Max’s URU Zone comparable to Central African Copper Belt-style of mineralization

2021.10.06

The re-opening of major economies has unleashed pent-up demand for all commodities, especially those used in manufacturing and agriculture.

However, the pandemic has also put tremendous pressure on supply chains. For example aluminum and copper prices have risen due to supply shortages and a drought in Brazil has pushed up the cost of coffee and sugar.

Supply constraints in certain industries plus greater demand for goods and services is a recipe for higher inflation. To the question of whether inflation is temporary, we are seeing increasing evidence it is not, i.e., that rising prices are becoming a permanent fixture of the economy.

In June the US consumer price index (CPI) surged by 5.4%, the most since 2008, as economic activity picked up but was constrained by supply bottlenecks. Inflation in July remained stuck at 5.4% and in August, the last number reported, it was at 5.3%.

Higher than normal inflation is being reflected in soaring commodity prices across the board.

In fact the Bloomberg Commodity Spot Index, a measure of the sector’s health, this week hit an all-time high. Tracking 23 energy, metals and crop futures contracts, the index on Monday rose 1.1%, topping a 2011 record. Commodity prices are so high, they have surpassed the levels seen during the China-led supercycle. According to Bloomberg, the index has surged more than 90% since reaching a four-year low in March of 2020, the start of the pandemic.

The news provider notes that persistent fiscal deficits and low interest rates have made commodities more attractive to investors seeking a hedge against inflation, with the price shocks drawing a comparison to the stagflation of the 1970s.

Stagflation is what happens when rising inflation occurs amid a recession.

Economic growth goes hand in hand with a rise in industrial activity, and as countries like the US and China continue to plan for more infrastructure investments, there will be more demand for copper and other metals.

According to Cochilco, the copper commission of top producer Chile, global copper demand will reach 24 million tonnes this year, up 2.4% compared to 2020, and 24.7 million tonnes for 2022, a 3% increase.

Driven by robust industrial demand, copper prices surged to an all-time high of $4.77/lb in the second quarter of this year. Compared to its trough of $1.94/lb in early 2016, this represents a 150% rally within the span of five years.

Even though copper — like many other commodities — has somewhat experienced a pullback, the base metal is still sitting at its highest in a decade.

Some of the biggest commodity trading firms and media houses remain bullish on copper given that demand is likely to accelerate during the global energy transition.

“Elevated demand expectations, especially from the push to electrify the transportation sector, together with an absence of new mine investment is likely over the coming years to push the market into a deep and price supportive deficit,” said Ole Hansen of Saxo Bank.

Goehring & Rozencwajg, which specializes in natural resource investments, believes that the current cycle will ultimately take copper prices higher, perhaps even above $10/lb. Justifying this aggressive price target, the New York-based research firm referenced copper’s last great rally, which saw the metal grow seven-fold from its 1999 bottom of $0.61/lb to $4.57/lb in 2011.

“Our models tell us the fundamentals are much better today than they were during the last bull market. Copper stocks have been strong performers as well. The average copper mining stock, as measured by the COPX ETF, is up nearly 100% year-on-year and 20% year-to-date,” Goehring & Rozencwajg wrote in their latest market commentary.

The covid-19 pandemic has had a notable impact on global copper production due to labor disruptions and mine shutdowns, resulting in copper mine supply falling 80,000 tonnes short compared with the previous year. Things are expected to return to normal this year, so 2020 will likely be just a slight bump on the road.

However, the real concern lies in the inevitable depletion of existing copper mines — a problem that has been brewing in the industry for over a decade.

A dearth of new copper discoveries and capital spending on mine development in recent years means that once an existing mine becomes exhausted, its output may not be replaced in time to meet a growing demand.

Moreover, since 2000, most reserve additions have come from simply lowering the cut-off grade and mining lower quality ore as prices moved higher (i.e. Chile’s Escondida copper deposit), a practice that may not be feasible for geological reasons in the upcoming cycle, as Goehring & Rozencwajg argues.

Although there will be new projects coming online, these will only offset depletion at existing mines, leading to stagnant overall mine supply growth.

