fused with the VMS deposit alongside it, giving it a unique geological flavor.

This style of mineralization is rare, however, it is known to occur in the Outokumpu District of eastern Finland. Outokumpu contains sulfide deposits with economic grades of copper, zinc, cobalt, nickel, silver and gold. Mining extended from 1913 to 1988 and involved exploitation of three major deposits — Outokumpu, Vuonos and Luikonlahti — with total production of around 50 million tonnes of ore.

Geologists believe that Outokompu’s unconventional deposit type first originated through deposition of copper-rich ore on the sea floor around 1,950 Ma. Some 40 Ma later, disseminated nickel sulfides formed through chemical interaction between massifs (blocks of rock) and adjacent black schists.

A 2007 geological paper states that mixing of these two “end-member” sulphides, i.e., the primary Cu-rich proto-ore and the secondary Ni sulphide disseminations, resulted in the uncommon metal combination of the Outokumpu-type sulphides. Late tectonic solid-state remobilisation, related to the duplexing of the ore by isoclinal folding, upgraded the sulphides into economic deposits.

As for just how closely Renforth’s Surimeau deposit resembles size and qualities of the Outokumpu District in Finland, it is too early to say, however the scale of the district is encouraging (up to 50Mt of ore has been mined in Finland) and we also know that Outokumpu is enriched with palladium, a high-value metal currently worth more than an ounce of gold (current spot Pd = $1,964/oz) – Renforth has yet to assay for PGE’s.

Moreover, the Finnish deposit contains a confluence of elements that yields a large suite of base metals. If Renforth can delineate a similar mix, there is a good chance they can be mined as a single unit like at Outokumpu, and processed into separate concentrates.

2021 exploration

The 260 km2 Surimeau property hosts several target areas for gold and base metals (nickel, copper and zinc) located south of the Cadillac Break, a major regional gold structure in Quebec.

In July, Renforth completed a four-hole drill program at the 5-km-long nickel, copper and zinc mineralized Victoria West target.

Victoria West is one of six polymetallic target areas on the Surimeau property historically documented as hosting mineralization.

It is located at the western end (5 km) of a 20-km-long magnetic anomaly that hosts proven mineralization at either end, with the Colony target at its eastern end.

The first drilling at Surimeau by Renforth occurred in October 2020 with 2.5 short holes completed. A total of 15 holes for 3,456m of drilling were completed during the 2021 program, drilling off 2.2 km of strike within the approximately 5 km-long Victoria West target. Another four holes totaling about 1,000m were drilled this summer.

The company plans to return to the field this fall to conduct surface stripping, to expose on surface a portion of the Victoria West mineralized system. Renforth also intends to fly a detailed magnetic survey of Victoria West using drones. Assays are pending for the bulk of the 2021 drilling at Surimeau.

Conclusion

Surimeau shows some promise of becoming a district-scale mining project, given its unique geological similarities to the Outokumpu District in Finland, as well as being analogous to a number of current and past-producing Canadian VMS deposits, some of which, like Kidd and LaRonde, are still in production decades after mining started.

Renforth is currently focused on the Victoria West target, but this target area is only 5 km of the 20-km magnetic anomaly. The strike is long and from what we know so far, it has a decent width, pinching and swelling on surface from between 80 and 450m.

You would not expect continuous mineralization over the whole 20 km but the fact remains Surimeau is a confluence of elements that gives you a large suite of base metals. These base metals could be synchronously mined as a single unit as they do at Outokumpu, producing concentrates for the various elements – nickel, zinc, copper, with potential PGE’s (from the nickel) – and smelting them separately.

Without copper the current global drive to electrify and decarbonize our transportation system does not happen. Nickel is used in lithium-ion batteries for electric vehicles.

Two of the most recent drill holes undercut holes drilled earlier in 2021. Visibly coarse pentlandite, and better chalcolpyrite, would seem to indicate to your author things are getting better as they go deeper, hole 2 ended in mineralization at 145 meters indicating some depth to the deposit.

Surimeau is a sulfide nickel magmatic sulfide deposit, juxtaposed with a copper-zinc volcanogenic massive sulfide deposit. These deposit types are effectively squeezed, or squashed together, and that’s what they have been mining at Outokumpu for over 50 years.

How big, how rich is Renforth’s Surimeau? Only time will tell, but the possibility of a Canadian junior having an Outokumpu type deposit is an exciting possibility and it’s why I own shares.

Renforth Resources

CSE:RFR, OTC:RFHRF, WKN:A2H9TN

Cdn$0.07 2021.09.16

Shares Outstanding 251m

Market cap Cdn$18.3m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid sponsor of his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.