Keeping Chinese parts out of American EV’s – Richard Mills

2023.12.14

In this ‘Under the spotlight’ written interview Rick Mills, editor of the Ahead of the Herd (AOTH) newsletter, talks to an AOTH technician. The topic is the US Government’s new regulations concerning keeping Chinese parts out of their EV’s.

“New guidelines from the US Treasury, Internal Revenue Service and Department of Energy prohibit the use of parts made or assembled by what they call “foreign entities of concern” (FEOC). The term refers to companies based in China, Russia, North Korea or Iran, or with at least 25% voting interest, board membership or ownership by a government of one of those countries.

Beginning in 2025, an eligible clean vehicle may not contain any critical minerals that were extracted, processed, or recycled by a FEOC.

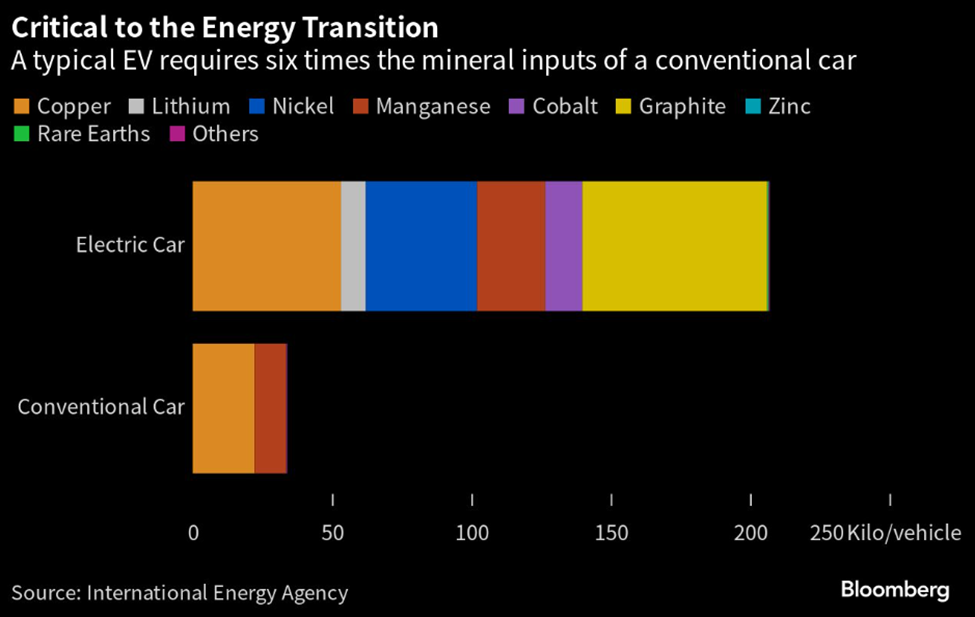

The regulations could reshape automakers’ supply chains. The IEA estimates that two-thirds of global battery cell production is in China, while the United States accounts for approximately just 10%.

China also leads the global processing of minerals needed for EV batteries, such as graphite and rare earths. The country has recently curbed exports of such materials, citing a need to protect national security.” CNN Business

AOTH: The Treasury and the DOE have put out their guidance.

RICK: I’m not surprised that the foreign entities – Russia, PRC, North Korea and Iran are exactly the same group that are already recognized in US federal law as so-called covered nations in DoD, national security and defense legislation space. For a long time now there have been the covered nations and they’re the exact same four as the FEOC nations. The only difference I see is that in the FEOC designation, they say “and such others shall be” so you know there’s a mechanism in place for the US gov’t to put other entities, largely country but who knows what, into that category on a case by case basis.

Below is a snippet from “The Biden Administration Unveils the Long-Waited Guidance on “Foreign Entity of Concern”

“On December 1, the Department of Energy (DOE) and the Department of the Treasury (Treasury) published highly anticipated proposed rules that will significantly impact China’s and other covered nations’ roles in the battery supply chain for electric vehicles (EVs) sold to U.S. consumers.

Pursuant to section 30D, FEOCs must be generally excluded from a vehicle battery’s supply chain in order for the vehicle to be potentially eligible for the (up to $7500) tax credit. Specifically, section 30D(d)(7) excludes from credit eligibility vehicles that are:

- placed in service after December 31, 2024, with respect to which any of the applicable critical minerals contained in the battery of such vehicle . . . were extracted, processed, or recycled by a foreign entity of concern; or

- placed in service after December 31, 2023, with respect to which any of the components contained in the battery of such vehicle . . . were manufactured or assembled by a foreign entity of concern.

