Max Resource Corp (TSX-V:MXR) survey says?

2019.02.22

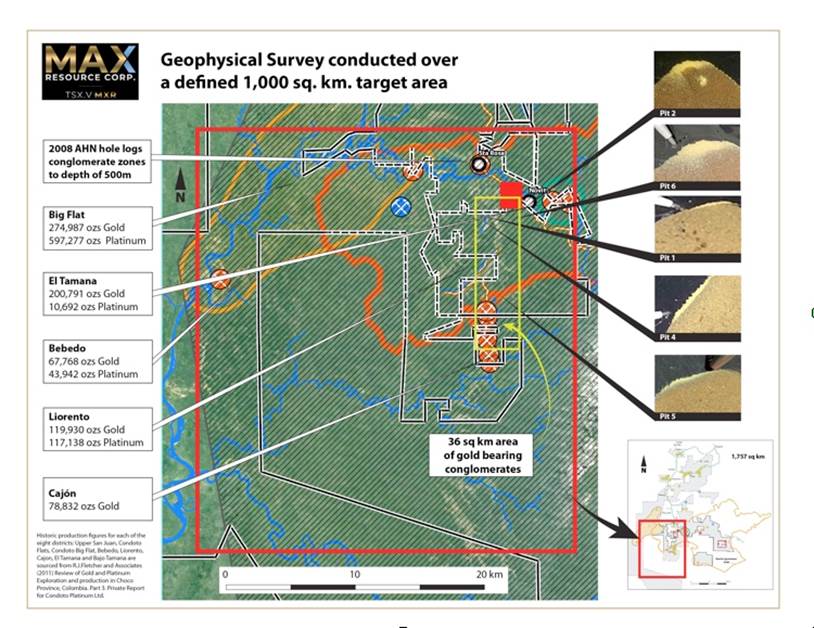

Max Resource Corp (TSX-V:MXR) continues to gather more data on the mineralization at its Chocó Precious Metals Project in Colombia – announcing on Friday, Feb. 22 that it has just completed a 1,000-square-kilometer Long Wave Infrared (LWIR) survey within its 1,757-square-kilometer property, located 100 kilometers from Medellin.

Otherwise known as thermal imaging, LWIR is a brand-new mineral exploration technique that employs satellite imagery to uncover targets that were previously unavailable to exploration companies. LWIR bands can penetrate vegetation and other ground cover, to mathematically “fingerprint” mineralized areas.

Max’s Chocó Precious Metals Project is either part of, or adjacent to, the Chocó Precious Metals District. Between 1906 (gold price was US$21 per/oz) and 1990 (gold price was 383 per/oz), Colombian mining company Chocó Pacifico extracted 1.5 million ounces of gold and a million ounces of platinum from the district, all within 8 meters of surface.

The aim of the LWIR survey was to see if there is a correlation between the conglomerate outcropping where Max is conducting a bulk sampling program (see below for details) and historical production, of which 1,000 square kilometers has been identified. We will see results of the LWIR survey next week.

LWIR survey details

The survey encompassed areas within or adjacent to Chocó Pacifico’s historical production and includes the 36-square-kilometer-area (upsized from the original 8 sq. km – see below for the news release) that Max has identified as potentially containing gold-bearing conglomerates.

Previous gold-producing zones (see map below) include:

- Big Flat – 274,987 gold ounces; 597,277 oz platinum

- El Tamana – 200,791 gold oz; 10,682 oz platinum

- Bebedo – 67,768 oz gold; 43,942 ozs platinum

- Liorento – 119,930 oz gold; 117,138 oz platinum

- Cajon – 78,832 oz gold

A completed hydrocarbon drill hole was also surveyed, since gold conglomerate has been found throughout the upper 500 meters of the hole.

“While the exploration to date appears to suggest a possible link between overlying Chocó Pacific production and underlying gold bearing conglomerates, the objective of the LWIR survey is to survey the remainder of the 1,000 sq. km historical production area for similar LWIR responses to the previously defined 36 sq. km area,” said Brett Matich, Max’s President and CEO, in the news release.

Last year Max ran an LWIR survey of its Gachala Copper Project, also in Colombia. The 3,400-square-kilometer survey identified eight targets within the 400 sq. km property, by showing the best spectral match signatures for the copper minerals chalcocite and chalcopyrite.

Located in a sedimentary copper basin comparable to the Zambian Copper Belt, historical sampling has identified a 24-kilometer strike length, with copper grades ranging from 0.5% to 13%. Anything over 1% is considered high-grade copper.

Gachala North Block spun off

Max announced it has hived off a portion of Gachala to Tasca Resources Ltd. (TSX-V:TAC). Under the terms of a non-binding letter of intent (LOI), Tasca agrees to issue Max 6 million shares (post-consolidation common shares), in exchange for the North Block of the Gachala Copper Project, which contains seven mineral license applications comprising 13,280 hectares.

