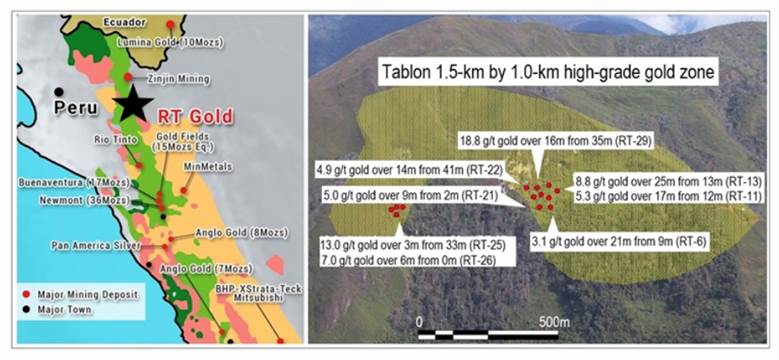

Max Resource: Historical drill core from RT Gold project highlights Tablon 1.5-km x 1.0 km high-grade gold zone

2020.12.22

In mineral exploration, often-times a company new to a project can achieve a good understanding of it from what has been done previously. Such is the case with Max Resource Corp. (TSXV:MXR, OTC:MXROF, Frankfurt:M1D2). The Vancouver-based company has published some fantastic intercepts from historic drill core at its recently acquired RT Gold property in Peru.

The highlights of a 1,600-meter drill program at the Tablon Zone, completed in 2001 and summarized by former operator Golden Alliance Resources in a 2011 technical report, are summarized in the table below. They include 18.8 grams per tonne gold over 16 meters from 35 meters depth; 8.8 g/t Au over 25m from 13 meters; and 5.3 g/t Au over 17m from 12m.

Figure 1: RT Gold project location; Figure 2: Tablon Zone and highlight drill hole results

