K9 Gold identifies more high-priority targets at Stony Lake

2021.01.27

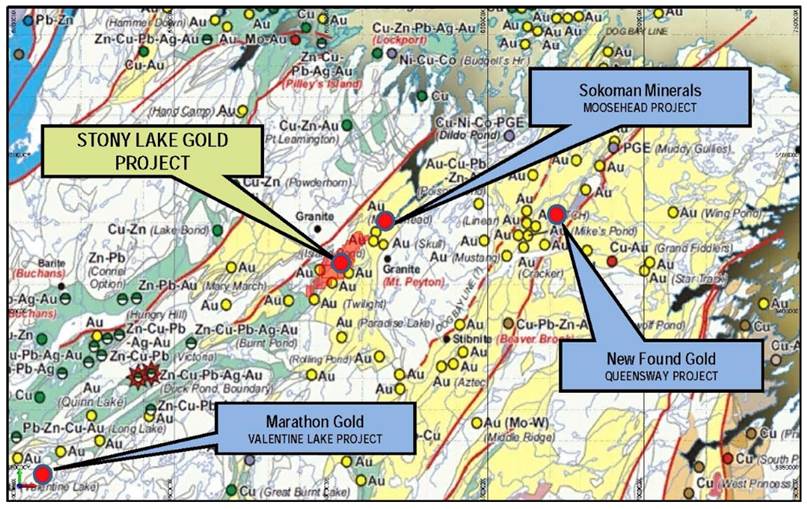

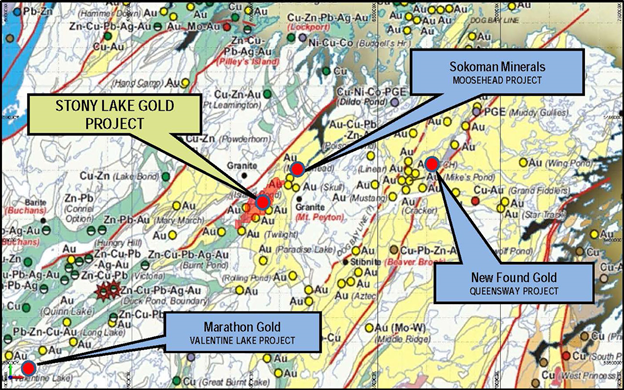

Since the new year, there have been plenty of movements in the exploration front in what is considered Canada’s biggest gold mining hotbed – Central Newfoundland.

Marathon Gold, whose Valentine project is the furthest along the development curve in the area, recently released a fresh set of drill results, highlighted by 4.67 g/t Au over 34m, 5.91 g/t Au over 11m, 3.51 g/t Au over 13m, 2.53 g/t Au over 16m and 35.88 g/t Au over 2m.

In the same week, New Found Gold also reported a new high-grade discovery at its Queensway project located 15 km west of Gander. An interval was drilled in or immediately adjacent to the main Appleton Fault structure for the first time, returning 6.5m at 18.1g/t Au including 2.95m at 38.7g/t Au. This discovery follows up on the two shallow high-grade intervals of 22.5 g/t Au over 10.4 m and 31.4 g/t Au over 15.9 m drilled within the Keats zone, where New Found Gold made a blockbuster discovery in late 2019.

Others in the region have also stepped up their activities. Sokoman Minerals have resumed drilling at the Moosehead property, with 20,000 m of drilling planned for the first half of the year.

Stony Lake VTEM Results

Meanwhile, K9 Gold Corp. (TSXV: KNC) (FSE: 5GP) (OTC Pink: WDFCF) is gearing up for further field work at the Stony Lake project while awaiting results from the 2020 exploration program, which includes a series of several airborne surveys, till sampling, as well as field mapping and sampling.

The Stony Lake property covers 13,625 ha and 27 km of favourable trend between Sokoman’s Moosehead discovery and Marathon’s Valentine Lake deposit (see map below).It also lies parallel to New Found Gold’s Queensway project along the prolific Dog Bay Line, where multiple high-grade intercepts have been drilled over the past year.

Earlier this month, the junior miner received interpretation of data from the airborne geophysical survey carried out last year on the Stony Lake property. This VTEM (Versatile Time Domain Electromagnetic) survey was designed to outline linear trends that demonstrate changes in resistivity due to faulting, alteration, sulphide mineralization and intrusive activity, which would in turn allow the company to define high-priority exploration targets in the basement below the Botwood Group.

This objective has been met, and a number of linear trends have been successfully identified.

Specifically, data interpretation shows two highly significant areas of interest that are coincident with various anomalies from earlier work. The two areas are known as Jumper’s Pond and Island Pond.

Additionally, there are numerous indications of potential narrow vertical conductive zones in the basement rocks beneath the Botwood sediments. This new information will be used to refine plans for the upcoming 2021 field season, which will include drilling.

New Targets Identified

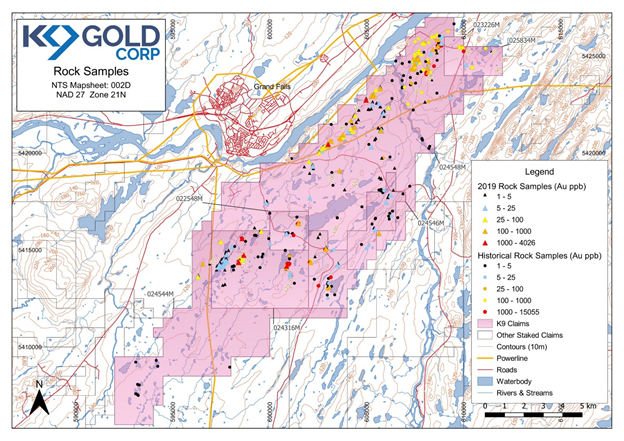

During an extensive field program completed in 2019, airborne geophysical coverage, followed by ground prospecting and sampling, had identified eight areas of highly anomalous to high-grade gold mineralization targets (15.05 g/t) at Stony Lake. Mineralization is found both within the Botwood Formation and in the basement rocks below.

