Renforth enhances value of Surimeau battery metals property with extension of Lalonde showing

2022.06.02

We all know Elon Musk just doesn’t shy away from blockbuster deals when it comes to realizing the wildest of his ambitions.

No, we’re not talking about the Tesla founder’s much-publicized bid to buy Twitter — that would be a discussion for another day. What we are focused on are the smaller scale, yet still significant, deals to keep his electric car ventures running.

This year, Musk’s company already inked two major nickel supply deals, the first with Minnesota-based miner Talon Metals, which is supported by Rio Tinto, followed by a long-term agreement recently signed with Brazilian mining giant Vale.

Nickel is a popular raw material with EV makers like Tesla because it provides the energy density that gives the car battery its power and range; it is estimated that an average EV contains about 15.7 kg of nickel metal.

While securing multiple nickel supply agreements shouldn’t come as a huge surprise for an EV company of this size, Tesla’s 2022 dealings do reveal an interesting fact about the direction it is heading when it comes to battery metal sources.

Nickel from the Right Place

Unlike the company’s past supply deals with miners (i.e. BHP), both Talon and Vale’s nickel operations are based in North America, which are closer to its production facilities. Given Elon Musk’s past pledge to give out “giant contracts” to miners that can produce nickel in an efficient, environmentally friendly manner, these deals also make sense.

About 70% of the world’s mined nickel currently comes from lateritic nickel ores, which are highly expensive to process and can cause harm to the environment. Many of these are found in the Philippines, Indonesia and New Caledonia — the top 3 producers.

As such, the industry is slowly moving away from nickel laterite projects and is strictly focused on nickel sourced from sulfide ores, which contain the high-purity nickel required in battery cathodes and are much easier to process.

Historically, most of the world’s high-purity nickel was produced from sulfide ores, including the giant (>10 million tonnes) Sudbury deposits in Ontario, Canada; Norilsk in Russia; and the Bushveld Complex in South Africa.

Tesla’s nickel supply deals this year are a great example of EV makers shifting towards cleaner, safer jurisdictions for their battery metals, in particular its long-term commitment to Canadian nickel.

Doing so, the EV market leader has pretty much set a precedent for the entire industry to follow, and for mining companies on the hunt for battery minerals in places like Canada, this can only be good news.

Canada’s Next Discovery?

As one of the few junior miners racing towards the next nickel discovery in Canada, Renforth Resources (CSE:RFR, OTCQB:RFHR, FSE:9RR) has the right metals at the right time, embodied in its Surimeau polymetallic project in Quebec.

