Moribund silver may soon have liftoff – Richard Mills

2022.10.29

After being stuck in a wide range with no trading momentum during the first two months of 2022, silver was given a boost in March, when Russia’s invasion of Ukraine triggered a rush for safe havens.

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty. The flight to safety subsequently sent silver prices past the $26/oz mark, which was last seen in August, 2021.

This silver rally proved to be a flash in the pan, however. An aggressive interest rate hike campaign by the US Federal Reserve, along with a record-high US dollar, has kept the safe-haven metal in check.

Still, there are multiple reasons to believe that longer term, silver will rebound — possibly returning to levels last seen during the early 2021 Reddit-fueled silver frenzy.

The potential forces behind silver’s next rally include: monetary demand, industrial demand, above-ground stocks, gold-silver ratio, silver-copper correlation, net short positions reduced, physical market tightness, and low inventory. We examine each of these in turn.

Monetary demand

Soaring bond yields indicate that investors think the US Federal Reserve will do whatever is necessary to bring down inflation, and will succeed, without crashing the economy. But, once the Fed can no longer deny that it’s wrong about being able to control inflation, and that the economy is weaker than they think, it will go back to loose monetary policy, i.e., quantitative easing (good for gold & silver).

The Fed, or US central bank, claims it will stop raising the federal funds rate when it reaches 4.6%, about 150 basis points higher than the current FFR, which is in a range of 3.0 to 3.25%. When the Federal Open Market Committee meets again in early November, it is expected to hike rates another 75bp, to a range of 3.75-4.0%.

The key point is, the Fed can only push interest rates so high, without blowing up the Treasury and being forced into an aggressive bond-buying program (QE), thus accelerating inflation. The irony is that in trying to bring down inflation through interest rate hikes, the Fed, because of the high debt levels, will fail, and will be forced into a loose monetary policy involving interest rate cuts and QE.

Between all of the global pressure points requiring a safe-haven investment, including the war in Ukraine, a potential Chinese attack on Taiwan, and the energy crisis in Europe, plus the fact that, by “blowing up the Treasury” with incessant interest rate hikes that are going to force the Fed to pivot back to monetary easing including QE and interest rate reductions, we see the perfect setup for precious metals, coming soon to a market near you.

The Fed, the debt, China and gold

According to The Silver Institute, physical silver investment demand, consisting of silver bar and bullion coin purchases, is projected to jump 13% in 2022, achieving a seven-year high.

Silver as portfolio diversifier

Gold is often touted as a smart means of portfolio diversification, beyond traditional stocks and bonds. However, new research by Oxford Economics advises that silver should also be included within a multi-asset investment portfolio.

The firm found investors would benefit from a 4 to 6% silver allocation, which is significantly higher than current holdings of silver by most institutional and retail investors.

To examine the potential long-run benefits of holding silver in a portfolio, Oxford Economics compared silver’s historical performance with a range of traditional asset classes, including stocks, bonds, gold, and other commodities, from January 1999 to June 2022. Among the findings, silver was shown to have a relatively low historical correlation with asset classes other than gold, suggesting silver’s valuable diversification potential.

While silver’s price movements are often closely correlated with gold, Oxford Economics’ analysis suggests that silver’s return characteristics are sufficiently different from gold to make it a valuable diversification tool that deserves its own portfolio commitment. This includes its many industrial applications and uses in so-called “green” technologies — discussed in the next section.

Industrial demand

Much of silver’s value is derived from its industrial demand and supply fundamentals. It’s estimated around 60% of silver is utilized in industrial applications, like solar panels and electronics, leaving only 40% for investing.

More and more silver is being demanded for use in solar photovoltaic (PV) cells, as countries adopt renewable energy sources.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. Silver paste within the solar cells ensures the electrons move into storage or towards consumption, depending on the need. It is estimated about 100 million ounces of silver are consumed per year for this purpose alone.

This figure is expected to rise in the coming years, with continued growth of electricity demand and renewable energy aspirations all pointing to rising solar power penetration.

Source: The Silver Institute & CRU Consulting

One projection has annual silver consumption by the solar industry growing 85% to about 185 million ounces within a decade, according to a report by BMO Capital Markets.

The US solar industry will likely be one of the leading drivers of silver demand. Installations grew 43% year over year in 2020, reaching a record 19.2 gigawatts of new capacity. By 2030, solar installations are expected to quadruple from current levels, according to a report from the Solar Energy Industries Association and Wood Mackenzie.