|

DDH Number |

From (m) |

To (m) |

Length |

Gold g/t F. Assay |

|

RT-1 |

13.50 |

15.00 |

1.50 |

1.16 |

|

and |

24.00 |

25.50 |

1.50 |

4.59 |

|

RT-2 |

39.50 |

39.94 |

0.44 |

44.05 |

|

RT-3 |

62.18 |

62.85 |

0.67 |

49.99 |

|

and |

105.76 |

106.10 |

0.34 |

54.89 |

|

RT-4 |

7.85 |

11.90 |

4.05 |

2.23 |

|

and |

18.02 |

20.29 |

2.27 |

2.67 |

|

and |

26.29 |

28.42 |

2.13 |

2.61 |

|

RT-6 |

9.07 |

30.48 |

21.41 |

3.10 |

|

including |

9.07 |

15.24 |

6.17 |

5.48 |

|

RT-7 |

10.08 |

30.00 |

19.92 |

2.41 |

|

including |

10.08 |

12.55 |

2.47 |

4.55 |

|

and |

25.53 |

25.91 |

0.38 |

7.44 |

|

RT-11 |

12.01 |

29.10 |

17.09 |

5.32 |

|

including |

15.54 |

18.20 |

2.66 |

14.20 |

|

RT-12 |

17.41 |

21.76 |

4.35 |

4.71 |

|

RT-13 |

13.41 |

38.83 |

25.42 |

8.78 |

|

including |

19.85 |

22.75 |

2.90 |

19.81 |

|

including |

31.21 |

38.83 |

7.62 |

12.61 |

|

including |

33.72 |

34.72 |

1.00 |

28.24 |

|

RT-14 |

17.68 |

19.36 |

1.68 |

5.47 |

|

RT-15 |

12.80 |

19.20 |

6.40 |

5.85 |

|

RT-16 |

16.17 |

20.07 |

3.90 |

13.18 |

|

RT-21 |

1.52 |

10.97 |

9.45 |

5.08 |

|

RT-22 |

8.45 |

9.50 |

1.05 |

2.58 |

|

and |

31.39 |

33.80 |

2.40 |

3.21 |

|

and |

40.75 |

54.86 |

14.11 |

4.85 |

|

RT-25 |

33.00 |

36.1 |

3.1 |

12.97 |

|

including |

33.00 |

34.00 |

1.00 |

33.30 |

|

RT-26 |

0.00 |

6.00 |

6.00 |

6.95 |

|

including |

1.00 |

2.00 |

1.00 |

17.37 |

|

and |

12.02 |

13.00 |

0.98 |

2.80 |

|

and |

17.00 |

18.00 |

1.00 |

2.98 |

|

RT-27 |

9.76 |

12.00 |

2.24 |

1.49 |

|

and |

26.00 |

27.00 |

1.00 |

1.43 |

|

RT-28 |

1.52 |

10.54 |

9.02 |

1.93 |

|

and |

18.35 |

28.10 |

9.75 |

2.21 |

|

including |

23.34 |

25.71 |

2.37 |

5.99 |

|

RT-29 |

1.20 |

8.00 |

6.80 |

2.75 |

|

and |

34.85 |

51.25 |

16.40 |

17.99 |

|

including |

42.00 |

44.15 |

2.15 |

118.10 |

Table 1. Diamond Drill Hole (DDH) intersections and gold fire assay results. Source: NI 43:101 Geological Report Rio Tabaconas Gold Project for Golden Alliance Resources Corp. by George Sivertz, Oct.3, 2011. Intervals are core lengths not true widths, which are unknown at this time.

|

DDH Number |

UTM E |

UTM N |

Elevation |

Azimuth |

Dip |

Length |

|

RT-1 |

706462 |

9418622 |

1918m |

355 |

-45 |

126.19m |

|

RT-2 |

706448 |

9418611 |

1916m |

355 |

-45 |

57.92m |

|

RT-3 |

706479 |

9418667 |

1955m |

340 |

-45 |

142.65m |

|

RT-4 |

706436 |

9418644 |

1948m |

147 |

-75 |

33.54m |

|

RT-6 |

706436 |

9418644 |

1948m |

127 |

-75 |

42.68m |

|

RT-7 |

706436 |

9418644 |

1948m |

115 |

-66 |

31.71m |

|

RT-11 |

706434 |

9418684 |

1985m |

310 |

-45 |

34.75m |

|

RT-12 |

706434 |

9418684 |

1985m |

310 |

-65 |

35.67m |

|

RT-13 |

706434 |

9418684 |

1985m |

280 |

-45 |

41.76m |

|

RT-14 |

706434 |

9418684 |

1985m |

280 |

-65 |

40.24m |

|

RT-15 |

706434 |

9418684 |

1985m |

344 |

-50 |

30.79m |

|

RT-16 |

706410 |

9418661 |

1976m |

310 |

-45 |

25.91m |

|

RT-21 |

706384 |

9418645 |

1976m |

– |

-90 |

24.4m |

|

RT-22 |

706353 |

9418697 |

2016m |

155 |

-45 |

69.21m |

|

RT-25 |

706144 |

9418499 |

2016m |

310 |

-45 |

39.94m |

|

RT-26 |

706144 |

9418499 |

2016m |

330 |

-45 |

33.53m |

|

RT-27 |

706144 |

9418518 |

2026m |

215 |

-45 |

45.73m |

|

RT-28 |

706397 |

9418691 |

1999m |

– |

-90 |

36.28m |

|

RT-29 |

706397 |

9418691 |

1999m |

180 |

-60 |

80.8m |

Table 2. Tablon DDH locations

“Management believes results like these are exceptional and rare. Whilst exploration is still at an early stage, the high-grades and thicknesses at shallow depths is remarkable,” stated Max’s CEO, Brett Matich, in the Dec. 21 news release. “Expansion potential for Tablon is significant, and re-analysis of the historic core will guide selection of high priority drill targets.”

