Hi-yo Silver Away!

2019.12.24

Silver is expected to begin the next decade newly burnished, through a combination of higher industrial and investment demand, and tightened supply owing to mine production issues and output cuts.

As December winds down and precious metals trade volumes dwindle, market analysts including us at Ahead of the Herd are crunching the numbers from 2019 and looking ahead to what the New Year might bring.

A banner year

Without hesitation we can say that 2019 has been an excellent year for gold and silver. Both metals traded flat during the first half, then bolted significantly higher after the US Federal Reserve reversed course and began cutting interest rates instead of raising them. Starting in July, the Fed lowered rates three times before freezing the (benchmark) federal funds rate at a range of 1.5 – 1.75% in November.

That, along with similarly dovish policies among other central banks, a record $17-trillion of negative-yielding sovereign bonds, and fresh safe haven demand due to tensions with Iran, and a lack of progress on trade talks, to name two key issues, powered precious metals to new heights.

Spot gold and silver both peaked in early September at a respective $1,552.00/oz and $19.67/oz. Metals Focus, a precious metals firm quoted by Kitco, estimates silver will average 3% higher this year compared to 2018. While gold has outperformed silver over the past 12 months, rising around 15% to silver’s 11%, some market observers are picking silver to be the precious metal to beat in 2020.

One analyst who spoke to Kitco is sanguine on silver due to its industrial component. “We are optimistic on the prospect for gold, but we think it will pay off more for those who are to purchase silver. We think the industrial demand side of the equation will improve later in the year,” a commodities strategy at TD Securities said earlier in the week.

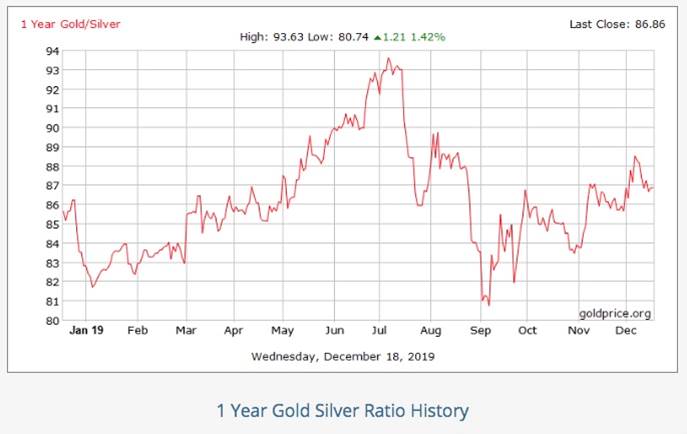

The same analyst thinks the gold-silver ratio in 2020 could improve for silver – although the current ratio of 86:1 is below the 26-year high reached in June.

The gold-silver ratio is simply the amount of silver one can buy with an ounce of gold. To find the ratio, divide the current gold price by the price of silver.

On June 12, the gold-silver ratio hit a 26-year high by breaking through the 90-ounce mark – meaning it took over 90 ounces of silver to purchase one ounce of gold. The higher the number, the more undervalued is silver or, to put it another way, the farther gold is pulling away from silver, valued in dollars per ounce.

The gold-silver ratio tells us, as precious metals investors, which is under-valued (or over-valued), silver or gold? For example at the current ratio of 86:1, a trader who has an ounce of gold could sell his gold for 86 ounces of silver.

The main factors that will determine silver’s fate next year, are whether or not there is a full resolution to the US-China trade war (a complete deal, to follow the recent phase-one agreement, would be bullish for the world economy, and boost demand for all metals including silver); global growth prospects, particularly in sickly Europe; the relative strength of the US dollar; bond yields; and whether central banks continue to keep a firm lid on interest rates.

Since very little gold is used by industry, it trades as an investment commodity – moving up and down in relation to factors like the dollar, inflation, interest rates and sovereign bond yields.

It’s estimated around 60% of silver is utilized in industrial applications, leaving only 40% for investing. And of the 60% demanded by industry, 8 of 10 ounces is either used up in manufactured products, or discarded in landfills.

This also explains silver’s volatility. Because the investment market for silver is so small (60% is locked up in industrial uses) it swings up and down wildly with relatively low volumes. A lower dollar and continued economic and political turbulence (consider the upcoming Brexit date and the unfolding impeachment process in the US) would support silver prices.