As most solar panels used in the US come from Asia, the Biden administration’s ban on solar panels from China, over forced labor concerns, places the US solar industry in a bind, potentially sparking a surge in domestic silver exploration.

5G technology is set to become another big new driver of silver demand. Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled devices.

The Silver Institute expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

A third major industrial demand driver for silver is the automotive industry. Silver is also found in many car components throughout vehicles’ electronic systems, and despite not being used in batteries, its superior electrical properties make it hard to replace across a wide and growing range of automotive applications.

A recent Silver Institute report says battery electric vehicles contain up to twice as much silver as ICE-powered vehicles, with autonomous vehicles requiring even more due to their complexity. Charging points and charging stations are also expected to demand a lot more silver.

It estimates the sector’s demand for silver will rise to 88Moz in five years as the transition from traditional cars and trucks to EVs accelerates. Others estimate that by 2040, electric vehicles could demand nearly half of annual silver supply.

In 2021, brazing and soldering alloys used 47.7Moz of silver, representing 9.3% of the total industrial demand for silver that year. By 2030, the demand for silver used in brazing and soldering is forecast to reach 58.8Moz, a 23% over 2021, according to a Silver Institute report released in June, titled ‘Silver in Brazing and Solder Alloy Materials’.

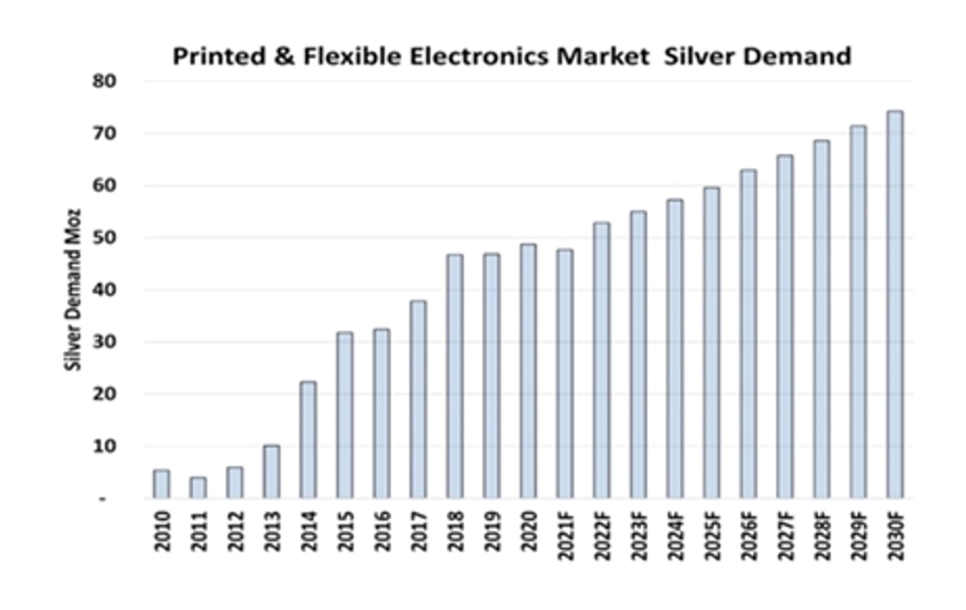

Finally, silver demand for “printed and flexible electronics” is forecast to increase 54% over the next nine years, rising from 48Moz in 2021 to 74Moz in 2030, meaning a consumption of 615Moz during this time frame.

A Silver Institute news release describes them as “mainstays” in a variety of electronic products, including sensors that measure everything from temperature, pressure and motion, to moisture, relative humidity and carbon monoxide. They are also used in medical devices, mobile phones, appliance displays and consumer electronics.

In 2021, a comprehensive report by Sprott titled ‘Silver’s Clean Energy Future’ found that three areas of growing demand for silver — solar, automotive and 5G — potentially account for more than 125 million ounces in 10 years. This doesn’t include the growth in investment demand for silver, which as mentioned represents about 40% of usage.

The higher usage of silver for industrial purposes, along with safe-haven demand for precious metals during a once-in-a-century pandemic, in 2020 lifted silver prices significantly.

Spot silver jumped to $28.32 an ounce in August 2020, its best performance in seven years, finishing the year up an impressive 47%, more than doubling gold’s 25% gain.

While silver prices have softened over the past two years, the outlook is positive due to a combination of strong monetary and industrial demand drivers.