Two of the license applications are contiguous to an area where historical exploration returned rock sample values ranging from 1.6% to 7.82% copper. Rio Tinto did stream sampling and limited rock sampling in 1999.

Tasca will also be getting a 4-km cobalt anomaly that has been identified by the Colombian Geological Survey. Cobalt – a key ingredient in electrical vehicle batteries – if often found within sedimentary copper deposits.

“The Tasca exploration team will immediately commence examination and evaluation of the occurrences in the North Block area to attempt to verify the historical data,” states the news release.

It’s important to recognize that Max will retain three-quarters of the Gachala Copper Project (40,258 ha) as Tasca begins exploring the highly prospective North Block.

This means that Max will stand to benefit from any discovery that is found on Tasca’s quarter of the project, in that the value of the entire project would obviously increase. Max currently isn’t getting any value for Gachala (all of the market interest is in the Chocó Precious Metals Project) so why not let another company conduct the exploration – shouldering the risk and expenditures – while Max concentrates on Chocó? It’s a smart strategy.

The deal also shows extreme confidence in their Chocó gold project to deliver. After all, no management team sells even one quarter of a highly prospective exploration project unless they think they have the goods at their main project.

It’s a good deal for Max, and a great deal if TAC has any kind of success. Getting some hits at Gachala could even stimulate Max to look at selling other portions of Gachala to Tascaor other interested juniors, as it “subdivides” the 53,538-hectare property and plows more funds into the treasury.

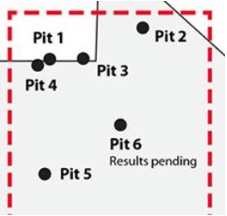

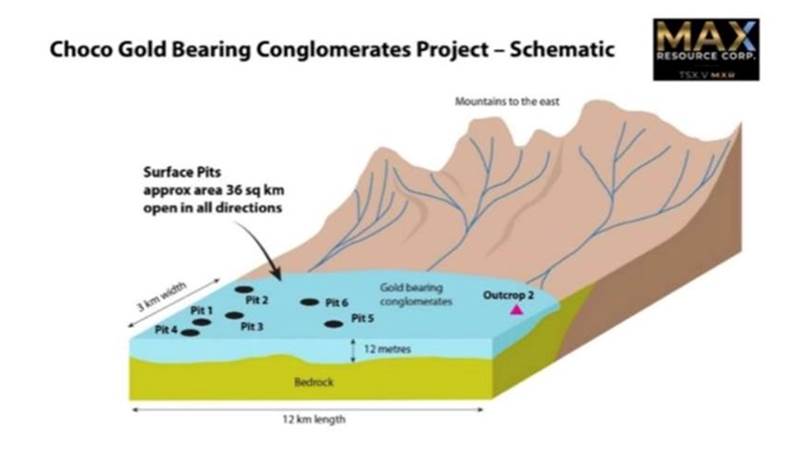

Back to the Chocó Precious Metals Project, to identify the extent of the mineralization, Max conducted a bulk sampling program with six sample pits, 2m by 2m by 30cm-deep, spread over 8 square kilometers. The pits targeted exposed conglomerate areas where previous alluvial mining had been done. A 12-meter-thick outcrop was also identified – random samples have been taken and are being tested for gold mineralization – results are pending.

The plan for the bulk sampling program is to 1) substantiate reports of free gold within the hard rock conglomerate and 2) determine the thickness of the gold conglomerate and how far it extends laterally.

Five of the six pit samples have come back, and every sample contains gold.

The as yet unanswered question, is, what are the grades?

The company has determined that the best way to obtain the grade of the gold-bearing conglomerate is to crush it and then process the material to recover the free gold from the sample, rather than assaying the samples.

About 2,000 kilograms of hard rock conglomerate was randomly collected from each pit, then a 50-kg sample from each pit was sent to a lab in Medellin, where it was crushed to <2mm, then gravity-separated to reveal the gold.

Read about the step by step sampling procedure in Max’s Feb. 14 news release

Here is a diagram of the 8 sq. km area that contains the test pits. We are supposed to get the grams per tonne of free gold of the minus-two-millimetre concentrate published soon. Let’s say it’s 0.5 g/t – one half gram per tonne.

8 sq. km is 8 million sq. meters, the conglomerate is, on average 12 meters thick and has a specific gravity (SG) of 2.2. Here’s how to figure the tonnage/gold contained in those 8 sq. km.

8 sq. km is 8 million sq. meters, the conglomerate is, on average 12 meters thick and has a specific gravity (SG) of 2.2.

8,000,000 x 12 x 2.2 = 211,200,000t x 0.5g/t = 105,600,000 grams gold divided by 31 = 3,406,451 potential ozs of gold.

