Max Resource Fully Financed

2022.05.25

For today’s article I’m going to do something very unusual, and that is to talk about a junior resource company without talking about its project.

The company is Max Resource (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) who have just completed a Cdn$16.8 million financing in May at $0.60, after closing a $7.7M financing @ $0.26 at the end of March.

Both financings were done in very soft, some might say awful, market conditions. The second PP, at $0.60 (at 2.3x the price of the March financing), closed on May 19, the day after the Dow Jones Industrial Average fell nearly 1,200 points, the worst trading session since the onset of the coronavirus pandemic in March, 2020.

Worries about inflation and a hawkish Fed combined with concerns over disappointing first-quarter earnings are unsettling investors. Although the selloff hit pause last Friday, it wasn’t enough to prevent the Dow from booking its eighth-straight week of losses, the longest losing streak since 1923.

And junior resource companies haven’t been spared the carnage, most have had their share prices at least halved and money to finance exploration is extremely hard to find. And yet there was Max closing two private placements for a total of $23,000,000.00 in less than three months, with the second PP done 2.3X higher than the first, and at a 10-cent premium to market. What’s going on here?

This last financing, done at $0.60, was institutional money. It was announced on May 11 and $15.3M closed on May 19. The “missing” $1.5M is being done by an institution that cannot do private placements, so therefore needs to use a sponsored broker. This $1.5M financing will close in two weeks. Institutions would now hold 20% of the company (see pie chart).

In connection with their earlier agreement with Max, Endeavour subscribed for 6.6 million units to keep their 5% ownership position.

Right now, Max has roughly $21M from the last two financings in the treasury (MAX also has 14,800,000 warrants at 0.36 from the March financing that are well in the money and should add another $5.3m). Enough to do all the IP (induced polarization geophysical survey), drilling, etc. they need to do.

Those involved in this 2nd financing, $0.60 common/ $0.85 warrant, were given a full warrant, good for a year.

This is perfect for Max. Because in a year, if all goes well, the 28,000,000 $0.85 warrants get exercised (allowing the two corner stone institutions participating in the financing to each increase to 10% of the company and not dilute their position further), raising another $23.8M to continue working.

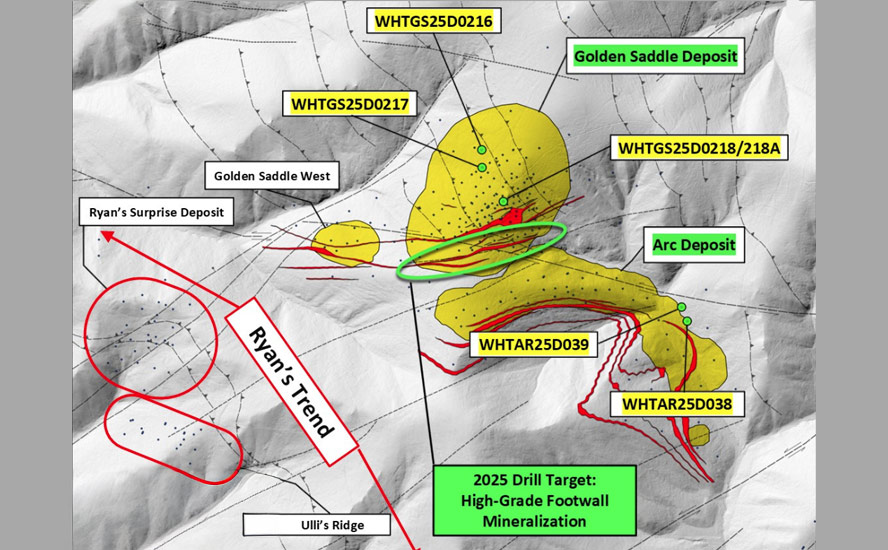

Giving these investors just the one year on their warrants enables Max to continue advancing the project. The full warrant, imo, keeps Max from having to finance again and puts 2 full years of “boots on the ground” into its CESAR Copper-Silver project, I think if Max hasn’t been bought by then…well two years is more then enough time for it to happen.

Remember this is not a short-term trade for the institutions involved (and we will, in very short time, know who they are as they will have to publicly report their holdings, and I will certainly write about them), there are no hedge funds involved, this is not a Short Form Prospectus with shares tradable the day after the financing closes, these are ‘buy and hold investors.’ As they say in the biz, “they are in the storage business not the moving business”, they are here for a potential buyout, as am I.

And I guarantee that if Max had joint-ventured or sold part of the property, if Max didn’t own 100% of CESAR (apart from Endeavour’s 0.5% net smelter royalty on new concessions), they would not be participating. They want maximum returns for their money, and that’s why they’ve taken part in the financing, without MAX even doing IP surveys or yet drilling a hole – they took part because of the project’s size and grade.

The ownership of 25% of the company’s outstanding shares by these institutional buyers is very important for other shareholders. No entity will be able to scoop up Max cheap. They will be forced to pay what these institutions think is fair value. And that offers a level of protection for the rest of us.

Conclusion

MAX will have raised $24.5m in a tough market. If things go well warrant exercise could bring in another $29.1m over the next 20 months. Everything Max has accomplished would be remarkable in a bull market. The fact it was done in such a soft market is incredible.

At the start of the article, I said I was going to do something highly unusual — talk about a junior without talking about its project. I’m not speaking about the project because the financings, especially the last one, speak volumes. They say more about Max’s CESAR project than I could put in a 10-page article.

The fact the share price has climbed $0.22, from $0.55 to $0.77, in the three trading days since the PP closed is further evidence.

I’ll talk about MAX’s CESAR Copper-Silver Project in another article.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.77 2022.05.24

Shares Outstanding 160.2m

Market cap Cdn$101.8m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSX.V:MAX) MAX is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.