Renforth channel sampling returns up to 2% copper at Surimeau polymetallic asset in Quebec

2022.01.25

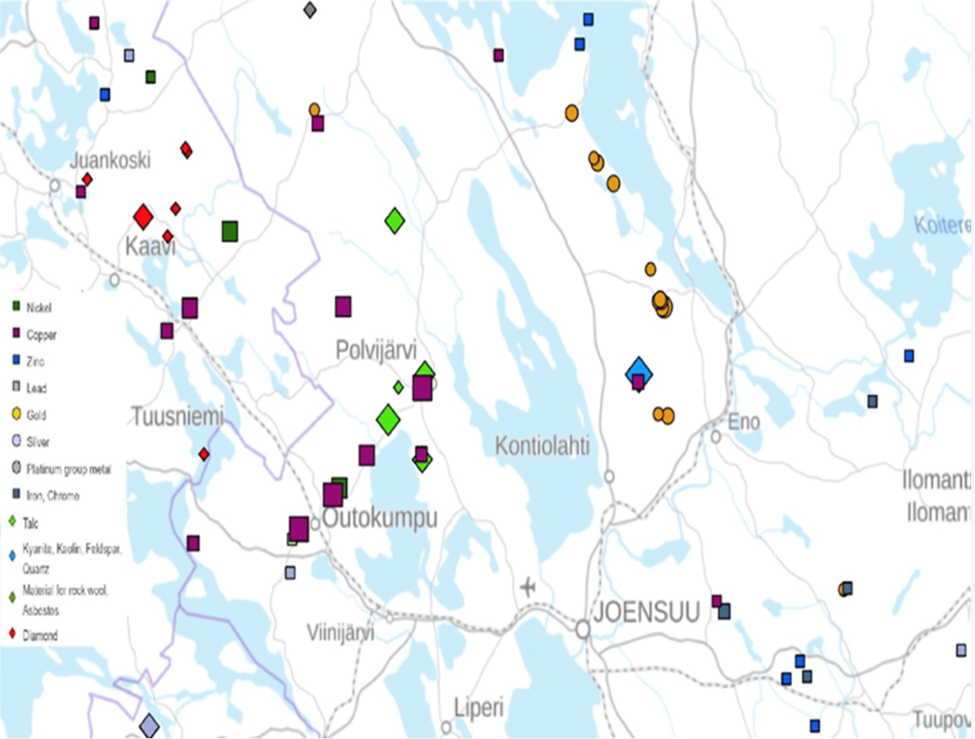

Renforth Resources’ (CSE:RFR, OTCQB:RFHRF, FSE:9RR) Surimeau project in Quebec hosts several target areas for industrial metals (nickel, copper, zinc, cobalt) located south of the Cadillac Break, a major regional gold structure.

