Protectionism becoming hallmark of US government policy – Richard Mills

2023.01.18

The United States’ reputation as a free-trading nation is under attack from forces inside the White House.

The turn to protectionism under the Biden administration is a much quieter approach than the blustery rhetoric employed by President Trump in his trade war with China, but the goal is the same: protect American industries that are vulnerable to foreign competition, through import tariffs and less direct measures such as tax credits and government subsidies.

The United States used to be the standard-bearer of globalization, which in simple terms, is the process by which people, goods, services, capital, and data move easily across borders. What happened to cause the United States to throw up trade barriers, whose removal it once championed?

Origins of US free trade…

Our story begins in the early 19th century, before the US Civil War (1861-65) pitted northern against southern states. (The Confederacy was formed on Feb. 8, 1861, by seven slave states: South Carolina, Mississippi, Florida, Alabama, Georgia, Louisiana and Texas.)

At the time, northern manufacturers sought the protection of high tariffs on competing exports, while southern cotton producers backed open trade policies to promote their exports.

The northern states eventually had their way.

In a primer on the rise of US protectionism, The Fraser Institute writes,

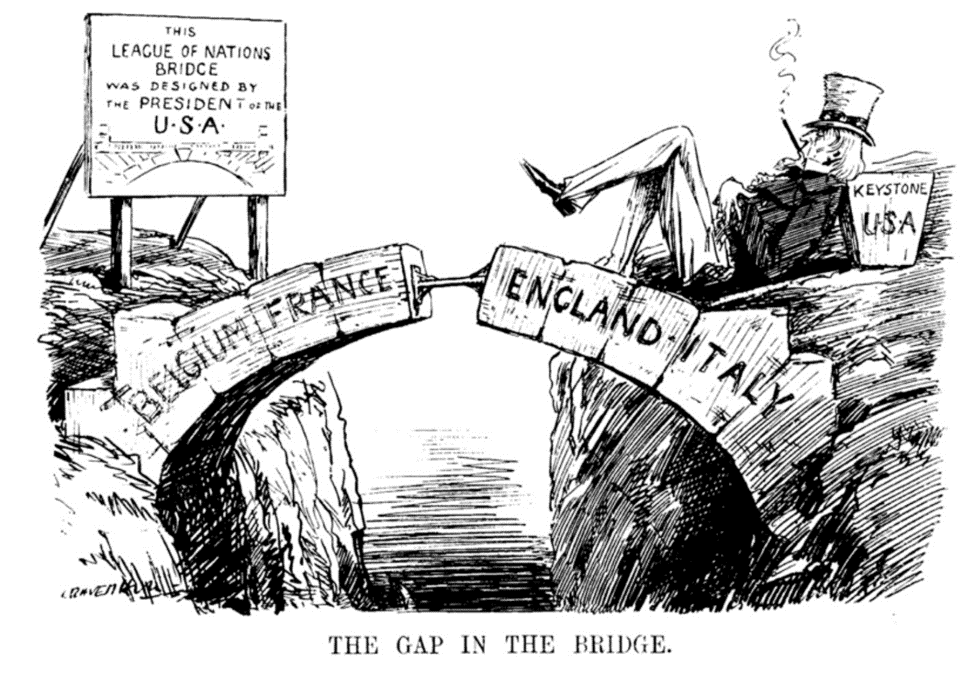

In those first decades of the 20th century, nationalist groups – like those operating today – undermined public support for trade. Governments bowed to the pressure. Trade barriers rose. The process culminated in the notorious Smoot-Hawley Tariff Act, passed by the US Congress in 1930.

Smoot-Hawley was designed to protect US sovereignty and jobs. Instead, it launched an international trade war that destroyed millions of jobs worldwide, laying the groundwork of suspicion and desperation that led to World War II.

According to The Department of State,

Smoot-Hawley marked the end of the line for high tariffs in 20th century American trade policy. Thereafter, beginning with the 1934 Reciprocal Trade Agreements Act, the United States generally sought trade liberalization through bilateral or multilateral tariff reductions. To this day, the phrase “Smoot-Hawley” remains a watchword for the perils of protectionism.

