Max finds high-grade gold, platinum at surface

2019.04.16

Max Resource Corp (TSX-V: MXR) is putting an extra two letters in its Choco Precious Metals Project: “Pt” for platinum.

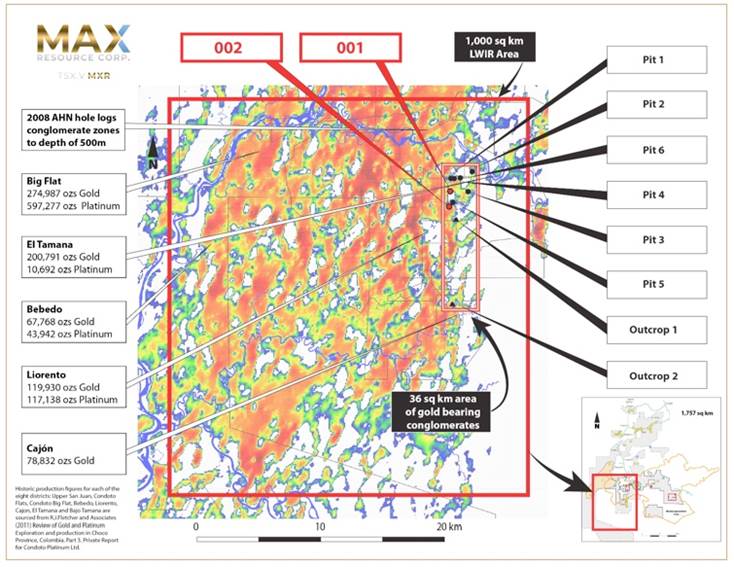

Up to now exploration at Choco, in Colombia, has focused on the conglomerate gold (free gold contained in hard rock up to about 12m below surface) but in its latest set of results, Max updates investors on the results of two samples taken from a 1,000-square-kilometer new exploration zone.

The sprawling zone was identified by a long-wave infrared (LWIR) satellite survey completed earlier this year.

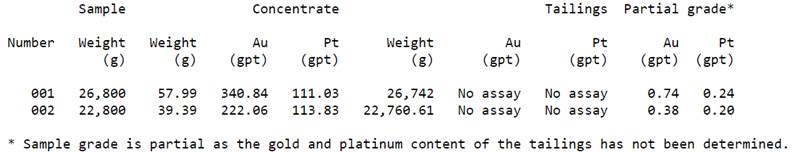

A concentrate made from the first sample graded 340.84 grams per tonne (g/t) gold and 111.03 g/t platinum, for a combined 451.87 g/t gold and platinum.

The second concentrated sample was 222.06 g/t gold and 113.83 g/t platinum.

It’s important to note that these two samples were taken from surface, within a 36-square-kilometer area initially identified by Max as potentially containing conglomerate gold. The samples are also near six test pits dug as part of a bulk sampling program. (see below for details)

The geological theory Max is operating under, is there is a precious metals intrusive (gold, platinum, palladium) that runs right up to surface. In some areas there is more platinum than gold (80-20%) and in others the ratio is reversed (20% platinum to 80% gold).

The conglomerate gold is fine-grained free gold whereas the overlaying alluvial gold and platinum is coarse-grained. If the conglomerate gold is indeed the source of the alluvial gold (and platinum), the company thinks that the grades will increase as the conglomerate is explored deeper, Max’s CEO, Brett Matich, told Ahead of the Herd in an earlier interview. Mr. Matich added by assaying the concentrates of samples at surface, it allows us to more quickly identify the enrichment zones over the 1,000 sq. km target zone. .

Its important to note that the concentrate is recovered simply by panning and the sample tailings which comprise of about 99.7% of the sample has not been assayed. Also recovered gold and platinum is significant compared to assays.

The two samples will be further assayed for evidence of other platinum group elements. At the same time, Max will move northward to collect more samples for assaying, within the 1,000 square kilometers identified by the satellite survey.

LWIR survey

Otherwise known as thermal imaging, LWIR is a new mineral exploration technique that employs satellite imagery to uncover targets that were previously unavailable to exploration companies. LWIR bands can penetrate vegetation and other ground cover, up to 60 centimeters (24 inches) beneath the surface, to mathematically “fingerprint” mineralized areas.

The aim of the LWIR survey was to identify a correlation between gold-bearing conglomerate outcrops (mineralized areas at surface) and historical production in the Choco Precious Metals District, located 100 kilometers from Medellin.

The results of the LWIR go far beyond the previously identified 36-square-kilometer area thought to contain gold-bearing conglomerates. Max has full and partial ownership of seven mineral license applications totaling over 1,757 square kilometers.

At a shareholders’ meeting on April 2, the company voted to acquire the mining rights to a 1,050-square-kilometer land package known as the Novita Project, finalizing a deal with previous rights owner Noble.

Max now controls a grand total of 2,807 square kilometers of prospective gold-bearing conglomerates in the Choco region of Colombia.

Max’s Choco Precious Metals Project is either part of, or adjacent to, the Choco Precious Metals District. Between 1906 and 1990, Colombian mining company Choco Pacifico extracted 1.5 million ounces of gold and a million ounces of platinum from the district, all from alluvial (riverbed), within 8 meters of surface.

Bulk sampling program

Max has bulk-sampled an area of historical alluvial gold mining (the conglomerate gold underneath has never been fully explored), by digging and sampling six pits (2m by 2m by 30cm-deep) spread over a 36 sq. kilometer area.

The plan for the bulk sampling program is to 1) substantiate reports of free gold within the hard rock conglomerate and 2) determine the thickness of the gold conglomerate and how far it extends laterally.

The company has determined that the best way to obtain the grade of the gold-bearing conglomerates is to crush the conglomerate and then process the material to recover the free gold from the sample, rather than assaying the samples.

About 2,000 kilograms of hard rock conglomerate was randomly collected from each pit, then a 50-kg sample from each pit was sent to a lab in Medellin, where it was crushed to <2mm, then gravity-separated to reveal the gold.

The grams per tonne of free gold of the minus-two-millimetre concentrate are being calculated and will be released as initial sample results. The final results of the entire 50-kg sample will be released later.

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Max Resources (TSX.V:MXR), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of MXR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.