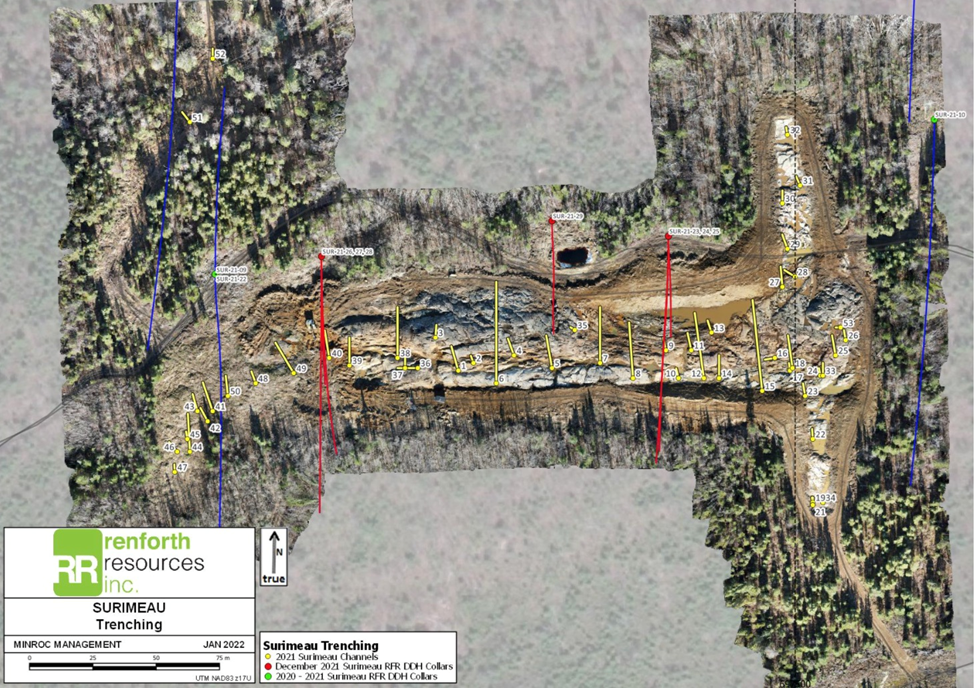

The exploration focus is currently on the sulfide-nickel-rich VMS targets, in particular the Victoria West prospect, which has been the site of drilling for over a year (see map below).

According to Renforth, information gleaned from drilling and trenching, along with surface sampling, creates an area of interest that includes about 5 km of strike on the western end of a 20-km magnetic anomaly. So far only 5,626m have been drilled.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside, and is intermingled with, VMS-style copper-zinc mineralization.

Geology

The Surimeau project occurs within a unique geological setting, where two types of mineralization, formed from different geological processes, are “mashed together” in one distinct orebody. It is best described as a magmatic nickel sulfide deposit, juxtaposed with a copper-zinc volcanogenic massive sulfide deposit.

The first type of deposit, which may contain nickel, cobalt and platinum group elements (PGEs), is associated with ultramafic rocks. The second type, volcanogenic massive sulfides (VMS), were formed on or near the ocean floor during ancient underwater volcanic activity.

VMS deposits are sought after for mining because they usually contain a mix of base metals such as zinc, lead, copper, and sometimes precious metals including silver and gold. The minerals usually form massive sulfide mounds or layers, making them relatively easy to extract.

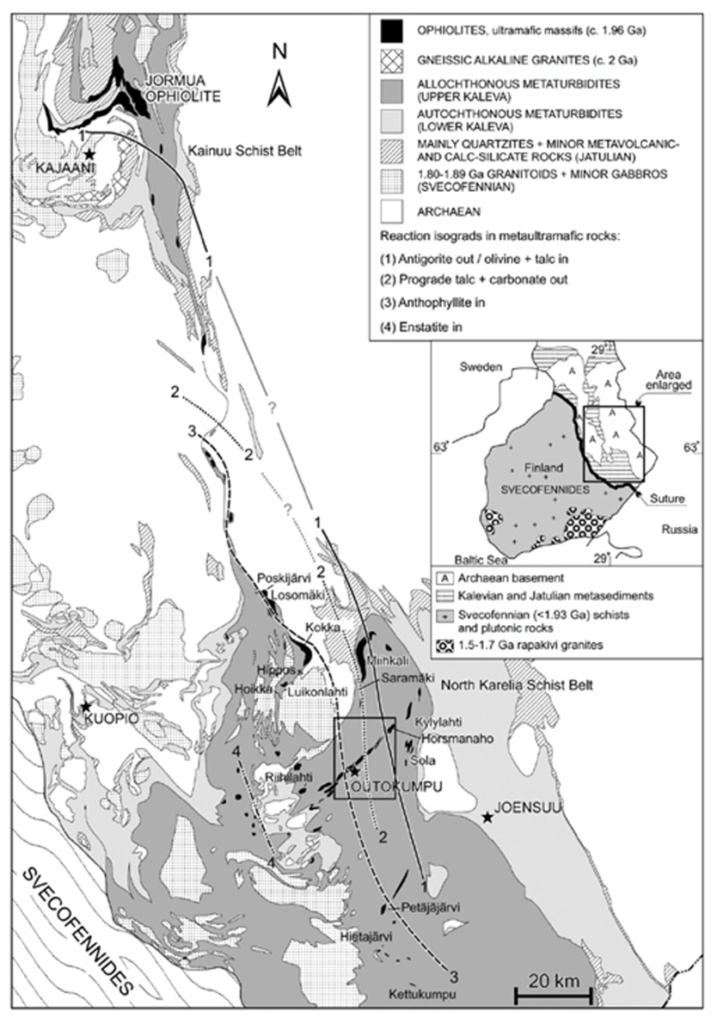

Surimeau’s mixed style of mineralization is rare, however, it is known to occur in the Outokumpu District of eastern Finland.

