Lithium market booming as supply chases demand – Richard Mills

2023.02.18

The move away from fossil-fuel-powered vehicles to EVs run on batteries is happening in almost every country. Governments are spending billions on EV charging infrastructure and subsidies to incentivize consumers to switch to hybrids and plug-in electric cars, vans and trucks. China is the leader but other countries are catching up, as large automakers like Volkswagen, Mercedes-Benz, GM and Ford come out with new EV models and plan new EV manufacturing/ assembly plants in North America and Europe.

The electrification of the global transportation system doesn’t happen without lithium-ion batteries that go into electric vehicles. While a smartphone holds a couple of grams of lithium, an EV battery uses around 10 kg of the super-light element.

A trillion EVs sold

According to Benchmark Mineral Intelligence (BMI), to meet demand, the global lithium industry needs to invest up to $42 billion by the end of the decade. This works out to $7 billion each year from now until 2028, helping it to meet predicted demand of 2-4 million tonnes per annum by 2030, which is four times higher than the 600,000 tonnes of lithium that was expected to be produced in 2022.

Bloomberg notes the forecast, from a recent BMI report, comes as Europe and North America look to reduce their dependency on Chinese lithium imports and to try to develop their own lithium production.

The Biden administration has earmarked billions to help process key battery metals including lithium, while in Canada, 2022’s budget included CAD$3.8 billion to build a domestic critical metals supply chain.

Electric cars are expected to account for nearly 80% of EV market revenues and 83% of battery demand over the next two decades.

Annual spending on EVs reached $388 billion in 2022, up 53% from 2021, according to a new report published by BloombergNEF. The total value of electric vehicles sold to date in the passenger vehicle segment has now crossed $1 trillion. 2023 sales are likely to top $500 billion.

Government funding

Lithium is included on a list of 23 critical metals the US Geological Survey has deemed critical to the economy and national security.

In February, 2021, President Joe Biden signed an executive order aimed at strengthening critical US supply chains. Last year, the United States included lithium, nickel, cobalt, graphite and manganese on the list of items covered by the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War.

The Biden administration’s plan is to have 50% of US auto production electric and hybrid by 2030.

To bolster domestic production of critical minerals, US miners can now gain access to $750 million under the act’s Title III fund, which may be used for current operations, productivity and safety upgrades, and feasibility studies.

The administration has also allocated $6 billion as part of the $1 trillion infrastructure bill — towards developing a reliable battery supply chain and weaning the auto industry off its reliance on China, the biggest EV market and leading producer of lithium-ion cells.

All of this is in addition to a major funding announcement on Oct. 19.

$2.8B for US battery supply chain

The Department of Energy is awarding $2.8 billion in grants to 20 manufacturing and processing companies for projects across 12 states.

The funding will come from the bipartisan infrastructure law passed in 2021, and will include components affecting both the electrical grid and electric vehicles, CNN reported.

The 12 states include Alabama, Georgia, Kentucky, Louisiana, Missouri, Nevada, New York, North Carolina, North Dakota, Ohio, Tennessee and Washington — some of which, like Georgia, Kentucky and Tennessee, already have battery plants in the works.

The projects are expected to “develop enough lithium to supply over 2 million electric vehicles annually,” states a fact sheet.

Battery plants galore

According to Bloomberg New Energy Finance, since 2009 there have been 882 battery manufacturing projects started or announced in the US, representing $108 billion in investment. Nearly 25% of those projects were rolled out in 2022.

Our research also found that global carmakers and established battery manufacturers have announced plans to invest at least $50 billion into a minimum of 10 states to build EV assembly and battery plants since the start of 2021, and states have made commitments totaling at least $10.8 billion to lure those investments, according to a tally of publicly disclosed incentives by Bloomberg and Good Jobs First. That figure almost certainly underestimates the actual number.

For a breakdown by state, read US battery and EV plants galore. Georgia alone has announced 30 factories related to electric cars and batteries since 2020.