Section 30D(d)(7) defines “foreign entity of concern” by cross-reference to Section 40207(a)(5) of the Infrastructure Investment and Jobs Act. Most relevant is clause (C) of that definition, by which an FEOC includes any “foreign entity” that is “owned by, controlled by, or subject to the jurisdiction or direction of a government of a covered nation (as defined in section 2533c(d) of title 10) – currently China, Russia, North Korea, and Iran.

AOTH: I was looking for some clarity, it does not seem to be there, how is a company suppose to deal with China on the issue of using their processing technology so we can have, in the US & Canada, a mine to magnet/ battery chain?

RICK: First of all let’s acknowledge the baseline piece, we don’t know exactly what kind of licensing this would allow from China so it is maybe a little murkier than people would like, but the easy way to deal with that would be to say technology licensing is off the table, no rentals, there can’t be licensing within an FEOC period. Clean up the language.

An agreement has to be in the form of a knowledge transfer right, not a procurement, you cannot buy a solution in a box, a black box that comes over and gets bolted into a processing facility and nobody quite knows how it works and you wouldn’t be allowed legally to open the box to see how it works lest you then recreate it, abrogate the agreement, try to reverse-engineer it somehow.

That’s what’s causing concern amongst anybody dealing with the processing gap that developers in the US would have, that at a minimum would include graphite, would include probably some things around gallium, would include some important pieces around rare earths separation for instance, and I think for me, not surprisingly all of those are areas where the US has 100% dependency and has had 100% dependency for a long long time, right?

Even in the case of rare earths where they’re being dug up, mined by MP, but they’re being sent to Shenghe for separation work, if there was that processing knowledge immediately resident in the United States that wouldn’t be happening, so knowledge transfer is needed in any of those areas.

Take graphite, I would say to people about the graphite space, when you’re out of the graphite space as the US has been since 1991, 30+ years it’s not a case of simply not having the material, we have graphite, we don’t have any of the knowledge base downstream from the material, from the extraction then into the processing and the advanced material production, because there’s been no material to support those parts of the value chain, so that’s not a surprise when you have 100% dependencies I think.

AOTH: You believe knowledge licensing can be done, that as long as we cue towards a true knowledge transfer that it would not be problematic, there will be no equity stake, there will be no board seats related to it, there will be none of that sort of thing, nobody’s procuring a solution in a box and bringing it over.

RICK: Yes, I wrote an article saying we don’t need the material from China, what we need is the processing knowledge to make the refined materials. Than we need to figure out how to manufacture what we need to be independent. We have enough graphite over here, we have enough rare earths, we have enough whatever of whatever we need to mine. Here at AOTH we have been advocating for the creation of a “mine to magnet/ battery” electric vehicle supply chain in North America for years.

The problem we have here is we don’t have the political will, we have NIMBYism, we don’t have refineries, we don’t have smelters, we definitely have the deposits, the biggest problem we have even if we built all this stuff is we don’t have the knowledge, we don’t know how to separate the rare earths, we don’t know how to make a rare earth magnet, we don’t know how to refine graphite, we don’t know how to make battery anodes, we don’t know any of that.

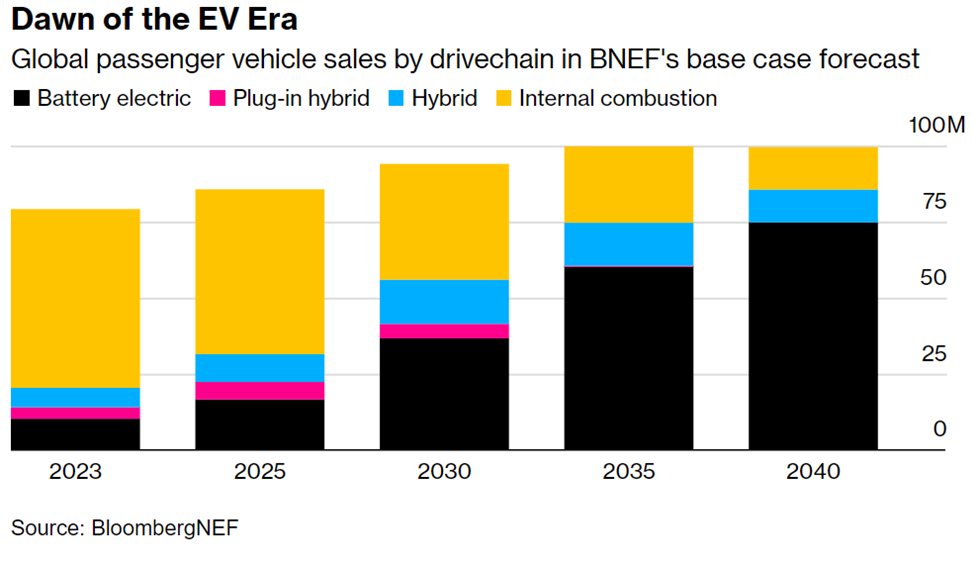

And the stakes are enormous, BloombergNEF forecasts global cumulative value of all forms of EV sales will hit US$8.8 trillion by 2030 and $57 trillion by 2050 in best case scenario.

