Lomiko hires management team, pursuing acquisitions strategy in Quebec

2021.11.02

A transition within the top positions at Lomiko Metals (TSXV:LMR, OTC:LMRMF, FSE:DH8C) will see long-time CEO Paul Gill step back to make room for a new chief executive, while the corporate strategy positions Lomiko as a growth vehicle to develop a critical minerals portfolio in Quebec with a distinct community first approach concerning the mining properties it is developing in the Canadian province of Quebec.

The incoming leadership team, announced on Oct. 26, is headed by Belinda Labatte, who also occupies a directorship on the company’s board; Vince Osbourne as chief financial officer, and Gordana Slepcev as chief operating officer.

Belinda Labatte has over 15 years of senior management experience in mining and 20 years of capital markets experience. She was most recently chief development officer at Mandalay Resources and before that, ran her own consulting company firm based in Toronto. Fluent in French, German and Spanish, Labatte has an MBA from the Rotman School of Management, holds an Institute of Corporate Directors (ICD.D) designation, and is a CFA charterholder.

Gordana Slepcev is a professional mining engineer with more than 25 years experience developing and leading mining operations. Slepcev’s extensive experience spans multiple commodities, including gold, base metals, coal and industrial minerals. She brings considerable experience in mineral exploration, permitting, corporate and regulatory/First Nations/ Indigenous relations, and project financing to Lomiko. Before joining the company, Slepcev was the COO for BMSI, a privately held company, where she was responsible for restarting the barite reprocessing facility, mitigating historical environmental impacts and overseeing EPCM contractors. She also was COO of Anaconda Mining, where she was responsible for the company’s operations and developing the Goldboro project in Nova Scotia.

Independent director Eric Levy, senior partner at law firm Osler, Hoskin & Harcourt LLP, has over 20 years of experience advising on securities and governance matters.

Jacqueline Michael will resign her position as CFO and director and continue in the role of controller for Lomiko, reporting to Vince Osbourne. Also resigning as director is Mike Petrina, who will remain with Lomiko in an operational capacity as project manager for the La Loutre project.

Out-going CEO Paul Gill will stay on as the board’s executive chair, and will continue to be involved in advancing the current portfolio of assets, and will keep overseeing the final stages of completing the ECOLOGO third party certification process, which reinforces Lomiko’s commitment to ethical practices as endorsed by the Quebec Mineral Exploration Association (QMEA).

According to the news release,

Lomiko is poised to develop its current critical minerals projects in Quebec and pursue a new growth strategy for the acquisition and development of new critical minerals assets to add to the Company’s portfolio.

The new leadership will continue to develop the Company’s high potential La Loutre graphite project into the Pre-Feasibility Stage (“PFS”) stage with the view of taking it into full production, along with plans for the advancement of its lithium exploration project, Bourier located near Nemaska Lithium and Critical Elements south-east of the Eeyou Istchee James Bay territory in Quebec.

“I am proud to welcome our new management team and new directors to Lomiko,” said Gill, from his new position as executive board chair. “The opportunity to build a new company with a wider scope and long-term vision is now. Lomiko is in a perfect position to benefit shareholders and contribute to developing new businesses in Quebec that will create jobs and prosperity while being committed to environmental and community stewardship.”

Belinda Labatte, incoming chief executive officer, said: “I thank Paul Gill, his team and the Board of Directors for the opportunity to build Lomiko into a high growth, dynamic and modern critical minerals company with an experienced, energetic and motivated team. We start with an excellent platform that Mr. Gill and his team have built as we move forward with our plans for a people-first approach to the development of critical minerals. We are taking steps to increase value and de-risk of the La Loutre graphite project and evolving from a high potential Preliminary Economic Assessment (“PEA”) project to an expanded project in the PFS stage. Our plans for La Loutre include a carbon-neutral mine plan, enhanced drilling in high potential zones, and a metallurgical testing program, among other priorities. We also plan to follow up on a very encouraging geophysical survey program at our lithium exploration project, Bourier, in Quebec, that was conducted mid-2021. We will begin to drill test the anomalies as part of a renewed exploration focus at Bourier.”

She continued,

“We are also actively reviewing other opportunities for portfolio growth in Quebec and North America where community engagement will be a priority. Our shared values of respect, personal performance, integrity and ingenuity are at the forefront. Our team has extensive experience in growing businesses large and small, in mine construction and operations, and a deep understanding and respect for long-term relationship building and entrepreneurial support needed in the communities where we operate. We are excited to build the profile of the critical minerals supply chain in Canada, share knowledge and be a part of the new energy transition employment opportunities ahead by applying action-oriented Environment, Social and Governance (“ESG”) practices in all areas of the business.”