Outokumpu contains sulfide deposits with economic grades of copper, zinc, cobalt, nickel, silver and gold. Mining was from 1913 to 1988 and involved exploitation of three deposits — Outokumpu, Vuonos and Luikonlahti. About 50 million tonnes of ore, averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined.

Geologists believe that Outokompu’s unconventional deposit type originated through deposition of copper-rich ore on the sea floor around 1,950 Ma. Some 40 Ma later, disseminated nickel sulfides formed through chemical interaction between massifs (blocks of rock) and adjacent black schists.

A 2007 geological paper states that mixing of these two “end-member” sulphides, i.e., the primary Cu-rich proto-ore and the secondary Ni sulphide disseminations, resulted in the uncommon metal combination of the Outokumpu-type sulphides. Late tectonic solid-state remobilisation, related to the duplexing of the ore by isoclinal folding, upgraded the sulphides into economic deposits.

First mined at the turn of the 20th century from a rich copper deposit known in Finnish as “strange hill”, by the 1930’s, Outokumpu had become a major producer of copper and an exporter of copper ore. Read more about the history

As for how closely Renforth’s Surimeau deposit resembles the size and qualities of the Outokumpu District, it is too early to say, however the scale of the district is encouraging (up to 50Mt of ore has been mined in Finland) and we also know that Outokumpu is enriched with palladium, a high-value metal currently worth more than an ounce of gold (current spot Pd = $1,944/oz) – Renforth has yet to assay for PGEs.

Moreover, the Finnish deposit contains a confluence of elements that yields a large suite of base metals. If Renforth can delineate a similar mix, there is a good chance they can be mined as a single unit like at Outokumpu, and processed into separate concentrates.

Quebec’s Dumont sulfide nickel deposit is another interesting analog to Surimeau. Described in a corporate presentation as “a shovel-ready sustainable nickel project,” Dumont is considered one of the only large-scale nickel deposits not currently owned by a major mining company. It has 2.8Mt of nickel in proven and probable reserves, and 110,000 tonnes of cobalt. A feasibility study estimates Dumont will be a top five nickel producer globally, producing an average 39,000 tonnes of the EV battery ingredient per annum for 30 years.

A 2019 technical report by Ausenco describes the geology:

The Dumont sill lies within the Abitibi subprovince of the Superior geologic province of the Archean age Canadian Shield. The sill is one of several mafic to ultramafic intrusive bodies that form an irregular, roughly east comprises a lower ultramafic zone which averages 450 m in true thickness and an upper mafic zone about 250 m thick. The ultramafic zone is subdivided into the lower peridotite, dunite and upper peridotite subzones. Cumulus nickel (Ni) sulphide and alloy minerals occur in parts of the dunite subzone and locally in the lower peridotite to form the Dumont deposit.