While silver’s performance has disappointed investors for going on a decade, many forget it rose spectacularly between 2000 and 2010, climbing well over 900%, and easily outpacing gold which “only” gained 600% during the same time frame. In April 2011 spot silver hit $55.59 an ounce, more than triple its current value.

Also, consider this: last year some 840 million ounces of silver were produced worldwide, compared to 108Moz of gold. Assigning $14 an ounce for silver and $1,400/oz for gold works out to a $13-billion-a-year industry versus $156 billion annually for gold – making the gold market 11 times larger than silver.

Demand drivers

Underpinning silver’s fine showing this year and likely, into next, are a number of important uses, beyond what people normally think of when they imagine silver, as for example jewelry or investable silver coins/ bars.

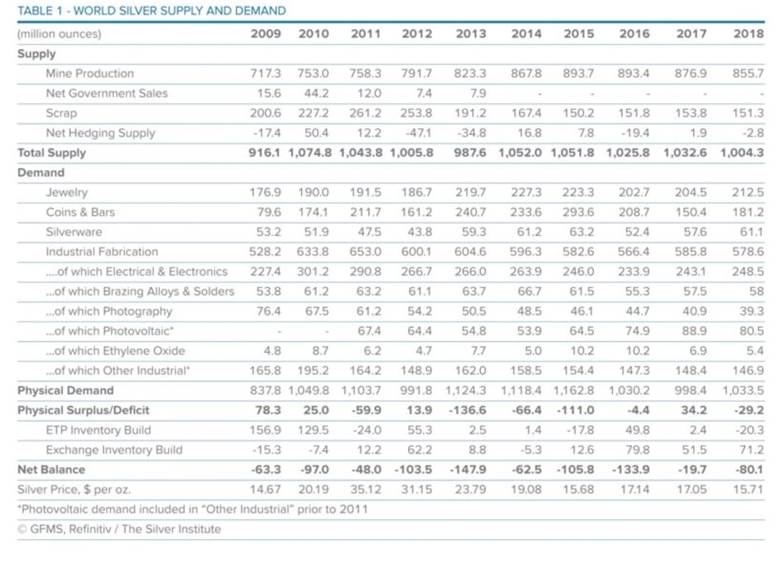

A record amount of silver was sought in 2018. According to the Silver Institute’s annual survey, total physical demand last year rose 4% to 1,033.5 million ounces – a three-year high. The need for silver was driven mostly by purchases of bars and coins, jewelry and silverware, particularly in India.

Reuters reported high gold prices had many Indian buyers turning to lower-priced silver for their bling. The country consumed 16% more silver jewelry in 2018 (76.5 million ounces) and bought 160% more silver investment bars, lifting overall jewelry demand 4% to 212.5 million ounces, and global bar and coin investment 20% to 181.2Moz.

Silver’s unique properties make it ideal for a number of industrial applications – almost as many as oil. The metal is strong, malleable and conducts heat and electricity better than any other material. Gold also has these properties but it is too expensive to use in circuit boards, solar panels, electric cars, etc.

Over 50% of silver demand comes from industrial uses like solar panels, electronics, the automotive industry and photographic applications.

The solar power industry currently accounts for 13% of silver’s industrial demand.

Indeed more and more silver will be demanded for its use in solar photovoltaic cells, as countries move further towards adopting renewable energy sources. Around 20 grams of silver are required to build a solar panel. The Silver Institute predicts 100 gigawatts of new solar facilities will be constructed per year between 2018 and 2022, which would more than double the world’s 2017 capacity of 398GW.

A recent study by the University of Kent found that rising demand for solar panels is driving up silver prices.

Supply slippage

As demand for silver in its various forms powers higher, finding enough metal is becoming a challenge. Last year’s silver supply of 1.004.3 billion ounces failed to meet physical demand of 1.033 billion ounces, leaving a 29.2Moz deficit.

According to Americas Gold and Silver, a Toronto-based precious metals producer, between 2017 and 2018, silver production across the sector fell 15%, the volume of processed ore slid 14%, and there was a 13% increase in the cash costs per ounce of silver. It’s important to note here, that the average head grade at silver mines has fallen by over 50% since 2010 – cutting into miners’ profitability.