The 2001 drill program into the gold-bearing massive sulfide, consisted of 33 holes, ranging in length from 10.4 to 132.5 meters, and dipping from –45 degrees vertical, over a 400 x 200-meter area. According to Max, High-grade gold values ranged from 3.1 to 118.1 g/t gold over core lengths ranging from 2.2 to 36.1-metres. In addition, hole RT-29 returned a metallics re-assay value of 186 g/t gold over 2.2-metres, indicating the presence of coarse gold.

The company notes that presently, only gold assays are available, however re-assaying will include multiple elements, done with the intention of delineating high-priority drill targets.

RT Gold is a project with potential scale. Acquired by Max earlier this year by option agreement, it sits along the Condor mountain chain of northern Peru, within the Cajamarca Metallogenic Belt. This geological belt extends from central Peru into southern Ecuador, and hosts a number of world-class gold deposits, including Fruta Del Norte (10Moz), Minas Conga (17Moz), Yanacocha (36Moz), Lagunas (8Mozs) and Pierina (7Mozs).

Two distinct mineralized systems occur within the RT Gold property, which lies 760 km northwest of Lima: the Cerro Zone, a bulk tonnage gold-bearing porphyry, and 3 km to the NW, the Tablon Zone, a gold-bearing massive sulfide target.

The Cerro Zone hosts four mineralized zones (Peak, West Breccia, La Catedral and Minas Sur) with highly anomalous concentrations of gold in rock and soils.

Structures assaying 0.1 to 62.9 g/t gold, hosted in mineralized wall rock, returned gold values of 0.5 to 1.0 g/t gold.

The soil geochemistry of the Cerro Zone has outlined a 2.0 km by 1.5 km gold anomaly, open in all directions grading from 0.1 to 4.0 g/t gold. Soil geochemistry is coincident with IP chargeability.

Despite the geophysics matching the geochemical (soil and rock sampling) results on surface, Cerro has never been drill-tested.

The Tablon Zone hosts numerous gold-bearing massive to semi-massive sulfide bodies within a 1.0 km by 1.5 km area of anomalous gold soil and rock geochemistry.

Other key points about the RT Gold project, gleaned from Golden Alliances Resources’ 2011 NI 43-101-compliant geological report, include:

- The property is on the east side of the Sierra Occidental of the Andes, at elevation of between 1,000 and 2,400 meters. The project sits within rugged terrain characterized by deeply incised valleys separated by narrow, high ridges.

- Access is by road from the coastal city of Chiclayo, which has an airport with scheduled daily flights to and from Lima. It takes 5-6 hours to drive to the project from Chiclayo.

- The first modern exploration was conducted in the late 1980s, when a government-funded Peruvian-German consortium re-opened the old Tablon mine workings.

- The primary exploration targets are disseminated gold deposits and polymetallic vein and replacement deposits.

- Mineralization at Tablon occurs in volcanic, sedimentary and carbonate units, probably Jurassic-age, whereas at Cerro, it occurs in a complex of volcanic and sedimentary rocks of Cretaceous to Tertiary age, that are cut by Tertiary-age felsic intrusions.

- There are numerous old mine workings at both areas, but no production records. Material was likely extracted by independent, small-scale miners.

- Past exploration includes geochemical surveys, geological mapping, helicopter-borne geophysical surveys, and a 33-hole, 1,600-meter diamond drilling campaign at the Tablon mine area in September, 2001. In the first quarter of 2002, another exploration program was carried out, including IP-resistivity and magnetometer surveys, detailed mapping and rock chip/ soil/ stream sediment geochemical sampling.

- Mineralization intersected at the Tablon Zone consisted of pyrrhotite, pyrite, sphalerite, galena, chalcopyrite and native gold. Gold grades ranged from <0.001 to 118.1 g/t Au. The 118 g/t Au assay was obtained from a 2.2-meter-long core sample interval. The best intersection from 2001 drilling was 18 g/t Au over 16.4 meters.

- No mineral resources or reserves estimates yet exist at Rio Tabaconas.