Higher prices called for

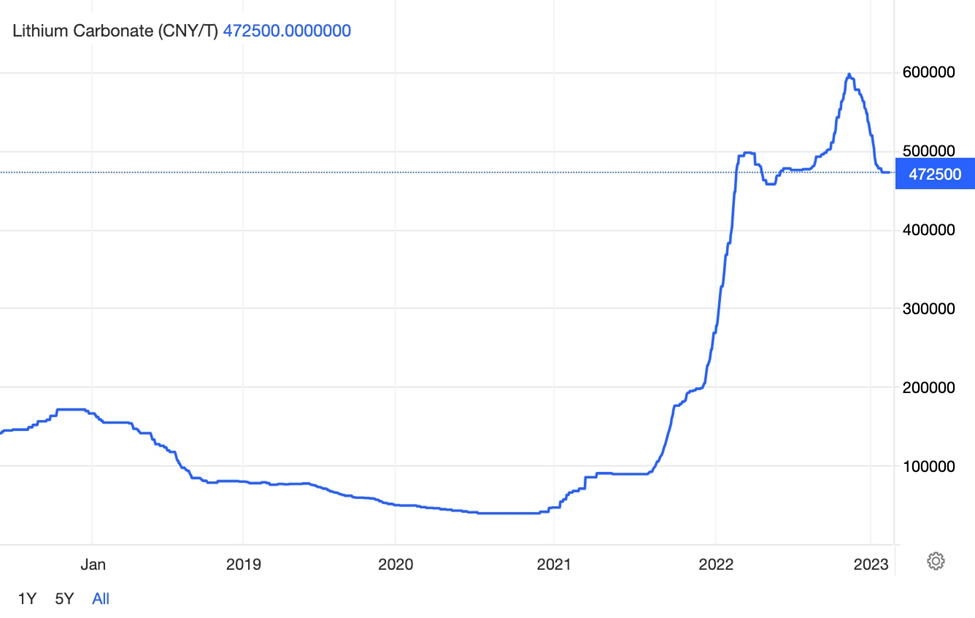

Booming global EV sales have lit a fire under lithium prices, which more than doubled in the past year, and are up nine-fold in the past three years, finds an index tracked by Benchmark Mineral Intelligence.

In November, the average spot price for battery-grade lithium carbonate was assessed by Fastmarkets at $80,800 per tonne. That’s a rise of more than 1,000% since the start of 2021.

The biggest risk to the lithium market is not a fall-off in demand, but ambitious plans to bolster supply falling short. Global lithium consumption has doubled over the past two years, and according to a January article, With suppliers unable to keep pace, a blistering price rally sent the total spot value of lithium consumption rocketing to about $35 billion in 2022, up from $3 billion in 2020, according to Bloomberg calculations.

There is growing tension between lithium suppliers, like US-based chemicals giant Albemarle, and electric vehicle makers that buy the material. Current high lithium prices are feeding through to higher battery prices, causing a headache to automakers striving for price parity with traditional gasoline-fueled models.

The “problem” is likely to intensify this year. Albemarle recently said it expects China’s electric-vehicle market to grow 40% in 2023, or at least by 3 million vehicles, boosting lithium demand in the world’s largest automobile market.

Chinese lithium customers are not slowing orders, and the country’s stockpiles of battery parts and cathodes are decreasing.

Helped by high prices, the planet’s largest producer of lithium is making money hand over fist. The company posted a better-than-expected quarterly profit, Wednesday, with a five-fold jump in lithium sales.

Net income was $1.13 billion, or $9.60 per share, compared with a loss of $3.8 million, or 3 cents per share, in the year-ago period.

Reuters said the results came despite a more than 300% increase in the price Albemarle charges its customers for the battery metal, adding that the firm plans on raising its lithium prices this year by at least 55%.

Albemarle has been calling for higher prices to incentivize mining companies to develop new lithium mines.

“(Lithium) pricing needs to remain elevated in order to support the incentives required to take on those investment risks,” Eric Norris, head of Albemarle’s Energy Storage division, said during the company’s 2023 Strategic Update presentation. “The (lithium) market is tighter than it was last year. There’s significant supply coming on, but the demand growth is more significant.”

