Impressive exploration upside with Palladium One

2019.08.16

Palladium One Mining (TSX-V:PDM, FRA:7N11) is exploring for platinum group elements (PGEs) at its LK Project in north-central Finland, and for nickel, copper and PGEs at its Tyko property near Marathon, Ontario.

The company is focused on its LK Project in Finland, where surface chip samples tested recently from Haukiaho and Murtolampi, two of the LK Project’s target areas, show promising PGE mineralization.

On Monday PDM updated investors on 2019 exploration work so far at LK.

“We are very encouraged by the reconnaissance sampling that identified PGE mineralization ~2 km east of the historic Haukiaho deposit which supports our conviction that Haukiaho not only extends to the west, but also significantly to the east, making it highly prospective for the definition of a significant open pit resource,” said Derrick Weyrauch, Palladium One’s interim president and CEO, in the Aug. 12 news release.

He added: “Murtolampi is a high priority target for the Company and we are extremely pleased with the excellent reconnaissance sample which yielded 0.78% Cu, 0.13% Ni and 3.106 g/t PGE.”

For AOTH subscribers, the important take-away from this news release, and really the entire story of Palladium One, is the tremendous exploration potential of the LK Project, which is predominantly a palladium play, and the earlier-stage Tyko nickel sulphide-centric property.

LK Project

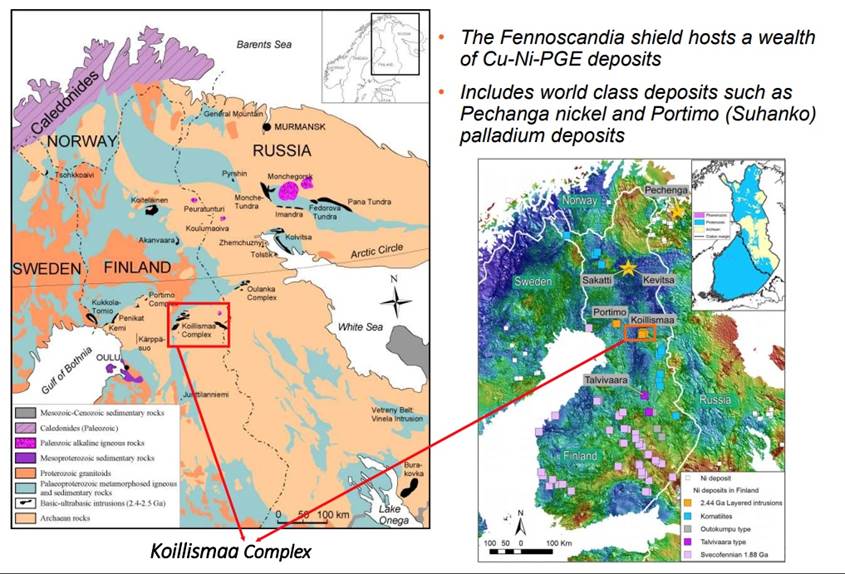

To understand why investors should put Lantinen Koillismaa (LK) on their radar, we need to first of all place the project in geographical and geological context.

