Renforth grows critical minerals exploration portfolio with acquisition of copper project – Richard Mills

2023.08.13

Renforth Resources (CSE:RFR, OTCQB:RFHRF, FSE:9RR) continues to grow its pipeline of battery and critical minerals exploration assets, this week announcing the acquisition of a project known to host copper mineralization.

The Copper Prince project, located near Iron Bridge, Ontario, consists of 15 claims that cover part of a known copper-bearing vein system (Copper Prince) with limited historic production, and a less well-documented vein/disseminated copper system (North Summit).

Mineralization at both Copper Prince and North Summit is hosted by steeply dipping white quartz veins, with a width of roughly 1-5m and traceable over a considerable distance. The veins host chalcopyrite, pyrite and specular hematite.

Historic work on the Copper Prince system (partially covered by Renforth claims) began in the 1920s, when trenching, drilling and limited underground development was completed by the Consolidated Mining and Smelting Company of Canada (Cominco). Historically recorded assays from the Renforth portion of Copper Prince include several copper values exceeding 1% from drilling by Cominco, along with low-grade gold and silver values. The historic information, however, has not been verified by Renforth.

The adit, and much, but not all, of the trenching and drilling, is a short distance beyond Renforth’s claims, with little information available regarding the work on either Renforth’s property or adjacent to it. Anecdotal comments suggest that there was limited production in the 1960s or 1970s from the adjacent adit, the company said.

Limited drilling was completed in 2012 by Lakeland Resources both within the Renforth property and adjacent to it, confirming some of the historic drill results. Only one map of the Cominco work is available, dating from 1947, after the work was undertaken but it showed several drill holes and trenches on the Renforth claims.

The North Summit copper occurrence, to the north of the vein system, was explored, trenched and drill-tested in the 1960s by North Summit Explorations Ltd (later Summit Diversified Ltd). Several good quality maps are available of geophysical surveys completed by North Summit, but their geologic exploration is poorly recorded and poorly located, and there are no maps accompanying the work reports, Renforth said. It is believed that the North Summit occurrence is likely to lie within the northeastern part of the Copper Prince property.

Renforth has 100% of the rights to these staked claims, with no underlying encumbrances, by way of assignment with no purchase cost paid.

The acquisition of Copper Prince property brings the total number of exploration assets held by Renforth to seven, in addition to its two significant assets. It follows the company’s most recent acquisition in Ontario, the McCart nickel property, to complement its main asset — Surimeau.

Main Asset – Surimeau District Property

The Surimeau project, located in the neighboring province of Quebec, is a district-scale property hosting several areas prospective for gold/silver and battery/industrial metals (nickel, copper, zinc, lead, cobalt, lithium and manganese). It is located south of the Cadillac Break, a major regional gold structure.