Each sq. meter of conglomerate potentially contains 0.42 g/t recoverable gold. Each sq. km potentially contains 420,000 ozs gold.

Max has also identified a second outcrop of gold-bearing conglomerate.

The discovery means that the original 8-square-kilometer exploration zone more than quadruples to 36 square kilometers. The significance can be better understood by taking a look at the schematic below.

The mineralization is open in all directions. In other words, the potential gold-bearing conglomerate could extend beyond 36 square kilometers, laterally and at depth.

Once we get the results of the LWIR survey, we’ll have an idea how far beyond the 36 sq. kms this already huge expanse of potentially mineralized ground extends.

Max has 100-per-cent ownership of 82 and 50 per cent ownership of seven mineral licence applications totalling over 1,757 square kilometres.

The big names behind Max

As every resource investor knows, the management, board of directors and advisory board (collectively known as “the team”) is an important indication of how well a company will do, irrespective of the property(ies) and the amount of mineralization that lies beneath the surface.

MXR added another member to what appears to be a stellar line-up, on Tuesday, Feb. 19. The Vancouver-based company appointed Dr. Chris Grainger to the advisory board – the second following the appointment of Andres Trivino, President of the Canada Colombia Chamber of Investment and Trade.

Based in Medellin, 100 kilometers from Max’s Choco Precious Metals Project, Dr. Grainger is a 20-year geologist with deep experience in Colombia including greenfield and brownfield exploration.

He is the former VP Exploration (Regional Projects) for Continental Gold and Chief Geologist for Colossus Minerals. Dr. Grainger has also held senior-level positions at Troy Resources, Lion Ore Australia, INCO Brazil and CVRD Brazil.

In 2012 Dr. Grainger joined Cordoba Minerals, which is exploring a porphyry copper-gold project 200 km north of Medellin. As the Vice President Exploration for Cordoba Minerals (TSX:CDB) Dr. Grainger was responsible for the project generation and development of the San Matias Cu-Au project that currently hosts the Alacran Cu-Au deposit discovery (78 Mt) and adjacent numerous porphyry prospects acquired by Robert Friedland’s HPX.

“As the technical member of the Advisory Council, Chris will employ his extensive operational, exploration and project definition experience within Colombia to both strategize and provide technical expertise for MAX,” said Brett Matich, MAX’s President and CEO, in a news release.

What caught my eye is the people on the board of Cordoba Minerals, one of Dr. Grainger’s former postings. From the “Corporate” page we see:

- Peter Meredith, Chairman. Mr. Meredith concurrently serves on the boards of directors of Ivanhoe Mines and Great Canadian Gaming. He has held senior executive roles and served on the boards of Turquoise Hill Resources (previously Ivanhoe Mines), Kaizen Discovery, SouthGobi Resources, China Gold International Resources Corp, Ivanhoe Energy, Entree Gold, Ivanhoe Australia, Asia Gold, Besra Gold (formerly Olympus Pacific Minerals), and Jinshan Gold Mines. During his tenure with the Ivanhoe group of companies he participated in raising more than US$4 billion to advance the business interests of various companies within the group.

- Eric Finlayson, Director. Mr. Finlayson is a geologist with over 35 years of global exploration experience. He was appointed President of High-Power Exploration in 2015 after serving as Senior Adviser-Business Development since 2013. Prior to joining HPX, Mr. Finlayson spent 24 years with Rio Tinto including five years as Global Head of Exploration.

- Govind Friedland. Mr. Friedland is the Executive Chairman of GoviEx Uranium and a Principal and Co-Founder of Ivanhoe Industries, the parent company of I-Pulse, a hi-tech company providing innovative solutions for mining, oil & gas, and advanced manufacturing sectors based in Toulouse, France. He was the former Business Development Manager for Ivanhoe Mines based in China and has significant experience in emerging markets.

- Tony Makuch, Director. Mr. Makuch is a professional engineer with over 35 years of management, operations and technical experience in the mining industry, and is the current President and CEO of Kirkland Lake Gold. He was previously the President and CEO of Lakeshore Gold, prior to its acquisition by Tahoe Resources, where he became Tahoe’s Executive Vice President and President of Canadian Operations. Mr. Makuch was the Senior Vice President and Chief Operating Officer of FNX Mining Company. Later becoming Quadra FNX Mining, the company agreed to a $3-billion takeover by Polish copper producer KGHM Polska Miedz SA, in 2011. Quadra FNX put its Morrison copper-precious metals deposit near Sudbury into production in 2010.

- Bill Orchow, Director. Mr. Orchow previously served as a director of Revett Minerals, acquired by Hecla Mining in 2015. He was also the President and CEO of Kennecott Minerals and Kennecott Energy, the third largest domestic coal producer in the United States.