Lomiko is also forming an advisory board to assist management in growing the company. Normand Champigny, CEO and director of Quebec Precious Metals Corporation, has been appointed to this group.

The company will grant 3,850,000 stock options to the newly appointed leadership team and independent director, exercisable over five years @ $0.12/sh.

La Loutre graphite project

Lomiko Metals holds a 100% interest in the La Loutre graphite project in southern Quebec, consisting of 42 minerals claims totaling 2,509 hectares.

The property is located approximately 117 km northwest of Montréal and 53 km east of the Imerys Carbon and Graphite’s Lac des Iles mine. Nouveau Monde Graphite and its high-purity mineral reserve at Matawinie are located 230 km to the north.

La Loutre was originally explored for base and precious metals in the late 1980s. However, historical reports pointed to the presence of graphite in different lithologies.

Recent sampling by Lomiko confirmed a graphite-bearing structure covering an approximately 7 x 1-kilometer area with results up to 22.04% graphite in multiple parallel zones of 30-50 meters wide.

Another area has also been identified covering approximately 2 x 1 kilometers in multiple parallel zones of 20-50m wide, including results up to 18% graphite.

The two mineralized areas on the property were later named the Electric Vehicle (EV) Zone and the Graphene-Battery Zone respectively, for the potential applications of the graphite material contained in each.

The project’s first resource estimate (2016) was obtained from only Graphene-Battery (see below), containing a pit-constrained 18.4 million tonnes of 3.19% graphitic carbon (Cg) indicated and 16.7 million tonnes @ 3.75% Cg inferred.

Encouraged by the initial estimates, Lomiko pursued further drilling at La Loutre, including the EV Zone, to boost its resource base. The latest (2019) drill program returned high-grade intercepts of 87.9m of 7.14% Cg, including 21m of 15.48% flake graphite; and 116.9m of 4.80% Cg, including 15.2m of 18.04% flake graphite.

These results allowed the company to expand the resource, as shown in the July 2021 PEA, to an estimated 23.2 million tonnes indicated grading 4.51% Cg (for 1.04 million tonnes of contained graphite), plus 46.8 million tonnes inferred grading 4.01% Cg (for 1.9 million tonnes of graphite).

Bourier lithium project

Lomiko also has a joint venture option to earn 70% of the Bourier lithium project from Critical Elements Lithium by funding exploration activities and other considerations.

The Bourier property consists of 203 claims totaling 10,252 hectares, in a region of Quebec that boasts other lithium deposits and known lithium mineralization (as shown below).

The lithium pegmatites in this area tend to occur in swarms in the volcano-sedimentary units. The Bourier property covers a large part of this regional volcano-sedimentary unit, which is also host to Nemaska Lithium’s Whabouchi deposit and Critical Elements’ Lemare showing.

Initial exploration at Lemare was undertaken in 2012 by Monarques Resources, which resulted in the discovery of a “granite pegmatite dyke containing a considerable amount of spodumene.”

The Bourier property lies adjacent and northeast to the Lemare property, where drilling conducted between 2016 and 2018 yielded results that included 41.5m @ 1.71% lithium oxide (Li2O), including 15m at 2.18% Li2O and 6m at 3.6% Li2O.

The pegmatite ranges in apparent thickness from 4.8 to 14.2 meters and was followed for close to 200 meters in length on surface. Further exploration will confirm whether similar mineralization exists at the Bourier property.

Although there has been little exploration for lithium undertaken at Bourier, based on other lithium deposits around the world, it is common for pegmatites to exist in “swarms.”

Recently the company and its JV partner Critical Elements mandated GoldSpot Discoveries to conduct remote targeting for lithium on its Bourier claims within the Nemiscau belt.

“We are confident that continued exploration, benefiting from the deployment of GoldSpot’s AI analysis and our joint geoscientific expertise, will continue to reveal the considerable potential of the Bourier property,” Jean-Sébastien Lavallée, CEO of the Critical Elements, said in the latest news release.

Paul Gill added that, “The results indicate Bourier requires extensive attention. Combined with Lomiko’s La Loutre project, which has already reported a PEA on July 29, 2021, Lomiko has had the best summer of its history.”

A total of 15 lithium targets were identified on the Bourier claims. The AI-driven data analysis also helped to reduce the area of investigation to approximately 9.5% of the total claim holdings, which should save field work time and costs.

An exploration crew composed of Critical Elements and GoldSpot geoscientists subsequently conducted a 20-day prospecting program on the property, with a focus on the lithium targets generated by GoldSpot.

Highlights include the discovery of five new sectors of spodumene-rich (Li) pegmatite; assay results are pending.

The main discovery, located about 11 km NE of Bourier Lake, consists of muscovite and garnet pegmatites showing 1-5% of centimeter-sized spodumene crystals (see below), over an outcropping area of 40 x 30m.