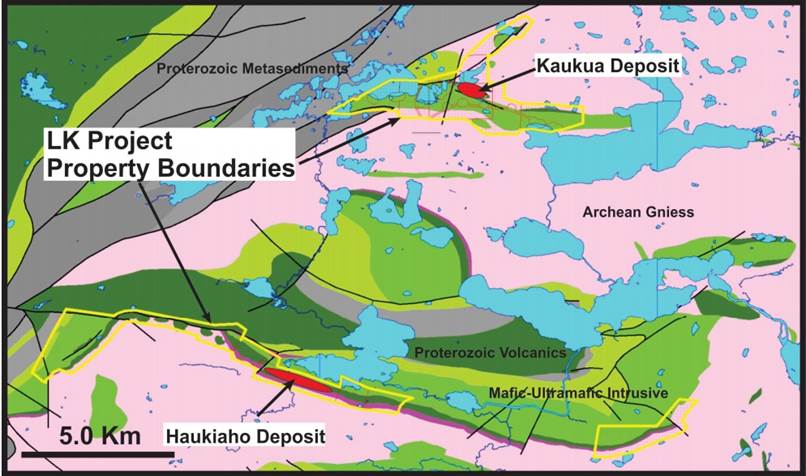

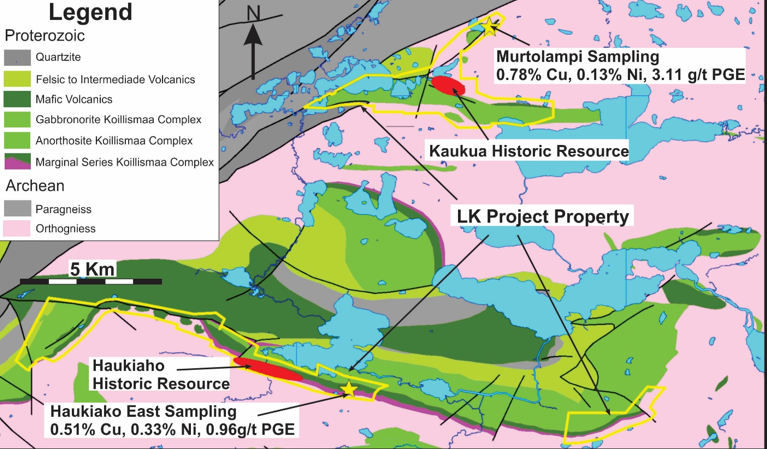

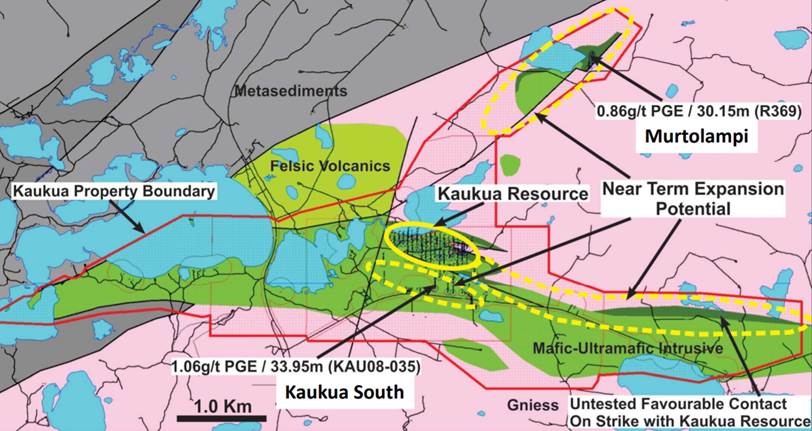

Located in north-central Finland, nine exploration permit applications (total 2,500 hectares) at LK feature three mineralized zones: Kaukua, Murtolampi and Haukiaho.

Surface sampling and previous drilling have shown evidence of palladium, platinum, gold, copper, cobalt and nickel.

Both Kaukua and Haukiaho have historical resource estimates (RE) (ie. not NI 43-101-compliant)

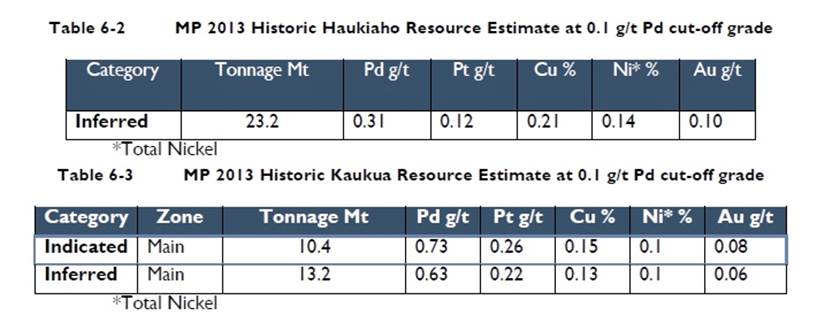

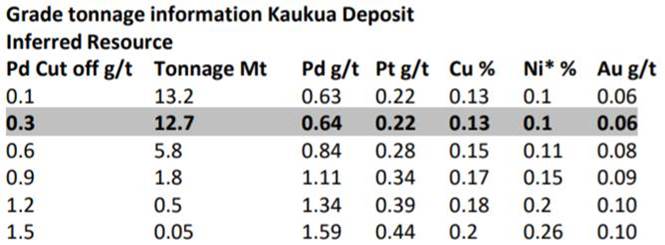

A 2013 historical RE at Kaukua amassed 10.4 million tonnes indicated, using a 0.1 grams per tonne (g/t) cutoff grade, comprising 0.73 g/t palladium, 0.26 g/t platinum, 0.15% copper, 0.10% nickel and 0.08% gold, plus an inferred resource of 13.2 million tonnes using a 0.1 grams per tonne (g/t) cutoff grade comprising 0.63 g/t palladium, 0.22 g/t platinum, 0.13% copper, 0.10% nickel and 0.06% gold.

At Haukiaho, an inferred RE, also completed in 2013, showed 23.2 million tonnes of 0.53 g/t combined PGEs and gold, with tracings of copper, nickel and cobalt.