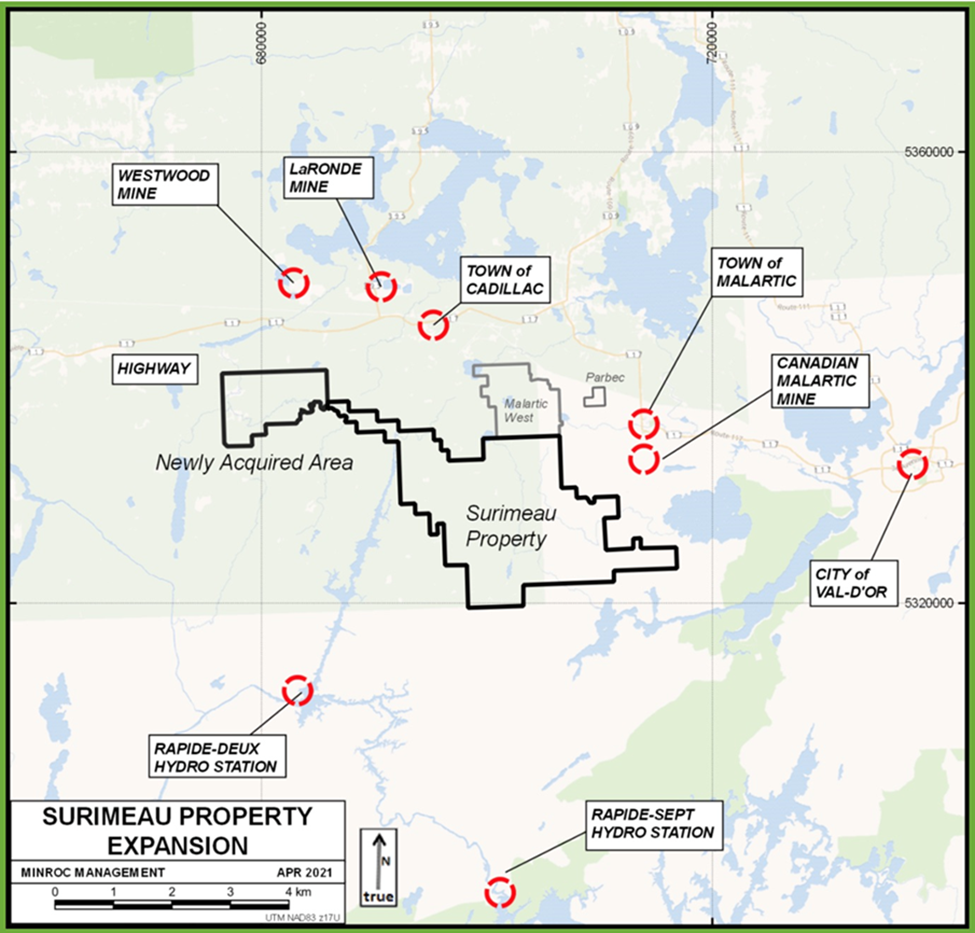

This 330 square-kilometer district-scale property hosts several areas prospective for gold and industrial metals (nickel, copper, zinc, cobalt, silver). It is located south of the Cadillac Break, a major regional gold structure that has produced over 100 oz. of gold since the 1900s.

To date, the exploration focus at Surimeau has been the sulfide-nickel-rich VMS targets, in particular the Victoria West prospect, which has been the site of drilling for over a year.

According to Renforth, information gleaned from drilling and trenching, along with surface sampling, creates an area of interest that includes over 5 kilometers of strike on the western end of a 20-kilometer magnetic anomaly. The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside, and is intermingled with, VMS-style copper-zinc mineralization.

So far, only 5,626 meters have been drilled over 2.2km of the known strike length at Victoria West, yielding results that allude to the presence of a large polymetallic camp richly endowed with nickel, copper, cobalt and zinc, along with some PGEs (platinum group elements).

The most recent assays came from seven holes (1,200m) drilled within the 275m strike length of the stripped area at Victoria West, where channel sampling earlier revealed consistent nickel-cobalt mineralization.

One drill hole returned 3.46% Ni and 491 ppm Co over 1.5m between depths of 196.5m and 198m, demonstrating the high-grade nickel potential present at Victoria West.

The high-grade intercept was within a broader mineralized zone of 170.55m, which averaged 0.16% Ni and 100.2 ppm Co. A 12m-long zone, between 187.5m and 199.5m down hole, averaged 0.54% Ni and 138.7 ppm Co.

These results followed up on the promising assays reported last fall, where each of the 21 holes returned mineralization as expected, with the four deeper holes demonstrating an increase in grade.

In the March 29 news release announcing the latest drill results, Renforth CEO Nicole Brewster said: “I am very happy with these results, they support our interest in Surimeau, an interest which only continues to grow.”

Brewster continued by saying: “We will soon drill again as we work to define not whether there are battery metals within the 6km long Victoria West area, but instead, answer the question of just how well endowed with battery metals this ‘hiding in plain sight’ discovery really is.”

“The potential, in terms of size, has always been significant. Now, with the results released today, the potential in terms of grade has increased,” she added in a note to shareholders.

The plan for Renforth now is to move as quickly and as efficiently as possible to have an initial inferred resource for Victoria West.

Resemblance to Past Producer

To fully understand the potential scale of a mining project, it’s always helpful to make comparisons with past producers that share similar geological traits.

The Surimeau property occurs within a unique geological setting where two types of mineralization, formed from different geological processes, are “mashed together” in one distinct orebody. It is best described as a magmatic nickel sulfide deposit, juxtaposed with a copper-zinc volcanogenic massive sulfide deposit.

