Inflation, real interest rates revisited

2021.04.14

Gold prices ticked higher on Tuesday after inflation data showed US consumer prices rose in March for the fourth straight month and inflation hit its highest level in 2.5 years.

Gold for June delivery climbed $8.50, or half a percent, to $1,741.20 an ounce, and spot gold at time of writing was trading at an even $1,745/oz, reversing a year-to-date downward trend. Since January, the yellow metal has fallen 8.7% due to a combination of factors including a stronger US dollar, higher US treasury yields and better macroeconomic data, as covid-19 inoculation programs gather pace.

However, the blistering speed of economic recovery in the US — economists are predicting annual GDP growth of 6.5%, versus a 2020 contraction of 3.5% — is stoking fears of inflation.

Unwilling to see their gains eroded in the near future by a loss of purchasing power (inflation increases the prices of goods and services over time, effectively decreasing the amount you can buy with a dollar in future), investors are dumping bonds and piling into riskier asset classes like stocks, causing bond prices to fall and yields to climb. The interest rate on the benchmark 10-year Treasury has been steadily increasing and now sits at 1.69%, after bumping along at between 0.5% and 1% for most of 2020 as investors rotated funds into Treasuries (and gold) as protection against pandemic-related market turbulence.

Consumer prices rise

The US Federal Reserve, whose dual mandate is to keep inflation in the “Goldilocks zone” of around 2% and to control unemployment, has been downplaying inflation, telling the public that even if prices rise, it will only be temporary.

In a recent interview with ’60 Minutes’, Fed Chair Jerome Powell said the Fed won’t raise interest rates based on short-term jumps in inflation readings.

However there is reason for concern that in fact, inflation is rising faster than expected and that could present a real dilemma for the Fed: allow prices of goods and services to rise, beyond what is comfortable for the middle and lower classes who typically bear the brunt of inflation; or hike interest rates during an economic recovery that is by no means on a strong footing — with unemployment continuing to be higher than before the pandemic (9.7 million in March 2021 compared to 5.7 million in February 2020) despite resumption of economic activity, and covid-19 still raging throughout the land.

Consider: the consumer price index (CPI) jumped 0.6% in March, led by higher oil prices, and the 12-month rate of inflation rose to 2.6% in March from 1.7% in February, as the bar graph below shows.

The rise in CPI is even more startling considering that 12 months ago inflation was close to 0%. The year over year gain is the highest since August 2018, and the month over month increase is the most since June 2009.

Michael Pearce, senior US economist at Capital Economics, said via CNBC, the US Labor Department report “is the clearest indication so far that the signs of mounting inflation evident in business surveys and producer prices are feeding through to stronger consumer prices.”

Gasoline prices surged 9.1% in March, up 22.5% from a year ago; they contributed the most to the monthly gain and were responsible for about half of the overall CPI increase, states CNBC.

Other energy indices crept up, including natural gas, which increased 9.8% over the past 12 months, fuel oil @ +20.2% and electricity @ +2.5%.

Food and take-away meals also nudged higher for the year, at a respective 3.5% and 6.7% — the latter claiming the biggest increase since 1997. Out of all food categories, the prices of meats, poultry, fish and eggs increased most, at 5.4%.

Core CPI, which excludes volatile food and energy costs, increased 0.3% monthly and 1.6% year over year.

A Wall Street Journal survey of economists and business leaders found that US GDP this year should grow at 6.4%, the highest since 1983, but that inflation is expected to hit 3% by June. That would mean a near doubling of inflation in just two months.

If US inflation keeps rising, but interest rates stay more or less the same (they can even rise a little), we will have negative real interest rates — the perfect condition for gold buying. In fact, the real yield on the US 10-year Treasury has already gone negative; it offers 1.69% and the current rate of inflation is 2.6%, making the real yield -0.91%.

(When real interest rates (interest rate minus inflation) are low, at, or below zero, cash and bonds fall out of favor because the real return is lower than inflation. If you are earning 1.6% on your money from a government bond, but inflation is running at 2.7%, the real rate you are earning is negative 1.1% — an investor is actually losing purchasing power. Gold is the most proven investment to offer a return greater than inflation, by its rising price, or at least not a loss of purchasing power.)

China

Zooming out from the United States, to China, the world’s second largest economy is also moving at a steady clip after pretty much nipping covid-19 in the bud.

Like in the US, though, this is proving inflationary.

Chinese exports rose sharply in March and imports grew to the most in four years, suggesting improved global demand amid worldwide vaccination programs.

Bloomberg reports that after months of deflation (falling prices) China’s producer price index (PPI) rose 4.4% in March, the most since July 2018, as the cost of oil, copper and agricultural goods rallies. As the world’s biggest exporter, China’s rising prices threaten to stoke inflation around the world.

Moreover, research quoted by Bloomberg finds that China’s PPI has a strong correlation with CPI in the US.