It’s also important to note that two political events that occurred in Q2 2021 could negatively affect copper supply moving forward.

In Peru, the new leftist government led by Pedro Castillo is seeking to impose a 70% tax on copper mining profits, which would discourage further spending on projects.

Following Peru’s lead, Chile has also proposed legislation that would see copper mine profits taxed at 75%.

While these new mining taxes have not yet been enacted, they are quickly gaining support in Peru and Chile — the first and second largest copper producing countries respectively.

“Our research strongly suggests that supply growth, which has been minimal since 2016, will continue to disappoint,” the Goehring & Rozencwajg report said.

As such, Acuity Knowledge Partners, formerly part of Moody’s Corp., is predicting a widening demand-supply gap that could reach as high as 8.2 million tonnes by 2030.

The yawning copper supply-demand imbalance is prompting major copper mining companies to make plans to add to their dwindling copper reserves. While copper miners previously went to so-called “brownfield” options, such as exploring for new copper orebodies on the outskirts of their producing mines, a recent development shows there may be a change in their reserves replacement strategy.

BHP is reportedly talking about buying into a copper project in the DRC next to Ivanhoe Mines’ massive Kamoa-Kakula copper mine, which recently started commercial production.

The Bloomberg story quotes un-named sources describing Western Foreland as a huge exploration territory that neighbors Ivanhoe’s Kamoa-Kakula mine, and notes that BHP’s interest in it would be a dramatic departure from the world’s biggest mining company’s policy of shunning risky jurisdictions.

The company sold its last mining asset in Africa, the rights to develop the Mount Nimba iron ore deposit in Guinea, to Ivanhoe’s Founder and Chairman Robert Friedland in 2019, leaving BHP to focus on Australia, Canada and Chile.

The DRC is considered one of the riskiest jurisdictions to mine in, owing to widespread corruption and sub-bar working conditions including reports of child labor. It consistently ranks close to the bottom of the Fraser Institute’s annual investment attractiveness index.

However, there is a realization, according to Bloomberg, that to get access to the best mineral deposits for the global energy transition, the company needs to operate in more risky jurisdictions.

This could mean stepping into so-called “greenfield” projects, areas where no previous mining or sometimes, no exploration at all, has taken place.

An example is BHP’s foray into Ecuador, where in 2010 the government of President Rafael Correa’s government nationalized the oil and gas industry. Despite the country’s history of resource nationalism, BHP has been building a stake in SolGold, the majority owner and operator of the Cascabel porphyry copper-gold project. In 2019 BHP paid SolGold £17,055,500 in exchange for a 14.7% interest in Cascabel.

BHP has made no secret it is especially bullish on copper. Aside from moving its copper and nickel exploration headquarters to Toronto earlier this year, the company as far back as 2016 rebalanced its portfolio to make copper its top priority behind only petroleum. (in fact copper is now #1, after BHP in August 2021 merged its oil and gas business with Woodside Petroleum)

“Structural grade decline creates an ongoing imperative for new copper supply. That future supply will likely be higher cost, based on a range of macroeconomic, socio-political and geographic factors — as well as idiosyncratic issues we track on a project by project basis. Chief among these is the rising costs associated with a greater reliance on desalinated rather than aquifer water [in Chile],” wrote BHP’s then vice president, marketing and minerals, in a column titled ‘The bullish thesis for copper’.

Max Resource Corp

While new copper discoveries create excitement in the industry, it is the size of a discovery that really matters and offers long-term growth potential for investors.

Such projects are extremely rare, but not impossible to unearth with the right approach.