Supply challenges

Albemarle executives quoted by Reuters warned of the “potential for significant deficits” by the end of the decade without new mines and processing plants.

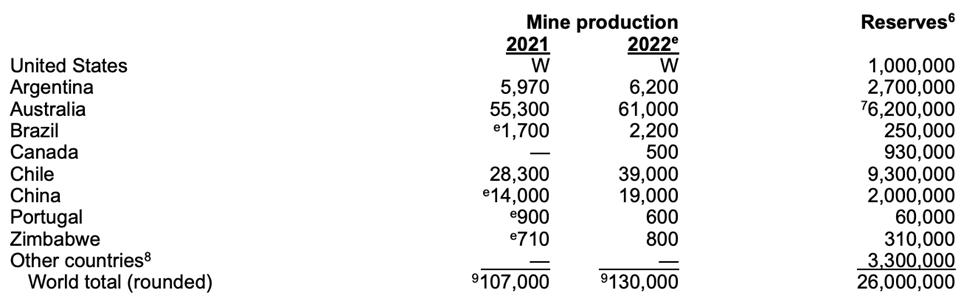

According to the US Geological Survey, six mines in Australia, one mineral tailings operation in Brazil, two brine mines each in Argentina and Chile, and three mineral and two brine operations in China, accounted for the majority of world lithium production in 2022.

While lithium prices have come off the boil compared to the record 600,000 yuan per tonne (USD$87,365) high set in November, the bull run is likely not over yet, with a deficit forecast for 2023.

New supply is ramping up but experts say it won’t be enough to catch up to demand. According to Fastmarkets, the whole industry has been cutting production since November, a trend that was expected to continue into late January. Several large battery makers will be operating at 30-50% capacity in the weeks ahead, the firm reported on Jan. 23.

Fastmarkets previously forecast a small surplus in 2023 but this has been revised to a deficit because of increased battery demand and some expected supply disruptions. The introduction, in the United States, of the Investment Reduction Act, has resulted in Fastmarkets upgrading its forecast for battery electric vehicle (BEV) sales by 80% in 2023 and 107% in 2024.

Mine supply could increase by 35%, year on year, to 984,000 tonnes, mostly fueled by Australia and China, but Fastmarkets is predicting a 2023 deficit of about 14,000 tonnes lithium carbonate equivalent (LCE).

Reuters metals columnist Andy Home agrees that The world has been running short of lithium, with a surge of new supply failing to catch up with a still faster demand wave as the electric vehicle revolution accelerates.

He notes that lithium demand in EV batteries has been given an extra boost by high prices for nickel and cobalt, which has caused many Asian EV manufacturers to switch to lower-cost, but more metals-intensive lithium-iron-phosphate chemistry.

Also, EV sales in China have been driven by government subsidies, which ended on Jan. 1, 2023, but the deadline brought forward future demand.

Homes points out that one of the problems regarding the supply of lithium, and any industrial mineral, is that greenfield projects are prone to missing time-lines. In lithium’s case this is accentuated by the need to certify chemical purity with customers.

Brownfields to greenfields

Despite this fact, analysts at Stifel GMP, via Proactive Investors, say this year could mark a shift from majority brownfield expansionary projects to riskier greenfield sources — the term brownfield referring to lithium production on top of existing infrastructure, whereas greenfield projects require new infrastructure to be built.

“The majority of the supply response from the global lithium market over the last seven years has been dominated by six brownfield asset expansions, while average global grades have dropped 29%,” the analysts said. “We expect supply growth in 2024-2025 to come from a more balanced 48%/52% of brownfield expansions/greenfield builds, as opposed to 85% of supply in 2022 coming from brownfield expansions.”

Stifel also argues that “lithium majors are cashed up and likely on the hunt for resource growth to protect incumbent market share,” creating a boon for companies developing lithium projects:

“North American lithium developers could prove to be an attractive destination for this dry powder as producers look to grow production and maintain market share within proximity to the West’s largest auto market and increasingly protectionist onshoring policies, all the while benefiting from low carbon electricity and a talented labor pool,” Stifel said, adding that,

“We now forecast LCE demand of 819 kilotonnes in 2023, increasing to 1.5 metric million tonnes/2.7MMt in 2026/2030 respectively, implying a 20% CAGR.”

