Norden Crown proceeds with drilling at Burfjord project in Norway to test copper endowment, expand mineralization footprint

- Home

- Articles

- Environment Global Warming Electrification

- Norden Crown proceeds with drilling at Burfjord project in Norway to test copper endowment, expand mineralization footprint

2021.10.09

Warnings of a worldwide depletion of copper reserves are not exaggerated.

The industrial metal not only plays an essential role in economic growth, but is also imperative to the global transition towards sustainable energy sources. More and more copper is being consumed worldwide to build electric vehicles and energy storage systems for the future.

As a result of greater energy transition, Fitch forecasts ‘green copper’ as a percentage of total copper demand to increase from approximately 5.6% this year to 15.7% by the end of this decade.

From a forecast of 1.4 million tonnes in 2021 to 5.4 million tonnes in 2030, Fitch expects green copper demand to average annual growth of 13% year-on-year over the next 10 years.

Adding together all end-use applications, this year’s copper demand is estimated at 24 million tonnes globally, up 2.4% from 2020, according to Chile’s copper commission. In 2022, demand is forecast to grow further, reaching as high as 24.7 million tonnes.

Driven by robust demand, copper prices have already surged to an all-time high ($4.77/lb) in the second quarter of this year. Compared to its trough of $1.94/lb in early 2016, this represents a 150% rally within the span of five years.

And despite the recent pullback, some of the biggest commodity trading firms and media houses remain bullish on copper given that demand is likely to accelerate during the clean energy transition.

However, the bigger catalyst for the next copper rally, according to analysts at Goehring & Rozencwajg, is the widespread challenges of supply that lie ahead.

The Covid-19 pandemic has already had a notable impact on global copper production due to labor disruptions and mine shutdowns, resulting in copper mine supply 80,000 tonnes short compared with the previous year.

While things are expected to return to normalcy this year, a dearth of new copper discoveries and capital spending on mine development for a number of years means that once some mines become exhausted, their output would not be replaced in time to meet growing demand.

Moreover, since 2000, most reserve additions have come from simply lowering the cut-off grade and mining lower quality ore as prices moved higher (i.e. Chile’s Escondida copper deposit), a practice that may not be feasible for geological reasons in the upcoming cycle, as Goehring & Rozencwajg argues.

Although there will be new projects coming online around the globe (DRC, Panama and Mongolia), these will only offset depletion at other existing mines, leading to a stagnant overall mine supply growth.

What Next?

What this means is that over the next few years, a new wave of copper discoveries must emerge, especially in the places we least expect (i.e. outside of South America) as new mining taxes in top producers Chile and Peru could happen at any day, placing further strain on world supply.

Europe, which first began using the metal some 8,000 years ago in the Balkans and witnessed its widespread adoption during the Bronze Age, has an abundance of Porphyry copper deposits that can be traced back to the Paleozoic and Late Cretaceous to Miocene ages.

Although Europe’s copper mine production makes up a small portion (~3.5%) of the global output, the potential is there to rise up the ranks.

Of the known Phanerozoic deposits across the continent, the US Geological Survey (USGS) estimates that there are at least 1 million tonnes of contained copper reserves. However, about 46 million tonnes of copper can be associated with the undiscovered porphyry copper deposits from this geological eon.

According to the USGS, there are at least five geographic areas containing permissive tracts for post-Paleozoic porphyry copper deposits, and these are where some of Europe’s main copper mines are found.

Russia and Poland have consistently ranked amongst the highest copper-producing nations. KGHM Polska Miedz, with its three copper mines in Poland, firmly holds a top 10 spot in the world’s top copper company rankings.

Other major mines can be found across the Iberian and Scandinavian peninsulas. Production in the latter region is dominated by Boliden, which currently operates four copper-producing mines in Sweden and Finland.

Sweden, in particular, has an interesting history when it comes to copper mining. The Falun mine in Dalarna county, now a museum and World Heritage site, has produced as much as two-thirds of Europe’s copper needs.

The mine operated for a millennium from the 10th century to the early 1990s. In its golden era, Falun produced as much as 3,000 tonnes of copper, helping Sweden to fund many of its wars in the 17th century.

Most of Sweden’s landmass is geologically part of the Baltic Shield, which also covers other Fennoscandia nations (Finland, Norway) and northwestern parts of Russia, and has the oldest rocks in Europe.

The Baltic Shield is currently one of the largest and most active mining areas on the continent, and has often drawn comparisons to the Canadian Shield and cratons in South Africa.

Norden Crown Metals

Due to its favorable geology and past mining history, it’s a matter of time that the Fennoscandia region sees renewed interest in its vast copper resources on top of its already steady production of iron ore and other base metals (zinc, lead).