AOTH: And so far we’ve let all of that go to China. Ok, forget the fact we’ve been snookered. At least we’re finally trying to figure out how to catch up. If you lose, or if you’ve never had, the upstream end of the activity you are going to watch the downstream pieces wither away & disappear.

The most important part, actually ‘the all of it’ is the fact they control the upstream end. Our problem over here is how do we get that knowledge?

RICK: We have to figure it out, we’re not going to disassemble a Chinese facility and move it to the United States, I’m not sure anyone’s thinking about doing that, but we have to figure out how to do the knowledge transfer in the direction of the US, and we have to have federal policy and federal law recognize that.

AOTH: Could we on an indigenous level in the United States, could we remedy that?

RICK: Yes we could, but I’m not sure how long it would take to develop the people with advanced degrees, and then the laboratory programs, the R&D, how long would it take to create that? If it took us 15 years to re-create that even at a sprint, these markets would have been firmed up and the first mover advantage would be strengthened even further for China, it would be hard to understand how the US would be able to get into that space.

The problem has kind of devolved down to the company level which is attempting to take a strategic vision down the whole supply chain and in some respects to remedy deficiencies and reverse conditions that have taken decades to build up. They’re doing that from a single private company perspective and hoping that the US gov’t puts a policy framework in place that encourages that.

I’m not criticizing what I see in the newest rules, because it does have the space in there for licensing by not directly ruling it out, but it lacks the granular clarity that knowledge transfer is acceptable. It’s a “thou shalt not” thing, not a ‘you can thing’. Thou shalt not have equity ownership in the FEOCs, thou shalt not have board seats going to the FEOCs etc. So what can companies do and will it pass muster isn’t provided, but the US door is, imo, open a crack.

AOTH: What about the Canadian side, do Canadian listed companies have any problems with the regulators on the Canadian side, or the Canadian fed, being a listed Canadian company?

RICK: Since national security of both countries is directly related to security of supply of these critical minerals I would say there aren’t issues. The extent to which they’re national security-related, from the point of view of the US facing Canada gov’t to gov’t, the US by law has for 30+ years recognized that Canada and Canadian industrial activities including mining-related ones, are part of the US defense industrial base. So literally it is the 50 states, territories and 10 provinces of Canada as one on security issues.

“The remarks to high-level government officials, executives and academics came Thursday in Paris at the International Energy Agency’s first-ever meeting about critical minerals. Granholm and other speakers repeatedly implied that one country — China — controls much of the world’s processing of materials used in everything from electric vehicles and wind turbines to missile guidance systems.

In this critical minerals and materials context we are up against a dominant supplier that is willing to weaponize market power for political gain.” Mining.com

From the Canadian position with the US, I don’t know if there’s an exact cognate on the Canadian legislative side, but there are no two countries in the world that are more closely connected on the national security side than the US and Canada. I don’t know if that means that the US gov’t don’t have any issues with it, Canadians don’t have any issues with it, I don’t know if I’d go that far, but the fact that there might be some coordination not only wouldn’t surprise me, but would seem to me on the national security side of things you would expect that to take place.

AOTH: Between Canadian feds and China there’s nothing there that they would bring up? There’s a lot of antagonism between China and Canada, has been for a couple years, is there anything that the Canadian government have or is in place or are they saying anything about China?

Rick: I think there’s been a fair amount of antagonism. What I’m saying is would it get fine-grained enough that the Canadian government would say, well the US gov’t might allow knowledge transfer agreements with China but we won’t and we will try to step in front on that because companies are TSX-listed or domiciled in Canada.

I don’t know that I’d see that taking place and I mean it’s just occurring to me again that there are clearly, if you look at what Secretary Raimondo did about chips and chip materials going into China, a surprisingly hawkish stance I’m just kinda processing what she said myself, it’s in the media this morning, you know there’s a pretty strong appetite, it’s one of the few bipartisan areas on the US side, where you can hardly be too tough on China these days, there’s a strong trend in that direction in Canada as well, but so far I don’t see it being so uniform that it would obscure the reality of the fact that you know having lost multiple links in the supply chains that there needs to be room for attempts to secure the knowledge transfers necessary to compete with China.

AOTH: So if you were a theoretical company and you were looking for knowledge transference or intellectual sharing and you saw this news, you would be encouraged?

RICK: I’m going to read something…

“Effective control is interpreted to mean an FEOC using technology licensing or contractual offtake terms to control an entity’s production and processing. A licensing agreement that is a true knowledge transfer arrangement may pass muster as control post-transfer would be attenuated.”