Another problem with lithium supply, is that much of the supply growth comes from China’s lepidolite deposits. According to BMI, the resources at Jiangxi, the hub of China’s emerging lepidolite mining sector, “are lower grade than Australian spodumene and result in more carbon emissions and waste production.” One Chinese company was forced to suspend production last year after government testing of the Jinjiang River found it to be polluted.

North American opportunity

Supply problems in China present an opening for Canada and the United States to become leaders in the global battery metals supply chain.

The US mines and processes only 1% of the world’s lithium, according to the US Geological Survey. There is just one lithium mine in operation, Albemarle’s Silver Peak, which extracts lithium from brine outside of Tonopah, Nevada, outputting a paltry 5,000 tonnes of lithium carbonate a year.

However, we cannot rule out the United States as a major lithium producer; within its borders are 1 million tons of lithium reserves, ranking it among the top five countries in the world, according to the USGS. In the less certain resources category, the US has 12 million tons, including continental, geothermal and oilfield brines, claystones and pegmatites.

Canada doesn’t currently produce lithium, but hosts about 2.5% of the world’s lithium deposits. According to Natural Resources Canada, the country has an estimated 2.9 million tonnes of lithium resources, in the measured and indicated category. In a writeup on lithium, NrCan also notes the following, about two Canadian lithium operations:

- The North American Lithium mine in Québec, formerly the Québec Lithium mine, reached commercial production in early 2018 and shipped spodumene concentrate to refineries in China for processing into lithium carbonate. Prices of lithium products and spodumene concentrate fell sharply later that year when global spodumene capacity nearly doubled, primarily in Australia. North American Lithium suspended production in 2019, sought bankruptcy protection, and was acquired by Sayona Québec in 2021, a joint venture between Sayona Mining (Australia) and Piedmont Lithium (U.S.). The new owners plan to restart the North American Lithium mine, develop other mining projects in Quebec, and build a lithium hydroxide refinery.

- After several years of exploration and construction, Nemaska Lithium produced its first spodumene concentrate at the Whabouchi Mine in Quebec in early 2017. The company suspended production in 2019, and the mine was put on care and maintenance. After seeking bankruptcy protection, Nemaska was acquired by the Pallinghurst Group in partnership with the Government of Quebec and emerged from creditor protection in 2020. The company plans to restart the mine and build a lithium hydroxide refinery in Bécancour, Quebec.

Conclusion

There is no doubt in my mind, that nascent battery supply chains in Canada and the United States will continue to grow. It was recently reported that global demand for lithium-ion batteries is expected to grow five-fold by 2030. In the United States, the demand is one magnitude higher, at 6X, and could translate to $55 billion by the end of the decade, Reuters said.

With an abundance of battery metals and cheap hydroelectric power, particularly in Quebec and British Columbia, Canada is uniquely positioned to become an EV leader, from the mining and processing of metal ores, all the way up to the manufacture and assembly of electric and hybrid vehicles.

Canada in, China out: Ottawa looks to localize critical minerals supply

The Liberal government under Prime Minister Justin Trudeau has said it is planning on spending CAD$400 million to build 50,000 electric vehicle charging stations, on top of half a billion Canadian dollars for charging infrastructure through the Canada Investment Bank and $1.7 billion to extend an incentive program for EV purchasers.

According to the president of the Canadian Vehicle Manufacturers Association, Canada will need 4 million charging stations by 2050, 80 times higher than the 50,000 currently targeted.

The large spending package is part of the government’s plan to require that 20% of new light-vehicle sales in Canada be zero-emissions by 2026. After 2026, the government’s mandate will require that at least 60% of sales are zero-emission by 2030 and 100% by 2035. Trudeau’s stated goal is to phase out gasoline-powered cars by 2040.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.