“The higher-than-expected PPI data could impact people’s judgment of inflation pressure in the U.S. and globally, and this impact shouldn’t be underestimated,” says Raymond Yeung, chief economist for Greater China at Australia and New Zealand Banking Group Ltd.

Manufacturing is expected to drive China’s economic growth going forward, with PPI increases possibly reach more than 7% in the next two to three months, according to a senior emerging markets economist at Commerzbank AG in Singapore.

Inflation understated

Inflation numbers are often trotted out by economists and the financial media but what do they really mean?

A recent study by the Harvard Business School and Bloomberg Economics, warns of the difference between real inflation suffered by consumers, especially the poorest, and official CPI statistics.

Economist and fund manager Daniel Lacalle points out that in Europe, the official calculation of CPI and the basket of goods used, fail to reflect the real increase in the cost of living:

According to Eurostat, the average house price and rent index has risen significantly above headline CPI, real wages, and real disposable income…

High inflation can furthermore be witnessed when it comes to the cost of education and healthcare. The prices of this have all increased more than the official CPI. The same is true for fresh food.

The same thing is happening in the US, where a Bloomberg Economics study showed that the expansionary monetary policy of the US central bank, which like the European Central Bank, hiked the prices of “non-replicable” (day to day) goods and services, amounted in many cases to two to three times the official inflation rate.

According to Lacalle, prices are rising not due to any external factors, but because of currency debasement which erodes purchasing power, as explained above.

Why should anybody care? Because rising prices of essential goods can lead to social unrest — think of the “yellow jacket” protests in the Eurozone against the increased cost of living, or the bread riots in Egypt during the Arab Spring.

Lacalle says the biggest risk is that inflation overshoots estimates, while central banks are unable to stop their current money-printing policies (quantitative easing), because only a few percentage points yield increase would cause a massive debt crisis for insolvent governments…

To conclude: the ECB and central banks should stop ignoring the effect fiat currency debasement has on the cost-of-living, because if current policies continue, things will only get worse, which may lead to significant social unrest and discontent.

Loss of purchasing power

We know from a previous article that the purchasing power of most Americans earning wages or collecting a salary, has stagnated over the past four decades.

This is all down to inflation and the inability of fiat currencies to protect against it.

US wages have failed to keep up with the price of goods, ie., the rate of inflation. The wage and salary earner is literally getting screwed every day because the value of the dollar is being devalued by a fractionally small amount. Over time, however, the diminished value is huge.

Consider: In the US there was an increase in inflation for every decade except the Depression when prices shrunk nearly 20%. The Bureau of Labor Statistics’ Consumer Price Index indicates that between 1860 and 2015, the dollar experienced 2.6% inflation every year, meaning that $1 in 1860 was equivalent to $27.80 in 2015. The dollar has lost 90% of its purchasing power since 1950.

A comparison between using gold versus dollars to buy a basket of breakfast groceries — milk, eggs, bread and bacon, and the gas to go get them — is illustrative.

1970

Milk: $1.32 per gallon

Eggs: 60¢ per dozen

Bread: 70¢

Bacon: 85¢ – 95¢ per pound

Gasoline: 36¢ a gallon

February 2021

Milk: $3.36 per gallon

Eggs: $1.59 per dozen

Bread: $1.32

Bacon: $5.77 per pound

Gasoline: $2.55 a gallon

Selling an ounce of gold in 2021 would give you about $1,750 — a 50X increase over the $35/oz gold in 1970. Obviously $1,750 buys a hell of a lot more breakfast groceries than $35 — you could probably feed an entire football team, including coaches and trainers, with everybody coming up for seconds.

The point is a grocery shopper using gold as a currency rather than dollars in 2021 would see a 50-fold increase in their purchasing power.

The shopper using dollars by contrast loses about 40% of their purchasing power because the prices of their grocery items have at least doubled or in the case of bacon quintupled. The 35 dollars can feed 40% less people than in 1970. If they had kept that same ounce of gold and cashed it in 51 years later, they could feed 50 times as many people.

Which has been the better store of value, dollars, or gold? Obviously, it is gold — the only true safe haven that protects the holder against rampant inflation caused by money-printing.

Conclusion

The actual inflation rate is well beyond the Fed’s 2% target, and we’re not talking about core inflation which strips out food and energy “because they’re too volatile” which is ridiculous.

Anyone who buys groceries and gas is seeing their purchasing power eroded on a daily basis due to inflation, and this inflation is usually not counted in official government statistics.

The US inflation rate has already doubled within a matter of months and is likely heading to 3% by June. In China a strong economy coming out of the pandemic has already pushed its producer price index up the highest in three years. Rising prices in the world’s biggest exporter threaten to stoke inflation around the world.

There is a strong correlation between China’s PPI and the US CPI.

Inflation may not seem like such a big deal now, but once it gets into a demand-fueled, supply-constrained economy (like currently), it can be tough to tame.

The last big bout of inflation the US experienced was in the 1970s. During the first quarter of 1973, consumer prices skyrocketed by nearly 30%, farm prices climbed 52% (red meat prices shot up 90%) and the cost of home heating nearly doubled.