So that’s basically in a nutshell what we’ve been talking about, if the licensing agreement is a true knowledge transfer, it may pass muster so if you were a company that was looking to do this and you saw something like that, you would be encouraged to the point of continuing.

The transfer licensing agreement is kind of a generic term and like I say it could be everything from hey, send me the magic box and I’ll bolt it in, and if I need to repair the magic box send me the spare parts to keep the box whirring, all the way to a knowledge transfer right, and so it’s a reminder to me to be very clear we talk in terms of knowledge transfer and we really need to be extremely disciplined on that because just talking about the licensing agreement is just too broad.

It’s incumbent on us to speak clearly about it’s a knowledge transfer that we’re seeking.

A licensing agreement that is a true knowledge transfer arrangement may pass muster as control post-transfer would be attenuated.”

It’s to bring back and make resident manufacturing knowledge in the United States and that’s very important, it’s not building a facility in China, it’s not building a facility in the US with foreigners running it, its building a facility in the US with Americans running it, it is bringing the requisite knowledge back in order to move the process forward in a US controlled setting.

Because Canada’s in play it could be a Canada-US setting. It could be facilities that include Canada literally on Canadian territory because of the special relationship that the two countries have.

AOTH: Explain knowledge transfer a little bit more, like how do you transfer that knowledge?

RICK: Well it gets pretty fine grained, and again I’d be careful here but it would be the work going on in the US, there would have to be care taken about diagnostics that would flow back to China. Let’s say that individuals came over, to advise, to consult, sometimes watch the technical crews in the US with Americans working, putting them in place, then there might be a shakeout period where the line and circuit is tested and so on.

Obviously you want people to be able to see the data from that and assess it and see if they have to recalibrate it in any way, there are so many points along the line you need to be careful about, how that flows back right? And so there is some sort of relationship that would have to take place over a certain period of time, but I think it’s along the lines of what we’ve discussed.

AOTH: A single phrase, “consulting services” is a good indicator, that touches close to what we mean when we use the phrase knowledge transfer.

RICK: Well that’s kind of intentional because we don’t want people to bring to it assumptions that they would have around licensing you know a solution in a box. Not to disparage that, but there’s a big category of licensing that would be just that, right? You get a special thing, it becomes part of your process and the licensing is such that you don’t get to know how that thing was put together or how it works you just get to have it on some sort of special basis, and it’s integral to your production but you’d have to say that’s a little unsettling over time because we really don’t know how it does what it does, that’s not what we’re after here.

AOTH: No, you’re after full cooperation to design, build and operate a manufacturing facility that is a ‘Chinese leave’, they don’t have a board seat, they don’t have any equity in the company, it’s been a knowledge transfer, I’m sure they’re gonna share in profits but they’re not involved anymore beyond consultation, right?

RICK: Correct, are they going share monetarily? They are, you have to have that consideration in any contract, so of course the consideration on their side is going be monetary, but it isn’t going to give them rights in terms of where the material is going to be sold, it doesn’t carry offtakes with it, it isn’t going to be carrying equity, board seats, anything that would involve them in the business and strategic positions of the company, no. We understand that that would fall outside of what the government has kind of put out now in terms of the guidance.

AOTH: What about Ford and CATL, they thought they had a done deal, some people in Congress don’t like it and we still don’t know if it’s going to be a go.

RICK: I don’t know and that’s not a dodge on my part, it’s kind of understandable that we wouldn’t know. Other than being inside Ford, or really being tied in somehow, to understand what the contours of the deal would be or even if it’s not fully fledged could they now lean it in a direction that is more towards a knowledge transfer and away from you know the forms that would be blocked by this, perhaps maybe redesign if they can at this point.

AOTH: Working with Chinese companies may be uncomfortable to some, but the way I see it, we can’t cut China out completely.

RICK: China has spent the last 20 years building their EV supply chain and the technology to support it. The world’s greatest R&D country in the world has been sidelined by China in the technology of mineral processing. It’s high time we acknowledged this fact and did something about it.

The answer is not to close the door on China but to work with them on the mineral processing side. Not the mining — as I’ve stressed, we or our allies have the minerals, all we need to do is have the government make mining them a priority.

Processing them is different. For two decades we were asleep at the switch. We didn’t notice when the United States ceded its permanent magnet technology to the Chinese, we could care less when China gobbled up cobalt mines in the DRC and created a monopoly on processing the rare mineral. Ditto for lithium, graphite, rare earths, copper, steel the list goes on. To do what we need to do starting from the ground level seems impossible in the time we have left before we are completely under the thumb of China concerning our clean energy goals and infrastructure plans.

AOTH: Thank you Rick.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.