Guyana Goldstrike poised to drill new Toucan Ridge target

- Home

- Articles

- Uncategorized

- Guyana Goldstrike poised to drill new Toucan Ridge target

2019.09.07

One of three “cratons” of the South American Plate, the Guiana Shield is recognized as a major gold-producing region that has continuity with West Africa. However, unlike West Africa (eg. Ghana, Burkina Faso), the Guiana Shield is under-explored particularly in the south – all the major and most of the minor deposits are in the north.

The rocks of the 1.7 billion-year-old formation consist of greenstones overlain by sub-horizontal layers of sandstones, quartzites, shales and conglomerates intruded by sills of younger mafic intrusives such as gabbros.

The relatively unexplored southwestern part of the country is the focus of Guyana Goldstrike (TSX-V:GYA), which is developing Guyana’s first gold-hosted banded iron formation.

The gold in banded iron is associated with greenstone belts believed to be ancient volcanic arcs, or in adjacent underwater troughs. Greenstone belts often contain gold, silver, copper, zinc and lead ores.

Gold in banded iron formations make excellent exploration targets because of their scalability. Like VMS deposits, they are often found in clusters, something that is attractive to major gold companies looking for new deposits that can be developed into mines with longevity.

The best example of a gold-bearing banded iron deposit is the shuttered Homestake mine in South Dakota. The elephant-sized deposit was the largest and deepest gold mine in North America before it closed in 2002. Between 1878 and 2001 Homestake produced an incredible 43.9 million ounces.

Two other good examples are the Lupin mine in Nunavut, also depleted, which produced about 3 million ounces, and the Musselwhite mine in Ontario, one of the largest gold mines in Canada with 1.85 million ounces in reserves. Goldcorp mines about 265,000 ounces a year from the banded iron formation that hosts the ore, which is composed of coarse almandine garnets in fine-grained grunerite.

Marudi Gold Project

A total of 42,000 meters of historical drilling has been completed at Guyana Goldstrike’s flagship Marudi Gold Project by previous operators since 1985, or 141 drill holes. Past exploration has delineated two zones of mineralization – Mazoa Hill and Marudi North – with a recently discovered third zone at an area named Toucan Ridge.

Just over a year ago, Guyana Goldstrike commissioned a new resource estimate to verify previous work done at the Mazoa Hill zone. The NI 43-101-compliant report delineated 259,100 ounces of gold at 1.8 grams per tonne (g/t) in the indicated category and 86,200 ounces inferred grading 1.6 g/t.

The 50-square-kilometer property is 85% unexplored – leaving plenty of upside for the company and investors. And it comes with an 18-year mineral license.

Phase 1 results

Recently Guyana Goldstrike released assay results from Phase 1 of its 2018-19 exploration program. Phase 2, which includes 2,500 meters of diamond drilling, is expected to begin soon, as Guyana’s rainy season comes to a close.

The first phase of exploration entailed the digging of 18 trenches totaling over 2,500 meters, with some 850 samples collected and sent to an assay lab.

Four of 11 areas identified as prospective for gold mineralization were explored – Paunch, Pancake, Marudi North and Toucan Ridge – a new bedrock target discovered about a kilometer north of Mazoa Hill, where magnetic anomalies seen in last summer’s helicopter geophysical survey correlated with gold anomalies identified by trenching. (in total the survey found 21 gold anomalies throughout the property)

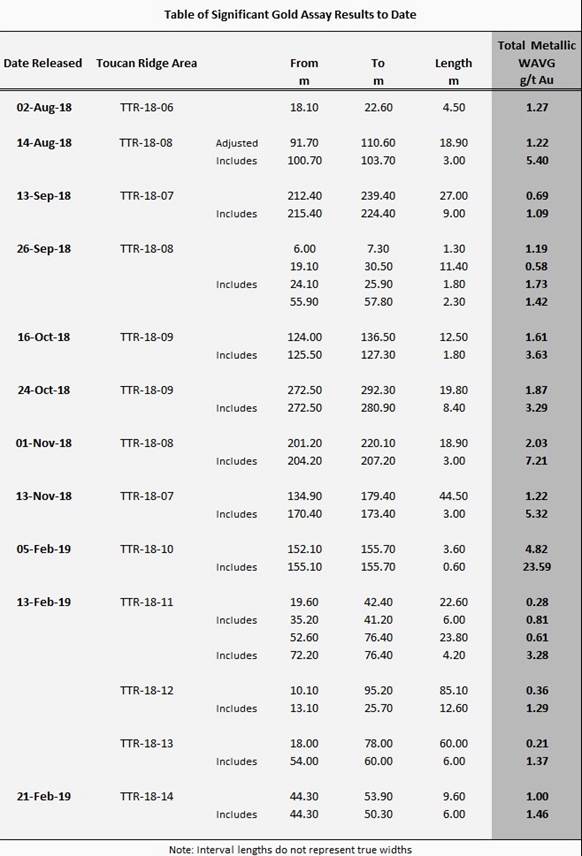

Among the best results, seen in the table below, are 18.9 meters at 1.2 grams per tonne (g/t) gold, including 3 meters at 5.4 g/t; 18.9m at 2 g/t, including 3m at 7.2 g/t, and a 44.5m intercept grading 1.2 g/t, of which 3m contained 5.3 g/t gold.