Recent talk of a new commodities super-cycle is reminiscent of 1973, when demand outstripped supply, sending the prices of foodstuffs, minerals and petroleum to the moon. By the summer of 1973, the inflation rate had reached 11%.

And there is another eery parallel investors should pay attention to. In ’73, recalls the Wall Street Journal, the U.S. was coming off a two-year experiment in wage and price controls, which artificially depressed prices and muted signals that the economy was overheating. Then, too, the Fed pursued an easy-money policy, keeping interest rates low…

In 2021 we’re emerging from the pandemic shutdown, which cratered growth and slammed the economy—depressing price pressures, not unlike what the price-control program did 50 years ago. Today’s Fed policies are even more expansive. And Congress has just enacted a $1.9 trillion stimulus bill—on top of earlier relief bills costing another nearly $2 trillion, a lot of which remains unspent and will continue to fuel demand this year and beyond.

In 1980 the Fed under Paul Volker, desperate to do something about the crushing inflation burden, suddenly raised interest rates to nearly 20%. The rise in prices was halted, but at the cost of a serious recession.

The current Fed says it has no plans to raise interest rates, but if inflation moves beyond 3%, maybe its 4% or 5%, will Jerome Powell remember the lessons of history and not do what the Fed did in 1980? ie. lift rates too fast and cause a recession?

There are disturbing signs a trap is being set, that the Fed could easily fall into. Again quoting form the Journal:

Does that mean that we’re doomed to repeat the earlier disaster? Today’s fiscal stimulus clearly dwarfs anything even considered in the 1970s. Moreover, there is a palpable excitement that Americans will finally be able to discard the shackles of Covid and spend the money they saved last year and the wages they’re starting to earn again. So demand is likely to soar.

As was the case 50 years ago, there are constraints on supplies: shipping delays are blocking deliveries; manufacturers can’t get parts to ramp up production; real-estate values are skyrocketing, while lumber shortages constrain home building; and most commodity prices are rising precipitously. Experts reassure us that the annual inflation rate will rise only to about 2%. We hope they’re right, but when demand increases faster than supply, prices tend to go up.

Regarding interest rate hikes — the common cure for inflation — one difference between now and then, is that the Fed is constrained by a runaway national debt, currently sitting at a mind-boggling $28 trillion.

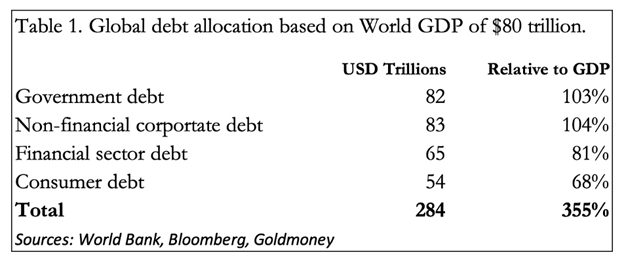

(other countries are just as guilty of piling up debt and kicking the can down the road as far as getting a handle on it. Its estimated the global debt is the equivalent of $284 trillion, representing 355% of global GDP. Simply put, that means $3.55 of debt is required for every dollar of GDP output.

The US government only brings in $3.5 trillion a year yet it must pay interest on the $28 trillion debt and pay bondholders their interest when the bonds reach maturity. We know the debt is going to increase this year and likely for the next three. It is obvious to anyone looking at this that the government cannot afford this debt, nor does it have any intention of paying it back.

The only reason the government can get away with it, whereas a business or private citizen could not, is because it owns a money printing press and controls interest rates.

The more money they print, the less the average American (or Canadian, it is the same in Canada) can buy.

Wages cannot keep up with how fast the federal government has, through excessively adding to the money supply (with newly printed money) or borrowing it to pay for spending programs, been devaluing the dollar.

Sooner or later people must realize that with all the money-printing that goes along with the tax and spend Biden administration, combined with runaway growth due to economies coming out of the pandemic, we are going to be struck by a major bout of inflation.

Over time, as we showed in the ‘One Dollar’ chart above, inflation erodes the purchasing power of fiat currencies and eventually they become worthless.

Will it become like the ‘70s? Hopefully not, but who knows? How can you protect yourself just in case? If you’re parking your money in any fiat currency, know that eventually the value of your investment will decline, through continued money-printing by politicians that must spend (and print) to survive, whether it’s spending on wars, pork-barrel politics, covid-19 relief programs or multi-trillion-dollar infrastructure buildouts.

A dollar today is worth 99 cents tomorrow and 98 cents the day after; history proves it. That’s what happens when you save in paper money not backed by gold.

Since 1972 gold has gone from $35 to $1,750. That’s the power of precious metals. Which is why I refuse to deposit cash into a money-losing savings account. In my opinion the coming inflation and soaring global debt levels all but guarantee another gold run is on its way.

Quality junior resource stocks have historically offered excellent leverage to rising precious metals prices. I believe they will do so this time as well.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.