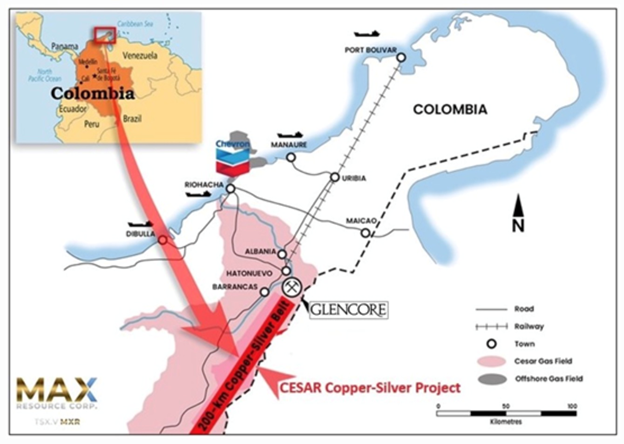

Within an underexplored region of northeastern Colombia, Max Resource Corp. (TSXV:MXR, OTC:MXROF, Frankfurt: M1D2) has not only been finding high-grade copper zones at its flagship CESAR property, but expanding these areas, confirming the potential existence of a massive sediment-hosted system comparable to the biggest in the world.

URU Zone

The Vancouver-based company is currently focused on the URU Zone, the second copper discovery Max has made at CESAR North this year, and one of five discovery zones since the company took ownership of the CESAR project in late 2019.

URU lies along the southern portion of the 80-kilometer-long CESAR North copper-silver belt, appears to be continuous over the entire 12 kilometers, and remains open in all directions.

The initial URU discovery (April 8, 2021) reported 16 rock chip channel samples returning greater than 1% copper extending over a 4-kilometer-long strike, with highlights of 5.7% copper and 14 g/t silver. In July the zone was significantly expanded, with its strike length tripled from 4 to 12 kilometers.

In August Max reported some impressive assay results from surface sampling, including 3.9% copper over 10-meter widths and visible copper over the zone’s 12 square kilometers.

Twenty-one rock samples returned values greater than 1% copper, with eight samples featuring 2% copper or higher, over widths ranging from 10 to 25 meters.

Among the >2% copper rock chip channel samples, highlights included 3.9% copper and 7 g/t silver over widths of 10 meters.

Grab samples collected over 25-meter widths returned 2.7% and 2.2% copper. Max is awaiting assay results from locations along the 10 kilometers of strike, shown as white dots in Figure 2 below.

“The widespread nature of the copper mineralization over significant widths demonstrates the major-scale potential of the URU zone, that is open in all directions. We look forward to additional URU zone copper assay results due [in October],” said Max’s CEO, Brett Matich, in the Aug. 10 news release.

Max has interpreted the sediment-hosted stratabound copper-silver mineralization in the Cesar Basin to be analogous to both the Central African Copper Belt (CACB) and the Polish Kupferschiefer deposits. Almost half of the copper known to exist in sediment-hosted deposits is contained in the CACB, including Ivanhoe Mines’ above-mentioned 95-billion-pound Kamoa-Kakula copper deposit in the Congo.

However, while the northern part of the 80-km-long CESAR North has been characterized as “Kupferschiefer-style” mineralization, the southern part containing URU is suspected to be more “Central African” in nature.

Kupferschiefer deposits are envisioned as huge flat-lying sheets of sedimentary copper. These slabs of “copper shale” can run for several kilometers but they are relatively thin, with an average mining thickness of just 2 meters, shown below.

By comparison, CACB-type mineralization has some thickness to it, and there may be feeder zones running into the orebody. To understand why Max thinks the URU Zone mineralization is Central African, take a look at Figure 3 below.

The image depicts a three-dimensional model of the URU Zone. The model shows the various mineralized occurrences, which range from 1,000 to 34,400 parts per million (ppm) copper and 5 to 656 ppm silver, presenting at surface within a mountainous topography. The elevation scale on the right of the model shows the rock copper and silver samples are between 600 meters and 1,800m.

As you can see the topography is obviously not flat. Some of the mineralization has to extend vertically. When I first saw this diagram of the terrain, I thought “that mineralization had to come from depth.”

The figure below shows the URU discovery cross-section. Notice that three of the four surface sample locations with grades attached are taken from where the green “ore shoots” rise up to the surface. The fourth sample location is deeper, taken from within the porphyritic intrusion, colored red.

The fact that the mineralization appears to run continuously for 1,200m (between 400m and 1,200m) through mountainous topography strongly suggests there is a lot of volume to it — it more or less goes from base to hill-top, which could indicate a major copper-silver system emplaced throughout. That’s an exciting prospect.

Assays from the URU Zone are due this month.