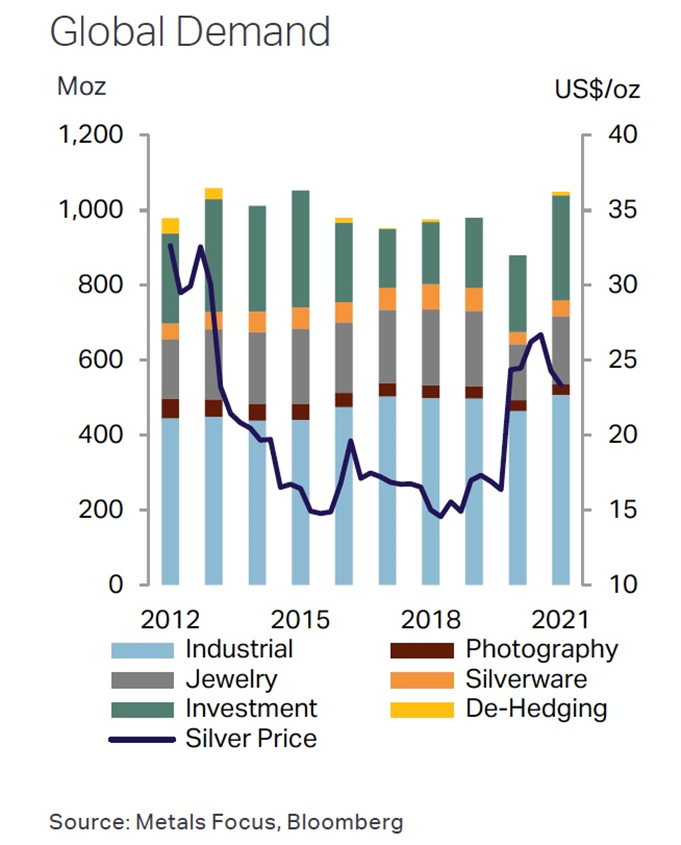

According to the 2022 World Silver Survey, global demand for silver this year is forecast to reach a record 1.112 billion ounces, driven by higher than normal silver fabrication, which is forecast to improve by 5%, as silver’s use expands in both traditional and green technologies. Silver’s use in jewelry and silverware is also expected to strengthen in 2022 by 11% and 21%, respectively.

Even with ongoing efforts to reduce silver loadings, record PV installations are expected to lift silver demand in this segment to an all-time high in 2022, SI states in a February press release. It adds:

Despite the prolonged worldwide chip shortage, the outlook for silver demand in automotive and 5G related applications remains robust this year. The former has been underpinned by increasing vehicle electrification, which leads to higher silver loadings per vehicle. Meanwhile, the latter has been assisted by the acceleration of building infrastructure to support 5G networks and strong demand from mobile devices.

Silver deficit forecast

Total mined silver supply in 2021 was 25,587 tonnes, or 822.6 million ounces. The Silver Institute expects mine production in 2022 to increase by 2.5%, to 843.2Moz, with the biggest rise occurring in Mexico.

After shifting to a deficit position in 2021 for the first time in six years, the silver market is expected to record a supply shortfall of 71.5 million ounces this year.

Above-ground stocks

“Native silver” found in the Earth’s crust on its own, is relatively rare.

Less than 30% of silver supply comes from primary silver mines. Over two-thirds is sourced from polymetallic ore deposits, including gold, lead/zinc operations and copper mines.

While most mined gold is still in existence, either cast as jewelry, or smelted into bullion and stored for investment purposes, the same cannot be said for silver. As mentioned, an estimated 60% of silver is utilized in industrial applications, leaving only 40% for investing. Of the 60% used for industrial applications, almost 80% ends up in landfills.

Despite silver being about 15 times more plentiful than gold in the Earth’s crust, silver and gold have roughly the same amount, ~2.5 billion ounces, available for investment purposes.

However, since very little gold is used by industry, it trades as an investment commodity — prices moving up and down in relation to factors like the US dollar, inflation, interest rates and sovereign bond yields.

Silver prices swing wildly, at relatively low volumes. For this reason, investors nicknamed silver “the devil’s metal”. Why is silver so volatile?

The simplest explanation is it has to do with the relatively equal amounts of above-ground investable silver and gold. Think about it.

People buy silver for all the same reasons they buy gold, but it’s cheaper than gold. A LOT cheaper. The gold-silver ratio right now is 85.75, meaning it takes almost 86 oz of silver to buy one oz of gold.

