Renforth completes in-fill drill program at its Surimeau Battery Metals Project, setting up for 2024 maiden resource – Richard Mills

2023-12-09

A junior resource company with a potentially district-scale battery metals property has just completed its fall drill program.

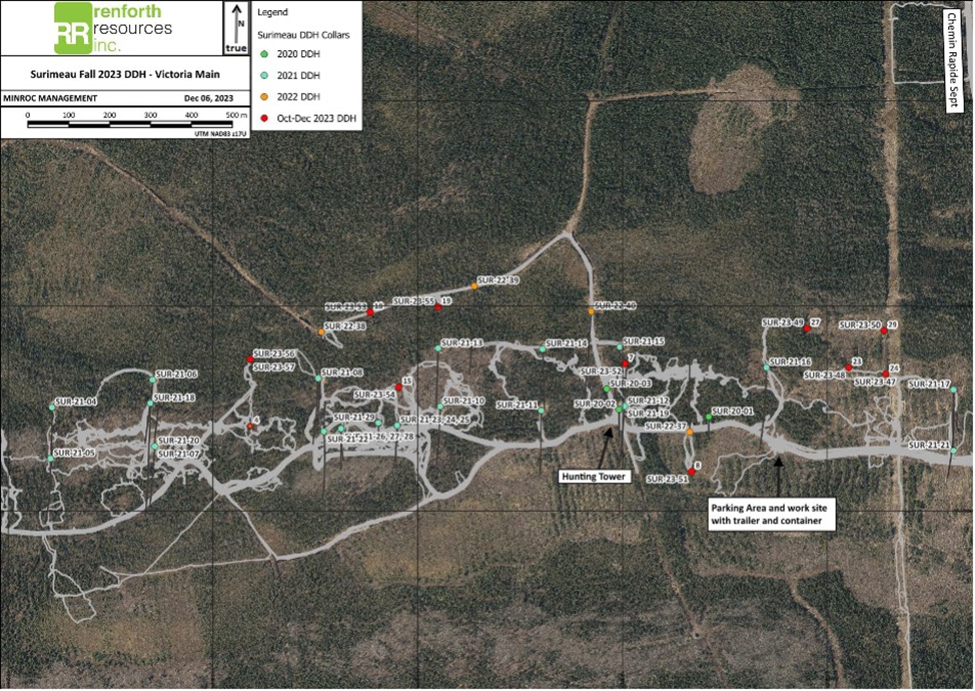

In-fill drilling occurred at Renforth Resources’ (CSE:RFR, OTCQB:RFHRF, FSE:9RR) Surimeau property, specifically the Victoria target, a ~20-km-long magnetic structure bearing nickel, copper, zinc and cobalt mineralization at surface.

This week, Renforth said its 11-hole, 3,500-meter drill campaign is now finished, with each hole intersecting the mineralized packaged, demonstrating consistency at greater depths, which has resulted in an improved tenor of mineralization.

Samples have been taken from each hole and submitted to the assay lab.

The company observes that the second-last hole drilled in the program delivered some of the best mineralization seen at any hole at Surimeau, as assessed visually and by an XRF analyzer. The hole was drilled 150 meters west and 265m north of the western end of the stripped area.

According to Renforth, This drill program brings the total meters drilled within the ~2km of strike within the central Victoria area to 10,000m, with the most recent holes generally being deeper. Observation of the newest core concludes that the Surimeau mineralized assemblage is hosted in intercalated lenses of graphitic black shales and lenses of ultramafic flows which contain elevated zinc, copper, and nickel sulfides.

In an earlier news release, Renforth said This drill program is designed to in-fill and undercut a portion of the Victoria mineralized structure, approximately 2 km of strike length from the road to the west, in an effort to tighten the drill pattern sufficiently to allow the calculation of an initial maiden resource in 2024.

The Lalonde mineralization, ~3 km north of Victoria West, was only recently drilled by Renforth. This surface mineralized system, similar to Victoria, currently stretches over ~9 km of ground-truthed strike.

Both zones are about 250-500 meters thick, running east-west across the central portion of the property. The two systems are interpreted by the company as two arms of a fold, with the fold nose located off the property and to the east.