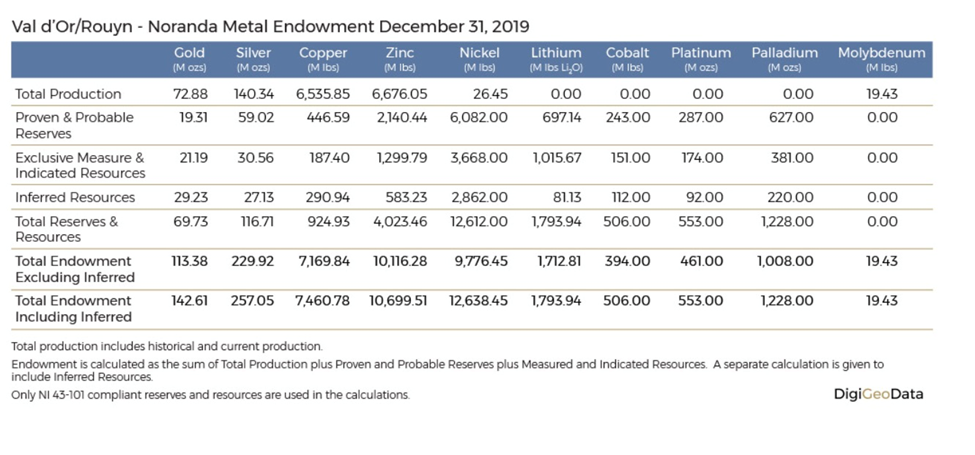

The Dumont project being developed by Nion, is located within the Abitibi region of Quebec that is famous for gold mining. It is about 25 km northwest of Amos, 60 km northeast of Rouyn-Noranda and 70 km northwest of Val d’Or. While no historical mining has been conducted on the property, the Val d’Or-Rouyn-Noranda region surrounding it has been and continues to be a prolific mining area.

According to DigiGeo Data, the area’s total gold endowment reached 113.4 million ounces at the end of 2019, or 142Moz when inferred resources are counted, making it one of the most productive gold-mining belts in Canada. There are also significant quantities of silver, copper and zinc, along with lithium, nickel, cobalt, platinum, palladium and molybdenum. At the end of 2019 there were eight mines producing gold, with additional production of silver, copper and zinc.

As one of the country’s most explored areas, DigiGeo Data notes that this part of the Abitibi contains an additional 74 deposits with NI 43-101 resources and reserves, at various stages of development from resource definition to feasibility.

Historical copper and zinc production from the Val d’Or-Rouyn-Noranda region between 1927 and 2019 was a respective 6.54 billion and 6.68 billion pounds. In the last 10 years, all of it has come from Agnico-Eagle’s LaRonde mine. LaRonde is primarily a gold-silver mine but it also processes copper and zinc as byproducts.

Besides Dumont and LaRonde, there are other polymetallic deposits in the vicinity. The historical Marbridge mine is 40 km NW of Val d’Or and 60 km SE of the Dumont deposit. The mine operated by Falconbridge Nickel, produced 702,366 tonnes grading 2.28% nickel and 0.1% copper over five years, before closing in 1968. It was Quebec’s first nickel mine.

Two points jump out at me from the above analysis. The first is that the Dumont deposit has nickel and cobalt in common with Surimeau, possibly but not yet confirmed, due to their similar geology. At Surimeau’s Victoria West target , the ultramafic orebody contains nickel and cobalt, and possibly platinum group elements. At Dumont, the nickel sulfide minerals and alloy minerals occur in the ultramafic zone.

The second point has to do with grades. The low-grade, polymetallic Outukompu camp was mined for over 100 years. Dumont is another seemingly low-grade polymetallic deposit. Its proven and probable reserves grades are only 0.27% nickel and 107 ppm cobalt (in comparison, the Voisey’s Bay mine in Labrador, one of the world’s largest, has a grade of 1.63% Ni).

The open-pit mine would produce a 29% Ni high-grade concentrate and is expected to be a low-cost producer, with second-quartile cash costs of US$3.22/lb.

The supply of several mined commodities especially copper and nickel is tightening, with few large deposits being discovered and existing one that are being mined out. Grades are also declining, and while this a few years ago would have rendered many mineral deposits uneconomic, with rising prices, they are now “in the money.” In layman’s terms, the amount of metal needed to justify mining goes down.

Nickel prices have risen from about $4 a pound in July 2017, to the current $10.18. Spot copper has more than doubled from just over $2/lb in April 2020, to the current $4.44. These price increases will improve the viability of some previously uneconomic, lower-grade copper and nickel deposits.

Exploration

Renforth’s first drilling at Surimeau occurred in October 2020, with 2.5 short holes completed.

This was followed by 15 holes for 3,456m in spring, 2021, drilling off 2.2km of strike within the approximately 5-km-long Victoria West target. Another four holes totaling about 1,000m were drilled last summer; these holes all delivered visible sulfides in the core.

Assays for the 21 holes drilled at Victoria West were announced in November, with each hole hitting mineralization as expected, and the four deeper holes demonstrating an increase in grade.