RT Gold

Meanwhile the company hasn’t taken its eye off its RT Gold project in Peru.

Optioned to Max in 2020 for US$300,000, the last exploration was conducted just over a decade ago, with the property lying dormant since.

RT Gold is a project with potential scale. It sits along the Condor mountain chain of northern Peru, within the Cajamarca Metallogenic Belt. This geological belt extends from central Peru into southern Ecuador, and hosts a number of world-class gold deposits, including Fruta Del Norte (10Moz), Minas Conga (17Moz), Yanacocha (36Moz), Lagunas (8Mozs) and Pierina (7Mozs).

Two distinct mineralized systems occur within the RT Gold property: the Cerro Zone, a bulk tonnage gold-bearing porphyry; and 3-km to the NW, the Tablon Zone, a gold-bearing massive sulfide target.

The Cerro Zone hosts four mineralized zones (Peak, West Breccia, La Catedral and Minas Sur) with highly anomalous concentrations of gold in rock and soils.

Structures assaying 0.1 to 62.9 g/t gold, hosted in mineralized wall rock, returned gold values of 0.5 to 1.0 g/t gold.

The soil geochemistry of the Cerro Zone has outlined a 2 by 1.5-km gold anomaly, open in all directions grading from 0.1 to 4.0 g/t Au. Soil geochemistry is coincident with IP chargeability.

Despite the geophysics matching the geochemical (soil and rock sampling) results on surface, Cerro has never been drill-tested.

The Tablon Zone is located 3 km NW from Cerro and hosts numerous gold-bearing massive to semi-massive sulfide bodies over a 150- by 450-meter area, within a larger 1 by 1.5 km area of anomalous gold soil and rock geochemistry.

The highlights of a 1,600-meter drill program at the Tablon Zone, completed in 2001 and summarized by former operator Golden Alliance Resources in a 2011 technical report, include 18.8 grams per tonne gold over 16 meters from 35 meters depth; 8.8 g/t Au over 25m from 13 meters; and 5.3 g/t Au over 17m from 12m.

No mineral resources or reserves estimates yet exist at Rio Tabaconas (RT Gold).

Conclusion

The URU Zone makes a very interesting addition to Max’s four other discoveries at CESAR. The potential discovery of a massive buried copper-silver porphyry with ore shoots extending to surface, and mineralization running through over a kilometer of mountainous terrain – is quite intriguing.

Max’s goal is to partner with a major to raise the funds to drill CESAR. Interest so far has been strong, with multiple non-disclosure agreements in place to advance the project, including a collaboration agreement with an industry-leading copper producer. There have been three field visits to the site (undisclosed parties), with a fourth one reportedly in the works.

While Max’s focus has been on CESAR, and right now the URU Zone in particular, there are rumblings of a field program at RT Gold, where some re-assaying has taken place.

In both countries, Max has the support of the local communities that own the land, a necessary requirement for exploration and moving mining projects forward. Community buy-in, the support of the local landowners in Colombia and Peru paves a smooth road for access and exploration activities.

Also worth noting, Max is employing in-country crews at both projects. There have been no interruptions owing to covid-19 restrictions and this is because Max does not have to fly geologists in and out of the country with all the requisite quarantines, tests and ultimately, delays. Crews are protected within their in-country covid bubble.

Max’s plan to find a partner to advance CESAR looks especially promising these days, as we see household mining names like BHP becoming more friendly to greenfield exploration. Witness BHP’s 2019 investment in SolGold and its more recent interest in Western Foreland, a large exploration project bordering Ivanhoe Mines’ huge Kamoa-Kakula copper deposit in Africa.

Major mining companies are only interested in large mineral deposits or deposits that are scalable to their needs. The way Max is going, CESAR appears to fit their criteria. The company keeps finding high-grade copper zones and expanding these areas, confirming the potential existence of a massive sediment-hosted system comparable to the biggest in the world.

Max Resource Corp.

TSXV:MXR, OTC:MXROF, Frankfurt:M1D2

Cdn$0.16 2021.10.05

Shares Outstanding 86.3m

Market cap Cdn$16.6m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MXR). MXR is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.