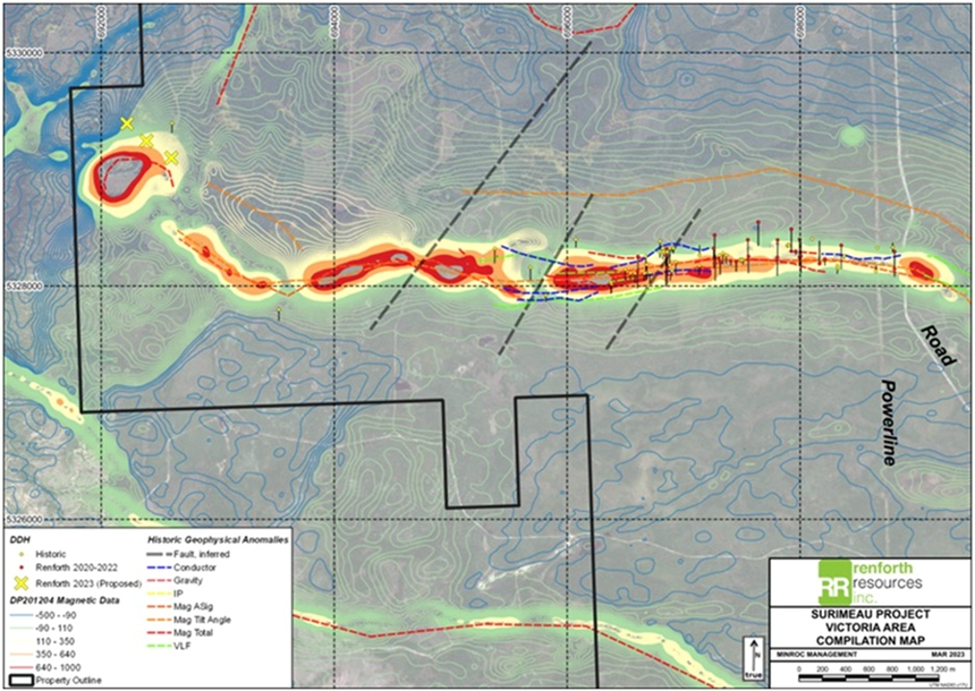

For the better part of two years, Renforth’s exploration focus has been on the more advanced Victoria mineralized battery metals horizon and parts of the longer Lalonde horizon lying parallel to the north (see map below).

Victoria is a ~20-km-long magnetic structure bearing nickel, copper, zinc and cobalt mineralization at surface. It stretches between the Victoria West mineralization, which has been drilled over 2.2 km, and the Colonie mineralization, drilled and surface-sampled by Renforth in the eastern part of the property.

The Lalonde mineralization, ~3 km north of Victoria West, was only recently drilled by Renforth. This surface mineralized system, similar to Victoria, currently stretches over ~9 km of ground-truthed strike.

Both zones are about 250-500 meters thick, running east-west across the central portion of the property. The two systems are interpreted by the company as two arms of a fold, with the fold nose located off the property and to the east.

While the defined area of mineralization spans a total length of ~29 km, which by industry standards is a long distance to cover, this is still just a small portion of a district-scale property that remains underexplored.

Earlier this year, the Renforth team started to move farther out, drilling in an area about 4 km west of the Victoria structure where work first began on the property.

An airborne electromagnetic/magnetic survey interpreted the western end of Victoria as showing an interesting curvature, possibly representing folding which may have resulted in mineralized fluid entrapment.

As far as we know, the ~20 km Victoria trend consists of ultramafic flows intercalated with graphitic mudstones, albite shears and calc-silicate rocks. The ultramafics and calc-silicates are what host most of the higher-grade nickel and cobalt mineralization, while the graphitic mudstones and albite shears host most of the higher-grade zinc and copper mineralization as sphalerite and chalcopyrite, respectively.

Surface sampling identified mineralization within the ultramafic rocks, with bands of calc-silicates typical of the Victoria system. Except for Renforth’s prospecting, the western end of Victoria had not been previously explored or drilled.

A six-hole drill program was carried out in March/April, with each hole encountering graphitic mudstones hosting copper, zinc and nickel. These holes were drilled over an approximate 700-meter strike length.

The main finding of the drill program, as indicated by Renforth in late June, is an increase in the frequency and thickness of the graphitic mudstone layers. Moreover, this mudstone is similar to the mineralization seen in the first holes drilled at Surimeau, about 6 km to the east, and it is also exposed at surface south of the previously drilled 2.2 km of Victoria strike.

Based on visuals and XRF readings, the mudstones deliver a consistent nickel value, along with higher levels of zinc and copper.

Similarity to Finland’s Mining Districts

According to Renforth, the zinc-rich graphitic mudstones at Surimeau are characteristic of a VMS (volcanogenic massive sulfide) environment, some of which may host economic VMS mineralization, as the mudstone is in direct structural contact with the surrounding ultramafic bodies.

Alteration of the ultramafics to calc-silicates along this contact is at times significant with widths of up to several meters. The calc-silicate-rich rock adjacent to the graphitic mudstones often hosts zinc and nickel, occurring as a significantly wider mineralized horizon in localized zones along strike. These wider mineralized areas are priority targets for ongoing exploration.

Renforth is looking at two examples of similar mineralization as models to guide its interpretation and exploration planning at Surimeau: the Outokumpu model and the Talvivaara mine, both in Finland.

The “Outokumpu model”, as designated by Renforth’s technical team, is based upon the company’s initial 2020 drilling which intersected significant mineralized graphitic mudstone in 2 of the 3 holes drilled, as well as its follow-up 2021 drilling. The results of the most recent drilling also support this model.