The Secretary of State to then-President Franklin Roosevelt, Corden Hull, feared that, if his Democratic Party legislators in Congress simply reduced tariffs, future Congresses would raise them again. His answer was to lock in lower tariff policies by negotiating foreign trade agreements. The US would reduce its tariffs but only in exchange for partner nations lowering theirs.

The Reciprocal Trade Agreements Act provided that, once the lower rates were negotiated, they could be implemented through presidential decree. No further Congressional action was required and the lower rates would be extended to all major US trading partners.

The Harvard Business Review notes that, At the time, the United States was running a substantial trade surplus in manufactured goods. One of Hull’s masterstrokes was to recruit U.S. exporting industries into the process on the side of trade-barrier reduction, thereby providing a counterbalance to the protectionist, import-competing industries (such as textiles) that had previously dominated the country’s trade policy. U.S. trade barriers remained relatively high in the 1930s, but the trend was now in the downward direction.

On imports subject to tariffs, US rates fell from the Smoot-Hawley average of 60% in 1930, to 5.7% by 1980, and 2.7% in 2013.

American’s free-trading stance fit hand and glove with its foreign policy during the Cold War. Trade agreements plus military alliances helped the major free-market economies to coalesce, with their growing prosperity a counter-balance to the centrally planned economies of the Soviet Union and China.

In the early 1980s, the US denounced Britain’s preferential trade deals with former colonies, and France’s favoritism of certain trading partners.

Attention turned to negotiating a free trade alliance with its northern neighbor, Canada, building on the first US-Canada trade agreement of 1935. The two nations were each other’s largest trading partners, so the economic gains from a free trade agreement were thought to be substantial.

The Canada-U.S. Free Trade agreement was completed in 1988, despite opposition from the New Democratic Party, Canadian labor unions and other pressure groups. Many Canadians will remember the heated exchange between Prime Minister Brian Mulroney and the late Opposition Leader John Turner, immortalized in this 1988 video clip.

Later, when Mexico sought a similar accord, the three-nation North American Free Trade Agreement (NAFTA) was born.

Global trade negotiations remained a US priority throughout the 1990s and helped created the World Trade Organization (WTO) in 1994. Thereafter, attention shifted to bilateral or regional accords, including free trade agreements with Jordan, Chile, Singapore, Morocco, Australia, Central America and the Dominican Republic (CAFTA-DR), Bahrain, Oman, Peru, Colombia, Panama, and South Korea.

By the late 20th century, most large US industries had internationalized their production and were dependent on foreign trade. However, free trade in the ‘90s was also starting to face a backlash. As Harvard Business Review explains it,

Multinational business had become the target of an emerging anti-globalization coalition, joining organized labor and NGOs, particularly environmentalists, who saw trade as a force enriching the wealthy at the expense of the environment, the poor, and the U.S. middle class.

Two manifestations of this new ethos, were the 1999 Seattle WTO protests, sometimes referred to as the Battle of Seattle; and the Occupy movement.

The Battle of Seattle was a series of protests surrounding the WTO Ministerial Conference. The negotiations were overshadowed by massive street protests, with crowds of up to 40,000 protesters dwarfing any previous demonstration in the United States against a world meeting of any organization associated with globalization.

Followers of the Occupy movement were opposed to socio-economic inequality and the perceived lack of democracy world-wide. The first Occupy protest to receive widespread attention was Occupy Wall Street that began in September, 2011. By October, Occupy protests had spread to over 600 communities in the United States, and they were happening in 951 cities across 82 countries.

…and protectionism

Into this politically charged environment, came the Trans-Pacific Partnership. The 2016, US-led agreement of 12 Asian and Western Hemisphere nations, aimed to address labor, environmental standards, intellectual property and other economic policies.

Former President Barack Obama became an advocate for the TPP during his second term, however the agreement became a lightning rod during the 2016 presidential election campaign. The two leading GOP candidates opposed it, (and all trade agreements) as did Democratic hopeful Hillary Clinton’s challenger, Bernie Sanders.

Trump tariffs

In January 2017, one of President Donald Trump’s first acts after taking office, was to formally withdraw from the TPP.

A year later, Trump started a trade war involving multiple battles with China as well as American allies such as Canada. NAFTA was re-negotiated and a new agreement, the clumsily worded United States-Mexico-Canada Agreement (USMCA) was signed on Dec. 10, 2019.