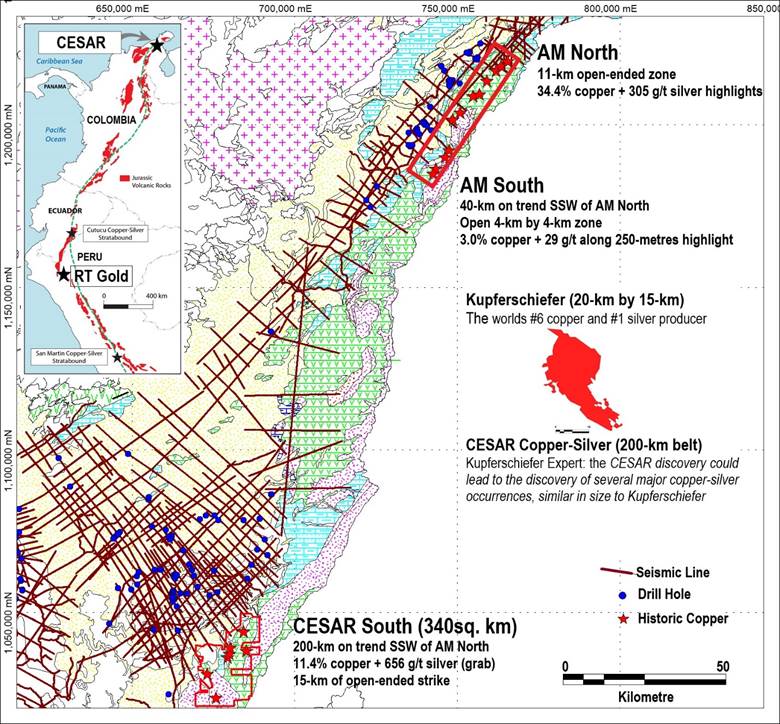

CESAR update

Meanwhile at Max’s CESAR copper-silver project in Colombia, where CEO Matich says “exploration is advancing vigorously”, the company anticipates initial results from analysis of recently obtained historic drill core early in the New Year.

The abundance of previous diamond drill core and related seismic data from oil and gas operations, will allow Max to model the paleo-topography of the mineralized stratabound horizon at CESAR. This will help to identify prospective areas for future drilling.

According to the company, the oil and gas drill cores, which are stored within a secure facility by the Colombian government, have never been studied from a metals perspective.

The analysis will concentrate on drill core intersecting the prospective Jurassic stratigraphy, focusing on XRF measurements, binocular microscope studies, and photography of both selected mineralized intervals and stratigraphic contacts. The results and seismic sections will then be integrated with the company’s existing database to help build a 3D structural model.

According to Matich: “The modeling should confirm the continuity of Jurassic stratigraphy and the copper-silver horizons from surface to considerable depths down dip.”

This study will also “greatly assist” the company’s targeted land expansion at CESAR, adds Matich.

The CESAR project spans about 500 square kilometers in northeastern Colombia, on the northern end of a 200-km-long, sediment-hosted copper-silver belt.

The Andean belt, which runs from northern Chile in the south, through Ecuador and Colombia, then arcs northwest into Panama, is known to host some of the world’s largest copper porphyry deposits including Escondida, Chuquicamata, Las Bambas and Collahuasi. Nearly half of the world’s copper is produced from this belt.

Colombia’s Cesar and Magdalena sedimentary basin is a related geological belt, formed over the same geological time period.

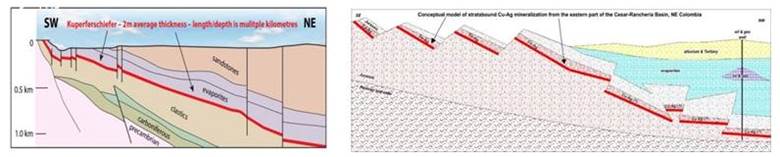

The basin is a massive geological feature that extends for over 1,000 km from the northern tip of Colombia southwards through Ecuador and Peru. The basin was a seabed trapped behind the uplifting Cordillera mountain ranges, and the model suggests that rich copper and silver-bearing fluids flooded up into the basin and deposited as they came in contact with organic matter on the seafloor.