Highlights of the 2020-2021 drilling included:

- A 111.05m mineralized interval starting at 57m down hole, averaging 0.17% Ni and 139.58 ppm Co (cobalt). A highest-grade 40-meter sub-interval assayed 0.22% Ni and 168.98 ppm Co.

- A 107.2m interval starting at 130.5m down hole, averaging 0.15% Ni and 112.64 ppm Co, within which the highest-grade sub-interval of 14.4m assayed 0.22% Ni and 196.4 ppm Co.

- A 119.7m interval starting at 81.3m down hole, averaging 0.13% Ni and 90.49ppm Co. A highest-grade 0.55m sub-interval assayed 0.95% Cu, 0.17% Ni and 217 ppm Co.

Since then, seven new holes (1,203m) have been within an approximate 275m strike length. The recently concluded stripping of this area encountered more copper and zinc on surface than was seen in the drilling.

According to Renforth, this is thought to be due to the presence of the ultramafic nickel/cobalt body and the magmatic copper/zinc body, consistent with the company’s Outokumpu-style model that suggests two different mineralized bodies juxtaposed in one location due to the circumstances of the mineralizing event.

The results of channel sampling across the 275 meters of stripped surface area at Victoria West were published this week. According to Renforth, the channel samples demonstrate elevated nickel, copper, cobalt and zinc values, the highlight being where the two mineralization types (nickel-cobalt and copper-zinc) mix.

Channel 49 featured a 12.9-meter section with assays of 0.121% nickel and 0.013% cobalt. Including within this section, were 0.224% Ni over 1m, and 5.5m of 0.43% copper and 1.63% zinc. The latter intersection included a best-grade 0.8m of 2.05% copper.

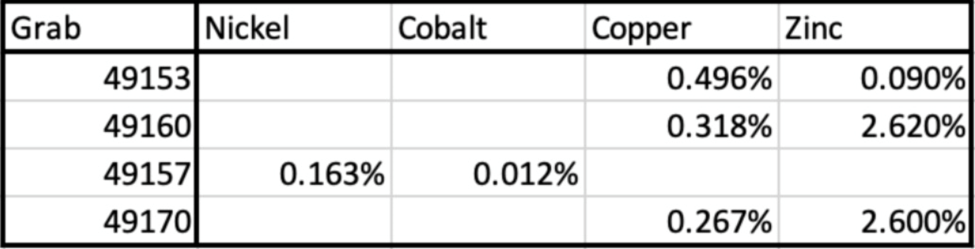

In addition to the channels cut, there were several grab samples taken. Highlights included 0.163% nickel and 0.012% cobalt, along with 0.496% copper and 0.09% zinc.

“I am happy to deliver results to shareholders which demonstrate that our discovery of a polymetallic, nickel/cobalt and copper/zinc mineralized system at Victoria West, stretching over >5km and hiding in plain sight, is a surface system. This gives Victoria West another advantage, in addition to numerous road access options and hydro-electric power, we are dealing with easily and cost-effectively accessed mineralization,” said Nicole Brewster, Renforth’s President and CEO.

Brewster noted that Surimeau is about 70 km from Glencore’s Horne smelter in Rouyn-Noranda, QC, Canada’s only copper smelter. If Renforth is able to develop Victoria West into a mineable asset, “the [processing] solution is situated within an hour of our doorstep,” she wrote in the Jan. 18 news release.

Sulfide nickel

Nickel deposits come in two forms: sulfide or laterite. About 60% of the world’s known nickel resources are laterites, which tend to be in the southern hemisphere. The remaining 40% are sulfide deposits.

Nickel sulfide deposits, the principal ore mineral being pentlandite, are formed from the precipitation of nickel minerals by hydrothermal fluids. They are also called magmatic sulfide deposits. The main benefit of sulfide ores is that they can be concentrated using flotation, a simple separation technique.

Yet large-scale sulfide deposits are extremely rare. Historically, most nickel was produced from sulfide ores, including the giant (>10 million tonnes) Sudbury deposits in Ontario, Norilsk in Russia and the Bushveld Complex in South Africa. However, existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting, nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

Nickel sulfide deposits provide ore for class 1 nickel users which includes battery manufacturers. These companies purchase the end product known as nickel sulfate, derived from high-grade nickel sulfide deposits. It’s important to note that less than half of the world’s nickel is suitable for the biggest growth market — EV batteries.