As The Peterson Institute put it, Each battle has used a particular US legal rationale, such as calling foreign imports a national security threat, followed by Trump imposing tariffs and/or quotas on imports.

Trump was especially keen to target China with tariffs – starting with steel and aluminum – in an effort to cut America’s trade deficit with China which was a thorn in Trump’s side and an election issue he campaigned on. The billionaire President also tried to exact concessions from China on subsidies for Chinese industries, and for forced technology transfers from American companies, in exchange for access to the 1.3 billion Chinese market.

America First

Trump’s “America First” trade policy has in many ways been followed by President Biden and his Cabinet, including Katherine Tai, the current trade representative, who is a strong believer in subsidies.

Last summer the administration said it will keep tariffs on hundreds of billions of dollars’ worth of Chinese imports in place, while it continues a statutory review of the Section 301 duties imposed in 2018 and 2019.

In December, Tai challenged the World Trade Organization’s decision that the Trump tariffs on steel and aluminum violate international trade rules. According to Bloomberg it was the strongest statement yet from the White House that Biden has no intention to remove the duties, which would potentially alienate one of his most important bases of support: steelworkers.

While the previous tactic was to get other countries to cut subsidies, in effect returning to a free trade “level playing field”, the Biden administration’s unabashed focus is on building a subsidy architecture of its own, complete with the kinds of local-content rules that American officials once railed against, states a recent article by The Economist, titled ‘What America’s Protectionist Turn Means for the World’.

Landmark legislation passed last year means the government is ready to spend nearly half a trillion dollars on semiconductor “chips” and green technology.

The “Chips and Science Act” authorizes about $52 billion in government subsidies for US semiconductor production and research, and an investment tax credit for chip plants estimated to be worth $24 billion. (Reuters, July 28, 2022).

Three US semiconductor manufacturers have already announced plans, including Skywater Technology, building a $1.8 billion research and production facility in Indiana; Global Foundries, which envisions an expansion to its New York factory creating roughly a thousand high-tech jobs; and Intel, which has announced a $20 billion investment to build a new mega chip factory in Ohio.

Most of the subsidies come in the form of tax credits, and in some cases, local content rules are in place. For example, electric vehicle buyers can apply a $7,500 credit to their purchase, but only if the car is assembled in North America. At least half the battery components in eligible cars must also be made on the continent. Wind, solar and geothermal projects will get higher subsidies if they use American steel and iron. Roughly half of their manufactured components must also be made in America, states The Economist.

Another big area of subsidization concerns farmers. The Minnesota Reformer reports that a US Department of Agriculture program touted as relief for lost trade during the US-China trade war, spent unprecedented sums of money. The Market Facilitation Program (MFP) doled out over $23 billion, more than all other USDA direct payment subsidies combined, yet the program failed to ensure that the payouts went to the farmers who most needed them.

According to The Fraser Institute, That bill could be the final shot that pushes a world already edgy about increased US protectionism into a trade war – a war that would have far more devastating consequences than the war in Afghanistan or the war against terrorism. A trade war would cut off opportunity for third world nations and leave all nations poorer and more suspicious of each other.

The Jones Act

Some US legislation that can be considered wildly protectionist, is still on the books, decades after it was first passed into law. For example the Merchant Marine Act of 1920, better known as the Jones Act, requires all cargo shipped between American ports to be carried on US-flagged vessels that are assembled entirely in America, and that have some of their major components manufactured in the US. These ships must be also at least 75% owned and crewed by Americans.

Among the key findings by the American Institute for Economic Research, regarding the Jones Act, are the following:

- The World Economic Forum has called the Jones Act the world’s most restrictive cabotage law, and the OECD ranks the US behind only China and Indonesia in the restrictiveness of its maritime-services regulations;

- Jones Act requirements have long been a protectionist drag on the US economy and are increasingly detrimental to national security. When the US military sent material to the Persian Gulf in 2002-03, American commercial ships took only 6.3% of the total, and foreign-flagged vessels a further 16%. (The US military transported the rest);

- Shipbuilding and shipping operations in the US have also become inordinately expensive. American-built coastal-size container ships are estimated to cost between $190 million and $250 million each, compared to about $30 million for foreign-made equivalents;

- According to some estimates, the daily operating costs of US-flagged ships are almost three times higher than those of foreign vessels. Crewing costs on American ships are reported to be about five times greater.