The LK Project has the rocks that few copper-nickel-platinum group elements (Cu-Ni-PGE) deposits can boast.

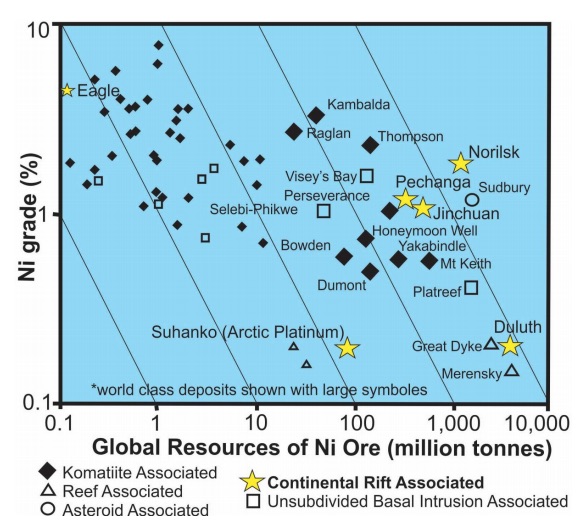

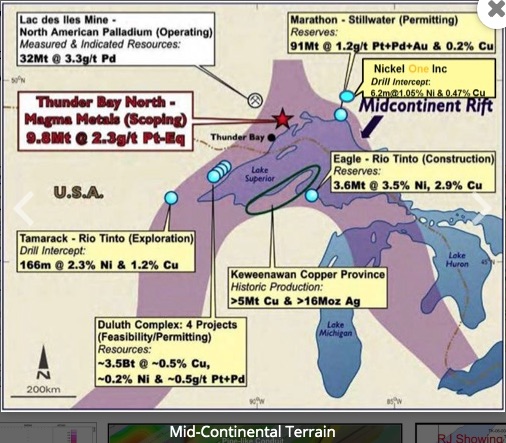

The geology dates back to the early Palaeoproterozoic era, ~2.4 billion years ago, during which continental rift-related igneous activity produced several mafic-ultramafic intrusions containing palladium-rich Cu-Ni-PGE sulfide minerals, chromium, as well as iron-titanium-vanadium. Continental rifting events have produced some of the largest Cu-Ni-PGE deposits in the world including the Duluth Complex in Minnesota, Pechanga and Norilsk in Russia, and China’s Jinchuan deposit.

They are relatively rare compared to other nickel deposit types, and often contain high PGE grades – such as Norilsk, Duluth and Eagle – a high-grade underground mine in Michigan acquired by Lundin Mining in 2013.

Several of these Paleoproterozoic rift-related mafic-ultramafic intrusions occur in an area known as the Fennoscandia shield (from the Latin words Fennia for Finland and Scandia for Scandinavia) This is “elephant-deposit country.”

The Fennoscandia shield includes a number of large Cu-Ni-PGE deposits including Pechanga on Russia’s Kola peninsula, Kevitsa, Sakatti, and the Portimo Complex located 90 km to the northwest of LK.

Portimo hosts Arctic Platinum’s Suhanko Project consisting of three large project areas, Suhanko, Narkaus and Penikat. The Suhanko Project has an impressive SAMREC Code Compliant Mineral Resource of 5.4 million ounces measured and indicated palladium, plus 4.4Moz inferred with platinum, gold, copper and nickel by-products.

The Portimo complex is of similar age to the Koillismaa layered complex, which hosts the LK Project, and is thought to have been formed by the same rifting event. These intrusions represent the roots of what was one a large igneous province. Such large fluxes of magma through these “roots” enables the formation of large-scale Cu-Ni-PGE deposits.

Historical exploration at LK goes back to the 1960s. About 35 kms of Koilissmaa’s “basal (base) contact” was mapped and reconnaissance-drilled (81 holes/11,514m) by majority-state-owned Outokumpu for copper/ nickel and later by GTK for Cu-Ni-PGE mineralization. GTK, the Geological Survey of Finland, punched in a series of widely spaced, short (typically ~ 30 meters depth) drill holes that demonstrated anomalous Cu-Ni-PGE mineralization along the entire 35 km’s of basel contact. And there in lies the exploration opportunity, the upside.

Only about four kilometers of the 25-km basal contact has been drill-tested, while the entire contact has been prospect drilled with very widely space shallow holes and which demonstrate mineralization along the entire contact.

These promising intersections were never followed up. Finland’s mining law was changed in the 1990s, mineral exploration was managed by the government. It’s easy to see why Koilissmaa was not considered a priority. The nickel and copper grades weren’t high enough in relation to base metals prices to create much buzz. And PGEs weren’t significant until the 1980s with the discovery of Stillwater, a large layered mafic intrusion in southern Montana.