Outokumpu is notable as it is a unique mining district in eastern Finland, where various mines have operated since 1913, with the deposits being polygenetic, formed by structural juxtaposition of two types of mineralization: 1) magmatic nickel-copper-platinum group metals; and 2) stratabound, syngenetic zinc-copper VMS types. Additionally, in the Outokumpu mines, black graphitic schist hosts the deposits.

Between 1913 and 1988, the Outokumpu district encompassed three major deposits — Outokumpu, Vuonos and Luikonlahti — with total production of around 50 million tonnes of ore containing 2.8% copper, 1% zinc, 0.2% cobalt, and minor amounts of nickel and gold.

The second mineralization model for Surimeau is Terrafame’s Talivaara mine, located north of the Outokumpu district, and also north of the Arctic circle. While Talvivaara does not currently appear to be a direct analogue to Surimeau, as Renforth points out, the characteristics of both Outokumpu and Talvivaara settings are still present on its property.

An excerpt from a 2015 paper published by Mineral Deposits of Finland summarizes the importance of black shales (including mudstones) and the difficulty of differentiating Outokumpu from Talvivaara settings:

“Because of their often-large extent, ancient black shale strata represent one of the most significant crustal reservoirs of organic carbon and sulfur, and potential resources of many metals, including so-called critical metals. In some cases, the metal concentrations of black shales can reach sufficiently high levels, generating an ore deposit.

“Characteristically, these deposits are polymetallic, such as the Paleoproterozoic Talvivaara Ni-Zn-Cu-Co deposit in Finland… a clear distinction between black shale-hosted deposits and volcanogenic massive sulfide (VMS) Cu-Zn-Pb-Ag-Au, sedimentary exhalative (SEDEX) Pb-Zn-Ag, or sediment-hosted epigenetic (Kupferschiefer, Katanga) Cu-Zn-Pb-Ag deposits cannot always be drawn, as the host rocks of these deposits may contain black shales influenced by migrating hydrothermal fluids (Coveney, 2003).”

Hosting a billion tonnes of ore grading 22% nickel, 0.13% copper, 0.5% zinc and 0.02% cobalt, the Talivaara mine currently contains 2.2Mt of nickel, 1.3Mt of copper, 5Mt of zinc and 0.2Mt of cobalt.

The heap-leach mine extracts ore from two small open pits, producing nickel and cobalt sulfates for batteries. Terrafame states: “The main factor behind the small carbon footprint is our bioleaching method, which consumes considerably less energy than conventional methods. The ore does not need to be crushed nor grinded as fine as in the traditional process, and high-temperature metallurgical processes are not used in further processing.”

Though Renforth is still in the early stages of proving Surimeau is a deposit of economic value, the company sees the related deposit type at Outokumpu, and the possibly related deposit type at Talvivaara, along with the latter’s “green” operations, as an inspiration for Surimeau’s future.

Conclusion

With the latest copper project acquisition, Renforth’s growth strategy becomes clear: to assemble a diverse set of energy metals projects to complement its Surimeau district-scale property, which itself is prospective for a wide range of critical minerals.

It’s been widely documented that the global energy transition requires lots more minerals like copper, lithium and nickel than the world has to offer. But now, it seems as though a global metals shortage is fast approaching.

Take copper, for example, analysts at Goldman are predicting that “we’ll be at the lowest observable inventories that have ever been recorded at 125,000 tonnes” in 2023. By year-end, the copper market is expected to be undersupplied, and sometime in 2024, peak supply will arrive, generating deficits from that point, the bank said.

As for battery metals, a report by the International Energy Agency (IEA) showed that literally hundreds of new mines must be built to meet the projected needs by 2030. This, based on IEA calculations, equates to a 10x increase over the current critical minerals supply chain.

Of all the key metals needed, nickel is facing the largest absolute demand increase as high-nickel chemistries are the current dominant cathode for EVs and are expected to remain so, the IEA report found. As many as 60 new nickel mines would be needed by 2030 to meet global net carbon emissions goals, the IEA estimates.

All of this means that exploration companies must up their efforts to locate the next critical minerals deposit containing lots of nickel, plus copper and other metals. This is reflected by Renforth’s recent asset buying spree, which would maximize its chances of discovery on top of an already large polymetallic project that remains underexplored.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.015; 2023.08.11

Shares Outstanding 326.3m

Market cap Cdn$4.9m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of RFR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.