Recognizing the importance of early-mover advantage, Norden Crown Metals Corp. (TSXV: NOCR) (OTC: NOCRF) (Frankfurt: 03E) has specifically identified its exploration focus on this part of the European continent.

In August, the company announced the start of exploration drilling at its 100% owned Burfjord copper project in northern Norway. In partnership with Swedish mining giant Boliden, the drilling will test a variety of geological, geochemical and geophysical target anomalies identified during the successful 2020 exploration programs.

The objective of this program is to continue testing copper-gold grades and continuity of new targets, historical mines and prospects at the Burfjord property.

Previous drilling by Norden Crown (March 2019) returned compelling results, including an intercept of 32 metres averaging 0.56% copper and 0.26 g/t gold (including 3.46 metres of 4.31% copper and 2.22 g/t gold) at shallow depths below a cluster of historic mine workings.

“The joint Norden-Boliden exploration team is excited to continue drill testing the copper endowed Burfjord anticline for its potential to host economic IOCG-style mineralization,” Norden Crown’s chairman and CEO Patricio Varas stated in the August 23 news release.

“The company has identified numerous high-grade zones within the East, West and Hinge domains of the anticline, and we continue to utilize magnetic and electromagnetic geophysical surveys to enhance the existing targets and to guide the planned diamond drilling,” Varas added.

To support the 2021 drill program, Norden and Boliden recently completed approximately 400 line kilometres (Phase I) of a two-phased UAV airborne magnetic geophysical program on the Burfjord property.

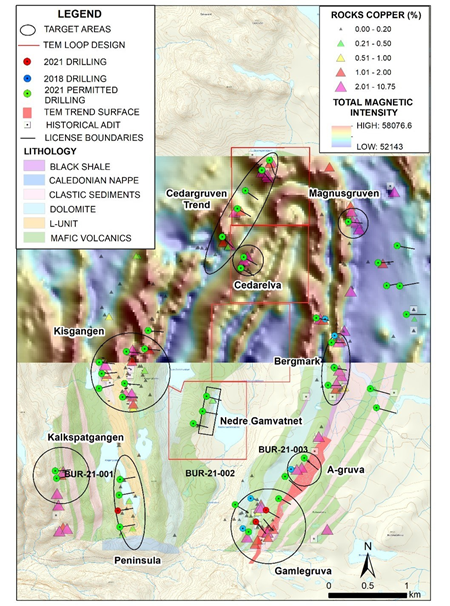

According to Norden, results of this tightly spaced survey are expected to help identify new exploration targets on the property and enhance and prioritize existing drill targets (see map below). Phase II of the survey (600 line kilometres) is expected to commence in the coming weeks.

2021 Exploration Targets

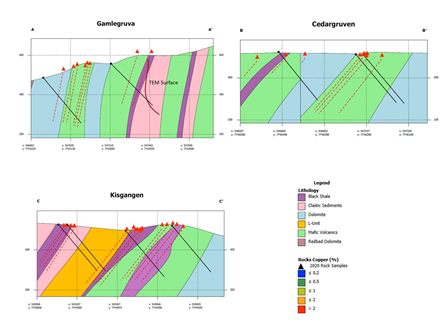

The 2021 exploration drilling program at Burfjord is focused on a number of copper targets that contain or are surrounded by historical adits, pits and workings within the extensively iron-carbonate altered Burfjord anticline.

These targets have been identified and prioritized using lithological and structural mapping, extensive rock and soil sampling, and ground-based electromagnetic geophysics. High-priority target areas within the East, Hinge and West zones of the anticline are described below:

East Limb

The “East Limb“ targets constitute a ~5 km long trend of discontinuously outcropping copper occurrences and historical mine adits characterized by disseminated copper sulfide mineralization (chalcopyrite and sporadic bornite).

As part of a surface exploration program in 2020, an electromagnetic anomaly was identified in the southern portion of the East Limb that is approximately 1,900 m in strike with a near-vertical dip.

This feature occurs near the mafic volcanic-albitized black shale contact and is the target horizon for a number of the planned drill holes in the East Limb.

Hinge

The Hinge zone is a structural target that is in the hinge of the Burfjord anticline and is characterized by intensely albitized black shales, breccias (e.g. Cedarsgruvan workings) and albitized dolomite (e.g. Cedarelva workings) in widespread, intense iron-carbonate alteration.

Disseminated copper sulfides and structurally controlled high-grade copper sulfide-bearing veins are present within this target area.

West Limb

The geology of West Limb is dominated by a 3,000 m by 400 m albite-iron carbonate-magnetite altered clastic sedimentary unit (L-Unit – see figure below) that is locally brecciated and contains disseminated copper sulfides (chalcopyrite) and chalcopyrite bearing quartz-carbonate veins.