Gold’s trading at US$1650.00 an ounce, you can buy an ounce of silver for US$19.24. If there is roughly the same amount of silver as gold available for investment purposes, it makes sense that the silver market would jerk higher, and faster, than the gold market. Put another way, if you’ve two commodities, each with a billion ounces available to purchase, the cheaper commodity, silver, will be bought in greater volumes and will be more volatile. Which price will double quicker – gold or silver?

Gold-silver ratio

We use the gold-silver ratio to find out how silver prices compare to gold. The ratio is the amount of silver one can buy with an ounce of gold. Simply divide the current gold price by the price of silver.

Gold has immunity, silver has ratio

On June 12, 2019, the gold-silver ratio hit a 26-year high by breaking through the 90-ounce mark – meaning it took over 90 ounces of silver to purchase one ounce of gold. The higher the number, the more undervalued is silver or, to put it another way, the farther gold is pulling away from silver, valued in dollars per ounce.

When gold is over-valued compared to silver, investors take advantage of the arbitrage opportunity, by selling some of their gold holdings to buy silver. The opposite occurs when silver is over-valued compared to gold. In that situation, they sell silver to buy gold.

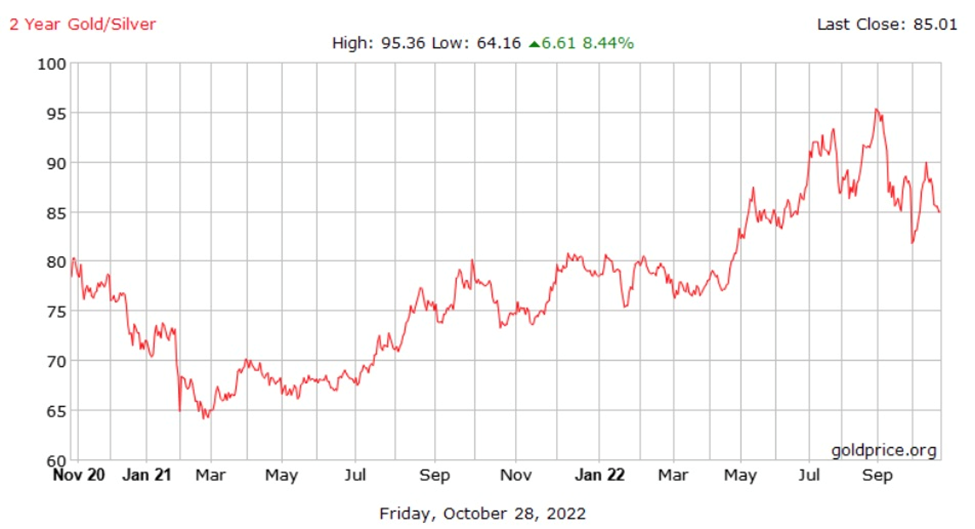

As the chart below shows, the gold-silver ratio over the past two years has been all over the map, reaching a low of 64.16 in March, 2021, and hitting a high of 95.36 in September, 2022.

For the past month the ratio has been tighter, fluctuating between 81.86 and 89.97. This is so far out of whack from the historical ratio of 54, that silver is on sale. It’s only a matter of time before silver corrects, because imho, gold is going higher.

Silver-copper correlation

The relationship between silver and gold is well-recognized, given that both are safe-haven, investment metals, and they are often found together in mineral deposits. Between silver and copper, less is known.

The very close correlation is seen below in the similar-shaped line graphs of one-year spot silver and copper.

I suggest the reason for the match, is the fact that both copper and silver are being increasingly demanded in green energy applications.

Economically this is a time of transition, as old-school technologies such as coal-fired power plants and gas-guzzling cars and trucks, give way to electric vehicles and price-competitive grid-scale renewables, chiefly wind and solar.

Silver seen tracking copper prices higher

Some including investment bank Goldman Sachs, are pointing to a new commodities supercycle, driven not by fossil fuels and the rise of China, that occurred in the 2000s, but by so-called “green” metals needed to electrify and decarbonize, to mitigate the effects of climate change, and meet new emissions targets.

According to a report from Wood Mackenzie, mining companies will need to spend $1.7 trillion over the next 15 years, to supply enough raw materials for the shift to a low-carbon world.

Two of the metals illustrative of this shift, are silver and copper.