It was around the same time that the Geological Survey also discovered -PGE mineralization at Portimo, which put Koiliismaa on the back-burner. While the Koillismaa deposit’s PGE content was recognized, it sat dormant until the mid-2000s, when private mining companies began to take an interest.

Still, only about 20,000m of the LK Project has been drilled since 2001, mostly at the Kaukua deposit.

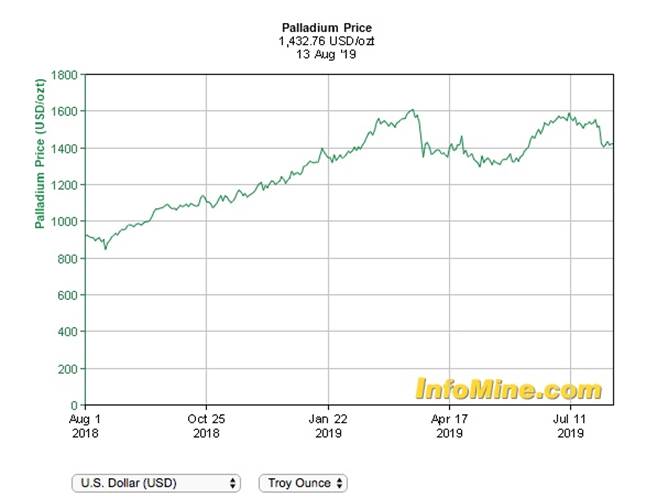

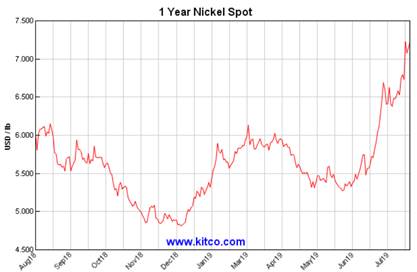

Now, with the price of palladium significantly higher than previous exploratory periods, Koillismaa, and the LK Project, is enjoying something of a rebirth.

Demand for the catalytic converter ingredient has surged since 2016 with the movement away from diesel-fueled vehicles, which pollute more. The price has more than doubled over the last three years (+124%) and ran up 18% in 2018.

Autocatalyst demand accounts for three-quarters of palladium demand. The metallic element is also facing restricted supply. 2018 was the seventh year in a row that palladium was in deficit because of strong vehicle sales.

2019 production is expected to trail consumption by 545,000 ounces, and there is limited scope for producers to increase supply, in the near term.

As drivers shift from diesel to gas-powered cars or hybrids, the market for palladium used in gasoline engines will expand. Contrary to what many on the eco-side of the political spectrum believe, gas-powered vehicles will be with us for quite some time as the world economy transitions to electric vehicles. Much more palladium then currently used will go towards E/ ICE hybrids because of the ‘range anxiety’ drivers feel when setting out on EV trip and to meet the much stricter new emission regulations on ICE powered vehicles.

Back to the LK Project, the presence of higher-priced PGEs offsets the relatively low grades of the other metals and makes the deposits very interesting indeed.

Palladium One is looking to build tonnage throughout the 2,500 sq. km property, key to their plans is Kaukua.

Palladium One’s immediate goal is to produce a new NI 43-101-compliant resource estimate from historical exploration data. To do that, over 100 historical core samples have been sent off for re-assaying. The results of the new resource estimate, at Kaukua, are due out in early September.

Another objective is to at least double the Kaukua resource through exploration at other target areas of the LK Project, like Murtolampi, described below. Only about one kilometer of an 8-km strike length has been drilled, and some holes host impressively thick “fault-stacked basal units” of greater than 100m. There is also the potential for a parallel zone to the south of Kaukua.

Haukiaho

At Haukiaho, the 2013 resource estimate identified 23.2 million inferred tonnes grading 0.21% copper (Cu), 0.14% nickel (Ni), 0.13 g/t platinum (Pt), 0.31 g/t palladium (Pd), and 0.10 g/t gold (Au) (0.53 g/t PGE) using a 0.1 g/t Pd cut off.

The largely unexplored area has about a 10-km strike length. While historical prospect drilling by GTK found multiple anomalous holes along the entire strike, the higher-grade shoots/ pods were not targeted and no modern induced polarization (IP) survey has been done.