Just as important in terms of exploration upside, Phase 1 picked out five new 3D magnetic targets based on the identification of quartzite-matachert in the host rock, which is an important indicator mineral for gold at Marudi. The same material was found in a 250m length of host rock that extends southeast of Toucan Ridge, and northeast of Toucan Ridge at East Marudi. Sixteen 2D magnetic targets were also selected for further exploration.

Finally, a 5-kilometer anomalous magnetic trend was identified at Mazoa Hill, the zone where the resource estimate was compiled. According to Guyana Goldstrike, Mazoa Hill is less than 10% drilled.

Phase 2 exploration

The second phase of exploration, 2,500m of drilling at Toucan Ridge, will target seven priority areas identified by previous geophysics, trenching and outcrops (a series of outcrops along a 1.1-kilometer section of a magnetic anomaly that extends for 1.7 km north of Mazoa were discovered earlier this year).

Phase 2 will also involve fresh trenching at Kimberley Ridge and Success Creek, along with a 3D geophysical interpretation west of the Mazoa Hill zone, which includes the Pancake, Kimberley Ridge and Success Creek targets.

If all goes well, Guyana Goldstrike says it may expand its diamond drill program beyond the initial 2,500m. The end game is to find a million ounces or more – enough to interest a gold major in a buyout.

Tookie Angus joins board

The company’s industry on the ground has been matched with the addition of new blood in the boardroom. Earlier this week GYA announced that Robert Stuart (“Tookie”) Angus will join the firm as an advisor to the board of directors.

The current chairman of San Marco Resources, K92 Mining and Kenadyr Mining, Tookie Angus is a well-respected senior executive and thought leader in the mining industry. For the past 40 years, Angus has focused on structuring and financing significant international exploration, development and mining ventures. Indeed his CV is chock full of mergers and acquisitions (M&A) successes, including:

- The $865 million takeover of Canico Resources, where he served as a director, by Brazil’s Companhia Vale do Rio Doce (CVRD). The 2005 acquisition was focused on Canico’s Onca Puma project, considered at the time to be one of the best undeveloped nickel projects in the world, bought by CVRD, the globe’s then-biggest iron ore producer.

- The friendly takeover of Bema Gold by Kinross Gold in 2007. The $3.2 billion deal gave Kinross 50 million ounces of gold, 80Moz of silver and 2.9 billion pounds of copper, spread over nine mines in five countries. Angus was a Bema Gold director at the time of the buyout.

- Holding director positions at Ventana Gold until it was acquired in 2011, and Plutonic Power up to its merger with Magma Energy, also in 2011.

- Serving as chairman of Nevsun Resources after its acquisition of Reservoir Minerals, until 2017. Consolidating the two Vancouver-based companies created 100% ownership of the high-grade upper zone of the Timok Copper Project in Serbia, and the producing Bisha open-pit copper zinc project in Eritrea, East Africa.

The president and CEO of Guyana Goldstrike, Peter Berdusco, had this to say about Angus’ appointment:

“With exploration and resource development moving forward at our Marudi Gold Project, the need to grow our team with industry experts has never been more important. Mr. Angus’ extensive mining experience in the base and precious metals resource sectors brings to Marudi the required acumen needed for success. Having Mr. Angus available to us is invaluable. We welcome him onboard.”

Conclusion

The addition of Tookie Angus to GYA’s board of directors is a tremendous vote of confidence for the company and what it’s doing in Guyana. And let’s not forget, when Guyana Goldstrike reached out to Zijin Mining – the largest gold company in China – looking to fund an exploration program, the gold major came through with a substantial $3.2 million – in exchange for a 24% stake.

To be clear, the funding is through Gold Mountain Assets, which manages Zijin’s Global Fund and its Midas Exploration Fund.

As I’ve said before, Guyana Goldstrike has everything I like to see in a gold junior: Historical drilling showing mineralization, ample upside, a safe jurisdiction to invest in, an experienced management team and high institutional/ insider ownership.

Marudi is a gold-hosted banded iron formation; we know this kind of gold deposit has legs. We already have a resource at Mazoa Hill, prospectivity at Marudi North, and a very promising new zone at Toucan Ridge. If all goes well this year GYA could have a million ounces and two pit outlines. There are additional targets to the east and the west. And the company doesn’t have any competition; it has 100% of Marudi and has a lock on the rest of the trend.

I’ll be watching GYA closely over the next few months, and anticipating a steady news flow as the drills pierce Toucan Ridge for the first time.

For more on Guyana Goldstrike, read Guyana Goldstrike aims to add ounces at gold-bearing banded iron formation

Guyana Goldstrike

TSX-V:GYA Cdn$0.12 2019.09.06

Shares Outstanding 58,452,037m

Market cap Cdn$7.01m

GYA website

*****

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Guyana Goldstrike and GYA is an advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.