- Because of the high cost of US coastal and Great Lakes shipping, the volume of American goods carried on these routes has fallen by about half since 1960. Today, only 2% of US domestic freight is carried by water, compared to 40% in Europe.

- If the Jones Act were repealed, many goods could be transported within the US more cheaply by water than on land. US waterborne freight to and from Canada and Mexico, which is not subject to the act, increased 300% from 1960 to 2017.

- Having destroyed US merchant shipping over the past 99 years [prior to 2017 — Rick], the Jones Act needs to be repealed.

Hurting consumers, taxpayers

Last March, during Joe Biden’s State of the Union (SOTU) speech, the president emphasized efforts to expand Buy American laws, which require the US government to purchase US-made materials for public construction projects. While Biden stated Buy American “supports American jobs”, there is little evidence of this.

According to The Cato Institute, Rather the law reallocates jobs to the sectors that supply the government. It has been estimated “saving” these jobs exceeds USD 250,000 per job. Thus, while some jobs may be “saved,” the rest of the country foots the bill.

The Heritage Foundation notes:

- The Buy American Act’s preference system allows privileged American firms to charge the US government (and taxpayers) between 6% and 50% more than market prices;

- There is no positive correlation between Buy American requirements and job growth in the affected industries. As Buy American laws expanded from 1980 to 2016, employment in the steel industry decreased from 500,000 to 136,000.

The Infrastructure Investment and Jobs Act strengthened existing Buy America rules by expanding the list of materials to items like copper used in electrical wiring, making federal purchases more expensive. For example, to meet Buy America provisions, in 2017 the Washington, D.C. transit authority paid an estimated $441 million more than the foreign equivalent for new railcars for its subway.

While Biden, in his SOTU address, recommended tax credits to increase renewable energy production, he kept quiet about the extension of tariffs on imports of solar cells and panels. According to The Cato Institute, The extension is counter to both reducing energy costs and reducing greenhouse gas emissions. Some estimates report the tariffs increased the cost of solar installations for the average homeowner, which could discourage Americans from switching to renewable alternatives.

The institute also points out that, despite Biden’s emphasis on the American worker, the president has failed to reverse tariffs imposed by the Trump administration on almost 17% of US imports. Tariffs, states the institute, are regressive, meaning they significantly impact the poorest. Tariffs may also result in US firms reaping larger profits because they are insulated from competition. For example, when tariffs were imposed on imported washing machines, the tariffs not only increased the prices of imported machines, but domestic ones, too, along with dryers, a complementary good.

Between 108% and 225% of the tariff costs were passed on to consumers through higher prices for these appliances. Moreover, the tariffs were an ineffective safeguard and did not revitalize the American washing machine industry. In fact, Whirlpool (who lobbied for these tariffs) cited sales losses even two years after the tariff imposition.

Motivations

If tariffs distort trade, making goods more expensive for consumers, and local content rules hike the prices of raw materials, making infrastructure projects dearer, why has the US government gone down the road of increased protectionism? The answer boils down to China.

While American leaders once believed they could rein in Chinese industrial policies, those hopes have been dashed, due mainly to a recognition that China is an economic adversary, not a friend. This idea germinated during Trump’s trade war with China (the Chinese simply imposed tariffs of their own on US imports, hurting American industries such as agriculture), and was strengthened by, for example, the Huawei controversy. Numerous countries allege that the telco’s products purposely contain security holes that China’s government can use for spying purposes. Also, China is the country that started the pandemic, failing to disclose its early cases to the rest of the world, and allowing the virus to spread through air travel. When other countries needed medical masks, China hoarded them.

The view now is that America needs its own industrial policies to avoid becoming reliant on a rival, particularly regarding future technologies.