It’s interesting to note that, back in the 1960s, GTK brought in a portable (truck-mounted) flotation concentrator to test the metallurgy of material blasted out of a small test pit about 2 km east of the current historic Haukiaho resource, this and 4 nearby short holes returned promising copper nickel grades but PGEs were never analyzed. Chip samples recently taken from this pit returned grades of 0.525 g/t and 0.957 g/t of PGE (palladium + platinum + gold) indicating the PGE mineralization extends well beyond the historic Haukiaho resource.

Comparing the structure of the two deposits, Haukiaho is currently more extensive than Kaukua but not as continuous, with discrete pods of mineralization present. Palladium One plans to start exploring the higher-grade intercepts and step out from there.

“These historic resources indicate that Haukiaho mineralization possesses pods/lenses of higher-grade material and with focused drilling could result in a higher-grade 43-101 compliant resource being defined,” PDM stated in the Aug. 12 news release.

“We are very encouraged by the reconnaissance sampling that identified PGE mineralization ~2 km east of the historic Haukiaho deposit which supports our conviction that Haukiaho not only extends to the west, but also significantly to the east, making it highly prospective for the definition of a significant open pit resource,” Derrick Weyrauch, Palladium One’s interim president and CEO, said in the news release.

Murtolampi

A third sample taken from the Murtolampi target showed quite a bit higher grades, 3.106 g/t PGE (Pt + Pd + Au), opening up the possibility of the Kaukua mineralization extending north to Murtolampi, which has seen some historical exploration.

The target was discovered by Outokumpu in the early 1990s and in 1999 GTK drilled a 200m long, shallow (average < 40m depth) fence of six diamond drill holes. Amazingly despite encouraging results including 0.21% Cu, 0.12% Ni and 1.01 g/t PGE over 19.0m in hole R369, the area was never followed up.

“Murtolampi is a high priority target for the Company and we are extremely pleased with the excellent reconnaissance sample which yielded 0.78% Cu, 0.13% Ni and 3.106 g/t PGE.” Derrick Weyrauch, Palladium One’s interim president and CEO

Tyko Project

PDM’s earlier-stage Tyko Project is also worth a mention for its high-tenor nickel potential. Tyko is located in northwestern Ontario around 25 km north of the Hemlo mine, and 55 km from the Marathon deposit which hosts a measured and indicated resource of 3 million ounces palladium and 618 million pounds of copper.

|

The Archean-aged mafic-ultramafic intrusion is rich in nickel; Tyko’s ore contains twice as much nickel as copper, and equal amounts of platinum and palladium.

Tenors averaged 8.6% Ni, 4.6% Cu and 3.3 g/t PGE at the RJ Zone, and 16.3% Ni, 8.70% Cu, and 12.8 g/t PGE at the Tyko zone. According to Palladium One, the high tenor of the sulfide minerals suggests a valuable concentrate could be produced, and that even if the sulfides are disseminated, the deposit could still be economic.

A 2016 winter drill program (14 holes, 1,780m) expanded historic showings and delivered the best nickel, copper and PGE grades to date. Palladium One plans to do some geophysics at the holes with high-grade nickel intercepts. The project has been airborne-surveyed but requires further geophysics.

Conclusion

Palladium One has two projects on the go, both with what we at Ahead of the Herd believe are miles and miles of blue-sky potential. We know that palladium and nickel are both in-demand metals for the foreseeable future, nickel for its use in batteries and stainless steel, and palladium as an important ingredient of catalytic converters found in gas-powered/ hybrid vehicles. Despite what the greenies say, gasoline-fueled cars aren’t going away any time soon, and in fact palladium-rich hybrids could play a key role in the transition from conventional to electric vehicles and in meeting much stricter new emission rules for ice powered vehicles.

At the LK Project in Finland, previous operators have really just scratched the surface of what could be an immense PGE-rich deposit on the scale of a Suhanko or Duluth Complex. The two deposits, Kaukua and Haukiaho, are both open in all directions. Previous drill results look good, and our musings of large-scale tonnage worthy of an open-pit, are backed by recent chip samples collected about 2 km from the Haukiaho resource.

Less work has been done at Tyko in Ontario, but we love the high nickel tenors. The 2016 drill results look promising. Two great projects concentrated on two minerals critical to our future transportation needs. Add in a previously announced share consolidation, whereby the number of outstanding shares were cut in half, and an oversubscribed private placement that raised $1.352 million, and Palladium One is starting to look very interesting. I will continue to watch this exciting exploration story unfold in the weeks ahead.

Richard (Rick) Mills

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Palladium One Mining (TSX-V:PDM, FRA:7N11).

Palladium One Mining (TSX-V:PDM, FRA:7N11) is an advertiser on Richard’s site aheadoftheherd.com.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.