We’ve already outlined all the green technology uses for silver, including EVs and solar panels.

Curiously, copper is often overlooked when tallying up the metals required for the transition to clean energy and electrification. There is no shift from fossil fuels to green energy without copper, which has no substitutes for its uses in EVs, wind & solar energy.

Copper: the most important metal we’re running short of

This year silver followed copper down. Could the reverse happen, when copper runs higher, due to the structural supply deficit we’ve been forecasting for years? It seems quite likely.

Goldman Sachs is forecasting the LME copper price to more than double from its current level, to $15,000 a ton in 2025. Let’s step back here and remember the incentive price to make mining copper attractive is US$9,000 a ton — copper is trading currently at $7,000/t.

Copper will have to rise from its current price of US$3.54 to a minimum $4.50/lb to incentivize miners to build mines.

Net short positions reduced

Wall Street commodities investment firm Goehring & Rozencwajg makes an interesting observation regarding the silver market:

Whenever smart money goes net long and dumb money goes net short, that often coincides with a significant bottom in precious metals. It doesn’t happen very often, but when it does, there is a significant buying opportunity.

By smart money, G&R is referring to “commercials”, who use the futures markets to hedge various commercial needs. “Speculators” (i.e., hedge funds, algorithmic traders, and other trend-followers) represent the dumb money.

In recent history, there have been three periods when gold and silver commercial traders were long and speculators were short: in the late 1990s/ early 2000s, when both gold and silver were incredibly cheap; at the end of 2015 when gold was ending its 45% pullback from 2011 highs; and in August 2018 when gold fell below $1,200/oz, then for the next two years surged over 75%.

Today, while the positioning of commercial and speculative gold futures traders is nowhere close to flashing a buy signal, it’s a different story for silver: commercials have slashed their net short positions by almost 90% over the last three months, and silver market speculators have cut back on their net long positions by nearly 95%.

The article by G&R, an excerpt from their Q2 commentary, states:

[J]ust as silver commercial players are on the verge of becoming net long, speculators are on their verge of going net short — a sign that the two-year corrective phase in silver is coming to a close.

The silver futures market is about to flash a significant buy signal; however the gold market still has not. For those who want to time the ending of the corrective phase in both gold and silver markets, we recommend waiting for commercial to go long in both and for speculators to go net short before significantly increasing their precious metals exposure. When this happened back in August 2018, it turned out to be a great time to significantly increase precious metals exposure.

Physical market tightness

According to one market analyst quoted by Kitco News, right now there is a significant disconnect in the silver market between investment demand in “paper” (silver ETFs) and physical bullion, and this is an environment where profits are made.

Peter Krauth, founder of the Silver Stock Investor newsletter and author of ‘The Great Silver Bull’, says the supply and demand imbalance is acutely felt among physical investors forced to pay record premiums for bullion because there isn’t enough supply.

APMEX, for example, is offering $10 over spot per coin, while SD Bullion is offering $10.50 and $11 over bid. SD Bullion CEO Tyler Wall has been quoted saying the physical silver market “is as tight as I’ve ever seen it,” adding that his company has been offering $11 over spot for US Mint Silver Eagles for over a week.

“Weak investment demand doesn’t change silver fundamentals. It’s only added to the clear disconnect and it’s in these types of markets where you find the best investment opportunities,” Krauth told Kitco. “We know from history and experience that when the silver market reverts back to the mean and corrects itself, it happens very, very quickly.”

(Recall what I said earlier about the silver market reacting faster and moving higher than gold, due to silver’s relative affordability, where both have about the same amount of above-ground stocks.)

Krauth acknowledges volatility in the silver price since the pandemic, but noted the average price in the last three years is above $22 an ounce, up nearly 40% from the previous three-year average from 2017 to 2019. He sees silver prices back in the low $20 range by mid-next year and in the high $20 range by the end of 2023.

Apart from buyers having to pay record premiums on physical silver, two more signs of physical market tightness are the spot price in backwardation, and a lack of silver on the Comex trading platform.

This week a report from Ronan Manly of Bullion Star said more than 50% of deliverable silver on the Comex is suddenly “not available”.

Backwardation means the spot price of silver is above the futures price, indicating strong demand for physical metal right now.

Panelists at the LBMA gold conference in Lisbon agreed that physical demand for gold and silver remains exceptionally strong, particularly in Asia and the Middle East.