Two pieces of legislation recently passed by Congress, the Innovation and Competition Act (2021) and the America Competes Act (2022), have in common the aim of diminishing the US-China relationship. They also share the idea of subsidizing US semiconductor production — which is something The Cato Institute finds especially irresponsible, given that nearly half (43%) of global chip manufacturing is in the United States, and only five and a half percent is in China:

While China subsidizes its semiconductor industry, there is no need for the United States to import China’s economic policy and subsidize U.S. semiconductor production…

Even Intel, named in the SOTU for its semiconductor production success, is not interested in government support. Copying China’s behavior will weaken American competitiveness, create larger global economic distortions, and demonstrate that the United States is faltering in its promotion of freer trade.

Effects on other countries

Subsidizing US industries like semiconductors and green technology might seem like a good idea, because it’s protecting US jobs and companies, but on a global scale, this creeping protectionism can have decidedly negative consequences.

That’s because a subsidy in one country leads to a subsidy in another, until eventually, all countries are doing it. As The Economist explains,

If the result is a global subsidy race, the downsides could include a fractured international trading system, higher costs for consumers, more hurdles to innovation and new threats to political co-operation.

America’s subsidies, says The Economist, are designed to draw business from China, which reinforces the Chinese government’s commitment to greater self-reliance, including through its own vast industrial subsidies.

The effects of US subsidies go far beyond China. Trade experts in Europe are concerned they could impede the continent’s green-tech ambitions. For example Northvolt, a Swedish battery manufacturer, is reportedly reviewing its plan for a factory in Germany, in favor of its existing American operations. By staying in the US, the company could receive up to $836 million in state aid, roughly four times what the German government is offering, along with cheaper US energy prices.

And while governments in theory could take the United States to the World Trade Organization, over its subsidies and local content requirements, in reality there is little appetite to do so. If the US were to lose a challenge, it would appeal the decision, and since the WTO no longer has an appellate body, because the United States blocked appointments to the Appellate Body, the case would simply die. Another form of attack would be to slap tariffs on American exports benefiting from unfair subsidies, but this would start a tit for tat trade war.

At the end of the day, governments are finding the path of least resistance is to try and out-subsidize the competition. The Economist identifies South Korea and Japan as examples:

The South Korean environment ministry has reportedly informed carmakers that domestic subsidies for electric vehicles could be limited to firms which run their own service centres in the country, excluding most foreign companies. Japan is making its own efforts to revive the manufacturing of advanced semiconductors. Eight domestic firms, including Toyota, a carmaker, and Sony, an electronics firm, recently announced the formation of a new chipmaking firm, Rapidus. Then the Japanese government promised ¥70bn ($500m) in funding for the firm’s semiconductor research.

Canada

Here in Canada, the Trump administration levied tariffs on Canadian steel and aluminum, showing officials that America’s second largest trading partner wasn’t exempt from US protectionism.

President Biden considered tax incentives that would have hurt Canada’s auto sector, before abandoning the idea following a major lobbying effort from Ottawa, Reuters said. The fact that Trump and his America First trade policy could be on the ballot in 2024, makes Canadian trade officials especially nervous.

As such, they are trying to ensure that the US recognizes the value of Canada’s friendship, by introducing an Indo-Pacific strategy that mirrors the one released by the United States last year. Both aim to counter Chinese power in the region. Last fall, Industry Minister Francois-Philippe Champagne led a trade delegation to Japan and Korea.

The idea fits with “friend-shoring”, or out-sourcing supply chains to trusted countries.

In a speech last year to the Brookings Institution, Finance Minister Chrystia Freeland insisted that we stop supporting autocracies such as Russia and China and focus on trade and investment in the countries of our democratic allies.

Why Friedland’s “friend-shoring” is such a bad idea

Canada is also setting itself up as an alternative supplier to China, especially regarding critical minerals, a sector that China dominates.

Facing criticism of “going too easy” on China, the Canadian government recently passed legislation making it harder for foreign state-owned firms to invest in Canadian critical-minerals companies.

Effective immediately, transactions involving investments by state-owned firms into these companies will only be approved on an “exceptional basis”.

Canada in, China out: Ottawa looks to localize critical minerals supply

Canada has also joined the Minerals Security Partnership, aimed at securing the supply of critical minerals as global demand for them rises. Other members include the United States, Australia, Finland, France, Germany, Japan, South Korea, Sweden, the United Kingdom and the European Commission. Note who is not in the club: China and Russia.

Conclusion

Once considered a champion of free trade, the United States over the past few years has become increasingly insular in its trading outlook, and protectionist in its economic policies.