Additional spodumene-rich pegmatites were sporadically found within a 1-km trend from the main discovery, highlighting the potential for a wider mineralized system. Four other spodumene-rich pegmatite zones were found elsewhere on the property.

Sale of Lomiko Technologies

Lomiko is expecting a fresh injection of capital, pursuant to a 2019 agreement to sell 100% of the company’s interest in Lomiko Technologies Inc., a subsidiary, to Promethieus Technologies Inc. (Canada) for $1,236,625.

In an Oct. 10 announcement, the Quebec-focused graphite and lithium explorer confirmed it has entered into and extended its previous sale agreement of Lomiko Technologies to Promethieus Technologies; the agreement runs from Oct. 4, 2021 to Nov. 30, 2022.

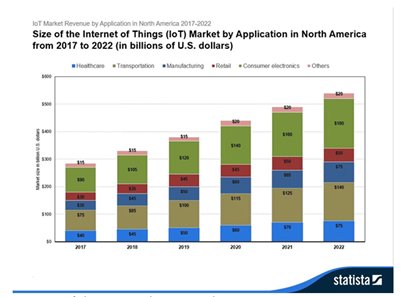

Lomiko Technologies’ holdings includes 18.5% of SHD Smart Home Devices, which was recently awarded a patent for its Internet of Things (IOT) HUB Device (see news release from June 26, 2021), and 40% of Graphene ESD Inc.

Upon completion of the sale, Lomiko Metals will receive $1,236,625, and be reimbursed $152,857 for expenses paid on behalf of Promethieus by Lomiko Metals, for a total consideration of $1.389 million.

Lomiko will retain a 20% interest in Promethieus, to be exchanged for 20% equity in a new company, Promethieus Ventures NV, which is in the process of listing on the Dutch Caribbean Securities Exchange (DCSX) with the intention of raising USD$10 million.

The transaction is expected to be approved at the upcoming Nov. 26, 2021, Lomiko AGM, given that 99% of shareholders gave the green light to the 2019 deal at that year’s AGM.

Promethieus has also agreed to purchase 40% of Graphene ESD for USD$10,000, giving Promethieus an 80% interest in Graphene ESD upon completion of the Lomiko Technologies purchase.

Conclusion

As we’ve previously discussed, the La Loutre PEA represents a major milestone for what could well be the next large-scale graphite project in Canada.

Highlights of the study are listed below:

- An open-pit project with total graphite production of 1.4 million tonnes spanning 14.7 years, for average annual production of 97,400 tonnes;

- Attractive cash costs of $386/tonne Cg and all-in sustaining costs (AISC) of $406/tonne Cg — both in the lower end of the industry spectrum;

- Low capex of C$236.1 million for pre-production, processing and infrastructure, plus another C$37.7 million budgeted for sustaining capital over the life of mine;

- An after-tax internal rate of return (IRR) of 21.5% and after-tax net present value (NPV) of C$186 million – strong results that support the advancement of the project to the next phase of development;

The PEA assumes an 8% discount rate and $916/tonne Cg sale price, which, given the project’s low costs, makes La Loutre a viable candidate to become the next major graphite producer in North America.

The early-stage study also alluded to the property’s geological potential to extend the mine beyond its approximate 15-year life. Opportunities are there to expand production by increasing the existing resource through further exploration and drilling.

The Bourier lithium property boasts a total ground position of 10,252 hectares in a region of Quebec that is known to host several lithium deposits.

According to Lomiko, Bourier is “potentially a new lithium field in an established lithium district,” and the plan is to explore the property in detail for battery minerals discoveries, not only lithium but also nickel, copper and zinc.

With lithium prices forecast to soar to new highs due to increased uptake of electric vehicles and battery storage in coming decades, industry-wide sentiment on battery mineral explorers like Lomiko is bullish.

As evidenced by the financings it has completed this year totaling $4.5 million, there is plenty of investor support for Lomiko’s graphite and lithium operations. The sale of subsidiary Lomiko Technologies, assuming shareholder approval in November, is expected to result in another significant cash injection of $1.389 million, a nice top-up to the treasury ahead of next year’s exploration season.

The new leadership team at Lomiko will be casting a fresh set of eyes over the La Loutre and Bourier projects; it will be interesting to see their approach to developing critical minerals in Quebec, and how the company plans to grow its project portfolio.

Lomiko Metals Inc.

TSXV:LMR, OTC:LMRMF, FSE:DH8C

Cdn$0.10, 2021.10.28

Shares Outstanding 238.1m

Market cap Cdn$21.5m

LMR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Lomiko Metals Inc. (TSXV:LMR). LMR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.