According to BloombergNEF, demand for class 1 nickel is expected to out-run supply within five years, fueled by rising consumption by lithium-ion electric vehicle battery suppliers.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically and technically feasible? The pickings are slim.

Decades of under-investment equals few new large-scale greenfield nickel sulfide discoveries. Only one nickel sulfide deposit has been discovered in the past decade and a half, Nova-Bollinger in Western Australia.

The result of such limited nickel exploration is a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will therefore be sought-after by major or mid-tier miners with the deep pockets required to build it into a mine.

Conclusion

While still at an early stage, Renforth considers the extent of its findings to date, plus other known targets and unexplored prospective ground, warrant further exploration.

Victoria West is only one of six polymetallic target areas on the Surimeau property historically documented as hosting mineralization. It is located at the western end of a 20-km-long magnetic anomaly that hosts proven mineralization at either end, with the Colonie target at its eastern end.

The fourth and latest to be prospected is the Huston area, located at the western end, about 18 km from Victoria West. This area is almost entirely unexplored with the exception of a limited drill program by Hecla in the 1980s, which focused on gold.

Results of last summer’s prospecting from the southwestern part of the area gave the first ever documented nickel occurrence at Huston, with one grab sample returning 1.9% Ni, 1.38% Cu, 1,170 ppm Co and 4 g/t Ag. Management considers this sample, which was taken from strongly foliated diorite, a coarse-grained intrusive igneous rock, to be a new discovery that will be revisited.

The company also plans to investigate the 14 km of magnetic anomaly between Victoria West and Colonie to determine the continuation of the ultramafic mineralization.

Could Surimeau be part of a polymetallic camp within the Val d’Or-Rouyn-Noranda region of Quebec? Well, the nearby Dumont deposit appears to have a similar style of mineralization containing nickel and cobalt. There is a lot of gold in Val d’Or-Rouyn-Noranda, but also significant amounts of silver, copper, nickel and zinc. Quebec’s first nickel mine was Marbridge, located in close proximity to Surimeau. Both properties are under 50 km from Val d’Or.

Renforth has a >5 km of a mineralized system, starting on surface, endowed with grades of nickel, copper, cobalt and zinc, along with some PGEs, which in the words of CEO Nicole Brewster, “collectively are giving the company of a total contained metal value which may exceed the cost to mine.”

Between Renforth’s and historical work there is >5 km of mineralized domain associated with a 20-km magnetic anomaly (which “sees” the nickel). It has the scale, location and grades comparable to other deposits/mines. Renforth is working to develop Surimeau into a deposit, within NI 43-101 industry standards.

Renforth is a special kind of junior for having both precious and battery metals.

At Surimeau, Renforth is exploring for nickel, copper and cobalt, minerals that all play critical roles in the clean energy transition. Its work to date has given us a glimpse of the project’s potential for exciting new battery metals discoveries.

The company has also been exploring for gold at its Parbec project, also in Quebec. Parbec is an open-pit gold deposit sitting on 1.8 km of the Cadillac Break, a regional structure located next to Canadian Malartic, Canada’s largest gold mine.

The May 2020 pit-constrained resource estimate showed 104,000 indicated ounces at 1.78 g/t Au and 177,000 inferred ounces at 1.78 g/t Au. Since then, Renforth has completed over 15,000m of drilling, with positive results received. The latest batch of assays had 3.06 g/t gold over a thickness of 21.85m.

Its Surimeau deposit at surface is just starting to reveal its secrets to the market. Just how large this nickel sulfide system is, remains to be seen. RFR is clearly hoping to find nickel sulfides that when refined would be appropriate for lithium-ion batteries. This, along with recent channel/ grab sample results containing copper and zinc, should put the project on the radar of potential acquirers.

Renforth Resources Inc.

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.07; 2022.01.20

Shares Outstanding 262.3m

Market cap Cdn$19.6m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources Inc. (CSE:RFR).RFR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.