According to K9 Gold, it is apparent that the resistivity low (or conductivity high) zones outlined by the VTEM survey can be mapped at all depths (to at least 600 m below surface), with locally stacked anomalies that correlate well with interpretations from the 2019 airborne magnetic survey. These stacked anomalies also correlate well with areas of known gold anomalies in lake sediments, till samples, rock samples from outcrop and boulders, and thus are high-priority exploration targets for the company.

Commenting on the company’s improved understanding of the project’s geological setting, K9 Gold CEO Jeff Poloni stated:

“With the VTEM and Mag surveys we continue to define both lithological trends and structure.The importance of these structures cannot be overstated as they are the conduits for auriferous fluids.”

Jumper’s Pond

In the Jumper’s Pond area, which is contiguous to Sokoman’s Moosehead property, there is a highly conductive zone that is interpreted to be in the basement rocks, beneath the Botwood sediments, at a depth of approximately 200 m below surface. Interpretation of the 2019 survey indicates that this structural zone extends from the Moosehead discovery through the northern property boundary and for approximately 1 km to the south.

Exploration work carried out by Cornerstone Resources in this area in 2001-2002 identified various areas of interest in the same zone. That work found numerous northwest trends interpreted to represent cross faulting. Work on adjacent properties has shown these cross-cutting structural trends as highly significant in the localization of gold mineralization.

Eight diamond drill holes were completed by Cornerstone in 2002, four of which intersected multistage quartz veining and brecciation with associated sulphide and sulphosalt mineralization hosted by late, northwest-trending structures.

Island Pond

At Island Pond, there is a large (3,000 by 5,00 m) relatively shallow conductive zone, possibly within the Botwood sediments, with indications of several deeper vertical conductive structures directly beneath.

Historical work in this area resulted in numerous overburden gold-bearing till anomalies with coincident highly anomalous lake sediment samples, as well as a cluster of mineralized boulders. This area also correlates with quartz-feldspar intrusive activity.

Prospecting over this area was carried out in the fall of 2020, for which analytical results are pending.

Stony Lake Gold Mineralization

At Stony Lake, large areas of significant gold mineralization occur primarily in altered Botwood sediments and quartz-feldspar porphyry intrusives associated with intense silicification, sericite-chlorite-carbonate alteration and a strong pyrite-arsenopyrite mineralogical association. These features indicate epizonal/mesozonal temperatures for the hydrothermal fluids and support the exploration model of hydrothermal fluids leaking upwards into the Botwood sediments from a deeper igneous intrusive source.

This area is now referred to as the Exploits Subzone gold district, which essentially covers the Silurian-age clastic sediments surrounding the Mount Peyton intrusive.

Current exploration is focused on the eight areas of gold mineralization identified in 2019. These are hosted in a variety of environments, including quartz-feldspar porphyries, reduced sandstones, quartz stockworks and quartz veins.

The property hosts both widespread low-grade mineralization (up to 4.0 g/t Au) within the Botwood Formation and high-grade veins (>4.0 g/t Au) in the basement rocks below the Botwood, similar to the nearby Queensway project, and the immediately adjacent Moosehead discovery.

Ongoing interpretive work on the Stony Lake property has yielded several direct comparisons with the Moosehead discovery, immediately to the northeast of Stony Lake’s Jumper’s Pond area.

As mentioned, both recent (2019) and historic (2001) geophysical work on the Jumper’s Pond area strongly suggests the presence of a large fold structure that plunges to the NE towards Moosehead, as well as several NW-trending structural features.

Emerging Gold District

Due to its favourable geology characterized by the presence of numerous deep crustal breaks, the Central Newfoundland Gold Belt has emerged as one of the world’s best gold mining districts.

Marathon Gold’s success since acquiring the Valentine project more than 10 years ago has demonstrated that Newfoundland – and the Maritimes in general – undoubtedly has the potential to host large-scale gold deposits. The high-grade discoveries and promising drill results from others actively exploring the region – such as New Found Gold and Sokoman Minerals – have more than validated this claim.

Not only has Central Newfoundland become an attractive destination for up-and-coming gold miners, investor interest in the area too has grown. Among those bullish on Newfoundland’s gold is Palisades Goldcorp, Canada’s largest resource-focused merchant bank, which mainly invests in junior miners with high growth prospects.

Over the past year, Palisades has made a series of investments in miners focused on Newfoundland, adding to a portfolio that already includes projects in Nevada. The bank is led by the same executive who founded New Found Gold and successfully took the company public in summer 2020.

Recently, K9 Gold received further backing from the bank, which, along with Sprott Asset Management LLP, has helped the company raise gross proceeds of $2.6 million to fund exploration at the Stony Lake project.

Conclusion

With the remaining results from its 2020 field work set to come in and exploration funding secured, K9 Gold is getting closer to what it calls an “aggressive exploration program” in 2021.

A permit has been received for the first phase of trenching, and permit applications for the rest of the work are being drafted. Following the well-documented successful techniques used on nearby properties, the program will include extensive trenching and till sampling, as well as IP-Resistivity surveying.

All of these will lead to a drill program at Stony Lake starting as early as Q1 2021.

k9 Gold Corp.

TSX.V:KNC, FSE:5GP, OTC:WDFCF

Cdn$0.33, 2020.01.27

Shares Outstanding 32.1m

Market cap Cdn$10.5m

K9 website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security.

AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard does not own shares of K9 Gold Corp. (TSX.V:KNC). KNC is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.