Historic adits are present within and along the flanks of this unit, and are the focus of exploratory drilling in this program.

Burfjord Project Overview

The Burfjord project, located in the Kåfjord copper belt near Alta, Norway, is highly prospective for iron oxide-copper-gold (IOCG) and sediment-hosted copper mineral deposits. The property comprises six exploration licenses covering an area of 5,500 hectares.

Mineralization at Burfjord belongs to the same deposit clan of the northern Fennoscandia region, a key IOCG province globally.

Copper mineralization was mined in the Burfjord area during the 19th Century, with over 30 historic mines and prospects developed along the flanks of a prominent 4 km x 6 km anticlinal structure consisting of interbedded metasedimentary and metavolcanic rocks.

Many of the rocks in the anticline have been subjected to intense hydrothermal alteration. This potential has only recently been recognized in Norway.

Mineralization occurs as both high-grade Cu-Au lodes that were historically mined at high cut-off grades (>3% Cu) and lower-grade, bulk-tonnage potential Cu-Au mineralization developed in stockwork vein arrays.

Norden Crown and Boliden believe this mineralization has economic potential and represents an attractive bulk-tonnage exploration drilling target.

Vein mineralization in the area is not only dominated by carbonate and iron-oxide minerals (magnetite and hematite), but also contain chalcopyrite, bornite and chalcocite in addition to cobalt-rich pyrite.

Only limited exploration has taken place in the modern era. Historic drilling (confined to the vicinity of Cedarsgruve mine) was reported to have returned 7 m averaging 3.6% Cu.

Exploration in Sweden

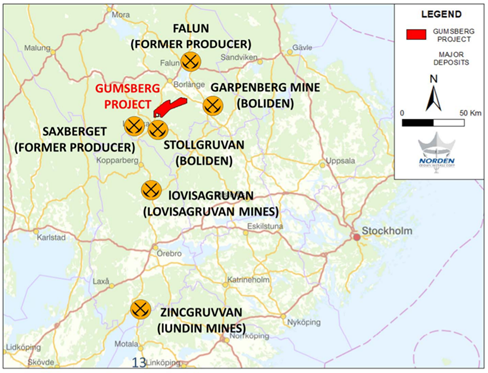

Meanwhile, Norden Crown is also searching for high-grade silver and zinc deposits at its Gumsberg volcanogenic massive sulfide (VMS) property in southern Sweden.

The 18,300-hectare land package, with five exploration licenses, was mined from the 13th century through to the 1900s, with an astounding 30 historic mines on the property including Östra Silvberg — the largest silver mine in Sweden from 1250 to 1590.

The project is located within the Bergslagen mining district, between the past-producing Falun and Saxberget mines, and the active Garpenberg (Boliden) and Zinkgruvan (Lundin) mines.

This year’s drilling focuses on Fredriksson Gruva, a past-producing zinc-lead-silver mine originally discovered in 1976. The objective is to demonstrate that the mineralization continues below the historical mine workings, as suggested by regional drilling done by past explorers, and to confirm the historical silver-zinc-lead grades.

The evidence so far is proving this theory correct.

The three holes drilled by Norden have all intersected wide and high-grade massive and semi-massive sulfide mineralization, in a geological setting unique to the Broken Hill Type (BHT) clan of deposits, which are some of the largest and highest-grade Ag-Zn-Pb ore deposits in the world.

Conclusion

The presence of BHT mineralization hosted in banded iron formations could be an important characteristic at Fredriksson Gruva to trace and find deposits with the potential for scale — something a junior miner like Norden Crown must be able to demonstrate to a prospective acquirer.

BHT deposits are widely considered to be a major source of lead, zinc and silver on Earth. Most of these have been discovered in Australia (i.e. Broken Hill mining property in New South Wales), South Africa, and parts of Sweden’s Bergslagen mining district, where the Gumsberg project is located.

The large size of some deposits of the type, plus their potential to contain high grades of Pb-Zn, makes them an attractive exploration target, which Norden has successfully identified at Fredriksson.

It’s also encouraging that another banded iron formation, the Dammberg Zn-Pb-Fe sulfide deposit, is in close proximity to the Frederiksson target.

What’s equally exciting is the company’s Burfjord copper property in Norway, where it has partnered up with Boliden to execute a 2,500m drill program to follow up on successful exploration in the past years.

Results so far have indicated a high potential to host economic IOCG-style mineralization, which, given the current state of the global copper market, warrants extra attention.

Norden Crown Metals Corp.

TSXV:NOCR, OTC:BORMF, Frankfurt:03E

Cdn$0.175 2021.10.07

Shares Outstanding 53m

Market cap Cdn$9.2m

NOCR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Norden Crown Metals (TSX.V:NOCR). NOCR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.