- Ignacio Rosado, Director. Mr. Rosado is the CEO of Volcan Compañia Minera, one of the largest producers of silver, zinc, and lead in the world with its shares publicly traded on the Peruvian stock exchange. He was the CFO of Hochschild Mining, leading the company’s US$500 million initial public offering on the London Stock Exchange in 2006.

This board of directors reads like a “mining who’s who”. First, we have Chairman Peter Meredith whose previous experience includes roles with mining magnate Robert Friedland’s Ivanhoe group of companies.

Friedland and Bill Hayden are the Co-Founder’s of Ivanhoe Mines, Friedland heading the same board of directors of which Bill Hayden is a member. Recall it was Bill Hayden’s interest in exploring the Choco region that led to MAX Resource Corp’s Choco Precious Metals Project.

For a thorough background on MAX, its conglomerate gold project and a fascinating history of gold in Colombia, read our Max has found its El Dorado

Of interest is the fact that Meredith was a director on the boards of four companies launched by Friedland who, according to Forbes, has a current net worth of $1.1 billion: Ivanhoe Mines, SouthGobi Resources, Jinshan Gold Mines and Ivanhoe Australia.

Reports indicate that Meredith helped raise $4 billion for companies in the Ivanhoe group. $4 billion? Executive bios usually detail raisings in the tens or hundreds of millions, not billions.

Eric Finalyson spent 24 years with Rio Tinto, the second largest mining company in the world behind BHP.

A quick Google search found that Govind Friedland is Robert Friedland’s son. Mining appears to be in the genes.

Tony Makuch is President and CEO of Kirkland Lake Gold, which made a $56 million investment in Novo Resources, the first mover in a conglomerate gold area play in the Pilbara region of Australia. Imagine how much due diligence Kirkland Lake did on Novo’s Purdy’s Reward property before dropping that kind of cash – knowledge that will be valuable for MAX to have if any of it can be shared in reference to the Choco Precious Metals Project.

Bill Orchow is no shrinking violet either. His Revett Minerals got bought out by Hecla Mining – whose Green Creek (Alaska), Lucky Friday (Idaho) and Casa Berardi (Quebec) mines make it the largest silver producer in the United States. The $20 million deal gave Hecla control of Revett’s Rock Creek project in northwestern Montana – considered to be one of the largest silver and copper deposits in North America. Orchow also headed up Kennecott Minerals, now a subsidiary of Rio Tinto. Rio Tinto Kennecott runs the Bingham Canyon copper mine in Utah – the largest copper mine in the United States.

Finally, we have Ignacio Rosado who heads up one of the largest producers of silver, zinc and lead. He led a $500 million IPO of Hochschild Mining.

Now I’m not saying Robert Friedland is involved here, but hey, a lot of his alumni are certainly on the margins, and his Ivanhoe co-founder is directly involved. Other high-level individuals, such as Kirkland Lake’s CEO must certainly be aware of Max efforts. The point of listing all these people, executives that are so high up on the mining food chain and their qualifications, is to demonstrate that MAX is showing what seems to be some serious scale.

An unwritten rule in mining is that serious players are not interested in small-scale properties. Major gold miners generally won’t take a sniff at anything less than a few million ounces (Moz). It appears to us here at aheadoftheherd.com the amount of prospective gold at MAX’s Choco Precious Metals Project is far more than “a few Moz”.

Conclusion

We know that Max is associated with some very influential executives, who are usually only interested in projects with serious scale.

Can’t wait to see how much potential gold-bearing conglomerate the 1,000-square-kilometer LWIR survey reveals.

We also see that the Ivanhoe group is a common thread. Bill Hayden is the co-founder of Ivanhoe Mines with Robert Friedland. Hayden led the discovery of Ivanhoe’s (TSX: IVN) Platreef in South Africa – the world’s lowest-cost platinum mine – and also convinced Friedland to pivot towards the Democratic Republic of the Congo, where Ivanhoe made the Kamala discovery, one of the richest copper finds on the planet (1.7 billion tonnes at 2.5% Cu).

Here’s what Friedland had to say about Hayden: “Mr. Hayden was a visionary whose geological passion and perseverance allowed our team of explorationists to be in a position to make the Platreef Discovery.”

We don’t want to make too direct a connection, but it appears that Ivanhoe Mines, through current and former insiders, is putting its winning formula into practice at Max’s ChocóPrecious Metals Project.

The formula is this: Go into a previously undeveloped but prospective mineral belt, buy up as many claims as possible, and then make a discovery. They did it at Voisey’s Bay, Canada, at Platreef, South Africa, at Oyu Tolgoi, Mongolia, and three times in the DRC – the most recent being the Kamoa-Kakula project last October. Friedland says Kamoa-Kakularanks as the world’s fourth largest copper deposit, and he ought to know.

These guys don’t think small, and neither do we.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Max Resources (TSX-V:MXR) is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of MXR.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.