The solution is to find new high-grade production, but the problem – like for gold – is finding enough world-class, multi-million-ounce deposits to make up for the lower grades and lesser mine output.

Silver production fell by 2% last year to 855.7Moz, the third consecutive drop after 13 years of uninterrupted supply growth. The 2019 World Silver Survey attributed the loss to falling production at lead and zinc mines; 75% of silver is mined as a by-product, mostly of gold, copper, lead and zinc.

As for 2019, mine supply from the top three silver-producing countries, Peru, Chile and Mexico, all dropped in the first half of this year. Data collected from each country showed Peru’s H1 silver production was down 10%, Chile’s fell 7% and Mexico’s saw a 4% decrease from January to May.

Four of the top five silver producers have shown considerable declines in mine supply, including Russia’s number one producer, Polymetal International, whose production during H1 2019 tumbled 14%. In October the world’s largest silver miner, Fresnillo Plc, admitted its annual silver and gold guidance would be at the lower end of an already reduced target, after reporting a fall in output during the third quarter, because of lower ore grades. Q3 silver production fell 14.5% and gold production slumped nearly 7%.

Globally, silver output in 2019 is expected to decline to 913.5Moz.

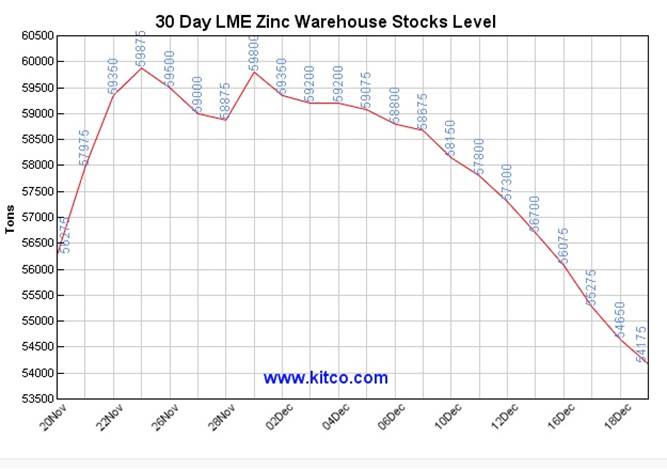

The 2018 narrative of shrinking silver supply due to falling production at lead and zinc mines, where silver is mined as a by-product, is just as relevant. As of November 2019, zinc and lead are both in terribly short supply in London Metal Exchange warehouses. At just 27,800 tonnes, zinc stocks are at their lowest in 20 years. Lead stocks are higher at 70,075 tonnes but have not rebuilt significantly from July’s decade low of 55,475t, CNBC reported.

The International Lead and Zinc Study Group blames supply bottlenecks for keeping lead and zinc (and silver) in deficit this year. The group widened its 2019 expected zinc supply deficit to 178,000 tonnes, from its earlier 121,000 tonnes prediction.

Conclusion

Recall that only 25% of silver production originates from primary silver mines. The rest is mined as a by-product of gold, copper, zinc and lead deposits. Silver exploration companies with pure-play silver projects are therefore rare, and typically trade at a premium to gold equities.

Companies with polymetallic mines that produce silver as a by-product are also highly desirable as an investment, especially during the current period of falling silver mine production.

Industrial demand for silver, particularly photovoltaics, is heading up, and should get another lift if and when the trade war with China is put to rest. Investment demand for silver also looks solid, with no end in sight to the low-interest-rate policy direction of central banks.

Add higher demand to shrinking supply, lower grades, and less silver by-product credits from falling lead and zinc mine production, we see a floor forming under silver prices, evidenced by a year-to-date gain of 8.6%.

Gold prices are holding up very well in the face of a Phase One trade deal with China, a continued strong dollar and higher interest rates in the US then elsewhere. At AOTH we do not believe the gold price is going to fall, quite the opposite actually.

During the last 20 years the gold/ silver ratio has been 60:1. Which makes the current ratio of 86 very high historically, 47:1 over the 20th century, and nearly 50% above the 20-year average of the 21st.

“Come on, Silver! Let’s go, big fellow! Hi–yo, Silver! Away!” Lone Ranger

Hi ho silver away. Indeed.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.