De-globalization in the face of greater inequality and more resource nationalism — the tendency of governments to protect their own natural resources, either directly by expropriating mines, or indirectly through higher taxes or local beneficiation rules — leads to tit for tat tariffs, something we saw during the US-China trade war, and subsidies, which ultimately end up being passed onto the consumer in the form of higher prices, or the taxpayer, who pays more for “Made in Country X”.

There is a gradual realization that the benefits of globalization aren’t what we thought they were, when considered in the context of the US-China trade spat and continuing tensions between the two superpowers; the pandemic which highlighted the West’s dependence on China for medical supplies; Britain’s exit from the European Union; the rise of US protectionism first with Trump and now Biden, who hasn’t removed Trump’s tariffs on Chinese goods and has additionally slapped sanctions on Russian banks and individuals along with a beefed-up Buy American rule; and the war in Ukraine, which has not only deepened geopolitical tensions but shown the fragility of European natural gas supplies, 40% of which, before the war, came from Russia.

Indeed the escalation in trade disruptions over the past few years has cumulatively called into question the vision of a globalized economy.

We see the world assembling into trading blocs, with a demarcation line between West and East. The West is represented by the United States-Mexico-Canada Agreement, the European Union, and the Minerals Security Partnership, among other economic agreements.

(A “Declaration of North America” was recently signed by Joe Biden, Justin Trudeau and Mexican President Obrador, at the North American Leaders’ Summit in Mexico City. Critics say the three leaders committed their countries to a woke agenda based on six “pillars,” that draw heavily from United Nations documents.)

The East revolves around China, with its Belt and Road Initiative creating a China-centric trading system independent of the United States, and China’s increasingly close trade relationships with Russia and the Middle East. There is also the BRICS (Brazil, Russia, India, China, South Africa), the Association of Southeast Asian Nations (ASEAN), and the Shanghai Cooperation Organization (SCO).

(Curiously, despite talk of US-China trade decoupling, it’s on track to break records. US government data through November suggest that imports and exports in 2022 will add up to an all-time high, Bloomberg said earlier this week.)

Part and parcel to de-globalization and the formation of competing trading blocs, is the “de-dollarization” trend.

As the reserve currency, the US dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks.

Lately though, de-dollarization is being pursued by countries with agendas at odds with the US, including Russia, China, Saudi Arabia and Iran. Consider: Just the nine permanent SCO members, let alone the rest of the pro-Chinese trade groups listed above, now represent 40% of the world’s population. One of their key decisions at last year’s SCO Summit, was to increase trade in their own currencies.

The importance of this cannot be underestimated: 40% of the world’s population is no longer interested in conducting trade using US dollars!

Russia and China have both made moves to de-dollarize and set up new platforms for banking transactions outside of SWIFT that skirt US sanctions. The two nations share the same strategy of diversifying their foreign exchange reserves, encouraging more transactions in their own currencies, and pretending to try and reform the global currency system through the IMF.

In 2014 after Russia annexed Crimea, there were calls to cut Russia off from SWIFT. In response the Kremlin developed its own financial communications platform, SPFS. As of March, 2022, the system had 399 users. Russia is currently negotiating with China to join SPFS.

China has also developed an alternative to SWIFT, in 2015 launching the Cross-Border Interbank Payment System (CPS) to help internationalize the yuan.

Without taking action to reverse this de-dollarization trend, Washington will see its global standing weaken.

In an earlier article I made a bold prediction, that China is planning on using its gold reserves to back its digital currency, the e-yuan. Could the e-yuan eventually replace the US dollar, or its digital equivalent, as the new global reserve currency? No I don’t believe so, but the way the direction of trade is moving I believe China’s digital currency will be used for trade between China’s Belt and Road Initiative member countries, China, Russia and the Middle East (and OPEC), the BRICS (Brazil, Russia, India, China, South Africa), the Association of Southeast Asian Nations (ASEAN) and the Shanghai Cooperation Organization (SCO)

Rise of the gold-backed e-yuan

Xi of Arabia and the petroyuan drive

The protectionists in the United States think they are helping American businesses and consumers when in fact they are adding to the demise of the global trading system we have known for seven decades, anchored by the mighty US dollar.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.