The first type of deposit, which may contain nickel, cobalt and platinum group elements (PGEs), is associated with ultramafic rocks. The second type, volcanogenic massive sulfides (VMS), was formed on or near the ocean floor during ancient underwater volcanic activity.

VMS deposits are sought after for mining because they usually contain a mix of base metals such as zinc, lead, copper, and sometimes precious metals including silver and gold. The minerals usually form massive sulfide mounds or layers, making them relatively easy to extract.

Surimeau’s mixed style of mineralization, however, is very rare; the best comparison so far is the Outokumpu district of eastern Finland.

Outokumpu contains sulfide deposits with economic grades of copper, zinc, cobalt, nickel, silver and gold. Mining took place from 1913 to 1988, and involved the exploration of three deposits — Outokumpu, Vuonos and Luikonlahti. Approximately 50 million tonnes of ore, averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined.

As for how closely Renforth’s Surimeau deposit resembles the size and qualities of the Outokumpu district, it’s too early to say. Nevertheless, the scale of this district is encouraging.

Moreover, the Finnish deposit contains a confluence of elements that yields a large suite of base metals. If Renforth can delineate a similar mix, there is a good chance they can be mined as a single unit like at Outokumpu, and processed into separate concentrates.

Surface Sulfide at Lalonde

As further proof of Surimeau’s potential to host a large polymetallic system, Renforth this week announced that current fieldwork has resulted in the discovery of surface battery metals sulfides at the Lalonde target.

Surface sampling of EM anomalies on the magnetic structure hosting the Lalonde showing has extended the battery metals mineralization to the east by 1.7 km and to the west by 400m, bringing its total strike length to 2.4 km.

Lalonde is located 3.7 km north of the Victoria West mineralization, which was previously drilled by Renforth over 2.2 km in strike length.

Unlike the Victoria West area and the Victoria magnetic structure, the Lalonde area has only seen limited work to date.

However, it should be noted that both Victoria and Lalonde were discovered in 1943 during the construction of the powerline for the Rapide Sept generating station south of Surimeau, which in both instances revealed surface mineralization.

A total of 2,318m was drilled at Lalonde in 1958 and 1968 in 23 drill holes. These were assayed for copper, nickel and zinc, revealing the presence of mineralization. Later drilling took place to the east and northeast of Lalonde, but the drill holes were only assayed for gold.

At Lalonde, Renforth previously took 34 grab samples during prospecting in 2020 and 2021, with each demonstrating the presence of elevated copper, nickel and zinc. The best grab sample results include the highest nickel result: 0.2% Ni, 578 ppm Cu and 785 ppm Zn.

Importantly, the prior sampling results from Lalonde were similar to those received from Victoria West. This gives credence to Renforth’s theory that mineralization at Victoria West and Lalonde, as well as the Colonie showing at the eastern end, all belong to the “Outokumpu” model of polymetallic system described earlier.

Recent prospecting at Lalonde has delivered one of best visually mineralized samples at Surimeau to date, validating the accuracy of EM anomalies indicating the presence of sulfides within magnetic structures at Surimeau.

Conclusion

As far as Renforth is concerned, there has been no shortage of interest in the Surimeau project given the sheer size of this district-scale property and the large assortment of metals it hosts, in particular key battery ingredients like nickel.

Exploration results to date have only reinforced the company’s view that Surimeau is richly endowed with battery metals that have been largely overlooked in the past. This was demonstrated by the success of the 2022 fieldwork, which established the polymetallic mineralization at the underexplored Lalonde showing over a 2.4 km strike.

Up until now, the Renforth exploration team has mainly focused on the “battery metals” package of nickel, cobalt, copper, zinc, platinum and palladium that is present in six known areas of the property. But it could soon be adding another exciting piece to Surimeau’s polymetallic package: lithium.

Like nickel, lithium is an essential part of the modern EV battery, and this mineral will be the focal point of Renforth’s recently initiated 2022 field program.

Borrowing a quote from Renforth chief executive Nicole Brewster, the project represents a “complete basket of metals you need for electrification, for the storage of energy.”

Even better, this battery metals package is located right here in North America, the main hunting ground for EV manufacturers like Tesla.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.05; 2022.05.31

Shares Outstanding 262.3m

Market cap Cdn$13.1m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.