While the defined area of mineralization spans a total length of ~29 km, which by industry standards is a long distance to cover, this is a small portion of a district-scale property that remains underexplored.

Earlier this year, the Renforth team started to move farther out, drilling in an area about 4 km west of the Victoria structure where work first began on the property.

In September, Renforth staked an additional 62 claims north of Lalonde — the balance of the mineralized magnetic anomaly discovered in the latest prospecting program — as well as historical government soil samples.

An airborne electromagnetic/magnetic survey interpreted the western end of Victoria as showing an interesting curvature, possibly representing folding which may have resulted in mineralized fluid entrapment.

Surimeau’s geology is best described as a sulfide nickel magmatic sulfide deposit, juxtaposed with a copper-zinc massive sulfide deposit. The nickel-containing ultramafic orebody has been fused with the VMS deposit alongside it, giving it a unique geological flavor.

This style of mineralization is rare; however, it is known to occur in the Outokumpu District of Finland, which contains sulfide deposits with economic grades of copper, zinc, cobalt, nickel, silver and gold.

These deposits are formed by structural juxtaposition of two types of mineralization — magmatic nickel-copper-platinum group metals, and stratabound syngenetic zinc-copper VMS types. Additionally, in the Outokumpu mines, black graphitic schist hosts the deposits.

Renforth interprets the Victoria mineralized horizon, which stretches ~20 km west to east across the central portion of the ~330 square km Surimeau property, to be an “Outokumpu-style” mineralized occurrence, commencing on surface to the deepest pierce point drilled to date, ~160m vertical depth.

The Outokumpu-type assemblage found at Surimeau generally consists of carbonate rock, calc-silicates and serpentinite in close contact with bands of graphitic mudstones that are generally less than 5 meters thick. Structural repetition is evident in drill core where in certain cases there are multiple repeated sequences.

The Talvivaara mine just north of Outokumpu shares similar geology and is notable for its “green” bioleaching process.

Mapping and prospecting work in August-September focused on four areas: Lac Beaupre, Victoria West, Lalonde Northeast and Fouillac.

The program identified two new locations of surface nickel-cobalt-zinc-copper mineralization north of the Lalonde system and south of the Victoria system. The polymetallic mineralization is similar to that seen at Victoria. Renforth notes that grab samples are preferential and not representative of a broader whole.

“Other than the obvious reason (new zones) making this a positive development it is also quite interesting — illustrative of the continued potential of our huge Surimeau property to surprise us, and perhaps evidence of something bigger happening. When you look at imagery Victoria, Lalonde and the new northern mineralization all echo each other,” CEO Nicole Brewster wrote in a note to shareholders.

Lithium was found in lithium/cesium/tantalum fractionated pegmatites and in the Pontiac sediments, where elevated lithium/rubidium/cesium appears to indicate proximity to blind pegmatites and may represent the mobility of lithium, offering an exploration vector.

Numerous granitic pegmatites are exposed along the southwestern and southern parts of Surimeau, especially along the Decelles granite-Pontiac metasedimentary contact. These pegmatite dykes often intrude into amphibolized Pontiac sediments. The prospecting program identified four grab samples with >200 ppm Li including one high-value sample of 990 ppm Li. All four samples were taken from Pontiac sediments in direct contact with granite/pegmatite. These samples appear to also have elevated Rb and Cs values.

Granitic pegmatites in the southern part of the property have coarse-grained green muscovite and contain anomalous Ta-Nb-Sn and Rb. Some of the granitic pegmatites also contain lithium indicator minerals: tourmaline, garnets and white K-feldspar. These are characteristics of a fractionated granitic melt which could evolve to become a lithium pegmatite and will be used to vector into exploration targets.

Renforth is undertaking a non-brokered financing to raise $500,000 through the sale of shares, on a flow-through basis. The company has repriced the private placement from 4 cents to 2.6 cents per unit.

Each unit is comprised of a common share and a purchase warrant exercisable for 24 months at $.05 to purchase an additional common share, and flow-through units at $.03 per unit, comprised of a flow-through share and half a warrant. A whole warrant is exercisable into an additional common share at $.05 for 18 months.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.025; 2023.12.08

Shares Outstanding 325m

Market cap Cdn$5.2m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does does not own shares of Renforth Resources (CSE:RFR)

RFR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of RFR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.