According to data from the CME Group and London Bullion Market Association, more than 527 tons of gold bullion has moved from vaults in New York and London — the two biggest Western gold markets — since the end of April.

In August Chinese gold imports hit a four-year high, with net imports via Hong Kong at 68.2 tonnes, compared with 48.7 in July.

Low inventory

Indeed the stocks of silver held by the LBMA and the Comex, are thinning out. Silver inventories in London (the LMBA) have fallen for 10 straight months and are now sitting at a new record low of just over 27,100 tonnes, or 871.3 million ounces.

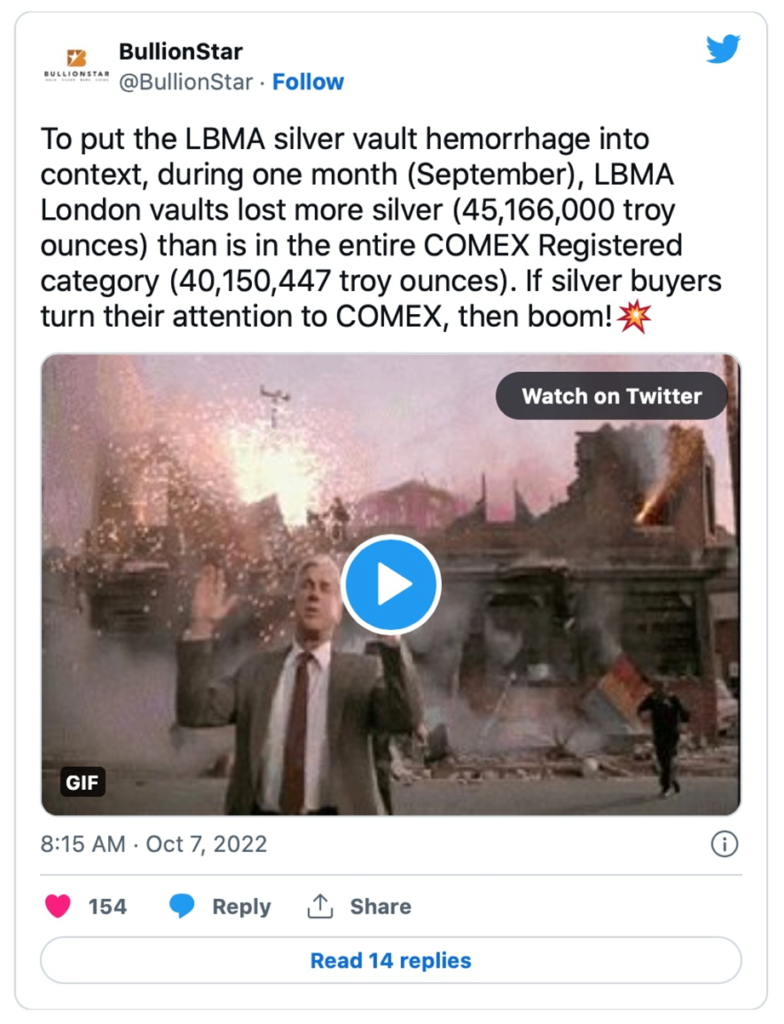

On the Comex in New York, registered silver totals just 1,186 tonnes, or 38.13Moz, a five-year low. In September the LBMA vaults lost 45.166Moz, more than the Comex’s entire registered category.

Bullion Star’s Ronan Manly said an important contributor to this unprecedented demand for physical silver is India. The country’s silver imports for the first nine months of 2022 totaled 8,217 tonnes. When annualized, this amounts to nearly 11,000 tonnes, representing one-third of the world’s silver supply.

Conclusion

Putting everything together, in my opinion, there is really only one conclusion: now is a great time to invest in silver.

The strength of industrial demand, coupled with continued investor interest in physical silver, are two of the main factors likely to power the metal higher.

The time to buy precious metals, or any other investment, is when they’re hated and undervalued. The current sentiment in the gold and silver markets is quite negative. Producers and junior miners are on sale and the juniors with the best development projects are offering major upside.

Personally I am taking advantage of the lull in the markets to accumulate positions in high-quality exploration companies with excellent projects in low-risk jurisdictions.

I see us going into a rising gold price environment and historically the greatest leverage to an increasing gold/ silver price is a quality junior. Also, for several metals like silver, copper, lithium, nickel and graphite, the green revolution is demanding more metal than can be supplied, and junior companies own the world’s future mines, making them extremely attractive take-over targets.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.