As such, CESAR represents a type of sediment-hosted copper mineralization that is typically flat-lying, near surface, and is known to be extensive in Africa, Poland and Colombia. These types of deposits are generally higher-grade than copper porphyry deposits.

The CESAR project area enjoys major infrastructure thanks to existing oil & gas and coal mining operations including Cerrejon, the largest coal mine in Latin America, jointly owned by BHP Billiton, XStrata and Anglo American. However, this area has only seen limited copper mining in the past.

Recognizing the prospect of a major copper discovery in the region, Max Resource acquired full ownership of the property shortly after its discovery, just over a year ago, and embarked on a first-pass exploration program focused on identifying surface outcrops.

Three major discoveries have been made thus far on the property:

CESAR location map

- AM North: recently expanded to 29 km2 of continuous copper-silver mineralization, open along strike and down dip, containing a high-grade area with varying intervals grading 4.0 to 34.4% Cu and 28 to 305 g/t Ag;

- AM South: discovered along the same stratabound mineralized trend, about 40 km south-southwest of AM North covering an area of 16 km2. Highlight values of 6.8% Cu and 168 g/t Ag from 0.1 to 25m intervals suggest that these horizons could be of significant size;

- CESAR South: a newly acquired 340 km2 property hosting stratabound copper-silver over at least 15 km of strike with highlight grab sample values of 11.4% Cu and 656 g/t Ag.

Kupferschiefer analogy

Based on the CESAR North (AM North and AM South) and CESAR South discoveries, at opposite ends of the 200-km-long CESAR target zone, Max believes that this large surface footprint represents another “Kupferschiefer-type” mineralization similar to Polish state miner KGHM’s massive Kupferschiefer copper deposits in Poland.

Kupferschiefer is Europe’s largest copper mine, with production in 2018 of 30 million tonnes grading 1.49% copper and 48.6 g/t silver from a mineralized zone of 0.5 to 5.5-meter thickness. The Kupferschiefer deposit is also the world’s leading silver producer, yielding 40 million ounces in 2019, almost twice the production of the world’s second largest silver mine.

The fact that CESAR’s Cu-Ag stratabound mineralization appears to be large, sub-horizontal sheets that repeatedly outcrop at surface, adds credibility to this Kupferschiefer comparison. Average grades of 1.0% copper and 20 g/t silver at CESAR also make a compelling case.

CESAR & Kupferschiefer comparison

In a recent presentation, leading Kupferschiefer expert Professor Adam Piestrzyński highlighted numerous similarities between CESAR and Kupferschiefer including basin characteristics, lithology, mineralogy, deposit parameters, metal grades and origin of sulfur.

A notable difference is that the Kupferschiefer orebody starts at 500m below surface, whereas the CESAR mineralization starts at surface. This means Max could be looking at a district-scale, even a regionally extensive copper-silver mineralized system.

Conclusion

For now, Max will continue to focus on: regional rock sampling and mapping at surface; compiling the results from a property-wide geophysical thermal analysis survey, while it awaits results of the drill core and seismic studies; and expanding its land holdings.

The CESAR project has certainly attracted the attention of interested parties due to its favorable location and geology. Max has three non-exclusive confidentiality agreements in place: the first with one of the world’s leading copper producers, a second with a global mining company and a third with a mid-tier copper explorer.

The company also had no problem raising money to keep exploration going at CESAR heading into the New Year. In October Max completed a $6.5 million private placement, which saw mining billionaire Eric Sprott invest in the company for the first time with a 9.6% shareholding.

Max Resource Corp.

TSXV:MXR, OTC:MXROF, Frankfurt:M1D1

Cdn$0.42, 2020.12.21

Shares Outstanding 86,386,434

Market cap Cdn$36.37m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Millswebsite/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Max Resources (TSX.V:MXR, OTC:MXROF, Frankfurt:M1D1). Max is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.